In the intricate landscape of modern business and financial interactions, the ability to clearly and efficiently document transactions is paramount. A well-constructed payment due upon receipt template serves as an indispensable tool for organizations, service providers, and individuals seeking to formalize financial exchanges with precision and professionalism. This document clarifies the terms of payment immediately upon a transaction’s completion, ensuring that all parties possess a transparent record of the agreement and the exchange of value. Its strategic application streamlines accounting processes, mitigates misunderstandings, and reinforces a professional operational ethos.

This article explores the fundamental role of a robust payment due upon receipt template in fostering clarity, accuracy, and efficiency across various financial scenarios. From small businesses to non-profit organizations and individual contractors, understanding the structure and utility of such a template is crucial for maintaining impeccable financial records, ensuring timely payments, and cultivating strong, trust-based relationships with clients and partners. By providing a standardized yet adaptable framework, this essential business document empowers users to manage their financial communications effectively and confidently.

The Indispensable Role of Clear Financial Documentation

The bedrock of any successful commercial enterprise or organized financial activity rests upon the integrity and clarity of its documentation. In an environment where financial details can often be complex and subject to interpretation, precise records are not merely good practice—they are a necessity. Comprehensive business documentation serves multiple critical functions, from substantiating tax filings and supporting audits to resolving potential disputes with customers or vendors. Without clear, professional records, businesses risk compliance issues, financial discrepancies, and damage to their professional reputation.

Detailed financial records, such as those generated from a carefully designed payment receipt, provide an irrefutable account of every transaction. This level of meticulousness ensures that all income and expenses are accurately tracked, offering a real-time snapshot of an entity’s financial health. Moreover, such documentation acts as a vital communication tool, confirming the specifics of a transaction to all involved parties, thereby fostering an environment of trust and mutual understanding. The strategic deployment of a well-defined financial template ensures consistency and accuracy across all outgoing payment acknowledgments and income records.

Core Benefits of Utilizing a Structured Template

Employing a structured template for acknowledging payments immediately upon their receipt offers a multitude of operational and financial advantages. A robust payment due upon receipt template serves as a cornerstone for effective financial management, transforming what could be a cumbersome manual process into a streamlined and error-resistant operation. This systematic approach contributes significantly to an organization’s overall efficiency and professional standing.

One of the primary benefits is enhanced accuracy. Pre-defined fields and a standardized layout drastically reduce the potential for human error in data entry. By prompting users to input all necessary information—such as transaction dates, itemized costs, payment methods, and unique identifiers—the document ensures completeness and precision. This structured input minimizes omissions or misinterpretations that can arise from ad-hoc documentation.

Secondly, the template promotes transparency. A clear and consistent layout ensures that all parties understand the terms of the transaction. Itemized lists of goods or services, detailed pricing, applicable taxes, and the total amount due or received are explicitly presented. This level of clarity helps prevent disputes, as both the payer and recipient have an identical record of the financial exchange, serving as definitive proof of transaction.

Finally, consistency is a significant advantage. Using the same form across all transactions establishes a uniform brand identity and ensures that all financial communications adhere to a consistent standard. This not only projects professionalism but also simplifies internal record-keeping and external audits. The uniform nature of the template allows for easier categorization and retrieval of information, enhancing overall record-keeping efficiency.

Customization for Diverse Applications

The inherent flexibility of a well-designed payment receipt template allows for extensive customization, making it suitable for a wide array of financial transactions across various sectors. While the core purpose—documenting payment due or received immediately—remains constant, the specific fields and details can be tailored to meet the unique requirements of different business models and operational needs. This adaptability is key to its broad utility, transforming a generic form into a specialized business documentation tool.

For sales transactions, the template can be customized to include fields for product codes, quantities, unit prices, discounts, and applicable sales taxes, creating a comprehensive sales record. This ensures that every item sold is accounted for and that the customer receives a detailed breakdown of their purchase. In the context of service provisions, the layout can be adapted to specify services rendered, hourly rates, project milestones, and labor costs. This clarity is crucial for freelance professionals and service-based businesses, providing clients with a transparent billing statement that details the work completed.

When managing rent payments, the form can incorporate property addresses, tenant names, payment periods, and any late fees or specific clauses, serving as an official record for both landlord and tenant. For donation acknowledgments, non-profit organizations can customize the template to include their tax-exempt identification number, the donor’s name and contact information, the donation amount, and a clear statement about the donation’s tax-deductible status. This ensures compliance with IRS regulations and provides donors with the necessary documentation for tax purposes. Similarly, for business reimbursements, the template can be designed to document employee expenses, project codes, approval signatures, and categories of expenditure, facilitating accurate expense record keeping and payroll processing. The ability to modify the content while retaining a consistent structure makes this financial template an invaluable asset for various financial reporting needs.

Scenarios Where This Template Proves Most Effective

The immediate and formal acknowledgment provided by this payment receipt template makes it exceptionally effective in numerous scenarios where prompt and clear documentation is critical. Its utility spans various industries and transaction types, ensuring that financial exchanges are recorded accurately and transparently at the point of action.

Consider the following examples where the template is particularly beneficial:

- Immediate Cash Transactions: When goods or services are paid for in cash, particularly in retail or service environments, providing a physical receipt instantly confirms the transaction, preventing future disputes.

- Services Rendered on the Spot: Freelancers, consultants, or technicians completing work directly at a client’s location can issue the form immediately, detailing the service performed and confirming payment receipt.

- Partial Payments or Deposits: For larger projects requiring an upfront deposit or installment payments, the document serves as a clear record for each payment received, delineating the amount paid and the remaining balance.

- Freelance Work Completion: Upon the final delivery of a project, a freelancer can issue the form to confirm the full and final payment, providing both parties with an official closing statement for the engagement.

- Vendor Payments for Small Businesses: When a small business pays a vendor for supplies or services, having this template ensures an immediate record of the outflow of funds, critical for expense tracking and reconciliation.

- Rent Collection: Landlords can provide tenants with this official receipt each time rent is collected, offering proof of payment and clarifying the period covered, which is vital for tenancy agreements.

- Charitable Contributions: Non-profit organizations can issue a donation acknowledgment to donors immediately, confirming their gift and providing essential information for tax deductions.

- Pop-up Shops or Temporary Events: Businesses operating temporarily can use the form to document sales efficiently without needing complex point-of-sale systems, ensuring every sale is recorded.

- Business Reimbursements for Employees: When employees are reimbursed for expenses, the document can serve as a detailed record of the reimbursement, including expense categories and approval.

In each of these instances, the template acts as a reliable, tangible, or digital proof of transaction, fortifying financial records and fostering accountability.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template hinges not only on its content but also significantly on its design, formatting, and overall usability. A well-designed receipt should be clear, professional, and easy to understand for all parties involved, whether presented in print or digital format. Adhering to best practices ensures that the document serves its purpose efficiently and reflects positively on the issuing entity.

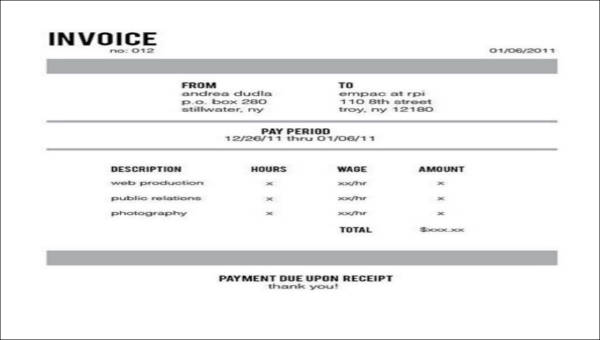

Essential Elements: Every payment receipt should contain core information to be comprehensive. This includes:

- Header: Clearly display your business logo, company name, address, phone number, and email.

- Recipient Information: Full name and contact details of the payer.

- Date of Transaction: The exact date the payment was received.

- Unique Receipt Number/Invoice ID: A sequential identifier for easy tracking and reference.

- Itemization: A detailed list of goods sold or services rendered, including descriptions, quantities, unit prices, and subtotal.

- Applicable Taxes and Discounts: Clearly separate these line items.

- Total Amount Due/Received: The final sum.

- Payment Method: Specify how the payment was made (e.g., cash, credit card, check, bank transfer).

- Terms and Conditions (Optional but Recommended): Any relevant disclaimers or return policies.

- Signature Lines: For both the recipient and the issuer, if a physical signature is required.

Formatting Tips: For optimal readability and professionalism, utilize:

- Clear, Legible Fonts: Opt for professional sans-serif fonts like Arial, Calibri, or Helvetica.

- Logical Flow: Arrange information hierarchically, making it easy to scan and understand. Important information should be prominently placed.

- Ample White Space: Avoid clutter. Sufficient spacing between sections and line items enhances readability.

- Consistent Branding: Incorporate company colors and logos to reinforce brand identity.

- Bold and Italics for Emphasis: Use sparingly to highlight critical information, such as the total amount.

Digital vs. Print Usability:

- Digital Versions (PDF): Ensure the file is easily downloadable and viewable across various devices. Interactive fields can be added for digital completion. PDFs maintain formatting integrity, crucial for an official document.

- Print Versions: Design for standard paper sizes (e.g., US Letter) with adequate margins. Ensure all text and graphics are clear when printed, avoiding light colors or overly complex designs that may not translate well.

By focusing on these design and usability principles, the template becomes not just a record, but an intuitive and reliable tool for financial communication.

Conclusion

The strategic adoption and consistent utilization of a well-designed payment due upon receipt template are more than mere administrative tasks; they are foundational to robust financial management and the cultivation of professional business relationships. This essential document, whether in print or digital form, serves as a clear, undeniable proof of transaction, safeguarding the interests of all parties involved by providing a precise and transparent record of financial exchanges. Its ability to ensure accuracy, foster consistency, and enhance transparency is invaluable in an operational environment that demands precision and accountability.

From the smallest cash transaction to the most complex service agreement, the template simplifies record-keeping, minimizes potential disputes, and contributes significantly to operational efficiency. By streamlining the acknowledgment process and standardizing financial communication, this form not only saves time but also projects an image of professionalism and reliability. Embracing such a structured approach to payment documentation is not just good practice; it is an indispensable component of sound financial governance and effective business communication in today’s dynamic marketplace.