Effective financial documentation stands as a cornerstone of transparent business operations and personal accountability. Within this landscape, the humble receipt plays an indispensable role, providing concrete proof of transactions. For recurring payments such as rent, a standardized approach is not merely convenient but essential for both parties involved. This article delves into the critical aspects of a monthly rental receipt template, exploring its purpose, benefits, and how it serves as a vital tool for meticulous record-keeping.

Whether you are a property manager overseeing a vast portfolio, an individual landlord managing a single unit, or a tenant meticulously tracking expenditures, a well-structured monthly rental receipt template offers clarity and assurance. It simplifies the process of acknowledging payments, ensures all necessary details are captured, and provides an undisputed record for financial reconciliation, tax purposes, and potential dispute resolution. Adopting such a template elevates the professionalism of the rental agreement, fostering trust and clear communication between landlords and tenants.

The Indispensable Role of Clear Financial Documentation

In any financial or business transaction, the clarity and accuracy of documentation are paramount. A payment receipt, for instance, serves as undeniable proof of transaction, safeguarding both the payer and the payee. Beyond simple acknowledgment, robust financial records are crucial for legal compliance, particularly concerning tax obligations and audit requirements. They provide a chronological and itemized account of all financial activities, which is vital for maintaining a healthy and transparent fiscal environment.

Clear documentation minimizes misunderstandings and can prevent or quickly resolve disputes. Without a formal sales record or a detailed service receipt, discrepancies in payment amounts, dates, or services rendered can escalate into costly and time-consuming conflicts. Establishing a consistent system for generating billing statements and other business documentation reinforces professionalism. This commitment to detail builds confidence among clients, tenants, and business partners, signifying reliability and accountability in all financial dealings.

Key Benefits of Structured Templates for Financial Records

Utilizing a structured template, such as the monthly rental receipt template, offers a multitude of advantages that enhance accuracy, transparency, and consistency in record-keeping. Templates provide a predefined framework, ensuring that all necessary information is systematically captured for every transaction. This standardization significantly reduces the likelihood of omissions or errors that can occur when generating receipts manually or ad hoc. A consistent format streamlines the entire process, from issuance to archiving.

The inherent structure of such a financial template promotes transparency by clearly itemizing all components of a payment. It allows for an easy breakdown of the total amount received, specifying the period it covers, any outstanding balances, and the payment method. This level of detail is invaluable for both parties in understanding where funds are allocated. Furthermore, consistency across all issued receipts facilitates easier review, auditing, and financial reporting, making it simple to track an expense record over time. The uniform presentation also aids in quickly retrieving specific documents when needed, thus enhancing overall operational efficiency.

Customizing Your Receipt Template for Diverse Applications

The fundamental structure of a receipt is remarkably versatile and can be readily customized far beyond its initial purpose as a monthly rental receipt template. While its core function is to acknowledge payment, the underlying layout can be adapted to suit a wide array of financial acknowledgments. This adaptability makes a well-designed template a highly valuable asset for various business and personal financial needs, offering a consistent approach to documenting different types of transactions.

Consider how the basic fields can be adjusted:

- Sales Records: A standard payment receipt can be modified to become an invoice form, detailing items purchased, quantities, unit prices, and sales tax. This transformation creates a comprehensive sales record for both the vendor and the customer.

- Service Receipts: For businesses providing services, the template can specify the nature of the service, hours worked, hourly rates, and any associated material costs. This provides clients with a clear service receipt detailing the value received.

- Donation Acknowledgments: Non-profit organizations frequently use customized versions to issue donation acknowledgments. These forms can include the organization’s tax ID, a statement that no goods or services were exchanged, and express gratitude, which is crucial for donor tax purposes.

- Business Reimbursements: Employees seeking reimbursement for business expenses can use a structured expense record template to itemize costs incurred. This includes travel, meals, and supplies, streamlining the internal accounting process.

- Billing Statements: For recurring services or subscriptions, the template can be formatted as a billing statement, indicating the current period charges, previous balances, and new amounts due. This provides a clear overview of financial obligations to the client.

The key to effective customization lies in identifying the essential data points for each specific use case and ensuring the template clearly presents them. Adding company branding, specific disclaimers, or unique identifiers further enhances the utility and professionalism of the document, making the template a truly versatile tool.

Effective Scenarios for Utilizing a Receipt Template

A well-designed receipt template proves indispensable in numerous practical scenarios where clear financial acknowledgment is required. Its structured format ensures all critical details are captured consistently, mitigating ambiguities and reinforcing trust between parties. Here are several examples of when utilizing such a template is most effective:

- Residential Rent Collection: For landlords and property managers, issuing a formal payment receipt for monthly rent ensures tenants have official proof of payment. This is crucial for their personal records and in case of any future disputes regarding payment status.

- Commercial Lease Payments: Businesses renting commercial spaces require detailed expense records for accounting and tax purposes. A robust template provides the necessary documentation for lease payments, security deposits, and common area maintenance fees.

- Proof of Payment for Utilities Included in Rent: When utility costs are integrated into the rent, a receipt template can itemize these components, showing the specific allocation of funds. This transparency is beneficial for both tenant and landlord understanding.

- Documentation for Security Deposit Payments: The initial payment of a security deposit should always be acknowledged with a detailed proof of transaction. The template can clearly state the amount, the date received, and conditions for its return, providing vital documentation for the tenant.

- Tracking Recurring Service Fees: Beyond rent, many subscriptions or services require regular payments. Using the template for these recurring fees ensures a continuous and verifiable record of financial transactions, such as gym memberships or maintenance contracts.

- Acknowledging One-Time Payments for Specific Events: For occasional payments, like facility booking fees, event deposits, or late payment charges, a formal receipt template confirms the transaction. This ensures all parties have a clear understanding of the one-time financial exchange.

- Loan Repayments Between Individuals: In informal loan agreements, issuing a receipt for each repayment installment provides a clear audit trail. This protects both the lender and borrower, preventing misunderstandings about the outstanding balance.

These examples underscore the template’s versatility and its vital role in maintaining accurate and transparent financial communication across various contexts.

Design, Formatting, and Usability: Best Practices

The efficacy of any financial template hinges not just on its content but also on its design, formatting, and overall usability. A well-crafted receipt should be intuitive, professional, and accessible in both print and digital formats. Adhering to best practices in these areas ensures that the document effectively serves its purpose as a reliable financial record.

Clarity and Readability:

The foremost consideration is clarity. Use clean, professional fonts that are easy to read, such as Arial, Calibri, or Times New Roman. Maintain an appropriate font size (typically 10-12 points for body text). Ample white space around text and sections prevents the document from appearing cluttered and improves readability. Information should flow logically, guiding the eye from one essential detail to the next without confusion. Headings and subheadings should be used to break up complex information, making it scannable.

Essential Fields:

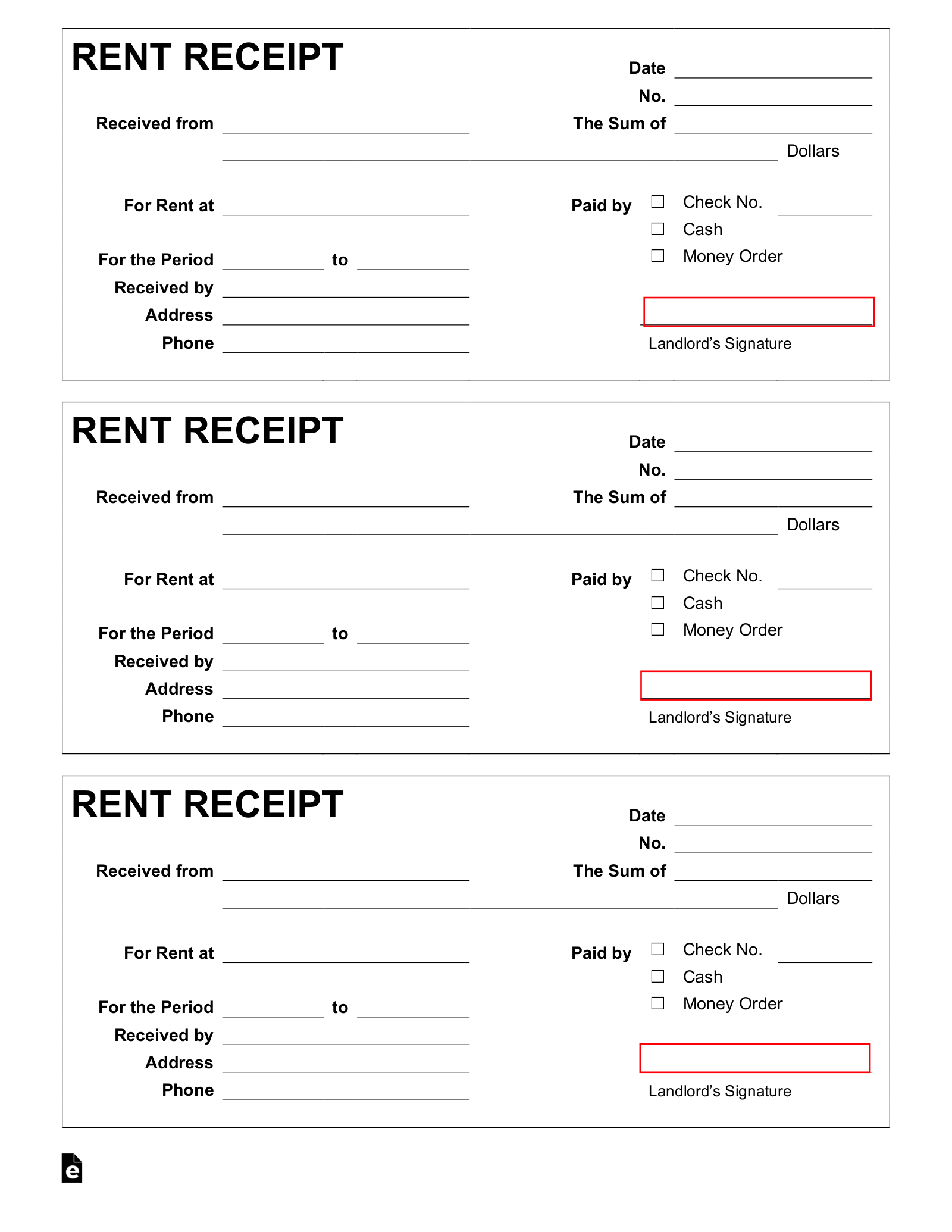

Every receipt, regardless of its specific application, must capture core information. These typically include:

- Date of Transaction: The precise date the payment was received.

- Amount Received: The total monetary value of the transaction.

- Payer and Payee Information: Full names, addresses, and contact details of both parties.

- Purpose of Payment: A clear description of what the payment covers (e.g., "Monthly Rent for October 2023").

- Payment Method: How the payment was made (e.g., cash, check, credit card, bank transfer).

- Transaction ID/Reference Number: A unique identifier for easy tracking.

- Authorized Signature/Digital Confirmation: A signature from the payee or a digital confirmation for authenticity.

- Outstanding Balance (if applicable): Any remaining amount due after the current payment.

Branding and Professionalism:

Incorporate your company’s logo and contact information prominently at the top of the receipt. Consistent branding reinforces professionalism and helps in easy identification. Ensure the template aligns with your organization’s overall visual identity, using consistent colors and fonts where appropriate. This level of detail elevates the document from a simple acknowledgment to official business documentation.

Digital vs. Print Versions:

For digital versions, consider creating a PDF file. PDFs ensure the layout remains consistent across different devices and operating systems. They are also easily shareable via email and can be digitally signed for added security. Ensure the file is small enough for convenient email transmission. For print versions, use high-quality paper and ensure printing is clear and legible. Providing duplicate copies (one for the payer, one for the payee) is standard practice for physical transactions. The layout should be optimized for printing, avoiding elements that might get cut off or appear incorrectly on paper.

Security and Integrity:

When dealing with digital files, implement measures to protect the document from unauthorized alteration. Password protection or encryption can be used for sensitive financial templates. For physical receipts, sequential numbering helps prevent fraud and ensures all forms are accounted for. Training staff on proper receipt issuance and storage protocols is also crucial for maintaining the integrity of these vital financial records.

The Enduring Value of a Professional Receipt Template

In an increasingly complex financial landscape, the value of a meticulously designed receipt template cannot be overstated. It stands as a testament to organizational commitment to transparency, accuracy, and professional conduct. Far more than a mere piece of paper or a digital file, this essential business documentation streamlines financial processes, minimizes potential disputes, and provides an undeniable audit trail for all transactions. Investing in a robust and adaptable template is, therefore, an investment in operational efficiency and strong financial governance.

Ultimately, whether used for acknowledging rent, sales, services, or donations, a well-structured receipt template empowers both payers and payees with clear, verifiable information. It transforms what could be a point of confusion into a clear record, fostering trust and accountability. By embracing such a reliable, accurate, and efficient financial template, organizations and individuals alike can navigate their financial responsibilities with greater confidence and precision, ensuring all monetary exchanges are properly documented and easily accessible.