In the intricate landscape of non-profit operations, the meticulous management of financial records is not merely a best practice; it is a fundamental pillar of accountability, transparency, and legal compliance. Among the various instruments crucial to this endeavor, a well-structured non profit donation receipt template serves as an indispensable tool, bridging the gap between a donor’s generosity and the organization’s fiduciary responsibilities. This document is far more than a simple acknowledgment; it is a formal record, a legal substantiation, and a testament to the trust placed in a charitable entity.

The primary purpose of such a template is to provide donors with verifiable proof of their contributions, which is essential for tax deduction purposes under IRS regulations. Simultaneously, it equips non-profit organizations with an organized system for tracking incoming funds, facilitating accurate bookkeeping, and streamlining audit processes. Both the donor, seeking tax benefits and confirmation of their impact, and the non-profit, striving for operational excellence and regulatory adherence, stand to benefit immensely from the consistent and professional application of this crucial financial document.

The Imperative of Clear and Professional Financial Documentation

The integrity of any organization, particularly those operating in the public trust, hinges significantly on its ability to maintain clear, accurate, and professional financial documentation. Such documentation extends beyond mere data entry; it encompasses a systematic approach to recording every financial transaction, ensuring that each inflow and outflow is meticulously cataloged and verifiable. This level of diligence is paramount for fostering confidence among stakeholders, including donors, grantors, and regulatory bodies.

In the context of non-profits, robust business documentation translates directly into enhanced accountability and transparency. Every payment receipt, proof of transaction, or expense record contributes to a comprehensive narrative of the organization’s financial health and ethical conduct. Without standardized processes and reliable forms, inconsistencies can emerge, leading to potential compliance issues, eroded donor trust, and operational inefficiencies that divert precious resources from the core mission. A professionally designed financial template underpins this entire system, offering a structured framework for all necessary information.

Key Benefits of Utilizing a Structured Non Profit Donation Receipt Template

Adopting a structured non profit donation receipt template is pivotal for ensuring accuracy, transparency, and consistency in financial record-keeping. This proactive approach offers a myriad of benefits that enhance both internal operations and external stakeholder relations. By standardizing the information captured for each contribution, organizations can significantly mitigate the risk of errors and omissions, which are critical for IRS compliance and accurate financial reporting.

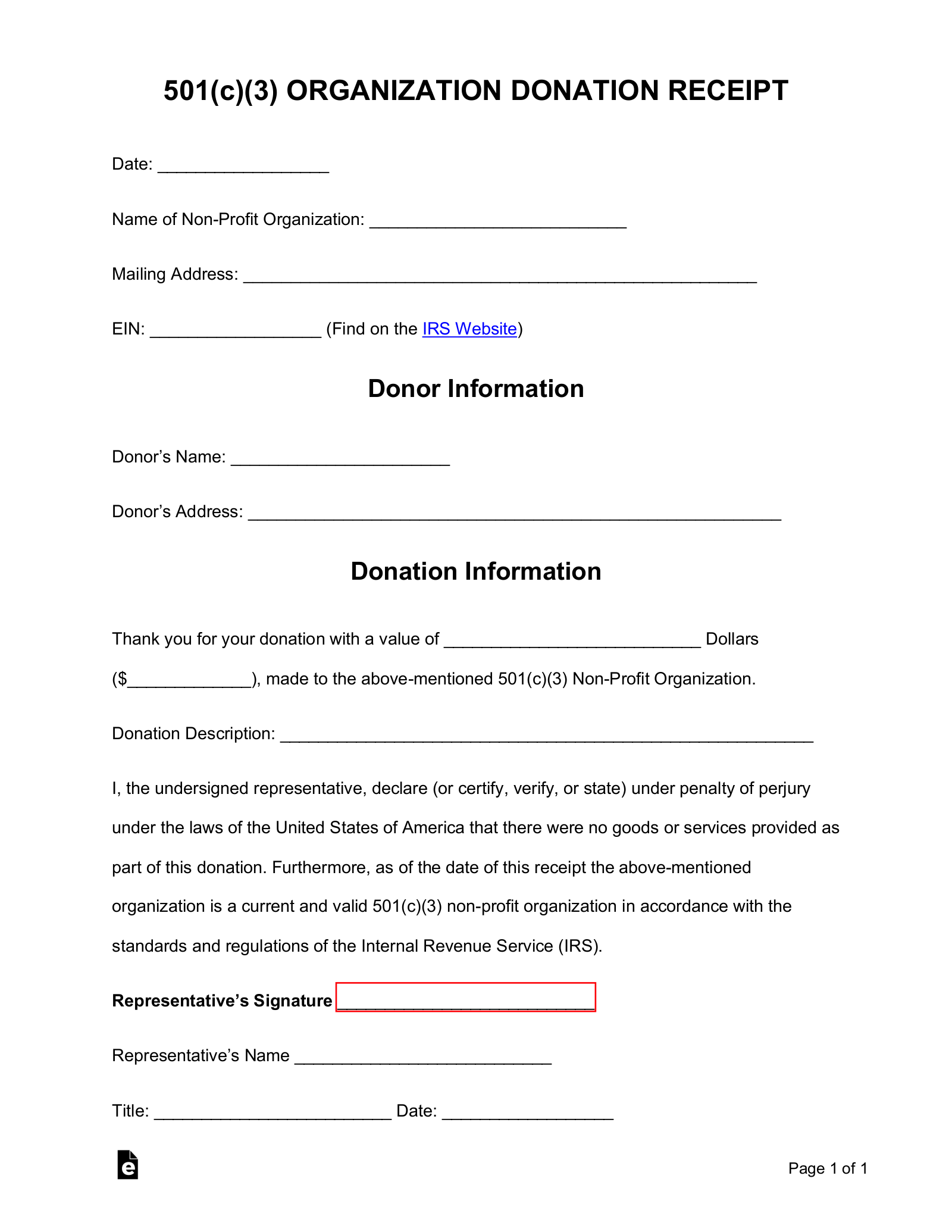

Firstly, a standardized layout ensures accuracy by prompting for all necessary details, such as the donor’s full name, address, donation date, amount, and the organization’s Employer Identification Number (EIN). This reduces manual input errors and ensures that all required information for a valid donation acknowledgment is consistently present. Secondly, it promotes transparency, providing a clear and unambiguous breakdown of the donation, including any goods or services provided in return for the contribution and their fair market value. This clarity helps donors understand the deductible portion of their gift, fostering greater trust.

Thirdly, consistency in formatting and content across all receipts streamlines the record-keeping process for the non-profit. It simplifies reconciliation with bank statements and accounting software, making year-end reporting and auditing significantly more efficient. Finally, this type of financial template reinforces a professional image, demonstrating to donors that their contributions are handled with the utmost care and responsibility. It aids in creating a comprehensive sales record for any goods or services exchanged, as well as a robust billing statement when required.

Customizing the Template for Diverse Financial Transactions

While primarily discussed in the context of charitable giving, the principles guiding an effective non profit donation receipt template extend broadly to encompass a variety of financial transactions. The underlying structure and requirement for clear, verifiable documentation are universal across different types of payment receipts. Organizations can readily adapt the core layout to serve multiple purposes, ensuring a consistent approach to financial record-keeping for all incoming funds.

For instance, the template can be easily modified to function as an invoice form for goods sold or services rendered by the non-profit. By adjusting fields to include item descriptions, unit prices, quantities, and a total amount due, it transforms into a robust sales record for mission-related enterprises. Similarly, for events where participants pay a fee, this form can be adapted into a service receipt, detailing the service provided and the amount paid.

Even for transactions outside the immediate scope of donations or sales, such as rent payments received from tenants in a property owned by the non-profit, or business reimbursements for operational expenses, the fundamental design offers a solid foundation. The adaptability of the document lies in its modular nature, allowing specific fields to be added, removed, or re-labeled while maintaining the core elements of a proof of transaction: sender, recipient, amount, date, and purpose. This flexibility ensures that one foundational template can support diverse financial documentation needs.

Practical Applications: When a Structured Receipt is Most Effective

A structured financial template for recording transactions is invaluable across a wide spectrum of scenarios within a non-profit organization. Its consistent application ensures that all financial interactions are properly documented, providing essential data for both internal management and external compliance. Here are several instances where utilizing a robust receipt form is most effective:

- One-Time Financial Gifts: For individual or corporate cash donations,

the receiptserves as immediate proof of contribution, detailing the amount received and the date of the transaction. - Monthly Recurring Donations: Even with automated systems, a cumulative annual statement or individual monthly receipts can be generated from the template, offering donors a consolidated

proof of transactionfor their ongoing support. - In-Kind Contributions: When donors provide non-cash assets (e.g., equipment, services, real estate),

the templateshould be adapted to acknowledge the item received, its description, and a clear statement that the organization does not provide valuation. Donors are responsible for substantiating the value for tax purposes. - Event Ticket Purchases: For fundraising events where a portion of the ticket price is tax-deductible,

this formshould clearly state the total price, the fair market value of any goods or services received (e.g., meal, entertainment), and the resulting deductible amount. - Membership Fees with Charitable Components: If a membership fee includes both a charitable contribution and tangible benefits,

the documentmust delineate these components, specifying the deductible portion. - Sponsorships: Corporate sponsorships, especially those involving marketing benefits, require a detailed

payment receiptthat outlines the sponsorship amount and any specific benefits provided to the sponsor, ensuring clear understanding of the deductible amount. - Goods or Services Sold by the Non-Profit: When a non-profit sells items (e.g., merchandise, publications) or offers services to generate revenue,

the templateacts as a crucial sales record, providing customers with abilling statementorservice receipt. - Volunteer Expense Reimbursements: While not a donation receipt, an adapted version can serve as an

expense recordfor reimbursing volunteers, ensuring proper tracking of outgoing funds and documentation for audit.

Design, Formatting, and Usability: Optimizing Your Receipt Template

The effectiveness of any financial documentation, including a donation acknowledgment, is significantly influenced by its design, formatting, and overall usability. A well-designed layout not only conveys professionalism but also ensures clarity, reduces errors, and facilitates easy processing for both the issuer and the recipient. Optimizing these elements for both print and digital versions is crucial in today’s diverse communication landscape.

Branding and Identification: Every receipt should prominently feature the non-profit’s official logo, name, address, and Employer Identification Number (EIN). This immediately establishes credibility and identifies the issuing organization. Consistent branding across all business documentation reinforces the organization’s identity and professionalism.

Essential Content Fields: The template must include specific, non-negotiable fields:

- Date of Donation: Clear date of receipt.

- Donor Information: Full name, address, and contact details of the donor.

- Donation Amount: Numerical and written amount of the contribution.

- Type of Contribution: Cash, check, credit card, stock, in-kind.

- Description of In-Kind Gifts: For non-cash donations, a detailed description, but without assigning a value (as per IRS guidelines).

- Organization Information: Legal name, address, EIN.

- Disclosure Statement: Essential for tax purposes, clearly stating that no goods or services were provided in return for the donation, or detailing the fair market value of any provided.

- Authorized Signature: A designated signatory for the non-profit (can be a printed name on digital versions).

Clarity and Readability: Use professional, legible fonts and maintain adequate white space to avoid a cluttered appearance. The information should be logically organized, with clear headings and distinct sections. This enhances the document's readability and ensures that critical information is easily identifiable.

Digital Versatility: For electronic distribution, this form should be generated in a universally accessible format, such as PDF. Ensure it is compatible with email systems and can be securely stored. Consider options for e-signatures and digital archiving to streamline processes. Digital versions should also be mobile-friendly, adjusting well to various screen sizes.

Print Considerations: For organizations that still issue physical receipts, professional-quality paper and clear printing are important. The file should be designed to print correctly on standard paper sizes without cutting off information or appearing distorted. Providing both print and digital options caters to donor preferences and operational needs.

A Reliable, Accurate, and Efficient Financial Record Tool

In conclusion, the strategic implementation of a robust non profit donation receipt template extends far beyond a mere administrative task; it is a foundational element of sound financial governance and effective donor stewardship. This critical financial template solidifies the financial relationship between a non-profit and its supporters, providing transparent, accurate, and consistent documentation vital for regulatory compliance and fostering unwavering trust. By streamlining the acknowledgment process, it frees up valuable time and resources, allowing organizations to focus more intently on their mission.

Ultimately, whether serving as a simple payment receipt, a comprehensive donation acknowledgment, or an adaptable service receipt, the template stands as a fundamental instrument in a non-profit’s operational toolkit. It embodies the organization’s commitment to accountability, ensuring that every contribution is formally recognized and every transaction meticulously recorded. Embracing a well-designed and consistently utilized template is not just about meeting legal obligations; it is about upholding the highest standards of financial integrity and professionalism, thereby strengthening the organization’s capacity to achieve its charitable objectives for years to come.