In the intricate landscape of modern business and personal finance, the seemingly simple act of documenting a transaction holds profound importance. While digital solutions increasingly dominate, there remains a critical need for reliable, tangible records, particularly for immediate exchanges. This is precisely where a well-designed handwritten receipt template becomes an indispensable tool. It serves as a foundational element for ensuring transparency, accountability, and clarity in financial dealings, providing a clear, physical acknowledgment of payment received or goods/services rendered.

The purpose of such a template extends beyond mere formality; it establishes a verifiable audit trail for both parties involved. Whether you are a small business owner, an independent contractor, an individual managing personal expenses, or a non-profit organization, the ability to issue a professional and structured receipt instantly can significantly enhance operational efficiency and credibility. This document is not just a piece of paper; it is a commitment to proper record-keeping, safeguarding against potential disputes and facilitating accurate financial tracking for all stakeholders.

The Importance of Clear and Professional Documentation in Financial and Business Transactions

Financial transactions, regardless of their scale, necessitate meticulous documentation. Clear and professional records are the bedrock of sound financial management, providing undeniable proof of transaction for all parties involved. Without proper documentation, businesses and individuals are vulnerable to misunderstandings, discrepancies, and even legal challenges, making effective business communication paramount. A systematically documented transaction serves as a definitive payment receipt, safeguarding against accusations of non-payment or disputes over the terms of exchange.

From a legal standpoint, comprehensive documentation fulfills compliance requirements and can be crucial evidence in the event of an audit or dispute. Tax authorities often require detailed records to substantiate income and expenses, making a well-organized sales record or service receipt invaluable. Furthermore, for internal accounting and auditing processes, consistent documentation streamlines operations, allowing for accurate reconciliation of accounts and informed decision-making. The professional appearance of a detailed invoice form or receipt also reflects positively on the issuing entity, reinforcing trust and professionalism in every interaction.

Key Benefits of Using Structured Templates for Handwritten Receipt Template

Adopting structured templates for a handwritten receipt template offers a multitude of advantages, primarily centered around ensuring accuracy, transparency, and consistency in record-keeping. Unlike ad-hoc notes, a template guides the user to capture all necessary information systematically, significantly reducing the likelihood of omissions or errors. This standardization fosters an environment of reliability, where every transaction is recorded uniformly, simplifying subsequent data entry and financial analysis.

A key benefit is the immediate creation of a clear proof of transaction. This not only provides peace of mind for both the payer and the recipient but also serves as an immediate reference for any future queries. The structured format ensures that essential details such as the date, amount, description of goods/services, and parties involved are consistently present. This consistency is vital for maintaining an organized expense record and business documentation, making it easier to track financial flows, analyze spending patterns, and prepare for tax season. The use of a dedicated layout also projects a professional image, enhancing customer confidence and streamlining the overall transaction process.

How This Template Can Be Customized for Different Purposes

The inherent flexibility of a well-designed receipt template allows for significant customization, making it adaptable for a diverse range of financial interactions. This adaptability ensures that while the core structure remains consistent, specific fields can be tailored to meet the unique requirements of various transactions. For instance, a basic template can be easily modified to serve as a specialized financial template for different sectors.

For sales transactions, the template might include fields for itemized lists, quantity, unit price, and total amount, perhaps with a space for sales tax. When used for service payments, it could feature sections for service description, hourly rates, labor costs, and project completion dates. For rent payments, essential additions would be the property address, rental period, and tenant/landlord names. Non-profit organizations often customize the document to function as a donation acknowledgment, including their tax-exempt status information and donor’s name and address. Similarly, for business reimbursements, specific categories for travel, meals, or supplies can be integrated, along with spaces for employee identification and department codes. The versatility of the layout makes it an invaluable tool across various financial scenarios, ensuring the receipt accurately reflects the specific nature of each exchange.

Examples of When Using a Handwritten Receipt Template Is Most Effective

While digital payment systems and electronic invoicing are prevalent, there are numerous scenarios where the immediate, tangible nature of a handwritten receipt template remains indispensable. Its effectiveness shines in situations demanding instant documentation without access to advanced technology, or when a physical record is simply preferred or required.

- Cash Transactions: When cash changes hands, particularly in small businesses, local markets, or direct sales, a physical receipt provides immediate, undeniable

proof of transactionfor both buyer and seller. - On-Site Services: Contractors, repair technicians, or service providers working at client locations often need to issue a

service receipton the spot, without access to a printer or reliable internet. - Small Businesses and Pop-Up Shops: Vendors at craft fairs, farmers’ markets, or temporary retail spaces may not have a Point-of-Sale (POS) system, making a pre-printed form the most efficient way to generate a

sales record. - Individual Transactions and Private Sales: When an individual sells an item privately, such as a used car or furniture, a handwritten receipt offers a simple yet legally sound document for both parties.

- Emergency Situations or Remote Locations: In areas with unreliable power or internet, or during emergencies, the ability to issue a physical receipt ensures transactions can still be documented accurately.

- Donations at Events: Non-profit organizations collecting contributions at events can use these forms as immediate

donation acknowledgmentfor donors, often a requirement for tax purposes. - Petty Cash and Reimbursements: For immediate

expense recorddocumentation when an employee makes a small purchase or incurs an expense that requires immediate reimbursement. - Landlord-Tenant Interactions: For landlords collecting rent in person, providing a

billing statementas a physicalpayment receipthelps maintain clear records for both parties, particularly when dealing with cash or checks.

Tips for Design, Formatting, and Usability

The effectiveness of any receipt template hinges on its design and usability. Whether intended for print or digital filling, a thoughtful layout ensures clarity, legibility, and ease of completion. For print versions, the focus should be on clean lines, sufficient writing space, and logical field arrangement. Pre-printed details, such as company name, logo, and contact information, save time and reinforce branding. High-quality paper stock can also enhance the professional feel.

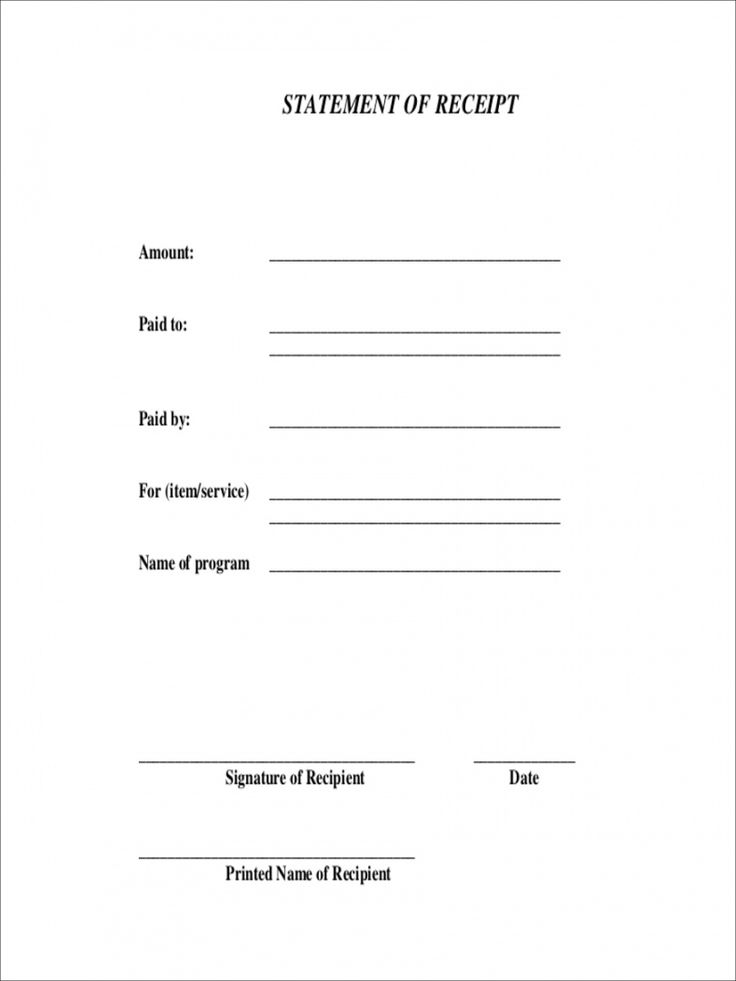

For digital versions (e.g., a PDF that can be printed and filled by hand, or one designed for digital entry then printing), fields should be clearly labeled and perhaps include placeholder text for guidance. Ensure the font is legible, and spacing is ample. Key elements to include in the layout are:

- Header: Clearly state "Receipt," "Payment Receipt," or "Sales Receipt." Include the issuer’s business name, logo (if applicable), and contact information.

- Receipt Number: A unique, sequential number for easy tracking and reference.

- Date: Space for the transaction date.

- Recipient Information: Name of the person or entity making the payment.

- Payer Information: Name of the person or entity receiving the payment.

- Amount Paid: Clearly displayed in both numerical and written form (e.g., "$150.00 – One Hundred Fifty Dollars and Zero Cents").

- Method of Payment: Indicate cash, check (with check number), credit card, or other methods.

- Description of Goods/Services: A detailed, itemized list of what was purchased or rendered. Include quantity, unit price, and total for each item.

- Subtotal, Tax, Total: Clearly separate these components to show how the final amount was calculated.

- Balance Due: If applicable, indicate any remaining balance.

- Signature Lines: Space for the signature of the recipient/issuer, and optionally the payer, to acknowledge receipt.

- Memo/Notes: An optional field for any additional relevant information or special instructions.

- Legibility: Use a font size that is easy to read, and ensure lines for writing are adequately spaced.

- Duplication: Consider templates with carbon copy functionality for easy creation of duplicates for both parties. Alternatively, a clear file structure for digital scans of completed receipts is essential.

Conclusion

In an era increasingly dominated by digital transactions, the foundational utility of a handwritten receipt template remains undeniable. It stands as a vital instrument for ensuring clarity, accountability, and legal compliance in various financial exchanges. By providing a structured, verifiable record, this essential business documentation mitigates potential disputes, streamlines accounting processes, and reinforces a professional image for any entity issuing it. Its inherent flexibility allows for seamless adaptation across diverse applications, from basic payment receipt issuance to comprehensive donation acknowledgment.

Ultimately, the strategic implementation of a well-designed financial template for handwritten receipts transcends a simple administrative task; it is a commitment to robust financial governance and effective communication. It empowers both individuals and organizations with the capacity to generate accurate, immediate proof of transaction regardless of technological access. Adopting and maintaining this reliable and efficient tool is not merely a best practice; it is a fundamental pillar of sound financial record-keeping, ensuring peace of mind and operational excellence in every transaction.