In an increasingly digitized economy, the demand for precise, verifiable, and easily accessible financial records has never been greater. For landlords, property managers, and tenants alike, the ability to generate and manage transaction documentation with efficiency is paramount. An online rental receipt template serves as an indispensable tool, streamlining the process of confirming rent payments and ensuring both parties maintain an accurate accounting of financial exchanges.

This digital solution not only simplifies administrative tasks but also fosters transparency and trust within landlord-tenant relationships. It is designed for US readers who prioritize clarity and robust record-keeping, providing a professional framework for documenting one of the most common financial transactions: rent payment. Its utility extends across individual property owners, large management companies, and tenants who require tangible proof of their payments for personal budgeting or tax purposes.

The Importance of Clear and Professional Documentation

Clear and professional documentation is the bedrock of sound financial management and effective business communication. In any transaction, particularly those involving recurring payments like rent, a meticulously prepared record acts as definitive proof of transaction. This record protects both the payer and the recipient, mitigating potential disputes and clarifying financial obligations. Without standardized documentation, discrepancies can arise, leading to miscommunication, legal challenges, and eroded trust.

A professional payment receipt reflects an organization’s commitment to accountability and operational excellence. It transforms a simple exchange of funds into a verifiable event, providing an indisputable audit trail. Such robust business documentation is crucial for tax compliance, internal auditing, and demonstrating due diligence in financial reporting. It underscores the value of transparency, which is a cornerstone of responsible financial practice in all sectors.

Key Benefits of Using Structured Templates

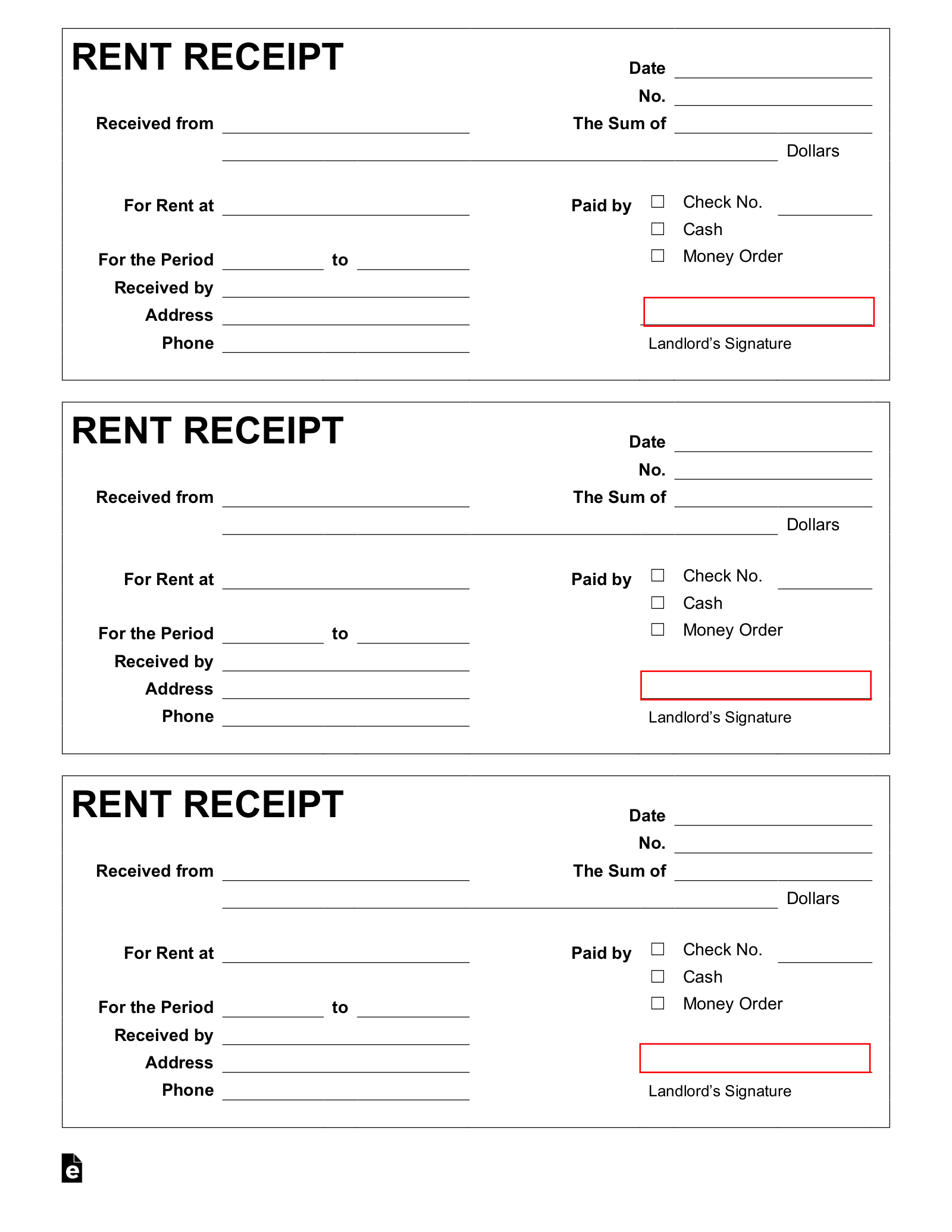

The adoption of structured templates for financial documentation offers a multitude of benefits, particularly when creating records like rent receipts. Primarily, these templates ensure accuracy by pre-defining fields for essential information such as payment date, amount, payer details, and recipient identification. This systematic approach minimizes errors that can occur with manual or improvised documentation, leading to more reliable financial records. Consistency is another significant advantage, as every receipt generated will follow the same format and include the same categories of information.

Beyond accuracy and consistency, the utility of an online rental receipt template extends to enhancing transparency. By standardizing the information presented, all parties can quickly understand the details of a transaction, leaving no room for ambiguity. This fosters trust and provides a clear financial template for all interactions. Furthermore, such a document significantly aids in record-keeping, simplifying the process of archiving, retrieving, and cross-referencing past transactions, which is invaluable for tax preparation, financial audits, and resolving any future disputes.

Customizing Your Digital Receipt Template

The inherent flexibility of a digital receipt template allows for significant customization, making it suitable for a wide array of financial transactions beyond just rent payments. While an online rental receipt template is designed with specific fields pertinent to property leasing, its underlying structure can be adapted. This versatility makes it an invaluable asset for various business and personal financial needs, demonstrating its broad applicability across different contexts.

Businesses can modify the layout to function as a sales record for goods sold, a service receipt for professional fees rendered, or an invoice form for tracking client billing. Non-profit organizations can tailor it into a donation acknowledgment, providing contributors with the necessary documentation for tax deductions. Even for individuals, such a financial template can serve as an expense record for business reimbursements or personal budget tracking. The ability to adjust branding, fields, and legal disclaimers ensures the document remains relevant and professional for any specific purpose.

Effective Applications of a Structured Rental Receipt

Using a structured receipt is particularly effective in scenarios where clear, verifiable proof of payment is critical. These templates provide a consistent and professional way to document financial exchanges, offering security and clarity to all parties involved. Examples of when using an online rental receipt template is most effective include:

- Monthly Rent Payments: Providing tenants with a clear and dated payment receipt immediately after funds are received, verifying that the rental obligation for a specific period has been fulfilled.

- Security Deposit Collection: Documenting the precise amount of a security deposit, the date received, and the terms under which it is held, establishing a clear record from the outset of a tenancy.

- Partial Payments or Installments: Recording specific amounts received when a tenant makes multiple payments towards a single month’s rent or a past-due balance, preventing confusion about outstanding amounts.

- Late Fees or Other Charges: Issuing a receipt for additional charges such as late payment fees, pet fees, or utility reimbursements, clearly itemizing these supplementary costs.

- Cash Transactions: Offering an indisputable record for cash payments, which are often harder to track than digital transfers, providing essential proof of transaction for both landlord and tenant.

- Move-Out Reconciliation: Using accumulated receipts as a comprehensive billing statement to reconcile all payments made against total rental obligations at the end of a lease term.

- Tax Documentation: Serving as an essential expense record for tenants seeking to deduct rental expenses for home offices or other business purposes, and for landlords needing to report income.

- Dispute Resolution: Acting as concrete evidence in the event of any payment disputes, offering a clear timeline and confirmation of all financial interactions.

Design, Formatting, and Usability Considerations

When designing and formatting a digital receipt template, careful attention to usability for both print and digital versions is paramount. The layout should be clean, intuitive, and logically organized, ensuring that key information is immediately discernible. For design, a minimalist aesthetic often works best, avoiding clutter and focusing on readability. Using a consistent font, appropriate font sizes, and ample white space enhances the professional appearance of the document. Incorporating an organization’s logo and contact information reinforces branding and professionalism, transforming a simple payment receipt into an extension of the business identity.

From a formatting perspective, fields for payment date, amount received, method of payment, property address, and tenant/landlord signatures should be clearly labeled and easily fillable. For digital versions, ensuring compatibility across various devices and operating systems is crucial. The file should ideally be exportable to common formats like PDF to preserve its layout and prevent unauthorized alterations, offering a secure and unchangeable financial record. Usability also extends to ease of generation and distribution; the template should facilitate quick input of data and effortless sharing via email or cloud platforms. This ensures the prompt delivery of the receipt, maintaining efficient business communication and reinforcing the value of the digital template as a versatile tool.

Enhancing Financial Record-Keeping with Digital Receipts

The strategic adoption of an online rental receipt template offers a clear pathway to enhanced financial record-keeping for property managers and tenants alike. By providing a standardized, clear, and easily customizable form, it elevates the process of documenting rental payments from a tedious administrative task to an efficient and secure operation. This approach not only safeguards against common financial discrepancies but also reinforces trust and transparency in all related transactions. The digital nature of such a record ensures accessibility, allowing for seamless storage, retrieval, and sharing, which are vital components of modern business documentation.

Ultimately, this digital template stands as a robust tool for maintaining accurate and consistent financial records. It simplifies compliance requirements, supports effective budgeting, and provides an undeniable proof of transaction for every payment. Embracing a structured receipt format is an investment in operational efficiency, accountability, and the long-term integrity of financial interactions, ensuring that all parties benefit from clear, verifiable documentation.