In an increasingly complex healthcare and financial landscape, meticulous record-keeping is not merely an administrative task; it is a fundamental pillar of sound financial management. For individuals navigating health insurance claims, Flexible Spending Accounts (FSAs), Health Savings Accounts (HSAs), or tax deductions, a clear, comprehensive payment record is indispensable. This is precisely where a robust medical insurance receipt template proves invaluable, serving as the definitive proof of transaction for services rendered and payments made.

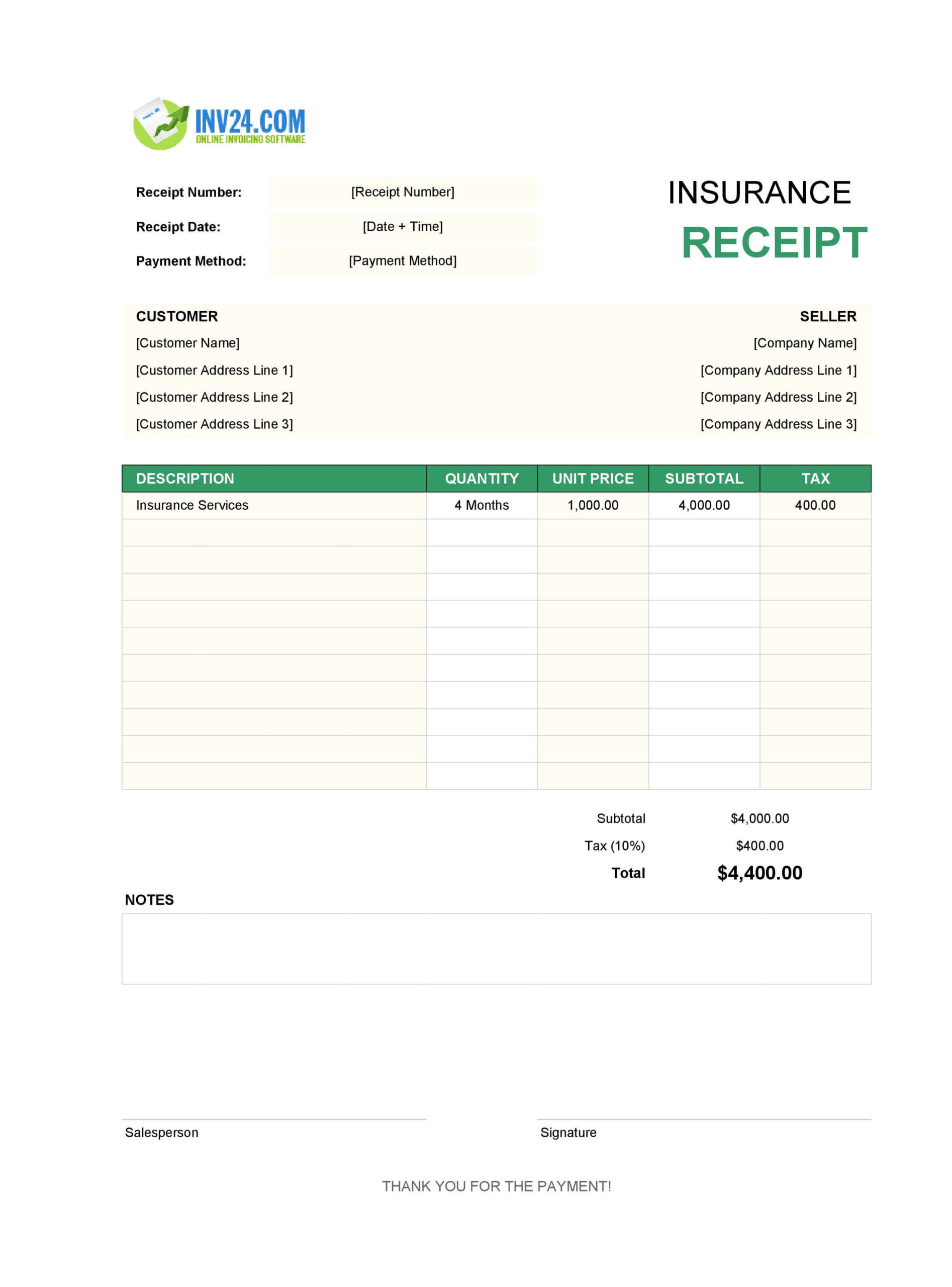

This essential document provides a structured framework for detailing medical expenses, making it easier for patients, providers, and insurers to track financial interactions. Its primary purpose is to offer a standardized, auditable record that can facilitate smooth reimbursement processes, aid in budget management, and ensure compliance with various financial regulations. Both patients seeking reimbursement and healthcare providers needing to issue professional acknowledgments stand to benefit significantly from its consistent application.

The Importance of Clear and Professional Financial Documentation

The integrity of financial and business transactions hinges on the clarity and professionalism of their associated documentation. In any industry, but particularly within healthcare, where financial figures directly impact personal well-being and often involve third-party payers, ambiguous or incomplete records can lead to significant complications. These can range from denied claims and delayed reimbursements to audit discrepancies and unnecessary disputes between patients and providers.

Professional documentation, such as a well-designed payment receipt, instills confidence and demonstrates a commitment to transparency and accountability. It acts as a verifiable audit trail, safeguarding all parties involved by clearly outlining the terms of a transaction, the amounts exchanged, and the specific services rendered. This level of detail is crucial for maintaining trust, ensuring regulatory compliance, and facilitating efficient financial operations.

Key Benefits of Structured Templates for Medical Insurance Receipts

Adopting a structured medical insurance receipt template offers a multitude of benefits, enhancing accuracy, transparency, and consistency in record-keeping. First and foremost, standardization reduces the potential for human error. By providing pre-defined fields for all necessary information—such as patient details, service dates, procedure codes, amounts paid, and payment methods—the template guides the user, ensuring no critical data points are overlooked.

Moreover, the use of a consistent layout promotes transparency. All parties know exactly where to find specific pieces of information, streamlining the review process for insurance companies, auditors, and individuals. This consistency fosters a clear understanding of financial obligations and payments, minimizing confusion. Ultimately, leveraging such a template contributes significantly to efficient financial management, saving time and resources that would otherwise be spent rectifying errors or clarifying incomplete records. The organized nature of this document supports efficient financial audits and ensures quick access to historical payment data when needed.

Customization for Diverse Payment Acknowledgments

While the core principles of a receipt remain universal, the underlying structure of a good payment receipt template is highly adaptable and can be customized for various financial transactions beyond medical insurance. The fundamental elements—payee, payor, date, amount, and description of goods/services—are applicable across a wide spectrum of business interactions. This flexibility makes a well-designed layout a versatile tool for any organization or individual.

For instance, the document can be tailored for sales receipts in retail, acknowledging customer purchases and payment methods. Similarly, service providers can adapt the form to issue detailed service receipts, outlining the specific work performed and associated costs. Businesses might customize it for internal expense reimbursements, ensuring employees are properly compensated and that company records are meticulous. Even non-profit organizations can adjust this template to serve as a donation acknowledgment, providing donors with official proof for tax purposes. The ability to modify fields, add branding, and specify unique transactional details makes the template an indispensable asset for diverse financial documentation needs.

When Using a Medical Insurance Receipt Template is Most Effective

The precise and detailed nature of a medical insurance receipt template makes it particularly effective in several specific scenarios. Its utility extends across personal finance management, professional administrative tasks, and compliance with various institutional requirements.

- Submitting Insurance Claims: When filing for reimbursement from a health insurance provider, a complete and accurate receipt is mandatory. The template ensures all required information, such as CPT codes, diagnosis codes, provider details, and payment specifics, is included, preventing delays or rejections.

- FSA/HSA Reimbursements: Individuals utilizing Flexible Spending Accounts or Health Savings Accounts need unequivocal proof of payment for eligible medical expenses. This form provides the necessary documentation to justify withdrawals and maintain compliance with IRS regulations.

- Tax Deductions: For medical expenses exceeding a certain percentage of Adjusted Gross Income (AGI), taxpayers can claim deductions. The detailed expense record provided by the receipt template is essential for substantiating these claims during tax filing.

- Personal Financial Planning and Budgeting: Tracking out-of-pocket medical costs is crucial for personal budgeting and financial oversight. The template offers a clear, consolidated view of these expenses, aiding in financial analysis and future planning.

- Dispute Resolution with Providers or Insurers: Should a discrepancy arise regarding payment or service, a clear, dated, and itemized receipt serves as indisputable proof of transaction, facilitating a smoother resolution process.

- Proof of Payment to Healthcare Providers: Even when not seeking reimbursement, having a formal payment receipt confirms that services have been paid for, preventing any future billing errors or misunderstandings from the provider’s side.

Design, Formatting, and Usability Tips

An effective medical insurance receipt template is not only comprehensive in its content but also intuitive in its design and formatting. Usability is paramount, whether the document is intended for print or digital distribution. A well-thought-out layout enhances clarity, reduces input errors, and improves the overall user experience.

- Clarity and Readability: Use a clean, professional font and appropriate font sizes. Ample white space around sections helps prevent visual clutter. Headings and subheadings should be clearly defined to guide the eye through the document.

- Essential Fields: Ensure all critical data fields are present and prominently displayed. These typically include:

- Provider Information: Name, address, contact details, NPI (National Provider Identifier).

- Patient Information: Name, address, date of birth, insurance ID.

- Service Details: Date of service, type of service, CPT/procedure codes, diagnosis codes (if applicable), unit cost, quantity.

- Financial Details: Total charges, amount paid by patient, amount paid by insurance, remaining balance, payment method.

- Transaction Details: Receipt number, date of payment, authorized signature/stamp.

- Logical Flow: Organize information in a logical sequence. Group related data fields together (e.g., all patient information in one section, all service details in another). This natural progression minimizes confusion and speeds up data entry and retrieval.

- Branding and Professionalism: Incorporate your organization’s logo and branding elements tastefully. A professional appearance reinforces credibility and consistency. Ensure the overall aesthetic aligns with business documentation standards.

- Print and Digital Adaptability: Design the template to be easily printable on standard paper sizes, with sufficient margins. For digital versions, ensure it is fillable (e.g., PDF forms) and compatible with common software. Consider an editable format like Microsoft Word or Google Docs for easy customization, alongside a static PDF for distribution.

- Version Control: If multiple versions or iterations of the template exist, implement a clear version control system. This ensures that the most current and correct layout is always in use, preventing the distribution of outdated forms.

- Accessibility: Consider users with varying needs. Ensure sufficient contrast in colors, and if possible, design digital versions to be compatible with screen readers.

The strategic design and meticulous formatting of the receipt directly contribute to its efficacy as a reliable financial tool.

Reliable, Accurate, and Efficient Financial Record-Keeping

In an environment where financial details can significantly impact individuals and organizations alike, the value of a meticulously designed medical insurance receipt template cannot be overstated. It transcends a mere piece of paper or a digital file; it embodies a commitment to precision, transparency, and operational efficiency. By standardizing the recording of vital payment and service information, this financial template serves as a bulwark against ambiguity and error, fostering clarity in every transaction.

Utilizing such a robust system ensures that all parties—patients, providers, and insurers—operate from a foundation of verifiable data. It streamlines the often-cumbersome processes of claims submission, reimbursement, and financial reconciliation, freeing up valuable time and resources. Ultimately, the systematic application of this receipt elevates the standard of financial record-keeping, transforming it from a potential source of frustration into a reliable and accurate cornerstone of sound financial management.