In the intricate world of finance and business, the meticulous documentation of transactions is not merely a formality but a fundamental necessity. An investment receipt template serves as a standardized and professional document designed to provide irrefutable proof of funds received or investments made. Its primary purpose is to acknowledge the successful transfer of assets or capital from one party to another, laying the groundwork for transparent and accountable financial dealings. This essential tool benefits a wide array of stakeholders, from individual investors and small businesses to large corporations and non-profit organizations, ensuring that every financial interaction is clearly recorded and verifiable.

The utility of a well-structured investment receipt template extends far beyond a simple acknowledgment of payment. It acts as a critical piece of business documentation, offering clarity and protection for both the sender and receiver of funds. By providing a clear record of when, how, and by whom an investment was made, this form helps prevent disputes, facilitates accurate accounting, and supports regulatory compliance. Its systematic application streamlines financial operations, allowing businesses and investors to maintain organized records that are easily retrievable for auditing, tax purposes, or internal review.

The Importance of Clear and Professional Documentation in Financial and Business Transactions

Clear and professional documentation stands as a cornerstone of sound financial management and robust business operations. In an environment governed by strict regulations and complex transactions, ambiguity can lead to significant financial, legal, and reputational risks. A meticulously prepared payment receipt or proof of transaction serves as a tangible record, offering an indisputable account of a financial event. This level of precision is vital for maintaining trust among parties, demonstrating compliance with legal obligations, and enabling accurate financial reporting.

Beyond mere compliance, professional documentation fosters operational efficiency. It provides a reliable audit trail, simplifying the process of tracking funds, reconciling accounts, and preparing financial statements. Without clear records, businesses face increased vulnerability to errors, fraud, and disputes, which can erode profitability and stakeholder confidence. Therefore, investing in superior documentation practices, such as the consistent use of an investment receipt template, is not an expense but a strategic imperative that safeguards assets and strengthens organizational integrity.

Key Benefits of Using Structured Templates for Investment Receipts

Utilizing structured templates for an investment receipt offers a multitude of benefits, centralizing around accuracy, transparency, and consistency in financial record-keeping. These templates provide a pre-defined framework, ensuring that all necessary details of a transaction are captured uniformly every time. This systematic approach drastically reduces the likelihood of omissions or errors that can occur when generating documents from scratch, thereby enhancing the reliability of your financial data.

Moreover, a well-designed template promotes transparency by clearly outlining the specifics of each investment. It explicitly states the amount received, the date of transaction, the parties involved, the nature of the investment, and any other pertinent terms. This clarity helps both the issuer and the recipient understand their financial position and obligations. The consistency achieved through template use is invaluable for maintaining a coherent financial history, simplifying future audits, and ensuring that all business documentation reflects a professional and organized approach. This commitment to structured financial forms builds confidence and supports a robust financial ecosystem.

How This Template Can Be Customized for Different Purposes

The inherent flexibility of an investment receipt template allows for significant customization, making it adaptable to a wide array of financial transactions beyond just traditional investments. Its modular design means core elements, such as sender and receiver details, transaction date, and amount, remain constant, while specific fields can be adjusted to suit distinct operational needs. This adaptability transforms it into a versatile financial template for various business interactions.

For instance, a business might adapt the layout to function as a sales record or a service receipt, detailing goods sold or services rendered instead of investment specifics. Non-profit organizations can tailor it into a donation acknowledgment, providing donors with official proof of their contributions for tax purposes. Similarly, property managers can modify it for rent payments, clearly outlining the period covered and tenant details. Even for internal use, companies can customize it as an expense record for employee reimbursements, ensuring all essential information for accounting and compliance is consistently captured.

Examples of When Using an Investment Receipt Template is Most Effective

The application of a well-crafted investment receipt template is pivotal in numerous scenarios where formal acknowledgment of financial transfer is essential. Its structured nature provides clarity and legal weight to transactions, making it an indispensable tool for various entities.

- Equity Investments: When an individual or entity purchases shares or a stake in a company, the investment receipt template provides official proof of their capital contribution, detailing the amount, date, and share allocation.

- Loan Repayments: For private loans or inter-company financing, this form can serve as a payment receipt, acknowledging the principal or interest payments received, helping both parties track the loan’s status.

- Crowdfunding Campaigns: Organizations running crowdfunding initiatives can issue these receipts to contributors, confirming their investment and often outlining the nature of the return or benefit promised.

- Real Estate Transactions: Beyond initial purchases, payments related to property development, down payments, or earnest money can be formally recorded using a modified version of the document.

- Venture Capital Funding Rounds: Startups receiving funding from venture capitalists can issue structured receipts to investors, documenting the specific terms and amounts of the capital injection.

- Donations to Charitable Organizations: While often called a donation acknowledgment, the underlying structure of a financial template can be adapted to provide official, tax-deductible proof of funds received by non-profits.

- Pre-payments for Future Services or Products: Businesses receiving upfront payments for services or products to be delivered later can use this receipt to formalize the pre-payment, acting as a billing statement for funds received.

- Partnership Capital Contributions: When new partners join a business or existing partners contribute additional capital, this form serves as clear documentation of their financial commitment and stake.

Tips for Design, Formatting, and Usability

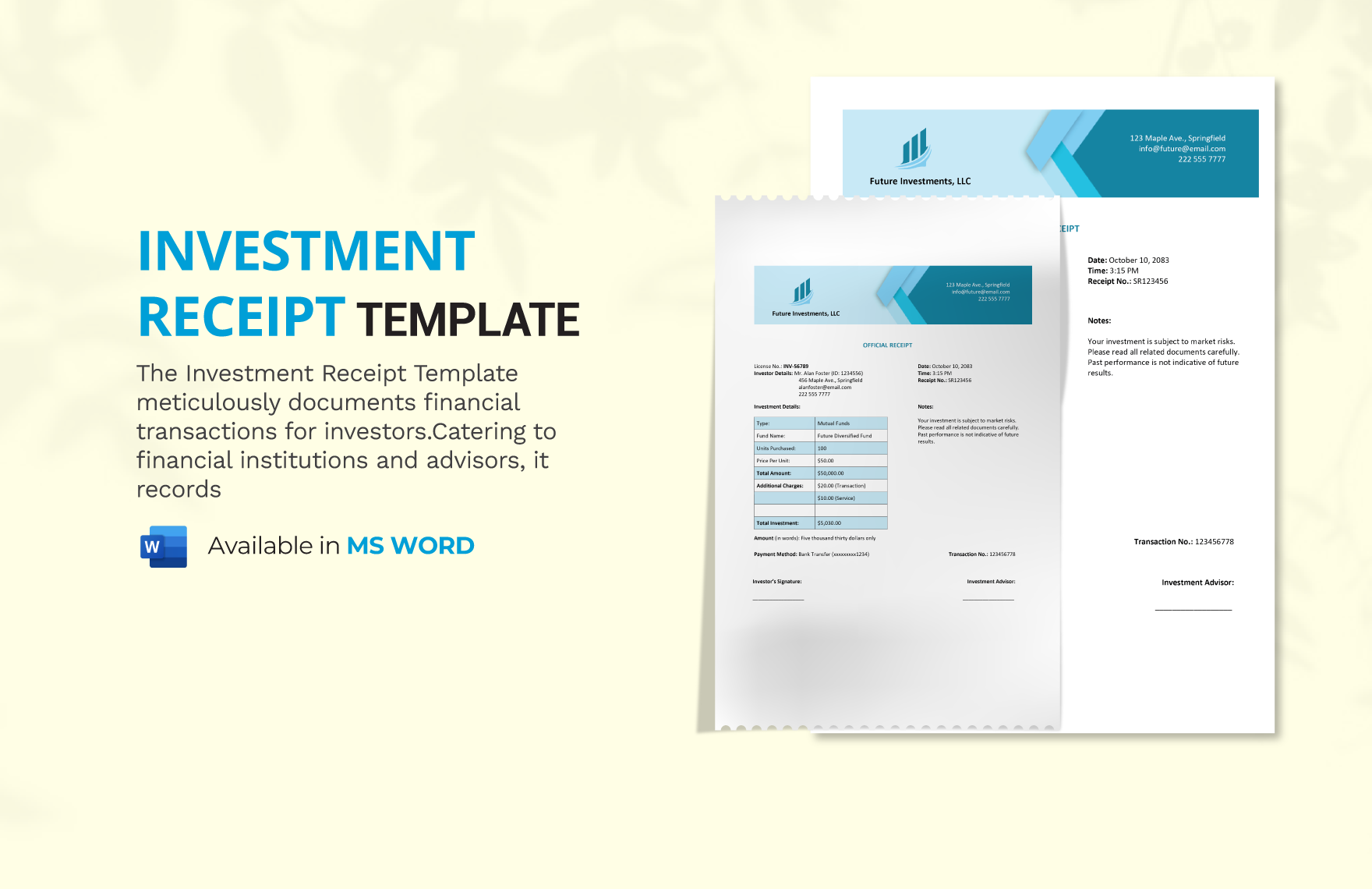

Designing and formatting an investment receipt template for optimal usability, both in print and digital formats, is crucial for its effectiveness. A clean, intuitive design enhances readability and professionalism, reinforcing the legitimacy of the transaction. Begin by ensuring a clear header that prominently displays the organization’s logo and contact information, along with the title "Investment Receipt."

For formatting, employ a consistent font style and size throughout the document. Utilize bold text for headings and key figures to draw attention to important data points. Arrange information logically, typically starting with sender and receiver details, followed by transaction specifics (date, amount, method), and then any additional notes or terms. Incorporate clear, labeled fields for every piece of data, making it easy for users to input or extract information. For digital versions, consider using fillable PDF forms or web-based interfaces that can automatically populate certain fields and calculate totals, improving efficiency. Ensure the template is easily printable, with adequate margins and a layout that avoids cutting off information at page breaks. Lastly, include a unique receipt number for each transaction to facilitate tracking and referencing, strengthening the document’s utility as a comprehensive proof of transaction.

Concluding Thoughts on the Value of Investment Receipt Templates

In the dynamic landscape of modern finance and business, the meticulous recording of transactions is not merely good practice—it is an absolute requirement for operational integrity, legal compliance, and strategic decision-making. The consistent application of a professionally designed investment receipt template elevates financial record-keeping from a burdensome task to a streamlined, highly efficient process. This specialized document acts as a formidable safeguard, providing unequivocal proof of financial exchange, thereby fostering an environment of trust and accountability between all involved parties.

Embracing this invaluable financial template ensures that every payment receipt is accurate, transparent, and consistent, offering an indispensable audit trail for internal review, external audits, and tax preparations. Its customizable nature allows it to serve a broad spectrum of needs, from confirming equity investments to acknowledging charitable donations, solidifying its role as a versatile and foundational piece of business documentation. Ultimately, by leveraging a well-structured receipt, organizations and individuals can enhance their financial management, minimize risks, and reinforce their commitment to clear, professional communication in all monetary dealings.