In the intricate landscape of modern business operations, meticulous record-keeping stands as a cornerstone of financial integrity and operational efficiency. Every transaction, regardless of its scale, necessitates clear, verifiable documentation. This fundamental principle applies universally, from small-scale service providers to large corporate entities. A well-structured receipt template is not merely a formality; it is a vital instrument for maintaining transparency, ensuring compliance, and fostering trust among all stakeholders.

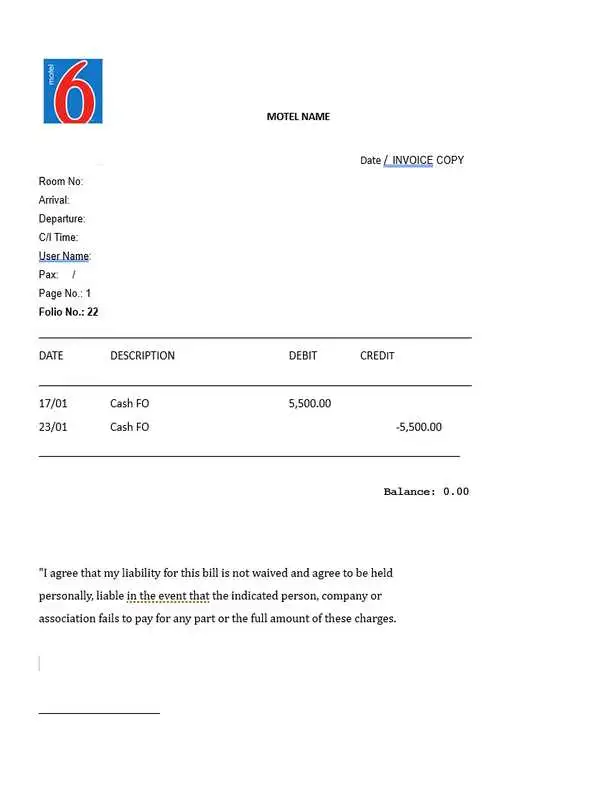

The concept of a standardized receipt, exemplified by a well-designed motel 6 receipt template, addresses a critical need for businesses to issue professional, comprehensive proofs of transaction. Such a template is an invaluable asset for proprietors, accountants, and customers alike, simplifying the tracking of expenditures, revenues, and services rendered. It provides a consistent framework for capturing essential transactional data, thereby streamlining administrative processes and enhancing overall financial accountability within any organization requiring such a document.

The Importance of Clear and Professional Documentation

Clear and professional documentation is paramount in all financial and business transactions, serving multiple critical functions. At its core, a robust system of documentation provides an irrefutable audit trail, which is indispensable for internal reviews, external audits, and tax compliance. This level of detail ensures that every payment receipt or proof of transaction can be traced back to its origin, verifying the legitimacy and accuracy of financial records.

Beyond compliance, well-structured documentation significantly reduces the potential for disputes. When an invoice form or a service receipt is comprehensive and unambiguous, it leaves little room for misinterpretation regarding the terms of a sale or the scope of services provided. This clarity protects both the service provider and the customer, solidifying professional relationships through transparent communication. Furthermore, it enhances a business’s reputation, signaling an unwavering commitment to professionalism and accountability in every interaction.

Key Benefits of Structured Templates for Financial Records

Utilizing a standardized financial template, such as a meticulously designed motel 6 receipt template, offers a multitude of benefits that extend far beyond simple record-keeping. These templates are engineered to ensure accuracy, transparency, and consistency in financial documentation, forming the backbone of sound financial management practices. Their structured format guides users to input all necessary information, significantly reducing errors that can arise from manual or ad-hoc receipt generation.

Accuracy is greatly enhanced through predefined fields, which prompt the inclusion of crucial data points like transaction dates, itemized services, amounts, and payment methods. This systematic approach minimizes omissions and ensures that every sales record or expense record is complete. Transparency is boosted by providing a clear, itemized breakdown of charges, allowing customers to easily understand what they are paying for and enabling businesses to clearly articulate their offerings. Consistency, another vital benefit, ensures that all receipts issued conform to a uniform standard, reinforcing brand identity and simplifying data aggregation for accounting purposes. This uniform presentation also facilitates quicker processing for reimbursement claims and tax declarations.

Customization for Diverse Transactional Purposes

While designed with certain transactions in mind, the motel 6 receipt template is remarkably adaptable for a wide array of financial interactions. Its inherent flexibility allows businesses to tailor the layout and content to suit various specific purposes beyond its initial conceptualization, ensuring that it remains a versatile tool for diverse operational needs. This adaptability is key for organizations that handle multiple types of transactions under one administrative umbrella.

For instance, a base template can be customized to function as an effective invoice form for product sales, detailing quantities, unit prices, and total costs. When adapted for service-based businesses, the document can include detailed descriptions of services rendered, hourly rates, and labor costs. Charities can modify it to serve as a donation acknowledgment, incorporating their tax identification number and specific language required for tax-deductible contributions. Similarly, businesses can adjust the form to serve as a billing statement for recurring services or as an expense record for employee reimbursements, adding fields for project codes or departmental allocations. The core structure provides a reliable foundation upon which specialized financial documents can be built.

Examples of When Using the Template Is Most Effective

The application of a well-structured receipt template extends to numerous scenarios where formal proof of transaction is essential. Its utility ensures that all parties involved have a clear, documented understanding of the financial exchange.

- Accommodation Services: Ideal for hotels, motels, bed and breakfasts, or short-term rental properties to provide guests with a detailed record of their stay, including check-in/out dates, room rates, taxes, and any additional charges. This serves as a vital payment receipt for travelers.

- Professional Service Engagements: Lawyers, consultants, freelance designers, or technicians can use this form to itemize services, hours worked, and associated fees, providing clients with a transparent service receipt.

- Retail Sales: For smaller retail operations or pop-up shops, the layout can function as a simplified sales record, detailing purchased items, quantities, and the total amount paid.

- Rental Payments: Landlords can adapt the template to acknowledge rent payments, specifying the period covered, the amount received, and any outstanding balances.

- Donations and Contributions: Non-profit organizations can customize this document to serve as a donation acknowledgment, providing donors with official documentation for tax purposes.

- Business Expense Reimbursements: Employees can utilize this template to document minor business expenses, facilitating efficient and accurate processing of their expense records for reimbursement.

- Repair and Maintenance Services: Auto mechanics, plumbers, or electricians can provide customers with a detailed breakdown of parts and labor, serving as a comprehensive service receipt.

- Event Registrations: Organizers of conferences, workshops, or festivals can issue this form as a proof of transaction for registration fees, outlining inclusions and event details.

Tips for Design, Formatting, and Usability

The effectiveness of any financial template hinges significantly on its design, formatting, and overall usability, for both print and digital applications. A thoughtful approach to these elements ensures that the document is not only functional but also professional and easy to interpret.

Design Principles:

- Clarity and Simplicity: Prioritize a clean, uncluttered layout. Essential information should be immediately visible and easy to locate. Avoid excessive graphics or complex fonts that can detract from readability.

- Branding: Incorporate your company’s logo, colors, and font styles to maintain consistency across all business documentation. This reinforces brand identity and professionalism.

- Logical Flow: Arrange fields in a logical sequence that mirrors the transaction process, making it intuitive for both the issuer and the recipient. Group related information together (e.g., customer details, transaction details, itemized breakdown).

Formatting Guidelines:

- Standardized Fields: Utilize consistent labeling for fields such as "Date," "Invoice Number," "Customer Name," "Description," "Quantity," "Unit Price," "Total."

- Legible Typography: Choose clear, readable fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12pt for body text, larger for headings).

- Ample White Space: Ensure sufficient margins and spacing between sections to prevent the document from appearing dense and overwhelming.

- Structured Tables: For itemized lists, use clear tables with distinct headers and borders to organize information neatly.

- Total and Subtotal Prominence: Make the total amount due or paid stand out, often in bold or a slightly larger font size. Clearly delineate subtotals, taxes, and discounts.

Usability for Print and Digital Versions:

- Print Optimization: Ensure the layout translates well to standard paper sizes (e.g., Letter, A4) without cutting off content. Use print-friendly colors and avoid excessive use of heavy backgrounds that consume ink.

- Digital Compatibility: For digital distribution, save the template in universally accessible formats like PDF. Ensure that any interactive fields are functional and that the document is accessible for screen readers if necessary.

- Fillable Fields: If used digitally, incorporate fillable fields to streamline data entry and reduce manual errors.

- Signature Lines: Include clear spaces for physical or digital signatures, verifying the transaction’s acceptance.

- Contact Information: Always include complete contact details for the issuing entity, making it easy for recipients to follow up with questions or for record verification.

The careful application of these design, formatting, and usability tips transforms a basic template into a highly effective financial instrument that supports efficient business documentation, whether as a payment receipt or an detailed invoice form.

Ensuring Reliability, Accuracy, and Efficiency in Financial Records

In conclusion, the strategic deployment of a robust financial template is an indispensable practice for any entity committed to financial diligence and operational excellence. Such a document transcends its basic function as a proof of transaction, evolving into a critical component of a comprehensive financial ecosystem. It stands as a testament to an organization’s commitment to transparency, accuracy, and adherence to professional standards, building confidence with every interaction.

By meticulously structuring the capture of transactional data, this template ensures that every financial record is reliable, accurate, and readily retrievable. It significantly streamlines accounting processes, simplifies audit preparations, and provides clarity in client communications. Ultimately, embracing a standardized, well-designed form like this enhances a business’s operational efficiency, minimizes potential liabilities, and strengthens its overall financial governance, establishing it as a hallmark of professional integrity in all business documentation.