Accurate and transparent financial record-keeping forms the bedrock of sound business practices and ethical charitable operations. In an era where scrutiny of transactions is ever-increasing, organizations and individuals alike benefit immensely from standardized documentation. A robust gift in kind receipt template serves as a critical tool, ensuring that non-cash contributions are properly acknowledged, valued, and recorded. This document is not merely a formality; it is an essential component for demonstrating accountability, facilitating tax compliance, and fostering trust among all parties involved.

This comprehensive guide delves into the significance of such a template, exploring its multifaceted benefits for non-profit organizations, businesses, and individuals engaged in charitable giving or non-monetary exchanges. By standardizing the acknowledgment process for goods, services, or property received, the gift in kind receipt template streamlines administrative tasks, minimizes discrepancies, and provides a clear audit trail. It equips users with a professional, structured approach to manage non-monetary assets, offering clarity and consistency in financial reporting.

The Imperative of Meticulous Documentation in Financial Transactions

In the complex landscape of financial and business transactions, the importance of clear, professional documentation cannot be overstated. Every transaction, whether monetary or non-monetary, requires a verifiable record to uphold integrity, ensure compliance, and mitigate potential disputes. Such documentation serves as proof of transaction, outlining the details of an exchange and solidifying the understanding between parties. It is fundamental for internal controls, external audits, and legal accountability.

Robust documentation safeguards an entity against potential legal challenges or financial irregularities. It provides a historical account of activities, enabling thorough analysis and informed decision-making. Furthermore, for tax purposes, particularly in the United States, detailed records are indispensable for justifying deductions or reporting income accurately. Without standardized forms like a payment receipt or an invoice form, organizations risk significant financial penalties and reputational damage, underscoring the critical need for meticulous record-keeping.

Core Advantages of a Structured Gift In Kind Receipt Template

Utilizing a structured gift in kind receipt template offers profound advantages in ensuring accuracy, transparency, and consistency in financial record-keeping. This specialized form eliminates ambiguity by providing designated fields for all pertinent information, guiding the user to capture essential details systematically. This structured approach significantly reduces errors that can arise from ad-hoc or incomplete documentation, thereby enhancing the reliability of financial records.

The consistent use of such a template fosters transparency by creating a clear, standardized record of every non-cash contribution. It provides an undeniable audit trail, detailing what was received, from whom, its estimated value, and the date of receipt. This level of clarity is vital for internal review, external audits, and demonstrating accountability to donors, stakeholders, and regulatory bodies. The template promotes uniformity across all acknowledgments, ensuring that every gift in kind receipt template issued adheres to the same high standards of professionalism and informational completeness, reinforcing organizational credibility.

Adaptability Across Diverse Transactional Needs

While commonly associated with charitable donations, the underlying structure and principles of a well-designed gift in kind receipt template possess remarkable adaptability, extending its utility far beyond the non-profit sector. Its framework can be customized to serve a broad spectrum of transactional needs, providing a standardized proof of transaction for various non-monetary exchanges. This flexibility makes it an invaluable business documentation tool across different industries.

For instance, businesses can adapt this form for recording services received in exchange for goods, or for documenting internal transfers of assets between departments. The template’s logical layout can be modified to function as a detailed service receipt, acknowledging the provision of non-monetary services. Similarly, it can be adjusted to serve as an expense record for non-cash reimbursements or as a specialized sales record for unique barter arrangements. The core concept — documenting a non-monetary exchange with specified details and an agreed-upon value — remains universally applicable, transforming the template into a versatile financial template.

Optimal Scenarios for Utilizing This Template

The application of this specialized receipt extends across numerous scenarios, providing critical documentation for non-monetary contributions and exchanges. Its structured format ensures that every relevant detail is captured, making it indispensable in situations where traditional cash receipts are not applicable. The effective use of the template ensures clarity, compliance, and accurate valuation, serving as a robust financial template for diverse situations.

Examples of when using the document is most effective include:

- Non-profit Organizations Receiving Goods: When a charity receives physical items such as office supplies, furniture, food, or clothing, this form precisely details the items, their condition, and an estimated fair market value.

- Acceptance of Professional Services: If a non-profit or business receives pro bono services (e.g., legal advice, graphic design, consulting), the template can document the nature of the service, the hours rendered, and its estimated monetary value for tax or internal reporting purposes.

- Donations of Property: For donations involving real estate, vehicles, or significant intellectual property, the document provides the necessary detailed description and valuation information required for IRS reporting.

- Barter Transactions Between Businesses: When two businesses exchange goods or services without direct monetary payment, adapting this form can serve as a mutual sales record or service receipt for each party, detailing the exchange for their respective financial records.

- Tracking Volunteer Hours: Although not a direct "gift in kind" in the traditional sense, a modified version of the template can help organizations track and acknowledge significant volunteer contributions, including an estimated value of the labor, for grant reporting or internal metrics.

- Internal Business Asset Transfers: Documenting the transfer of non-monetary assets between departments or subsidiaries within a larger organization can be managed effectively using this form, ensuring clear internal expense records.

- Proof of Non-Cash Contributions for Tax Deductions: For individual donors, the receipt is crucial proof of transaction for claiming non-cash charitable contributions on their income tax returns, especially for items valued over $250.

- Recording Sponsored Events Contributions: When a sponsor provides goods or services (e.g., venue space, catering, promotional items) instead of cash for an event, the document clearly outlines the value and nature of their contribution, serving as a donation acknowledgment.

Each of these applications underscores the versatility and critical importance of having a standardized method for documenting non-cash transactions. The template ensures that both the giver and receiver have a clear, professionally formatted record.

Tips for Design, Formatting, and Usability

The effectiveness of any financial template, including this one, hinges significantly on its design, formatting, and overall usability. A well-designed receipt is not only functional but also reflects professionalism and facilitates accurate data entry. Attention to these details ensures that the document is easy to understand, complete, and retain, whether in print or digital format.

- Clarity and Legibility: Prioritize a clean, uncluttered layout with ample white space. Use professional, easy-to-read fonts (e.g., Arial, Calibri, Times New Roman) at a legible size. Headings and labels should be clear and concise, guiding the user through each section.

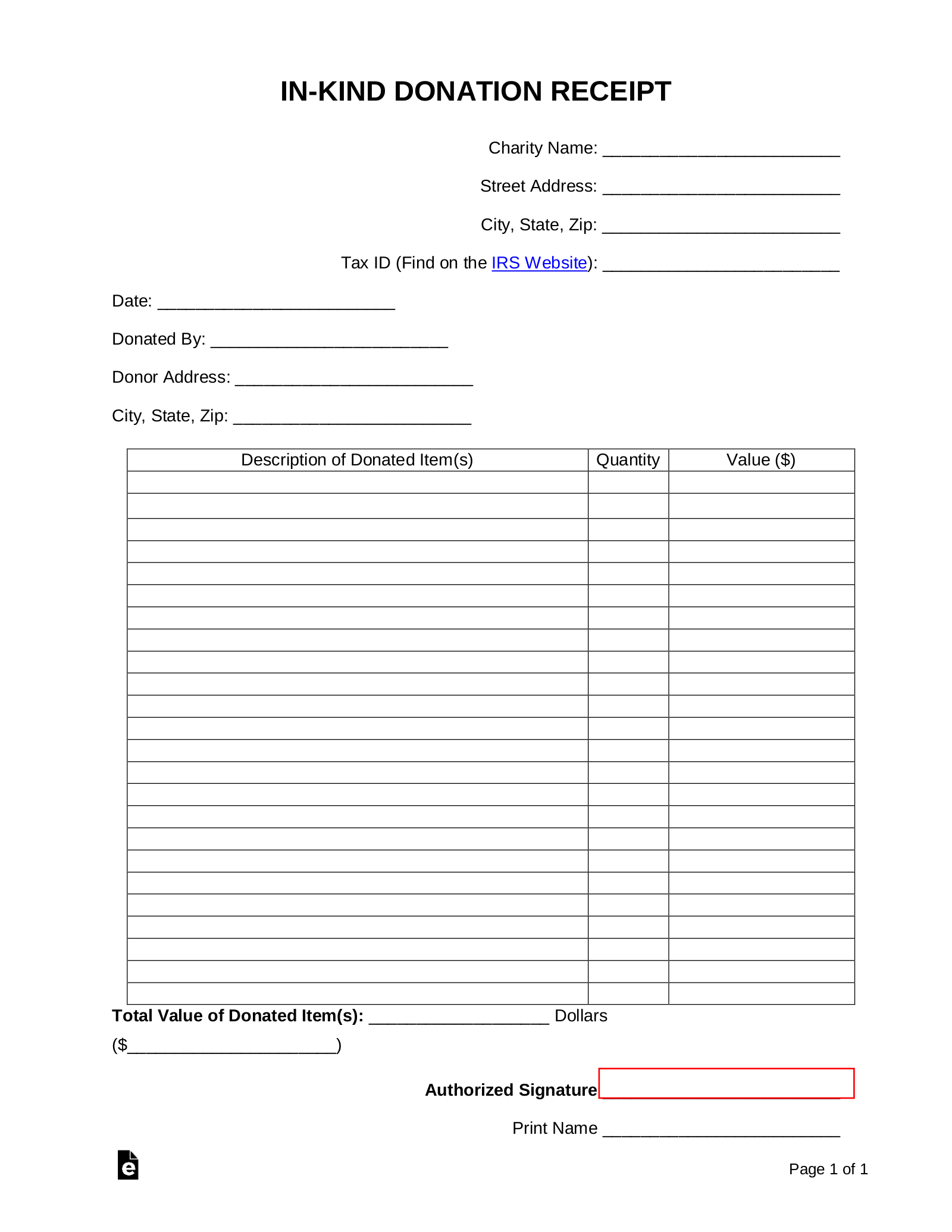

- Essential Data Fields: Ensure the template includes all necessary fields:

- Organization/Recipient Information (Name, Address, EIN/Tax ID)

- Donor/Giver Information (Name, Address, Contact)

- Date of Contribution/Receipt

- Detailed Description of the Gift In Kind (Type, Quantity, Condition, if applicable)

- Estimated Fair Market Value (with a disclaimer that the organization does not appraise value for tax purposes)

- Purpose or Use of the Gift

- Acknowledgment Statement (e.g., "No goods or services were provided in exchange for this gift," or description of any provided)

- Authorized Signature Line (Recipient Representative)

- Unique Receipt Number (for tracking)

- Branding and Professionalism: Incorporate your organization’s logo, branding elements, and contact information prominently. A professional appearance reinforces credibility and ensures the document is easily identifiable. This consistency also aids in building brand recognition and trust.

- Accessibility and Version Control: For digital versions, ensure the file is accessible (e.g., fillable PDF, online form). Implement a clear version control system if the template undergoes revisions, ensuring that only the most current version is in use. This prevents confusion and maintains consistency across all records.

- Digital vs. Print Considerations:

- Digital: Optimize for digital completion and electronic signatures. Ensure fields are fillable and savable. Consider integrating with existing CRM or accounting software for streamlined data entry and record management. The layout should be responsive if it’s a web-based form.

- Print: Design for standard paper sizes (e.g., 8.5" x 11"). Ensure all text is dark enough to print clearly and that the layout doesn’t cut off information at page breaks. Provide clear instructions for printing and filing.

- Disclaimer for Valuation: Crucially, the template should include a disclaimer stating that the receiving organization does not provide legal or tax advice, and that the donor is responsible for substantiating the fair market value for tax deduction purposes. This protects the organization from liability and properly informs the donor.

By meticulously attending to these design and formatting considerations, organizations can create a payment receipt or donation acknowledgment that is not only legally compliant but also exceptionally user-friendly and reflective of their professional standards. This commitment to detail elevates the document from a mere formality to a powerful tool for efficient business communication.

In conclusion, the careful development and consistent application of a well-structured template for non-monetary contributions represent a significant asset for any organization or individual involved in such transactions. This financial template transcends its basic function as a proof of transaction, evolving into a cornerstone of operational efficiency, regulatory compliance, and transparent communication. It provides a reliable framework for accurately documenting valuable non-cash assets, ensuring that every gift, service, or property exchange is acknowledged with precision and professionalism.

Ultimately, the utility of this form extends to safeguarding financial integrity and fostering trust. By providing a clear, standardized record, the document not only streamlines internal accounting processes and simplifies audit preparations but also empowers donors and partners with the necessary documentation for their own tax and financial planning. Investing in a robust and adaptable template is therefore an investment in accuracy, accountability, and the long-term credibility of an organization, cementing its status as an indispensable financial record tool.