In the intricate landscape of modern healthcare and business, the integrity of financial documentation stands as a cornerstone of transparency, accountability, and professional trust. A meticulously crafted receipt serves not merely as an acknowledgment of payment but as a vital record, underpinning numerous administrative, financial, and legal processes. For both individuals and organizations, having a clear, standardized proof of transaction is indispensable. This is particularly true in the medical sector, where precision in billing and expenditure tracking is paramount for patient peace of mind, provider compliance, and efficient insurance processing.

The utility of a well-structured document, such as a medical office visit receipt template, extends far beyond the immediate point of sale. It empowers patients to manage their healthcare expenses effectively, submit accurate claims to insurance providers, and maintain personal financial records for tax purposes. Simultaneously, it furnishes medical practices with an organized system for sales records, payment verification, and internal auditing, thereby enhancing operational efficiency and bolstering financial integrity. This introductory exploration aims to elucidate the multifaceted significance of such a template, delineating its purpose, its beneficiaries, and its foundational role in fostering clear, unequivocal financial communication.

The Imperative of Clear Financial Documentation

The practice of maintaining clear and professional documentation is not merely a formality; it is a fundamental requirement for sound financial management and robust business operations. In an era defined by stringent regulatory compliance and increasing demands for transparency, every financial transaction necessitates an unimpeachable record. This principle holds true across all sectors, from retail sales to complex service agreements, underscoring the universal need for documents that accurately reflect the terms and execution of monetary exchanges.

Professional documentation serves several critical functions. Firstly, it provides irrefutable proof of transaction, essential for resolving disputes, substantiating tax deductions, and facilitating audits by regulatory bodies. Secondly, it fosters trust and credibility with clients, customers, and patients, assuring them that their financial interactions are handled with the utmost professionalism and accuracy. Finally, well-organized financial templates, such as a detailed payment receipt or a comprehensive billing statement, streamline internal processes, reduce administrative overhead, and minimize the potential for human error, contributing significantly to a healthy financial ecosystem within any organization. Neglecting this crucial aspect can lead to significant financial discrepancies, legal challenges, and damage to an entity’s reputation, making robust business documentation an absolute imperative.

Key Benefits of Structured Templates for Medical Office Visit Receipts

The adoption of structured templates for financial records, specifically a medical office visit receipt template, offers a multitude of benefits that transcend mere convenience. These templates are meticulously designed to ensure accuracy, foster transparency, and maintain consistency in record-keeping, all of which are critical for effective financial management within healthcare settings and beyond. By standardizing the information captured for each transaction, they eliminate ambiguity and reduce the likelihood of errors that can complicate billing, insurance claims, and personal expense tracking.

One of the foremost advantages is the enhanced accuracy these templates provide. Pre-defined fields guide data entry, ensuring that all necessary details—such as date of service, provider information, patient details, service codes, and payment specifics—are consistently recorded. This standardization greatly minimizes the potential for omissions or misinterpretations, which can be particularly detrimental when dealing with sensitive medical information and financial obligations. Furthermore, the transparent nature of such a template allows patients to clearly understand the breakdown of charges and payments, fostering confidence in their healthcare provider’s billing practices.

Consistency is another critical benefit derived from using a structured medical office visit receipt template. Every payment receipt generated will follow the same layout and include identical information categories, simplifying reconciliation processes for both the practice and the patient. This uniformity is invaluable for compliance, making it easier to audit records, process insurance claims, and prepare financial reports. The efficiency gained by not having to manually create or verify each receipt significantly streamlines administrative tasks, allowing staff to focus on patient care rather than laborious data entry. Ultimately, a robust financial template serves as a powerful tool for robust record-keeping, an essential component of responsible financial stewardship.

Customizing the Template for Diverse Applications

While the concept of a medical office visit receipt template is tailored to a specific industry, the underlying principles of its design and functionality are remarkably versatile. The core structure—documenting a transaction between two parties, detailing services or goods exchanged, and acknowledging payment—can be adapted for an extensive range of financial interactions. This inherent adaptability makes the template a fundamental tool for any organization or individual requiring clear, verifiable proof of payment.

For instance, the layout designed for a medical visit can be easily customized to serve as a general service receipt for a consulting firm, an invoice form for a freelance graphic designer, or a payment receipt for a home repair contractor. The fields for "patient name" and "service codes" can be modified to "client name" and "project description," while "co-pay" might become "deposit" or "final payment." This flexibility allows businesses to maintain professional and consistent documentation across various operational facets without reinventing the wheel for each type of transaction.

Beyond commercial services, the utility extends to non-profit organizations for donation acknowledgment, ensuring donors receive proper documentation for tax purposes. Even for personal financial management, an individual can adapt the template for rent payments, tracking business reimbursements, or documenting the sale of personal property. The key is to recognize the elemental components of a financial transaction and to adjust the specific nomenclature and descriptive fields to align with the unique context. A well-designed medical office visit receipt template, therefore, provides a foundational framework that, with thoughtful customization, can efficiently meet the diverse documentation needs of virtually any payment or sales record scenario.

Effective Applications of a Comprehensive Receipt Template

A well-designed receipt template, initially conceived to document the specifics of a medical office visit receipt template, holds broad applicability across numerous financial scenarios. Its structured format and comprehensive data fields make it an indispensable tool for ensuring accurate and reliable financial records in a variety of contexts. The consistency and clarity offered by such a document greatly simplify financial tracking and compliance for both individuals and organizations.

Examples of when using this template is most effective include:

- Documenting Patient Co-pays and Deductibles: Providing patients with an immediate, itemized proof of payment for their portion of healthcare costs.

- Tracking Out-of-Pocket Medical Expenses: Essential for individuals to aggregate their medical expenditures for personal financial planning and budgeting.

- Substantiating Insurance Claims: Furnishing insurance companies with the necessary details to process reimbursements accurately and efficiently.

- Claiming Tax Deductions for Medical Expenses: Serving as official documentation required by tax authorities to validate eligible medical deductions.

- Verifying Health Savings Account (HSA) and Flexible Spending Account (FSA) Withdrawals: Proving that funds were used for qualified medical expenses, ensuring compliance with IRS regulations.

- Monitoring Personal Health Expenditures: Assisting individuals in maintaining a comprehensive record of their healthcare costs over time.

- General Sales Records: Adapting the document to provide customers with an itemized payment receipt for goods purchased in a retail environment.

- Service Receipts: Issuing detailed records for services rendered by professionals, from legal counsel to consulting services.

- Donation Acknowledgments: Providing non-profit organizations with a formal mechanism to thank donors and offer a proof of transaction for tax-deductible contributions.

- Business Reimbursements: Documenting expenses incurred by employees for business travel or purchases, facilitating accurate reimbursement processes and expense record keeping.

- Rent Payments: Offering tenants a verifiable receipt for rental payments, which can be crucial for lease agreements and financial audits.

In each of these applications, the structured nature of the template ensures that all pertinent information is captured, minimizing discrepancies and fostering transparency. This robust financial template ultimately streamlines the recording process and provides a clear, undeniable audit trail for all parties involved.

Optimizing Design, Formatting, and Usability

The effectiveness of any financial documentation hinges significantly on its design, formatting, and overall usability. A receipt, regardless of its application, must be clear, concise, and easy to comprehend for all stakeholders, whether in print or digital format. Optimizing these elements ensures that the information is readily accessible, interpretable, and professional, thereby enhancing trust and minimizing potential errors or confusion.

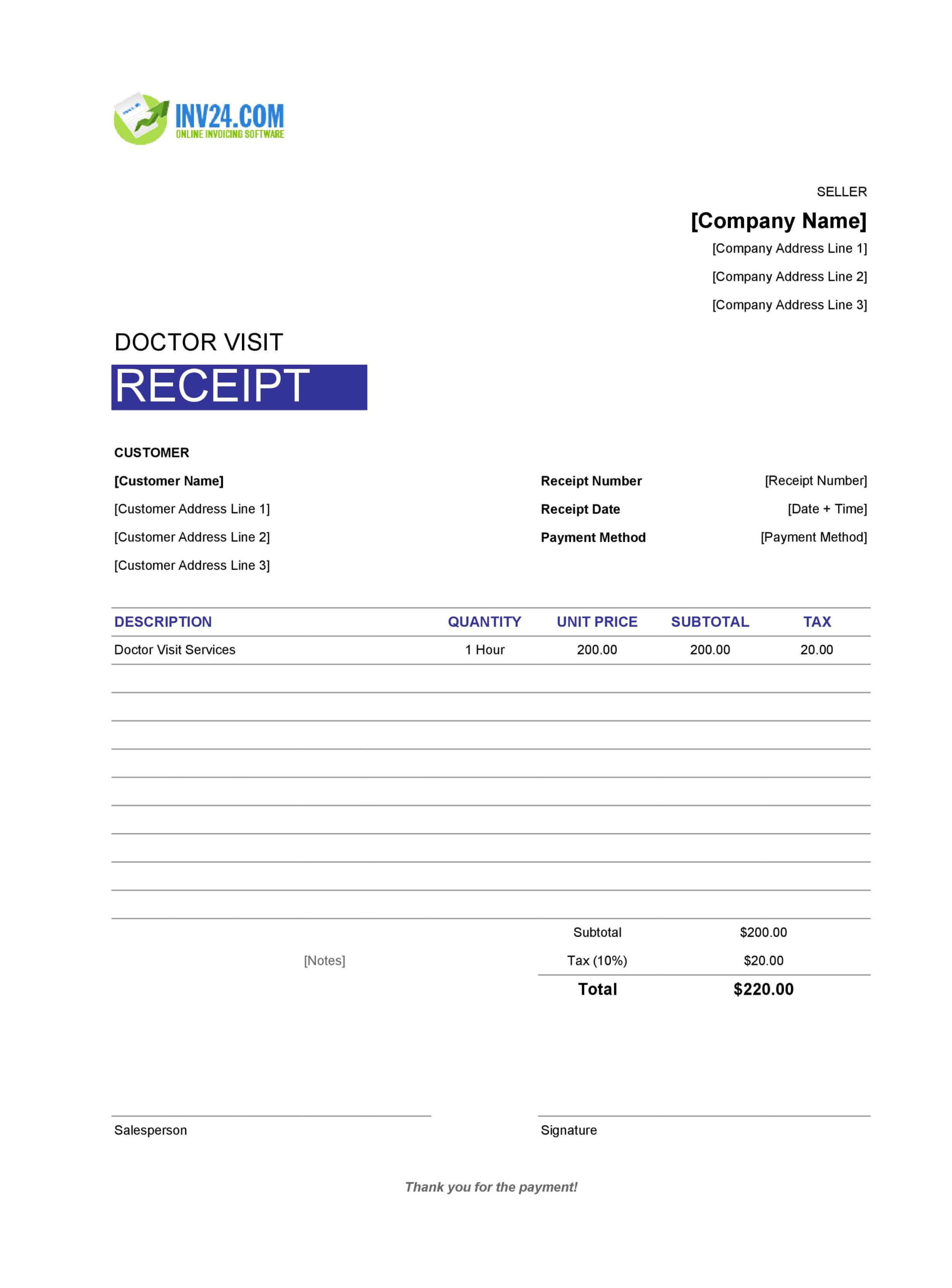

When designing the document, clarity and readability should be paramount. This involves using legible fonts, appropriate font sizes, and ample white space to prevent information overload. Essential fields, such as the date of transaction, names of the payee and payer, the total amount paid, a detailed description of services or items, and the method of payment, must be prominently displayed. Including fields for authorization or a signature further reinforces the validity of the transaction. Branding elements, such as a company logo, contact information, and a unique receipt number, are crucial for professionalism and easy identification.

For digital versions, which are increasingly common, considerations extend to file compatibility, e-signature integration, and mobile-friendliness. The template should ideally be available in easily shareable and secure formats, such as PDF, to maintain its integrity across various platforms. The layout should be responsive, ensuring it displays correctly on different screen sizes, from desktops to smartphones. For print versions, ensuring that the document prints clearly, without cutting off information or requiring excessive paper, is also important. Ultimately, a well-designed form is intuitive, allowing users to quickly locate and understand the critical details of the financial exchange, thereby serving its purpose as a reliable financial template with utmost efficiency.

In conclusion, the strategic implementation of a well-designed financial template, such as the one described, represents a significant enhancement to financial record-keeping and business communication. Its intrinsic capacity to ensure accuracy, cultivate transparency, and promote consistency across all transactions makes it an indispensable asset. From the precise documentation of healthcare expenditures for a medical office visit to the acknowledgment of diverse payment types across various industries, this document serves as a steadfast pillar of organizational efficiency and trustworthiness.

The enduring value of such a template lies in its ability to simplify complex financial processes, providing clarity to patients, streamlining operations for providers, and offering robust evidence for compliance and auditing purposes. By adopting and customizing a professional form, entities can uphold the highest standards of financial integrity, foster stronger relationships built on clear communication, and navigate the complexities of modern commerce with confidence. It is more than just a piece of paper; it is a testament to an organization’s commitment to precision, professionalism, and reliable financial stewardship, truly making it an essential tool for any entity engaged in financial transactions.