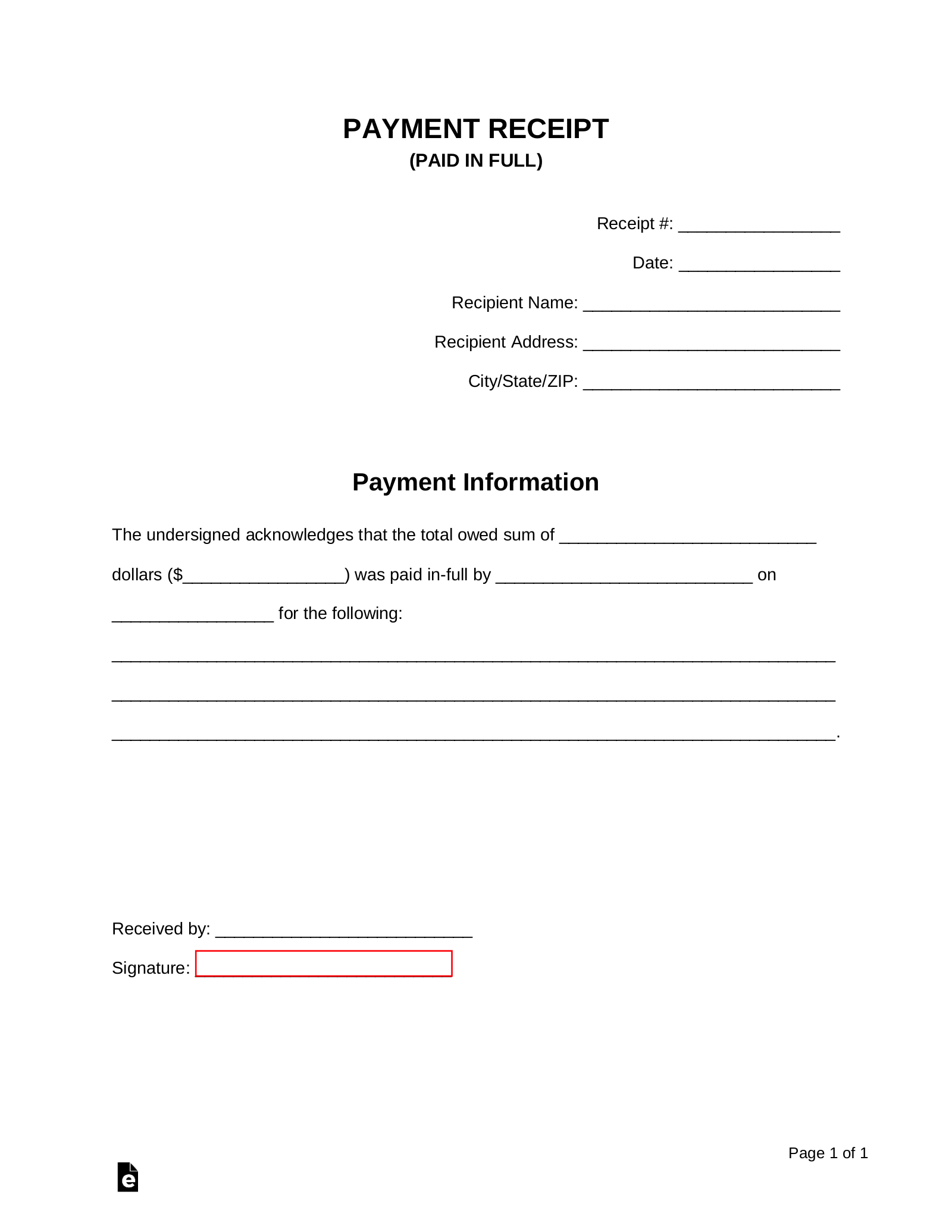

In the intricate landscape of financial transactions, the definitive confirmation of payment is not merely a courtesy but a critical business imperative. A robust paid in full receipt template serves as the unequivocal declaration that a financial obligation has been entirely satisfied, marking the culmination of a transactional cycle. This essential document provides both the payer and the payee with an irrefutable record, fostering trust and clarity in commercial and personal dealings. It transcends a simple acknowledgment, acting as a final testament to the completion of a financial commitment.

For businesses of all sizes, independent contractors, landlords, and even non-profit organizations, the strategic utilization of a well-designed paid in full receipt template streamlines administrative processes and fortifies financial record-keeping. It is an indispensable tool for ensuring transparency, preventing disputes, and maintaining a professional image. This article will explore the multifaceted value of employing such a template, detailing its structure, benefits, customization potential, and best practices for implementation in modern business communication.

The Importance of Clear and Professional Financial Documentation

Effective financial documentation is the bedrock of sound business practice and personal financial management. In any transaction, from a complex B2B service contract to a simple retail purchase, a clear and professional record safeguards the interests of all parties involved. Such documentation acts as a critical reference point, validating agreements and providing a tangible proof of transaction. Without it, the risk of miscommunication, financial discrepancies, and potential legal disputes significantly increases.

Beyond merely confirming payment, comprehensive documentation supports auditing processes, tax compliance, and internal financial reporting. It ensures that every monetary exchange is accounted for, contributing to overall financial transparency and accountability. A meticulously maintained system of payment receipts and acknowledgments reflects an organization’s commitment to integrity and precision, enhancing its reputation and operational efficiency.

Key Benefits of Structured Templates for Financial Records

Adopting a structured template for issuing final payment acknowledgments offers a multitude of advantages. Firstly, it ensures accuracy by standardizing the information collected and presented, minimizing the potential for errors or omissions. Each field is intentionally designed to capture essential data points, guaranteeing that no critical detail is overlooked. This systematic approach reduces the administrative burden and enhances the reliability of financial records.

Secondly, a robust paid in full receipt template promotes transparency. By clearly outlining what was paid for, the amount received, the date of transaction, and the parties involved, it leaves no room for ambiguity. This clarity is vital for internal reconciliation and external verification, fostering trust between transacting entities. Furthermore, the consistency derived from using a predefined layout improves the professional presentation of your financial communications. A standardized form projects an image of competence and organization, reinforcing confidence in your business practices.

Customizing the Template for Diverse Applications

The inherent flexibility of a well-designed financial template allows for its adaptation across a wide array of transactional contexts. While the core purpose of confirming full payment remains constant, the specific details and presentation can be tailored to meet unique industry or organizational requirements. This versatility makes the document an invaluable asset for various sectors.

For example, a sales record might emphasize product details, serial numbers, or warranty information. A service receipt could include a breakdown of labor hours and materials. Landlords might incorporate clauses related to tenancy agreements or security deposit refunds. Non-profit organizations using this template as a donation acknowledgment might add tax-deductible information or a message of gratitude. Similarly, when used for business reimbursements, the form would detail the expenses covered and the employee who incurred them. The ability to modify headings, add specific fields, and integrate branding ensures that this versatile paid in full receipt template remains relevant and effective across a broad spectrum of financial interactions.

Examples of When Using a Final Payment Template is Most Effective

The application of a definitive payment acknowledgment extends across numerous scenarios where the finality of a financial obligation needs to be unequivocally established. Utilizing the template in these specific contexts not only provides clarity but also serves as a protective measure for all parties.

- Completion of Loan Repayments: When a borrower makes the final payment on a loan, mortgage, or credit facility, receiving this document confirms the debt has been fully extinguished, releasing them from further obligation.

- Settlement of Large Purchases: For significant acquisitions like vehicles, real estate, or high-value equipment, the receipt provides essential proof of ownership and payment completion, crucial for legal and insurance purposes.

- Final Payment for Services Rendered: Upon the conclusion of a project or service contract, such as construction work, consulting engagements, or legal services, the receipt verifies that all fees have been settled.

- Lease or Rent Payment Finality: Landlords can issue this form to tenants upon receiving the final rent payment for a term, or when a security deposit is returned, signifying the closure of the rental agreement.

- Subscription or Membership Cancellations: When a recurring service is canceled and all outstanding dues are cleared, the document confirms that no further charges will be incurred.

- Donation Acknowledgments: Non-profit organizations use this template to confirm the receipt of a full donation, which can be vital for the donor’s tax records.

- Business Expense Reimbursements: Employees receiving reimbursement for business-related expenses can be issued this form to confirm the amount paid and that the expense has been settled by the company.

- Layaway Plan Completion: For retail items paid off over time, the receipt signifies that the item is fully owned by the customer and can be taken home.

Design, Formatting, and Usability Considerations

The effectiveness of any financial document is significantly influenced by its design, formatting, and overall usability. A well-structured template should be intuitive, professional, and accessible in both print and digital formats. Clarity in presentation directly translates to clarity in communication, minimizing potential misunderstandings.

Key design elements include:

- Clear Headings and Labels: Use concise and descriptive titles for all fields (e.g., "Amount Paid," "Date of Payment," "Recipient Signature").

- Logical Flow: Arrange information in a sequential and easy-to-follow manner, guiding the user or recipient through the document effortlessly.

- Branding Elements: Incorporate your company logo, name, and contact information prominently to maintain brand consistency and professionalism.

- Adequate Space for Information: Ensure sufficient space for writing or typing details without overcrowding the layout.

- Legible Typography: Choose professional and easily readable fonts, avoiding overly decorative or small typefaces.

Formatting best practices:

- Consistent Layout: Maintain uniform spacing, alignment, and sizing throughout the document for a polished appearance.

- Use of Tables or Grids: For itemized lists or breakdowns, tables can effectively organize information and enhance readability.

- Digital Signatures/Approval Fields: Include dedicated areas for electronic signatures or approval stamps to accommodate digital workflows.

- File Naming Conventions: For digital versions, advise users on clear naming conventions to facilitate easy retrieval (e.g.,

[ClientName]_[InvoiceNumber]_PaidInFull.pdf).

Usability considerations for both print and digital:

- Printability: Ensure the document is designed to print cleanly on standard paper sizes without cutting off information or requiring special settings.

- Fillable Fields (Digital): For digital forms, implement fillable fields to enable easy data entry and reduce reliance on manual input.

- Accessibility: Consider users with visual impairments by using high-contrast colors and providing options for larger text where applicable.

- Version Control: For templates used across an organization, establish a version control system to ensure everyone is using the most current and approved iteration of the form.

- Security: If the template is used for sensitive financial data, ensure that digital versions are secured with appropriate encryption and access controls.

By adhering to these design, formatting, and usability principles, the template becomes not just a record, but an exemplary piece of business documentation that enhances operational efficiency and stakeholder confidence. It transforms a routine transaction into a professional interaction.

Conclusion: The Enduring Value of a Reliable Financial Record

In an era where financial transactions are increasingly complex and diverse, the utility of a precisely crafted payment receipt remains paramount. This fundamental business documentation serves as an immutable testament to the completion of a financial obligation, offering peace of mind and undeniable clarity to both payers and payees. Its structured nature minimizes ambiguities, fortifies record-keeping integrity, and underpins the trust essential for healthy commercial relationships.

The strategic implementation of such a financial template transcends mere administrative convenience; it is a proactive measure that mitigates potential disputes, streamlines audits, and reinforces an organization’s commitment to professionalism. By ensuring that every final payment is acknowledged with a clear, consistent, and comprehensive document, businesses and individuals alike can navigate their financial landscapes with greater confidence and efficiency. Embracing this reliable tool is an investment in accuracy, transparency, and the enduring strength of your financial operations.