In the intricate landscape of financial transactions, the seemingly simple act of acknowledging payment holds significant legal and practical weight. For landlords and tenants alike, a clear and undeniable record of rent payment is not merely a courtesy but a fundamental element of responsible financial management. The absence of such documentation can lead to misunderstandings, disputes, and considerable legal complications for both parties involved.

This article delves into the critical role of a meticulously designed home rent receipt template, a standardized document that serves as irrefutable proof of payment. It elucidates its purpose, outlines its benefits, and provides guidance on its effective utilization. Professionals in property management, individual landlords, and tenants who prioritize clear financial accountability will find this discussion invaluable in establishing and maintaining transparent transactional records.

The Imperative of Clear Financial Documentation

Professionalism in financial and business transactions hinges critically on the clarity and completeness of documentation. Each monetary exchange, regardless of its scale, necessitates a tangible record that accurately reflects the details of the transaction. This principle is especially vital in property rental, where substantial sums are exchanged regularly, forming the backbone of a contractual agreement.

Clear documentation serves as a mutual safeguard, offering protection against potential disputes or miscommunications regarding payment status. It establishes an indisputable audit trail, crucial for tax purposes, legal compliance, and general financial transparency. Without robust payment receipts, individuals and businesses expose themselves to significant risks, including challenges to payment claims or difficulties in proving financial obligations have been met.

Core Benefits of a Structured Template

The adoption of a structured template for payment acknowledgments, such as a home rent receipt template, offers a multitude of benefits that extend beyond mere record-keeping. Foremost among these is the assurance of accuracy. A well-designed template guides the user to input all necessary information, minimizing omissions and errors that could compromise the validity of the proof of transaction. This standardization ensures that every receipt issued contains consistent and complete data.

Furthermore, a template significantly enhances transparency, providing both payer and payee with a clear, identical understanding of the transaction details. This clarity fosters trust and reduces the likelihood of discrepancies or disagreements. The consistent application of such a financial template also streamlines administrative processes, saving time and effort for both parties by ensuring that all relevant information, from payment dates to amounts and method, is captured uniformly. This systematic approach contributes directly to improved financial consistency and robust business documentation.

Customization and Versatility in Application

While the focus here is on rent payments, the fundamental structure and principles embodied in a robust receipt template are remarkably versatile. This foundational layout can be readily customized to suit a myriad of financial acknowledgments across various sectors. For instance, the core components of the document—details of payer and payee, date, amount, purpose, and method of payment—remain constant.

This adaptability allows the document to be repurposed effectively as a sales record for goods sold, a service receipt for professional services rendered, or even a donation acknowledgment for charitable contributions. Businesses can adapt the invoice form for internal business reimbursements or as a billing statement for client charges. The capacity to modify fields for specific transaction types—such as adding a product description for sales, a service hour breakdown for services, or a property address for rent—underscores the template’s broad utility across diverse financial interactions, ensuring each payment receipt is fit for its intended purpose.

When a Home Rent Receipt Template is Most Effective

Utilizing a dedicated and well-structured receipt is most effective in scenarios where clear, verifiable proof of payment is paramount. Such a template provides an essential safeguard for both landlords and tenants, ensuring that all financial transactions are meticulously documented. The consistent application of this form eliminates ambiguity and fortifies the professional relationship between the parties.

Examples of when using the template is most effective include:

- Monthly Rent Payments: Providing a clear acknowledgment for regular rent payments, establishing an ongoing record of compliance with lease terms.

- Security Deposits: Documenting the initial security deposit payment, including the amount, date received, and any conditions for its return, safeguarding both parties.

- Partial Payments: Recording instances where a tenant makes a partial payment, clearly indicating the amount received and the remaining balance due.

- Late Fees or Penalties: Acknowledging the payment of any late fees or other penalties, ensuring transparent record-keeping of all additional charges.

- Utility Reimbursements: Documenting payments made by tenants for utilities or other shared expenses that are reimbursed to the landlord.

- Cash Transactions: Offering crucial proof of transaction for payments made in cash, which otherwise leave no digital footprint.

- Move-in/Move-out Payments: Confirming the receipt of initial rental payments upon move-in or final payments upon move-out.

- Tax Documentation: Serving as an official expense record for tenants claiming rental deductions and for landlords reporting income.

- Dispute Resolution: Providing an undeniable financial template that can be presented as evidence in the event of any payment-related disputes or legal proceedings.

Design, Formatting, and Usability Best Practices

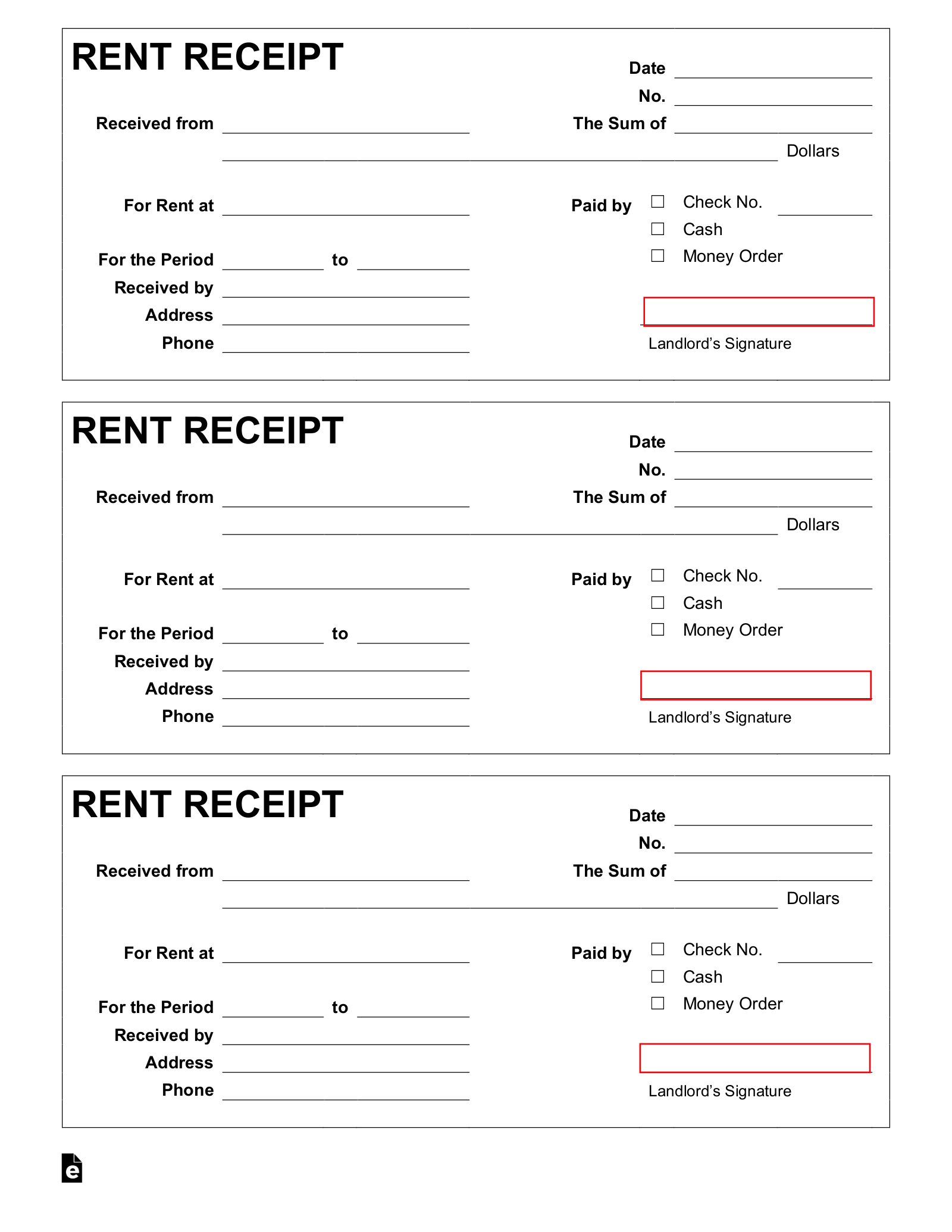

The efficacy of any financial document, including a payment receipt, is significantly influenced by its design, formatting, and overall usability. For both print and digital versions, clarity and legibility are paramount. The layout should be clean and intuitive, ensuring that essential information is easily identifiable and comprehensible at a glance. Important fields such as date of payment, amount received, payer and payee names, property address, and payment method should be prominently displayed.

Using a professional font, appropriate font sizes, and ample white space enhances readability. For digital versions, ensuring the file is easily editable and savable in common formats like PDF or Microsoft Word provides flexibility. Print versions should be designed to fit standard paper sizes and be easily reproducible. Incorporating branding elements, such as a company logo, can add a professional touch and reinforce credibility. The document should also include a unique receipt number for tracking and a clear space for signatures, confirming the agreement of both parties to the details recorded. Ultimately, a well-designed receipt template minimizes potential for human error and ensures that the financial record is robust and reliable.

Conclusion

In an era where meticulous financial record-keeping is increasingly critical for individuals and businesses alike, the humble payment receipt stands as a cornerstone of accountability and transparency. A thoughtfully constructed template, adaptable for various financial exchanges, transcends its basic function to become an indispensable tool in managing monetary transactions professionally. It offers a structured approach that not only streamlines administrative tasks but also significantly mitigates the risks associated with undocumented financial movements.

The consistent application of such a financial template provides peace of mind, assuring both parties that payments are accurately recorded and acknowledged. It reinforces trust, promotes clarity, and stands as an authoritative proof of transaction for legal, tax, and personal financial management purposes. Embracing a standardized, professional receipt template is not merely a best practice; it is an essential component of sound financial governance, ensuring that every payment is a clearly documented step in a transparent and responsible financial journey.