In the intricate landscape of financial transactions and philanthropic endeavors, meticulous documentation stands as a cornerstone of accountability and transparency. For non-profit organizations, businesses, and individuals alike, understanding the critical role of an in kind donation receipt template is paramount. This specialized form serves not merely as a bureaucratic formality but as a vital instrument for substantiating non-cash contributions, ensuring compliance with tax regulations, and fostering trust between donors and recipients. It meticulously records the exchange of goods, services, or property, providing an essential paper trail for all parties involved.

The value derived from a well-structured in kind donation receipt template extends beyond mere compliance; it underpins effective record-keeping and robust financial management. Donors rely on these documents for substantiating tax deductions, particularly for non-cash contributions where valuation can be complex. Simultaneously, recipient organizations utilize this form to accurately track their assets, report their financial position, and demonstrate their commitment to ethical practices. By standardizing the acknowledgment process, the template streamlines operations, reduces errors, and safeguards the integrity of charitable and business transactions involving non-monetary exchanges.

The Importance of Clear and Professional Documentation

Clear and professional documentation is an indispensable element of sound financial and business practices. In an environment where regulations are stringent and scrutiny is common, detailed records serve as a primary defense against potential disputes or audits. For any organization, whether a burgeoning startup or an established non-profit, comprehensive business documentation provides a verifiable history of all transactions, affirming transparency and ethical conduct. It underpins effective financial reporting and ensures that all stakeholders, from internal management to external auditors, have a precise understanding of financial flows.

Beyond regulatory compliance, robust documentation fosters an environment of professionalism and trust. A well-organized system of payment receipts, invoice forms, and service receipts demonstrates an organization’s commitment to accuracy and integrity. This attention to detail not only mitigates financial risks but also enhances credibility with donors, clients, and partners. In the absence of clear records, organizations risk misstatements, operational inefficiencies, and damage to their reputation, underscoring the fundamental role of precise financial templates in maintaining organizational health and public confidence.

Key Benefits of Using Structured Templates for Financial Record-Keeping

Structured templates offer a multitude of advantages in financial record-keeping, transforming what could be a cumbersome task into an efficient and reliable process. When acknowledging non-cash contributions, a comprehensive in kind donation receipt template serves as a foundational tool for ensuring accuracy and consistency across all transactions. These pre-designed forms guide users through the necessary data entry fields, minimizing the likelihood of omissions or errors that could invalidate a record for tax purposes or internal accounting.

The inherent structure of these financial templates promotes transparency by standardizing the information collected and presented. This uniformity allows for easier auditing, faster reconciliation of accounts, and a clearer understanding of an organization’s financial position. Furthermore, using a consistent layout for every donation acknowledgment or expense record significantly improves operational efficiency. Staff can process contributions more quickly, and financial data can be aggregated and analyzed with greater ease, leading to better decision-making and a more streamlined workflow. This approach significantly reduces administrative burden and enhances overall organizational effectiveness.

Customization for Diverse Financial Transactions

While initially designed for non-cash contributions, the underlying structure of a receipt template is remarkably versatile, allowing for extensive customization across a broad spectrum of financial transactions. The core components—such as donor/recipient details, transaction date, item description, and valuation—can be adapted to suit various business and personal needs. This adaptability makes the template a powerful tool for streamlining different aspects of financial administration, extending its utility far beyond its original purpose.

For instance, this form can be reconfigured into a standard payment receipt for cash transactions, an invoice form for services rendered, or a detailed sales record for goods sold. The flexibility lies in modifying the specific fields to reflect the nature of the exchange, whether it involves money, goods, or services. By adjusting labels and adding or removing sections, the same fundamental layout can effectively serve as a billing statement, a service receipt, or a detailed business documentation tool, making it an invaluable asset for efficient record-keeping across numerous operational contexts.

Effective Applications of a Structured Receipt Template

A well-designed receipt template proves invaluable in a variety of scenarios where clear documentation of non-monetary exchanges or specific financial transactions is required. Its structured nature ensures that all pertinent details are captured, providing irrefutable proof of transaction. Here are several examples of when using such a template is most effective:

- Non-Profit Acknowledging Non-Cash Gifts: Essential for charities receiving physical goods like furniture, clothing, or artwork, or services such as pro bono legal advice or skilled labor. The document provides critical information for both the organization’s accounting and the donor’s tax deduction claims.

- Small Business Receiving Goods/Services in Lieu of Cash: When a business accepts goods or services as payment or partial payment for its own products or services (bartering), this form accurately records the transaction, its value, and the nature of the exchange for internal records and tax reporting.

- Individuals Documenting Charitable Contributions: Donors making significant non-cash contributions to qualified organizations require this receipt to substantiate their charitable deductions to the IRS, particularly for items valued over $500, which often necessitates additional appraisal.

- Business Reimbursements for Non-Monetary Exchanges: In scenarios where employees or partners are reimbursed for out-of-pocket expenses that involve goods or services rather than direct cash, this form serves as a clear expense record, detailing what was exchanged and its agreed-upon value.

- Recording Rent Payments Made with Goods/Services: In specific agreements, a tenant might provide services or goods in exchange for rent. The template can be adapted to document these non-cash rent payments, ensuring both landlord and tenant have a clear record for accounting and legal purposes.

- Proof of Transaction for Barter Agreements: Any formal barter agreement between two entities, where goods or services are exchanged without monetary involvement, benefits from a detailed receipt to document the terms, items exchanged, and their fair market value.

The consistent application of such a receipt ensures that financial records are complete, auditable, and compliant with relevant regulations, thereby safeguarding the interests of all parties.

Design, Formatting, and Usability Best Practices

Designing and formatting a receipt for optimal usability is crucial for ensuring its effectiveness, whether in print or digital form. The layout should prioritize clarity, readability, and a professional aesthetic, reflecting the seriousness of financial documentation. Key elements must be easily identifiable and logically organized to facilitate quick completion and accurate interpretation.

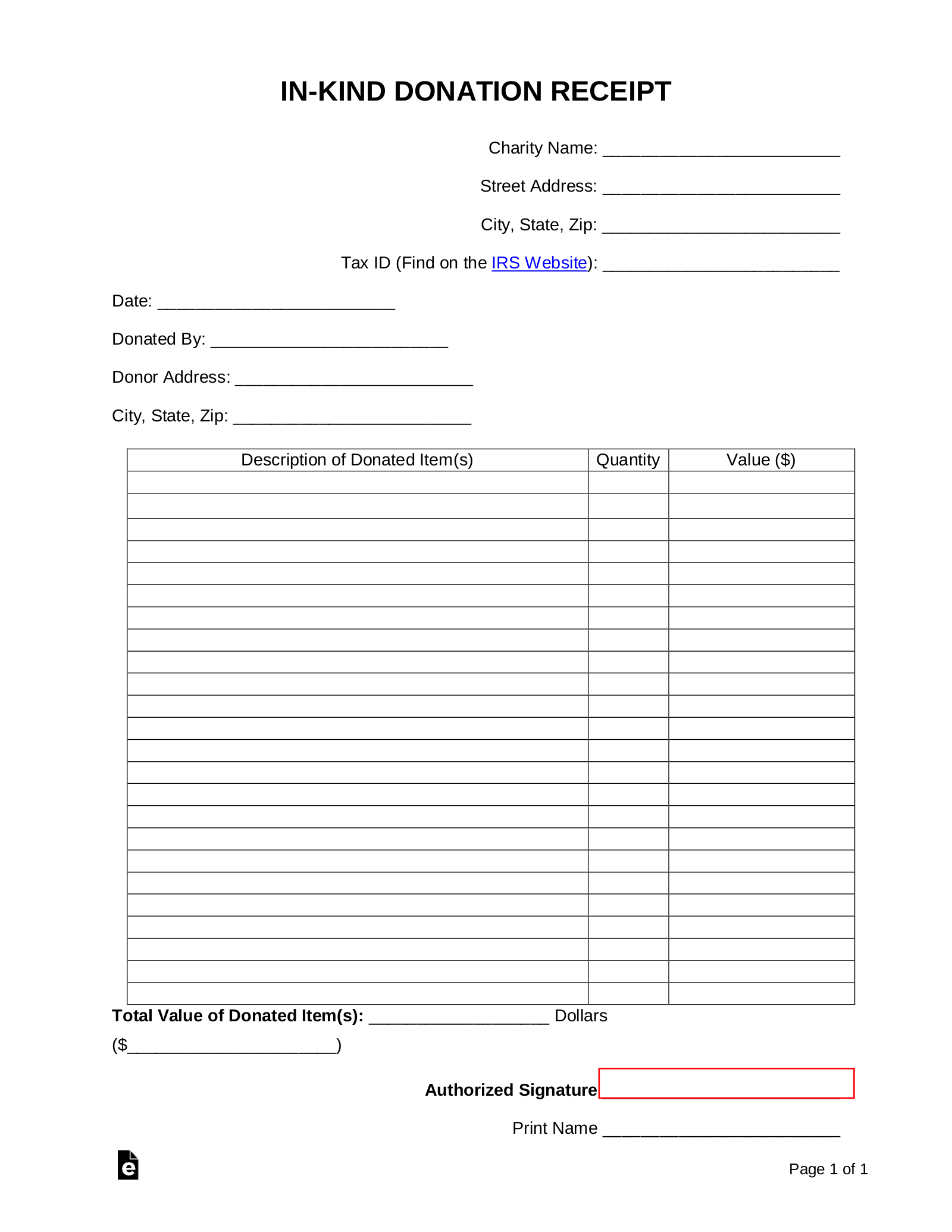

Essential Components for Clarity

The foundation of a robust receipt lies in its core components. Every form should prominently feature the full legal names and contact information of both the donor/provider and the recipient organization. The date of the transaction is non-negotiable, alongside a clear, detailed description of the item(s) or service(s) donated or exchanged. Crucially, the fair market value of the non-cash contribution must be stated, often accompanied by a disclaimer that the organization cannot provide a valuation but is reporting the donor’s stated value. Spaces for authorized signatures from both parties add a layer of authenticity and agreement.

Formatting for Readability

Effective formatting significantly enhances readability. Utilizing clear, legible fonts and an appropriate font size ensures that all text is easily digestible. Ample white space around text blocks and fields prevents a cluttered appearance, making the document less intimidating and easier to navigate. Headings and subheadings should be used to break up information, guiding the user’s eye through the various sections of the template. Bold text can highlight critical information, such as the total value or specific terms, further improving scannability and comprehension.

Branding and Professionalism

Incorporating an organization’s logo and branding elements lends a professional touch to the document, reinforcing its legitimacy and source. Consistent use of organizational colors and styles contributes to brand recognition and presents a cohesive corporate image. Even for individuals or small businesses, a clean, well-designed layout elevates the perceived professionalism of the transaction. This attention to detail in the layout contributes significantly to building trust and credibility with those receiving or issuing the receipt.

Digital Versus Print Considerations

For digital versions, the template should be available in a universally accessible format, such as PDF, to ensure consistent display across different devices and operating systems. Editable PDF forms or web-based forms can streamline data entry and reduce manual errors. For print versions, ensuring that the form prints correctly on standard paper sizes without cutting off information is vital. Both versions should be designed to be intuitive for the user, whether they are filling it out electronically or by hand. Implementing features like auto-fill capabilities in digital forms or clear lines for handwritten entries in print versions can greatly improve user experience. Maintaining version control for the template is also essential to ensure that all parties are using the most current and compliant iteration of the form.

Conclusion

In the realm of financial record-keeping, the strategic deployment of a specialized receipt template stands out as an indispensable practice for both individuals and organizations. This robust financial template serves as a critical mechanism for acknowledging a wide array of transactions, particularly non-cash contributions, ensuring that every detail is meticulously documented. Its structured format not only simplifies the complex task of record-keeping but also instills confidence, guaranteeing compliance with established regulations and fostering a culture of accountability.

Ultimately, a well-executed receipt or financial template is far more than a simple piece of paper; it is a powerful tool for maintaining transparency, accuracy, and efficiency in all financial dealings. By leveraging such a reliable and standardized document, entities can significantly streamline their administrative processes, mitigate potential risks, and uphold the highest standards of financial integrity. This commitment to precise documentation reinforces trust and solidifies an organization’s reputation as a responsible and trustworthy steward of resources.