Accurate and professional record-keeping is a cornerstone of responsible financial management, whether for individuals, non-profit organizations, or businesses. In the context of charitable giving, particularly involving tangible assets, a standardized furniture donation receipt template is an indispensable tool. This document serves not only as a formal acknowledgment of a contribution but also as critical evidence for tax purposes, ensuring compliance and transparency for all parties involved. It empowers donors to confidently claim eligible deductions while providing recipient organizations with a clear audit trail of their incoming resources.

The primary goal of a furniture donation receipt template is to streamline the documentation process, ensuring that every essential detail of a donation is captured accurately and consistently. For donors, this means having a reliable proof of transaction that meets the stringent requirements of tax authorities like the IRS. For charities and other recipient entities, it translates to efficient record management, enhanced accountability, and the ability to maintain a professional standard in their interactions with benefactors. This comprehensive article will explore the myriad benefits, crucial components, and practical applications of such a template, establishing its vital role in effective financial communication and compliance.

The Importance of Clear and Professional Documentation

In any financial or business transaction, the clarity and professionalism of accompanying documentation are paramount. This principle holds especially true for charitable donations, where legal and tax implications are significant. Clear and professional documentation, such as a well-structured payment receipt or donation acknowledgment, serves multiple critical functions. Firstly, it establishes an undeniable proof of transaction, eliminating ambiguity and potential disputes regarding the details of a contribution. This level of clarity fosters trust between donors and recipient organizations, reinforcing the integrity of the charitable process.

Beyond establishing trust, robust documentation ensures compliance with regulatory requirements. For example, the IRS mandates specific information for non-cash contributions exceeding certain values, making a detailed record indispensable for both the donor claiming a deduction and the organization justifying its tax-exempt status. Professional documentation reflects an organization’s commitment to accountability and transparency, enhancing its credibility among stakeholders, including donors, auditors, and regulatory bodies. Conversely, poor or incomplete documentation can lead to financial inaccuracies, legal challenges, and a diminished public image, underscoring the non-negotiable value of meticulous record-keeping in all aspects of financial communication.

Key Benefits of Using Structured Templates for Furniture Donation Receipt Template

Adopting structured templates for a furniture donation receipt template offers a multitude of benefits that extend beyond mere compliance, enhancing efficiency, accuracy, and overall operational integrity. These standardized layouts provide a systematic approach to data collection, significantly reducing the likelihood of human error that often arises from manual, ad-hoc record-keeping. By pre-defining fields for essential information—such as donor details, item descriptions, estimated values, and organizational information—the template guides users to capture all necessary data points consistently.

One of the foremost advantages is ensuring accuracy in financial records. Pre-formatted fields minimize omissions and inconsistencies, guaranteeing that every receipt is complete and contains uniform information, which is vital for internal accounting and external audits. This consistency also bolsters transparency, as all relevant details are clearly presented and easily retrievable. Furthermore, using a standard layout promotes efficiency; staff spend less time creating receipts from scratch and more time focusing on core charitable activities. This also speeds up processing times for donors seeking tax deductions, as the necessary information is readily available and correctly formatted. Ultimately, this robust financial template serves as an invaluable asset for maintaining meticulous records, fostering donor confidence, and streamlining administrative tasks associated with non-cash contributions.

Customization for Different Purposes

While the focus here is on furniture donations, the underlying principles of a well-designed receipt template are universally applicable across various financial transactions. The adaptability of such a form makes it an invaluable asset for diverse business documentation needs, extending far beyond charitable contributions. For instance, the core structure can be easily modified to serve as a payment receipt for services rendered, detailing the nature of the service, the amount paid, and the date of transaction. This ensures that both service providers and clients have a clear proof of transaction for their records.

Similarly, an invoice form for product sales can be derived from the fundamental layout, incorporating fields for itemized lists, unit prices, quantities, and total amounts. This transforms the basic receipt into a comprehensive sales record essential for inventory management and revenue tracking. The flexibility of the template also allows for its application as a billing statement or a rent payment receipt, where recurring payments and specific contractual details need to be documented. Furthermore, it can be tailored for internal business reimbursements, functioning as an expense record that clearly outlines the expenditure, purpose, and date. The ability to customize this foundational financial template for various operational demands underscores its versatility as a critical tool for maintaining organized, consistent, and legally sound records across a spectrum of activities.

Examples of When Using the Template is Most Effective

The structured approach offered by a dedicated template for documenting non-cash contributions proves particularly effective in several scenarios, ensuring accuracy, compliance, and professional communication. Utilizing this form simplifies complex administrative tasks and reinforces accountability.

- Non-Profit Organizations Receiving Tangible Goods: Charities that frequently accept physical donations, such as thrift stores, homeless shelters, or disaster relief organizations, benefit immensely. The consistent format ensures all required IRS information, including donor details, item descriptions, and fair market value estimates, is captured for every contribution, simplifying year-end tax reporting for both the organization and its benefactors.

- Individuals Donating Large Items for Tax Write-Offs: When an individual donates significant items like household furniture, appliances, or vehicles, they often seek to claim a tax deduction. A professionally generated receipt provides the necessary documentation to substantiate their claim to the IRS, particularly for non-cash contributions exceeding $500, which require additional substantiation like a detailed description and the organization’s acknowledgment.

- Businesses Liquidating Assets via Donation: Companies undergoing office renovations, equipment upgrades, or closure might choose to donate surplus furniture or other assets to non-profits. The template facilitates the documentation of these business documentation transactions, allowing the business to claim appropriate deductions for corporate social responsibility initiatives while providing the recipient with official records.

- Estate Executors Managing Charitable Bequests: Executors of estates often manage the distribution of assets, including charitable bequests of furniture or household items. Using a standardized receipt ensures that these donations are properly documented, assisting with the estate’s accounting and fulfilling the deceased’s wishes accurately, providing a clear audit trail for all disbursements.

- Community Drive Collection Points: During large-scale community donation drives for specific causes, temporary collection points can become overwhelmed. Providing pre-printed or digital versions of the receipt template allows volunteers to efficiently process donations, ensuring every contributor receives appropriate acknowledgment and proof of their generosity.

In each of these instances, the use of a formal document streamlines the process, minimizes errors, and maintains a professional standard, reinforcing the value of structured financial templates.

Tips for Design, Formatting, and Usability

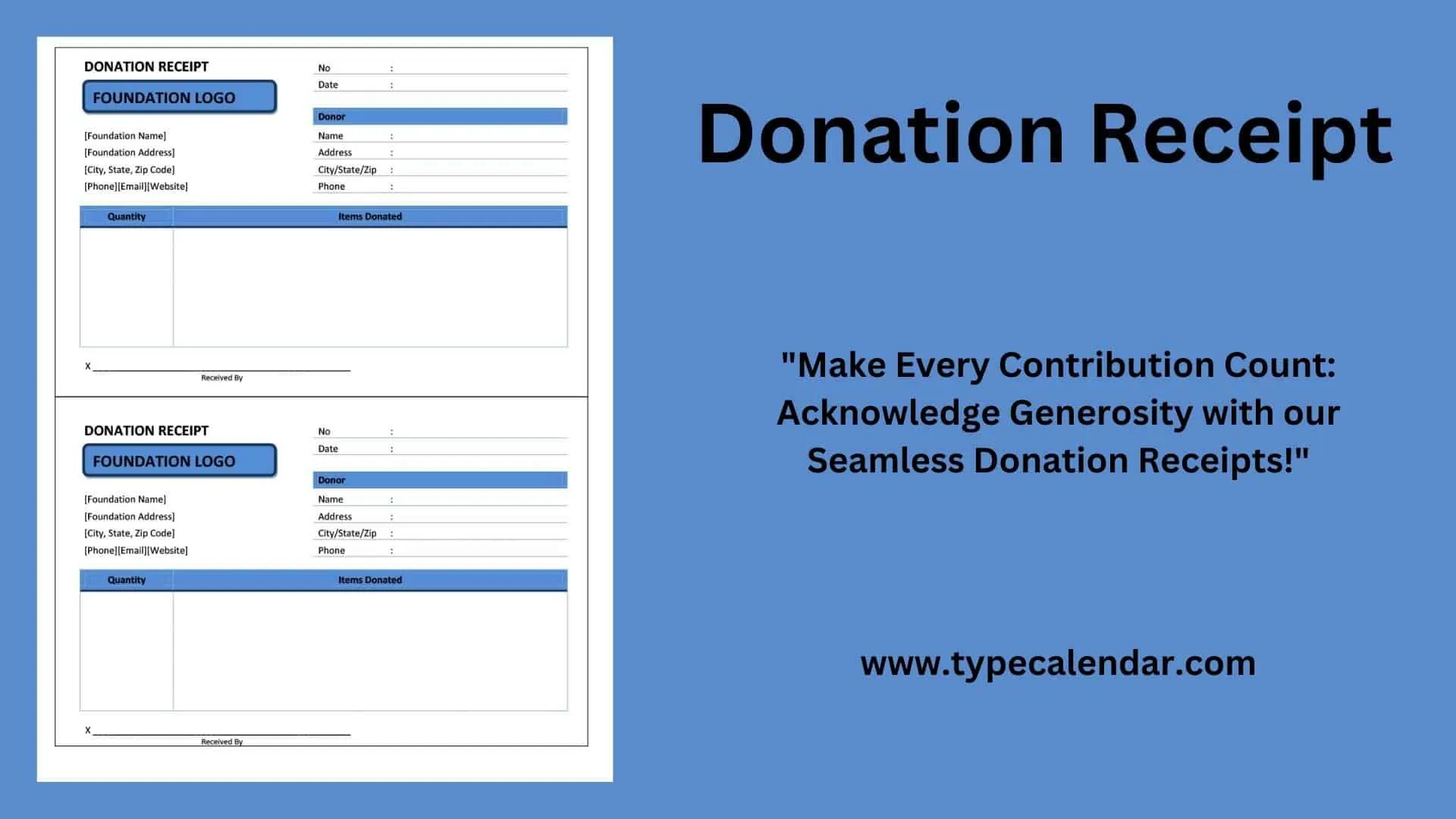

The effectiveness of any financial template, including a donation acknowledgment, hinges significantly on its design, formatting, and overall usability. A well-designed receipt should be intuitive, clear, and comprehensive, catering to both the issuer and the recipient. When considering the layout, prioritize a clean, uncluttered appearance with logical flow. Essential fields should be easily identifiable and grouped, guiding the user through the information input process. Using legible fonts and an appropriate font size ensures readability for a wide audience, preventing misinterpretation of crucial details.

For optimal usability, consider both print and digital versions of the document. A print-friendly layout should minimize excessive graphics or heavy background colors that consume ink, while still allowing for organizational branding like a logo or contact information. Digital versions, often provided as fillable PDF forms or web-based interfaces, should include interactive fields, auto-calculation capabilities where relevant, and clear instructions. Ensure that the file is compatible across various devices and operating systems. Moreover, incorporating consistent branding elements—such as an organization’s logo, color scheme, and contact details—not only reinforces professionalism but also enhances trust and recognition. Implementing sequential numbering for each receipt adds a layer of security and greatly simplifies tracking and auditing processes, making the expense record more robust. Finally, clear disclaimers or instructions regarding the valuation of donated items (e.g., advising donors to consult with a tax professional) enhance the template’s informational value and limit organizational liability, reinforcing its role as a responsible business documentation tool.

Concluding Thoughts on the Value of a Structured Template

In the complex landscape of financial transactions and charitable giving, the value of a meticulously designed receipt template cannot be overstated. From serving as an undeniable proof of transaction for donors seeking tax deductions to providing critical business documentation for non-profit organizations, this robust financial template is an indispensable asset. It champions accuracy, transparency, and consistency in record-keeping, laying the groundwork for professional communication and robust compliance with regulatory frameworks. By standardizing the information capture process, it drastically reduces administrative overhead and minimizes the potential for errors, thereby enhancing operational efficiency for all parties involved.

The versatility of this type of form, enabling its customization for diverse applications such as sales records, service receipts, or expense records, further underscores its fundamental utility. It stands as a testament to the power of structured documentation in fostering trust, ensuring accountability, and streamlining financial processes. Investing in a well-crafted template is not merely about generating a piece of paper; it is about fortifying an organization’s reputation, empowering donors, and securing the integrity of every transaction. Ultimately, a reliable, accurate, and efficient financial record tool is an essential component of sound financial management, reinforcing the professionalism and credibility of any entity that employs it.