In today’s complex financial landscape, precise and transparent record-keeping is not merely an administrative task but a fundamental requirement for individuals and organizations alike. For healthcare consumers navigating insurance claims, tax deductions, or personal budgeting, a detailed record of services rendered and payments made is invaluable. A well-designed medical itemized receipt template is an indispensable tool that provides this clarity, transforming a simple transaction into a comprehensive and verifiable financial document.

This comprehensive guide delves into the critical role of such a template, outlining its structure, benefits, and practical applications. It is designed for US readers who prioritize organization, accuracy, and professional communication in their financial dealings. From individual patients seeking to optimize their healthcare expenses to providers aiming for impeccable business documentation, understanding and utilizing this specialized form enhances transparency, fosters trust, and streamlines financial processes across the board.

The Imperative of Clear Financial Documentation

The backbone of any sound financial operation, whether personal or business, lies in meticulous documentation. Clear and professional financial documentation serves multiple crucial purposes, extending beyond simple proof of payment. It establishes a verifiable audit trail, safeguards against disputes, ensures compliance with regulatory standards, and provides the necessary data for informed decision-making. In the context of healthcare, where costs can be substantial and insurance policies intricate, the need for clarity becomes paramount.

Robust business documentation mitigates ambiguity and provides undeniable proof of transaction. Without a properly itemized receipt, reconciling charges, filing insurance claims, or even tracking personal spending can become a challenging and error-prone endeavor. This commitment to detailed financial records reflects professionalism and a dedication to transparency, thereby building stronger relationships with clients, patients, or business partners.

Key Benefits of Structured Templates for Financial Records

Adopting a structured template for financial records, especially one designed for medical expenses, offers a multitude of advantages that transcend basic record-keeping. The methodical approach offered by a robust medical itemized receipt template ensures accuracy by standardizing the information captured for each transaction. This standardization significantly reduces the potential for human error and omissions, which can lead to costly discrepancies down the line.

Furthermore, a well-defined layout fosters transparency by presenting all relevant details in an easily understandable format. Both the service provider and the recipient can quickly ascertain what services were provided, when, by whom, and at what cost. This clarity is essential for effective communication and avoids misunderstandings regarding billing. Consistency in record-keeping is another major benefit, as it ensures that every payment receipt adheres to the same professional standards, regardless of the specific transaction or individual processing it. This uniformity simplifies financial review processes, making it easier to track trends, identify anomalies, and manage overall financial health. Ultimately, a structured form enhances accountability, strengthens financial controls, and streamlines administrative tasks, saving valuable time and resources.

Customizing the Template for Diverse Applications

While the primary focus here is a medical itemized receipt template, the underlying principles of its structure and design are remarkably versatile, allowing for significant customization across various financial interactions. The core objective—to provide a detailed, verifiable proof of transaction—can be adapted for numerous purposes beyond healthcare. For instance, businesses can modify the layout to serve as an official invoice form or a detailed sales record, itemizing products sold, quantities, unit prices, and total amounts.

Service providers, from consultants to mechanics, can customize the document to reflect specific labor hours, parts used, and service descriptions, ensuring a transparent service receipt. Landlords might adapt the form into a rent payment acknowledgment, detailing the rental period, amount received, and any outstanding balances. Non-profit organizations could transform the file into a donation acknowledgment, specifying the donor, donation amount, and the purpose of the contribution, which is often crucial for tax purposes. Even for internal use, companies can tailor the template for business reimbursements, outlining approved expenses, dates, and project allocations. The adaptable nature of this detailed financial template makes it an invaluable asset for nearly any entity requiring clear, itemized financial documentation.

When to Employ the Medical Itemized Receipt Template Effectively

Understanding when to deploy a medical itemized receipt template effectively is crucial for maximizing its utility and ensuring optimal financial management. This specific type of financial template excels in scenarios where detailed breakdowns are essential for accuracy, compliance, or personal financial tracking.

- Insurance Claims Submission: When filing health insurance claims, insurers often require highly detailed receipts that specify each service, its corresponding CPT code (Current Procedural Terminology), the date of service, the provider’s information, and the amount charged and paid. The template ensures all necessary information is present for prompt processing and reimbursement.

- Health Savings Account (HSA) or Flexible Spending Account (FSA) Reimbursements: For individuals utilizing HSAs or FSAs, itemized receipts are mandatory to prove that expenses were qualified medical costs. The receipt provides the necessary documentation for tax-advantaged account withdrawals or reimbursements.

- Medical Expense Tax Deductions: Taxpayers who itemize deductions may be able to deduct medical expenses exceeding a certain percentage of their adjusted gross income. An organized expense record, backed by itemized receipts, is vital for substantiating these claims during tax preparation or in case of an audit.

- Tracking Out-of-Pocket Maximums: Patients often need to track their out-of-pocket spending towards their annual insurance maximum. A clear billing statement allows them to accurately monitor their progress and know when their insurance will begin covering 100% of eligible costs.

- Dispute Resolution: In instances of billing errors or discrepancies with a healthcare provider, an itemized receipt serves as concrete proof of charges and payments made. This detailed payment receipt is indispensable for resolving disputes effectively and accurately.

- Personal Financial Budgeting and Record-Keeping: For individuals managing their personal finances, the receipt provides a clear overview of healthcare expenditures, allowing for better budgeting and financial planning for future medical needs.

- Estate Planning and Elder Care: When managing the finances of an elderly parent or handling an estate, a precise expense record of medical costs is essential for accountability, legal compliance, and proper distribution of funds.

Tips for Design, Formatting, and Usability

The effectiveness of any financial document hinges not only on its content but also on its design, formatting, and overall usability. A well-designed template is intuitive, professional, and accessible in both print and digital formats.

Design Principles:

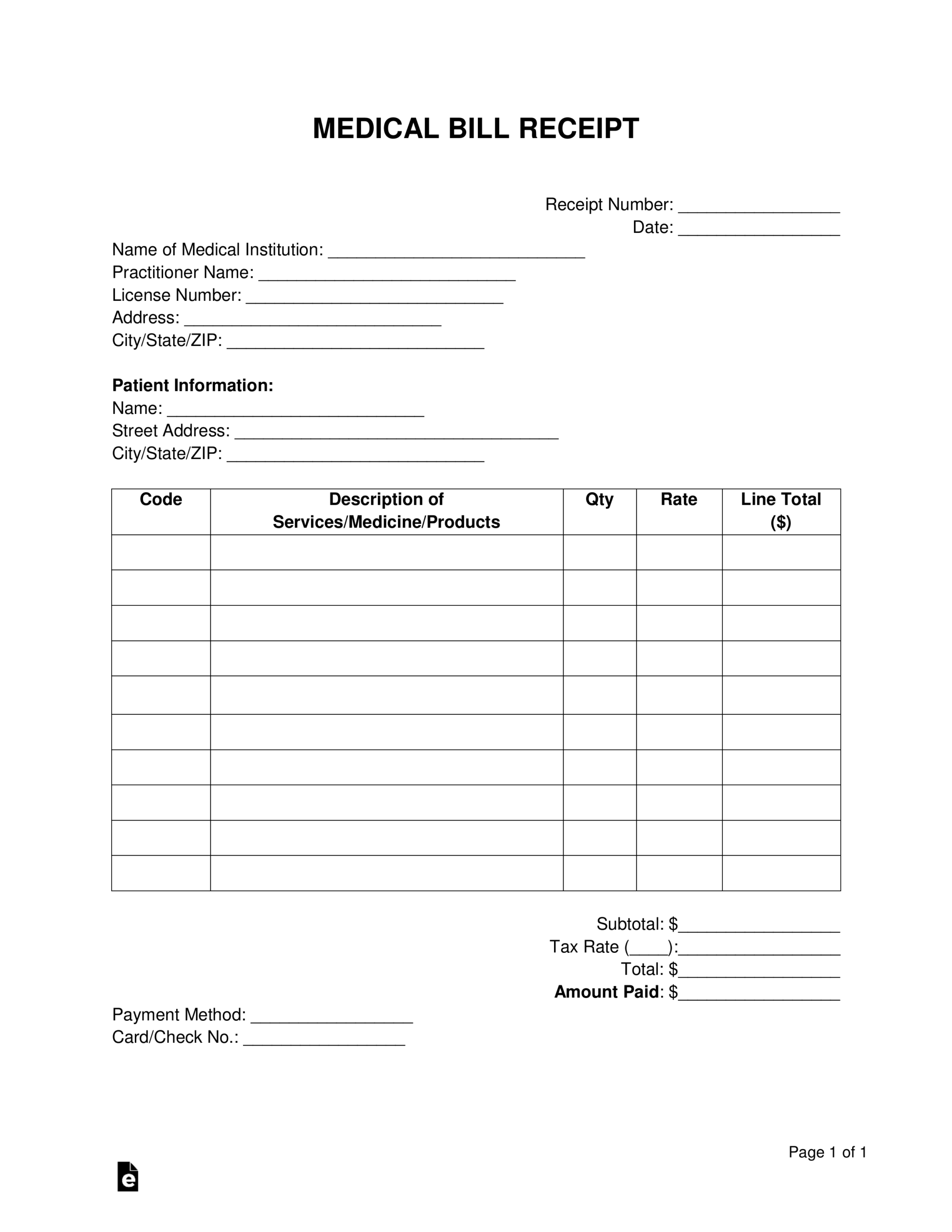

- Clear Headings and Sections: Utilize distinct headings for critical information blocks such as "Patient Information," "Provider Details," "Services Rendered," and "Payment Summary." This helps users quickly locate specific data points.

- Professional Branding: Incorporate the provider’s logo, contact information, and any required legal disclaimers. Consistent branding reinforces legitimacy and professionalism.

- Ample White Space: Avoid clutter. Generous use of white space improves readability and makes the document less intimidating to review.

- Legible Fonts: Choose clear, professional fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12pt for body text) to ensure readability for all users.

Formatting Considerations:

- Logical Flow: Arrange information in a logical sequence that mirrors a typical transaction process. Start with identifying information, move to services, then pricing, and conclude with payment details.

- Consistent Data Fields: Ensure that fields for dates, amounts, and descriptions are consistently formatted throughout the document. For instance, all dates should follow a MM/DD/YYYY format.

- Tables for Itemization: Use tables effectively to list itemized services, including columns for Date of Service, Description of Service, CPT/HCPCS Code, Quantity, Unit Price, and Total Amount. This tabular format is crucial for clarity.

- Calculated Fields (Digital): For digital versions (e.g., spreadsheet or PDF forms), incorporate automatic calculations for subtotals, taxes, and grand totals to minimize manual errors.

Usability for Print and Digital:

- Print-Friendly Layout: Design the layout to be easily printable on standard paper sizes (e.g., 8.5×11 inches) without cutting off important information. Ensure colors are print-friendly.

- Fillable PDF/Digital Formats: Provide the template as a fillable PDF or a compatible digital file (like an Excel spreadsheet) that allows users to type in information directly. This enhances efficiency and reduces illegibility.

- Accessibility: Consider accessibility for users with visual impairments by using high-contrast colors and ensuring digital versions are compatible with screen readers, where applicable.

- Clear Instructions: If the template is complex, include brief, clear instructions on how to fill it out or where to find specific information.

By adhering to these design and formatting guidelines, the template becomes not just a record, but an effective communication tool that serves its purpose flawlessly, whether handed over in person or transmitted electronically.

The Enduring Value of a Structured Financial Tool

In an era demanding unparalleled accountability and transparency, a meticulously structured template for financial transactions stands as a cornerstone of effective financial management. This adaptable financial template transcends its specific application, embodying the principles of clarity, accuracy, and consistency that are vital for both individual fiscal responsibility and robust organizational operations. It serves as a definitive payment receipt, a comprehensive expense record, and an irrefutable proof of transaction, streamlining processes that might otherwise be fraught with complications.

Embracing the use of such a professional layout empowers users to navigate complex financial landscapes with greater confidence and precision. Whether for personal budgeting, insurance claims, or regulatory compliance, the consistent application of this form simplifies audits, minimizes disputes, and fosters a transparent environment. Ultimately, the value derived from integrating a reliable, accurate, and efficient financial record tool into one’s operations is immeasurable, solidifying its status as an indispensable asset for anyone seeking clarity in their financial dealings.