In the intricate landscape of non-profit operations, the meticulous management of financial records stands as a cornerstone of accountability and trust. Organizations committed to public benefit rely heavily on transparent processes, not only for internal governance but also for fostering confidence among donors, stakeholders, and regulatory bodies. A robust system for acknowledging contributions is paramount to this endeavor, ensuring that every act of generosity is properly documented and recognized.

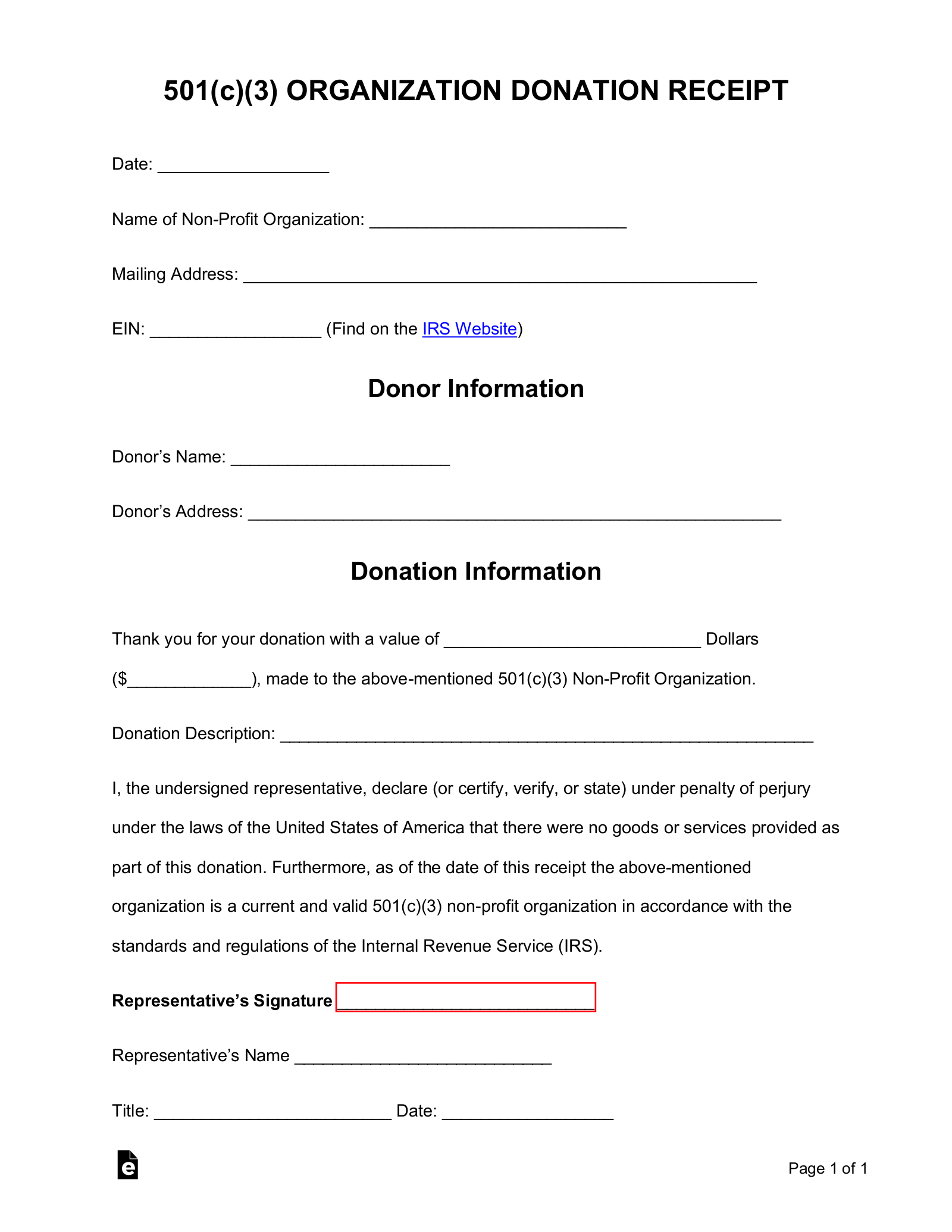

The essential non profit contribution receipt template serves precisely this critical function. It is more than just a piece of paper or a digital file; it is a formal acknowledgment providing proof of donation, a vital document for both the donor seeking tax deductions and the organization maintaining precise financial records. This document streamlines the process of confirming charitable gifts, upholding compliance standards, and reinforcing the professional integrity of the non-profit sector. Its utility extends across various types of contributions, providing a standardized method for recording invaluable support.

The Importance of Clear and Professional Financial Documentation

Clear and professional documentation is not merely a best practice; it is a fundamental requirement for any entity involved in financial transactions. For non-profit organizations, the stakes are particularly high, as their operations are often scrutinized by donors, grantmakers, and government agencies like the IRS. Accurate records ensure regulatory compliance, mitigating risks associated with audits and potential penalties.

Beyond compliance, precise financial documentation, such as a well-crafted payment receipt, builds and maintains donor trust. It demonstrates transparency and competence, assuring contributors that their support is being managed responsibly and ethically. This proof of transaction acts as an official record, validating the financial relationship between the donor and the organization. Furthermore, robust internal documentation facilitates efficient auditing processes, supports strategic financial planning, and enhances overall organizational transparency, reinforcing the non-profit’s mission and credibility.

Key Benefits of Utilizing a Structured Non Profit Contribution Receipt Template

Adopting a structured non profit contribution receipt template offers a myriad of advantages that transcend simple record-keeping. These benefits are foundational to operational efficiency, financial integrity, and positive donor relations. By standardizing the acknowledgment process, organizations can significantly enhance their administrative capabilities.

First, accuracy is vastly improved. A predefined layout minimizes the potential for human error in data entry, ensuring that all necessary information—such as donor details, contribution date, and amount—is consistently captured. This precision is vital for financial reporting and for donors to accurately claim tax deductions. Second, the template fosters transparency; a consistent format instills confidence in donors that their contributions are being handled professionally and in accordance with established guidelines. Third, it ensures consistency in record-keeping, creating a uniform archive of all donations received. This standardization simplifies internal reconciliation, audit preparations, and overall financial management. Finally, utilizing such a financial template significantly boosts efficiency. It reduces the time and effort spent on generating individual receipts, allowing staff to focus on mission-critical activities rather than repetitive administrative tasks. This structured approach helps organizations meet IRS requirements for donation acknowledgments, making it an indispensable business documentation tool.

Customization and Versatility of the Receipt Template

While specifically designed for non-profit contributions, the underlying principles of a well-structured receipt are universally applicable across various financial transactions. The fundamental layout of this form can be readily customized to serve diverse documentation needs, providing a robust framework for acknowledging a wide range of payments or contributions. This adaptability makes the template a highly versatile tool for any entity requiring formal transaction records.

For commercial enterprises, the basic structure can be transformed into a detailed sales record or an invoice form, clearly itemizing goods sold or services rendered. Similarly, for businesses or individuals managing rental properties, the document can function as a rent payment receipt, specifying the period covered and the amount received. Corporations often adapt such forms for business reimbursements, documenting employee expenses. The core elements – recipient and payer information, date of transaction, amount, and a clear description – remain consistent, ensuring comprehensive financial documentation regardless of the specific application. This inherent flexibility allows organizations to maintain a cohesive system for all forms of incoming funds, from a simple payment receipt to a complex donation acknowledgment.

When to Employ a Non Profit Contribution Receipt Template Effectively

The strategic deployment of this versatile document is crucial for maximizing its benefits and ensuring compliance. While its primary role is to acknowledge charitable gifts, understanding specific scenarios where the template is most effective can streamline administrative processes and strengthen donor relations.

- Monetary Donations: For all cash, check, credit card, or electronic fund transfer contributions, a promptly issued receipt is essential for the donor’s tax records and the organization’s financial accounting.

- In-Kind Contributions: When donors provide non-cash assets such as goods, services, real estate, or stock, the template is adapted to describe the item, its estimated value (as provided by the donor or appraised), and the date of contribution. This typically requires a more detailed description within the document.

- Event Sponsorships: Organizations sponsoring events often make contributions that are partially a donation and partially payment for goods or services (e.g., advertising). The receipt must clearly delineate the deductible portion from the non-deductible value received.

- Membership Fees: If a portion of a membership fee is tax-deductible as a charitable contribution, the receipt should explicitly state the deductible amount, particularly if benefits like publications or event access are included.

- Fundraising Auction Purchases: When items are purchased at a fundraising auction, the amount paid above the fair market value of the item is typically tax-deductible. The document must specify the deductible portion.

- Volunteer Services: While volunteer hours themselves are not tax-deductible, the documentation of services rendered can be important for internal tracking, grant reporting, and recognizing donor engagement. Although not a tax receipt, the template can be adapted for an acknowledgment of service.

- Any Contribution Requiring Formal Acknowledgment: Any time a donor provides support and requires formal documentation for tax purposes or simply for their own records, using this template ensures a consistent and professional approach. This elevates the donation acknowledgment beyond a simple thank you, establishing it as a critical piece of financial documentation.

Design, Formatting, and Usability Considerations

The effectiveness of any financial template hinges not just on its content, but also on its design, formatting, and overall usability. A well-designed receipt enhances clarity, professionalism, and accessibility for both the issuing organization and the recipient. Whether intended for print or digital distribution, thoughtful attention to these elements is critical.

Clarity and legibility are paramount. Choosing professional, easy-to-read fonts, ensuring adequate line spacing, and employing a logical layout prevents confusion and reduces the likelihood of errors. Essential fields should be prominently displayed and clearly labeled, including the non-profit’s legal name, Employer Identification Number (EIN), donor’s name and address, date of contribution, and the exact amount or a detailed description of the in-kind gift. Crucially, the document must include language stating that no goods or services were provided in exchange for the contribution, or if they were, a clear statement of their fair market value. Incorporating the organization’s branding, such as a logo and consistent color scheme, reinforces its identity and professionalism. For digital versions, creating fillable PDF forms or integrating the layout into an online donation system can significantly improve efficiency. These digital files can be easily emailed, reducing printing and mailing costs. For print versions, using quality paper stock can further convey a sense of professionalism. Ultimately, the usability of the document ensures that it is straightforward to complete, easy to understand, and readily accessible for all parties involved, making it a reliable expense record and financial template.

Conclusion

In the realm of non-profit management, the diligent generation and distribution of contribution receipts are not merely an administrative chore but a strategic imperative. The thoughtful utilization of a well-designed non profit contribution receipt template emerges as an indispensable tool, bolstering the financial integrity, operational efficiency, and public trust of any charitable organization. By standardizing the acknowledgment process, these organizations uphold their commitment to transparency and accountability, crucial elements in a sector reliant on public generosity.

This specialized financial template ensures that every donation, whether monetary or in-kind, is accurately recorded and professionally acknowledged, serving as vital business documentation for both the donor and the non-profit. It streamlines compliance with IRS regulations, minimizes the potential for errors, and frees up valuable resources that can be redirected toward fulfilling the organization’s mission. Ultimately, a robust system built upon such a template does more than just process transactions; it reinforces donor confidence, fosters long-term relationships, and validates the crucial impact of every contribution, proving itself as a reliable, accurate, and efficient financial record tool.