In an increasingly complex financial landscape, the meticulous documentation of transactions is not merely a best practice; it is an absolute necessity. For individuals managing expenses related to childcare or elder care, and for providers offering such essential services, a well-crafted dependent care receipt template serves as an indispensable tool for maintaining clarity, ensuring compliance, and facilitating accurate financial reporting. This crucial document acts as definitive proof of payment for services rendered, safeguarding both parties involved in a transaction by providing a transparent and verifiable record.

The primary purpose of such a template extends beyond simple acknowledgment of payment; it underpins critical financial processes, including tax credit claims, flexible spending account (FSA) reimbursements, and general expense tracking. Both families leveraging dependent care services and businesses providing them stand to benefit significantly from its structured application. For the former, it ensures eligibility for valuable tax breaks like the Child and Dependent Care Credit or smooth processing of pre-tax benefits. For the latter, it solidifies professional credibility, streamlines internal accounting, and mitigates potential disputes by offering undeniable proof of service delivery and payment receipt.

The Paramount Importance of Professional Financial Documentation

Professional financial documentation forms the bedrock of sound financial management for individuals, businesses, and non-profit organizations alike. Clear, accurate, and consistent records are not just administrative niceties; they are fundamental to legal compliance, audit readiness, and maintaining fiscal integrity. Every payment receipt, invoice form, and expense record contributes to a comprehensive narrative of financial activity, providing an undeniable proof of transaction that can be referenced years later.

Without robust documentation, businesses face heightened risks of financial discrepancies, miscommunication, and legal challenges. Similarly, individuals may miss out on significant tax savings or encounter difficulties when seeking reimbursements from employers or insurance providers. High-quality financial templates, therefore, are critical instruments that instill confidence, minimize errors, and uphold transparency across all monetary exchanges. They transform ambiguous transactions into verifiable data points, fostering trust and accountability in every financial interaction.

Key Benefits of Utilizing a Structured Dependent Care Receipt Template

Adopting a structured dependent Care Receipt Template yields a multitude of advantages that transcend basic record-keeping. The inherent design of such a layout is to standardize information, ensuring that every essential detail is captured consistently and precisely. This systematic approach is vital for ensuring accuracy, enhancing transparency, and maintaining consistency in all related financial records, whether for personal use or business operations.

Firstly, accuracy is dramatically improved by pre-defined fields that prompt users for specific information, minimizing omissions and errors common with handwritten or ad-hoc receipts. This standardization translates into reliable data for budgeting, tax preparation, and audit purposes. Secondly, transparency is bolstered as the document clearly delineates service dates, payment amounts, and payee details, leaving no room for ambiguity between the payer and the service provider. This clarity helps prevent misunderstandings and builds a foundation of trust. Finally, consistency is achieved through a uniform presentation across all transactions, simplifying data entry, retrieval, and analysis. This consistency is particularly beneficial for businesses managing multiple clients or for individuals tracking numerous dependent care expenses throughout the year, streamlining the entire financial management process.

Customizing the Template for Diverse Financial Applications

While specifically designed for dependent care, the fundamental architecture of this template is remarkably versatile and can be readily customized for a broad spectrum of financial applications. Its core structure, which includes fields for payer and payee information, transaction date, amount, and a description of services or goods, makes it an adaptable financial template for various scenarios. This flexibility ensures that the underlying principles of clear transaction recording can be applied universally, enhancing business documentation practices across different sectors.

For sales transactions, the document can serve as a simple sales record or proof of purchase, confirming that goods have been exchanged for payment. In the realm of services, it easily transforms into a service receipt or a simplified billing statement, detailing the work performed and the corresponding charges. Landlords can adapt the form into a rent payment receipt, providing tenants with formal acknowledgment of their monthly contributions. Non-profit organizations frequently modify the layout to function as a donation acknowledgment, providing donors with the necessary documentation for tax-deductible contributions. Moreover, businesses can leverage this adaptable structure as an expense record for employee reimbursements, ensuring that all business expenses are meticulously documented and approved. The inherent design promotes adaptability, making it an invaluable tool for comprehensive financial management across various needs.

When is a Dependent Care Receipt Template Most Effective?

The utility of a robust dependent care receipt template becomes particularly evident in specific situations where verifiable proof of payment and service details are critical. Its structured format ensures that all necessary information is captured, making it an indispensable tool for compliance and financial clarity.

- Tax Filings for Dependent Care Credit: Individuals claiming the Child and Dependent Care Credit on their federal income tax returns absolutely require detailed receipts. This form provides the necessary documentation to substantiate eligible expenses, including the care provider’s identification number (SSN or EIN), name, address, and the amount paid.

- Employer Flexible Spending Accounts (FSAs) or Dependent Care Assistance Programs (DCAPs): Employees participating in these pre-tax benefit programs must submit receipts for reimbursement. This template ensures that all required information for FSA or DCAP claims, such as the dates of service and the specific nature of the care, is readily available and clearly presented.

- Childcare Providers Issuing Proof of Payment: Daycares, preschools, and other childcare facilities benefit from using a consistent template to issue receipts to parents. This not only streamlines their administrative tasks but also enhances their professional image by providing clear, standardized documentation.

- Nanny Services, After-School Programs, and Summer Camps: Independent care providers or specialized programs can utilize this form to provide professional payment receipts, offering peace of mind to parents and simplifying the tax reporting process for both parties.

- Elder Care Services: For families managing expenses for aging relatives, whether for in-home care, adult day services, or skilled nursing, the receipt serves as a vital expense record for personal financial tracking, potential tax deductions, or long-term care insurance claims.

- Any Situation Requiring Verifiable Expense Records: Fundamentally, whenever there’s a need to document money paid for dependent care to ensure accuracy, compliance, or future reference, this type of receipt is the most effective and reliable solution.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial document, including a dependent care receipt template, hinges significantly on its design, formatting, and overall usability. A well-designed receipt is not only functional but also reflects professionalism and facilitates clear communication, whether it’s a print or digital version.

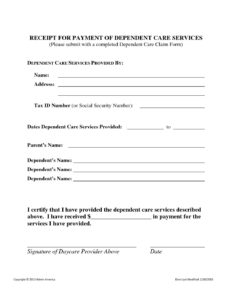

Clarity and readability are paramount. The use of clean, legible fonts and an uncluttered layout ensures that all information is easily discernible. Avoid overly ornate designs or small text sizes that can hinder comprehension. Key elements should be logically grouped and spaced for quick scanning. Essential data fields must be prominently featured, including the full legal names of both the payer and the payee, the complete mailing address and contact information for the service provider, the precise date of payment, the period for which services were rendered, a detailed description of the services, the total amount paid, and the signature of the recipient (or an authorized representative). Including the care provider’s tax identification number (SSN or EIN) is also crucial for tax purposes.

Incorporating professional branding, such as a company logo and consistent color scheme, can enhance credibility for businesses without compromising clarity. For digital versions, ensure the file is in a universally accessible format, such as PDF, allowing for easy sharing and printing while maintaining document integrity. Features like fillable fields and digital signature capabilities can significantly improve usability and efficiency. When designing for print, consider standard paper sizes and ensure that all content fits comfortably within margins. For both print and digital applications, the template should be intuitive, requiring minimal effort to complete accurately, thereby serving as a truly efficient financial template for all users.

The adoption of a robust dependent care receipt template is a strategic decision that underscores a commitment to financial integrity and operational efficiency. It transitions the often-informal process of documenting dependent care expenses into a streamlined, professional, and verifiable system. By providing a clear proof of transaction, this indispensable tool minimizes potential ambiguities, supports compliance with tax regulations, and facilitates accurate record-keeping for both service providers and recipients.

Ultimately, whether utilized for securing valuable tax credits, managing pre-tax benefit accounts, or simply maintaining precise personal or business documentation, this form stands as a testament to diligent financial practices. It empowers users with the certainty that every payment, every service, and every financial detail is meticulously recorded, offering peace of mind and a reliable framework for managing one of life’s most essential expenses. Embracing such a high-quality financial template is not merely about fulfilling a requirement; it is about cultivating a foundation of accuracy, transparency, and accountability that benefits all parties involved.