In the intricate landscape of financial transactions and philanthropic endeavors, the importance of meticulously documented records cannot be overstated. For organizations that rely on the generosity of donors, particularly those contributing non-monetary assets, a robust and standardized method for acknowledging these gifts is not merely a courtesy—it is a critical operational necessity. This article explores the significance and practical applications of a well-designed non cash donation receipt template, a foundational tool for ensuring transparency, compliance, and effective record-keeping for both the donor and the recipient organization.

The development and consistent application of a specialized non cash donation receipt template serves as a cornerstone of responsible financial stewardship. It provides a structured framework for documenting gifts in kind, which can range from tangible goods like equipment, inventory, and real estate, to intangible assets such as intellectual property or services. Donors benefit immensely from a clear and official record for tax deduction purposes, while non-profit organizations gain a reliable system for auditing, compliance with regulatory bodies, and internal financial reporting. This essential document underpins the integrity of the donation process, fostering trust and clarity for all parties involved in charitable giving.

The Imperative of Clear and Professional Financial Documentation

The bedrock of any credible financial operation, whether commercial or non-profit, is unimpeachable documentation. Clear, concise, and professional records are not just administrative overhead; they are vital instruments that uphold accountability, facilitate auditing processes, and maintain the confidence of stakeholders. In a world increasingly driven by data and regulatory scrutiny, a robust system for capturing every payment receipt or proof of transaction becomes indispensable. This principle extends profoundly to the realm of charitable contributions, particularly those involving non-cash assets.

Well-structured business documentation, encompassing everything from a detailed invoice form to a comprehensive sales record, ensures that every financial interaction is traceable and verifiable. For non-profit entities, this level of precision is even more critical due to specific regulatory requirements governing charitable donations. The consistent application of a professional financial template prevents misunderstandings, mitigates the risk of disputes, and provides a solid foundation for financial reporting, ultimately safeguarding an organization’s reputation and legal standing.

Key Benefits of Utilizing a Structured Non Cash Donation Receipt Template

Adopting a standardized, structured approach to documenting non-cash contributions through a non cash donation receipt template offers a multitude of strategic advantages for charitable organizations and their donors. Primarily, such a template significantly enhances the accuracy and consistency of record-keeping. By providing predefined fields for all essential information, it minimizes the potential for human error and ensures that critical data points are never overlooked, leading to more reliable financial statements and reports.

Furthermore, the implementation of a consistent non cash donation receipt template promotes unparalleled transparency in financial dealings. Donors receive a clear, official donation acknowledgment that details their contribution, its estimated value, and the receiving entity, which is crucial for their tax compliance. For the organization, this standardized form simplifies internal processes, makes data retrieval for audits or annual reports far more efficient, and reinforces its commitment to ethical governance. This streamlined approach not only saves administrative time but also builds stronger relationships based on mutual understanding and trust.

Customization and Versatility of Receipt Templates

While a non cash donation receipt template is specifically designed for documenting in-kind contributions, the underlying principles of its structure are highly versatile and adaptable across a broad spectrum of financial transactions. The core components of any effective receipt—identifying information for both parties, a detailed description of the transaction, the value or amount, the date, and authorization—are universally applicable. This inherent adaptability means that similar structured layouts can be customized for numerous other purposes, serving as an invaluable financial template for various business needs.

For instance, the fundamental design principles of this document can be easily modified to create a payment receipt for goods sold, a detailed service receipt for professional services rendered, or even a specialized form for rent payments. Businesses can adapt the template to track business reimbursements, manage an expense record, or generate comprehensive billing statements. The adaptability of such a well-organized layout underscores its utility beyond its primary function, proving its value as a versatile tool for maintaining meticulous business documentation across diverse operational contexts.

When a Structured Receipt Template is Most Effective

The strategic deployment of a structured receipt template is most effective in scenarios where formal acknowledgment and detailed record-keeping are paramount. Its utility extends across various situations, ensuring clarity, compliance, and professional communication.

- Receiving Significant In-Kind Donations: For substantial non-cash gifts, such as vehicles, real estate, or large quantities of inventory, a detailed receipt is crucial for accurate valuation and legal compliance for both the donor and the recipient organization.

- Documenting Regular Recurring Non-Cash Contributions: Organizations that regularly receive non-monetary support, like weekly food donations or ongoing volunteer services, benefit from a standardized form to track the cumulative impact and value of these consistent contributions.

- Providing Proof for Tax Deductions: Donors require official documentation from the qualified organization to claim non-cash contributions on their income tax returns. The receipt serves as irrefutable proof of their gift, detailing the item and the date of donation.

- Internal Record-Keeping for Audits: During internal or external audits, organizations must present clear and consistent records of all financial activities, including non-cash transactions. The template ensures that all necessary information is readily available and uniformly presented.

- Acknowledgments for Community Support: Beyond legal and tax requirements, issuing a professional receipt demonstrates gratitude and acknowledges the vital role donors play in the organization’s mission, fostering stronger community ties.

- Any Situation Requiring Official Proof of Non-Monetary Value Transfer: Whether it’s a loan of equipment, a pro-bono service, or a transfer of intellectual property, any scenario where a non-monetary asset changes hands and requires formal documentation benefits from a structured receipt.

Design, Formatting, and Usability Best Practices

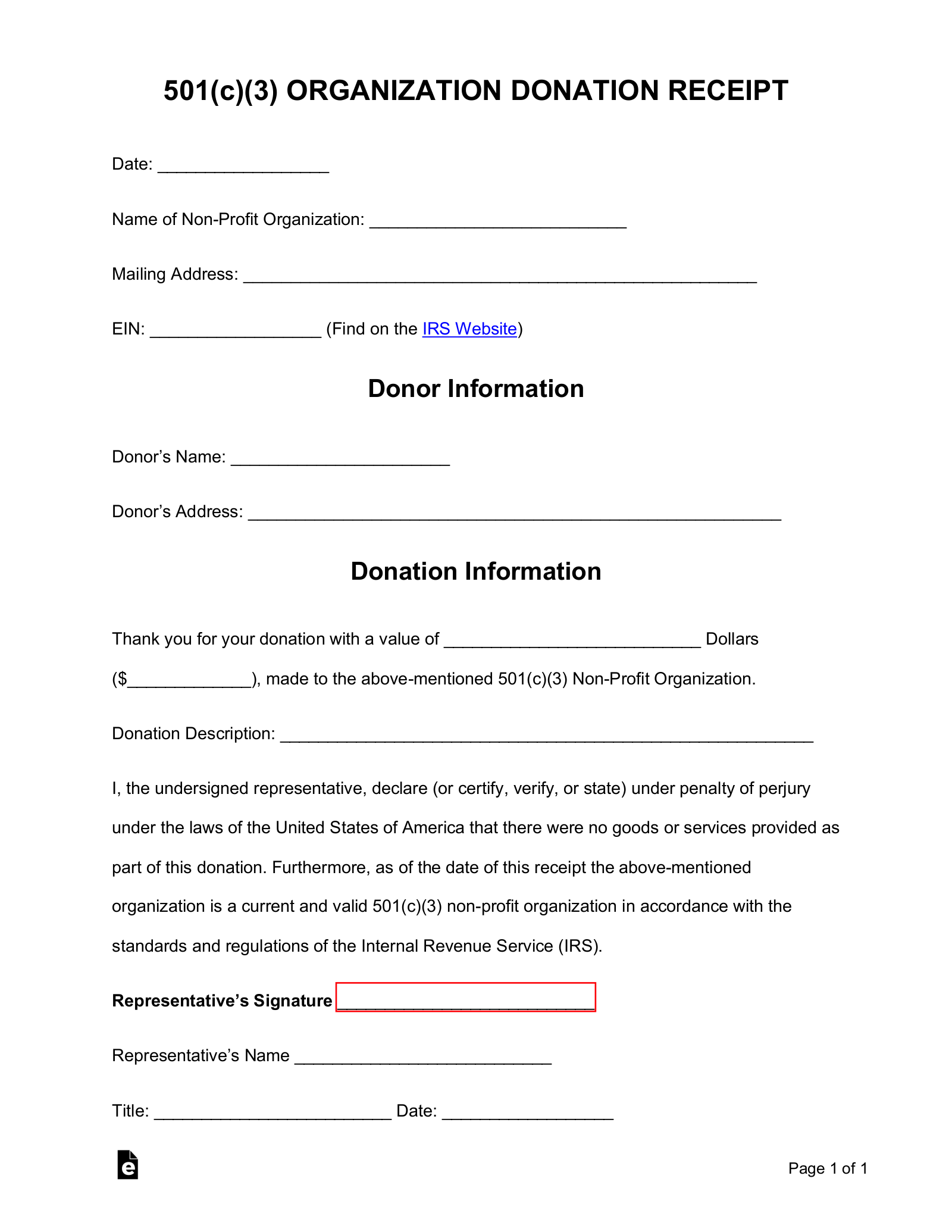

Designing and formatting a receipt template for optimal usability, whether in print or digital format, is crucial for its effectiveness. The primary goal should always be clarity and simplicity. Utilize readable fonts (e.g., Arial, Calibri) and a logical layout that guides the user’s eye through the document. Essential fields should be prominently displayed and clearly labeled, ensuring that all required information can be entered swiftly and accurately. This approach enhances the overall professional appearance of the financial template.

Key elements that should always be included in the document are:

- Donor Information: Full name, address, and contact details.

- Recipient Organization Information: Legal name, address, Employer Identification Number (EIN).

- Item Description: A detailed account of the non-cash item(s) donated, including quantity, condition, and any distinguishing characteristics.

- Valuation: A statement acknowledging that the organization does not appraise the item, but that the donor is responsible for determining its fair market value for tax purposes (unless the organization is qualified to do so for specific types of donations).

- Date of Donation: The exact date the gift was received.

- Authorized Signature: The signature of an authorized representative of the organization, along with their printed name and title.

- Legal Disclaimers: Any necessary statements regarding tax deductibility or donor responsibilities.

For branding purposes, organizations should incorporate their logo and official colors into the layout. This not only reinforces their identity but also lends an air of official legitimacy to the receipt. When considering digital versions, ensure the file is easily convertible to PDF for secure distribution and archival. Online forms should be intuitive, mobile-responsive, and equipped with data validation to prevent common errors. Accessibility features should also be considered for all digital formats, ensuring the template is usable by individuals with disabilities. For printed versions, using high-quality paper and clear printing ensures durability and professionalism.

Concluding Thoughts on Financial Record Management

The diligent use of a well-crafted receipt template transcends mere administrative compliance; it embodies an organization’s commitment to integrity, transparency, and operational excellence. This invaluable tool stands as a testament to diligent financial record-keeping, simplifying complex transactions and fortifying the trust between charitable entities and their benefactors. It ensures that every non-cash contribution is accurately documented, minimizing potential discrepancies and providing a clear audit trail for both internal and external scrutiny.

Ultimately, embracing a standardized approach to documenting non-monetary gifts through a robust receipt is a strategic investment in an organization’s future. It streamlines workflows, enhances data accuracy, and provides essential legal and tax documentation for all parties. By consistently utilizing such a reliable, accurate, and efficient financial record tool, organizations not only fulfill their fiduciary responsibilities but also strengthen their operational backbone, allowing them to focus more energy on their core mission and less on administrative challenges.