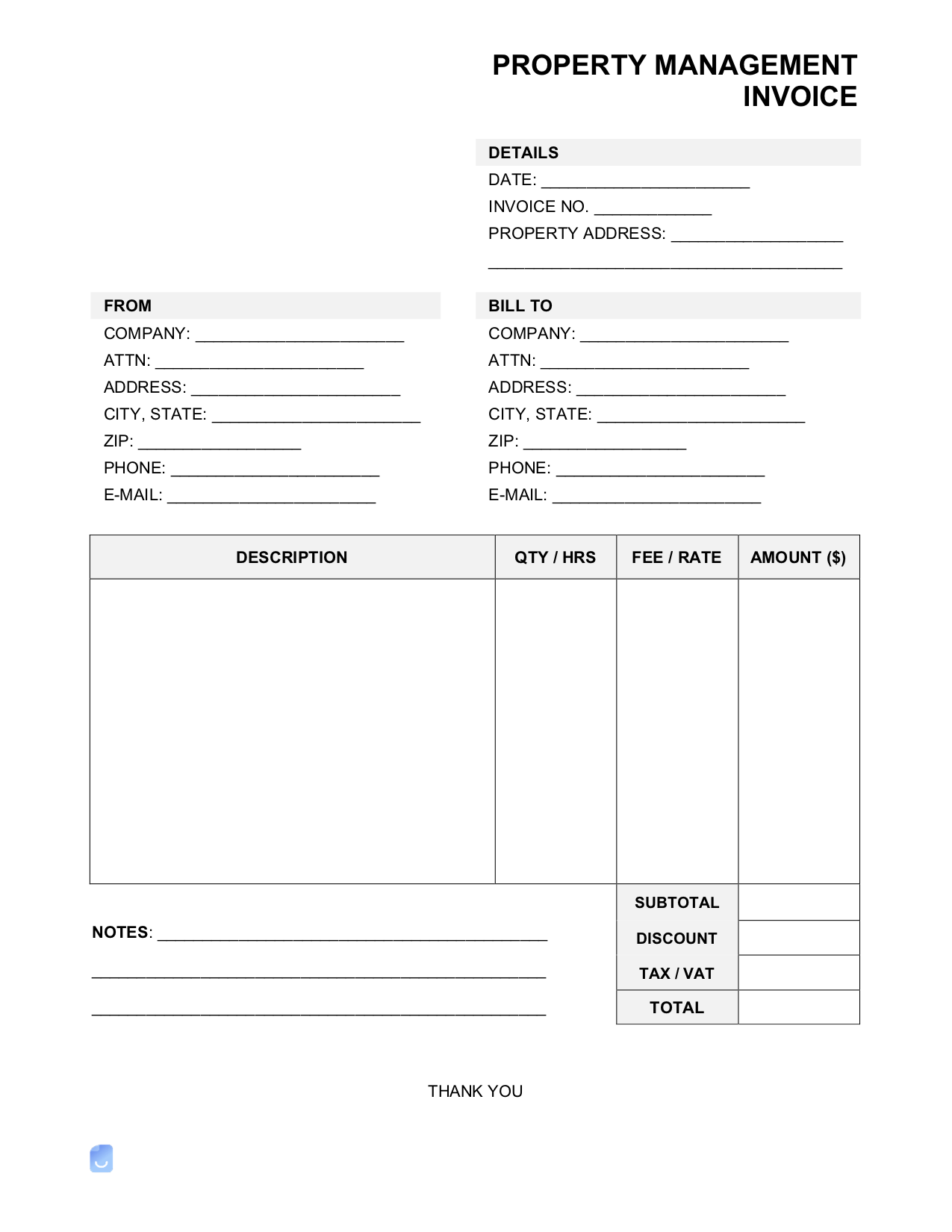

In the intricate world of real estate and asset administration, meticulous financial record-keeping is not merely good practice; it is an absolute necessity. A property management receipt template serves as a fundamental tool, designed to streamline the documentation of financial transactions between property managers, landlords, and tenants. Its primary purpose is to provide undeniable proof of payment, ensuring clarity and accountability for all parties involved in a property’s financial lifecycle. This formalized structure minimizes discrepancies, enhances transparency, and fosters trust, laying a solid foundation for sound financial management.

This essential document benefits a wide array of stakeholders. For property managers and landlords, it offers a standardized method for tracking incoming funds, simplifying reconciliation processes, and preparing for tax season or audits. Tenants, on the other hand, gain a verifiable record of their payments, which can be crucial for resolving disputes, demonstrating compliance with lease agreements, or even for personal financial management. Accountants and auditors also find immense value in these structured receipts, as they provide a clear, consistent audit trail that supports the financial integrity of the property management operations. Adopting a well-designed property management receipt template is therefore a strategic decision that underpins effective business communication and robust financial health.

The Indispensable Role of Professional Documentation in Financial Transactions

The backbone of any successful business, particularly within the financial and real estate sectors, is robust and professional documentation. Every financial transaction, irrespective of its size or nature, requires a clear, unambiguous record to establish its validity and particulars. This principle extends far beyond mere convenience; it is a critical component for legal compliance, audit readiness, dispute resolution, and ultimately, the maintenance of professional credibility.

Professional documentation, such as a meticulously crafted payment receipt, provides an immutable timestamp and detailed account of when funds were exchanged, by whom, for what purpose, and the exact amount involved. In the absence of such records, businesses expose themselves to significant risks, including misunderstandings, financial inaccuracies, potential legal challenges, and a general erosion of trust among clients and partners. A consistently applied system of clear documentation acts as a protective shield, safeguarding financial interests and ensuring all parties are operating from a shared, verified understanding of financial commitments and transactions. It transforms abstract financial movements into concrete, verifiable proof of transaction, crucial for both day-to-day operations and long-term strategic planning.

Core Benefits of a Structured Property Management Receipt Template

Adopting a structured property management receipt template offers a multitude of advantages that extend far beyond simple record-keeping. The inherent design of such a form is tailored to enhance accuracy, foster transparency, and ensure consistency across all financial interactions related to property management. These elements are vital for maintaining operational efficiency and upholding professional standards.

Firstly, accuracy is significantly bolstered by the use of pre-defined fields and consistent formatting. This systematic approach minimizes human error, ensuring that all critical data points—such as payment amounts, dates, payment methods, and specific line items—are captured correctly every time. Such precision is indispensable for reconciling accounts, generating financial reports, and preparing for any internal or external audits. Secondly, transparency is inherently built into the document’s structure. By clearly itemizing what a payment covers—be it rent, security deposit, late fees, or maintenance charges—the receipt provides an unambiguous breakdown for both the payer and the payee. This level of detail eliminates ambiguity, prevents disputes, and promotes a clear understanding of financial obligations and settlements. Lastly, consistency is achieved through a uniform layout and content. Every receipt issued will present information in the same professional manner, which not only projects a strong brand image but also simplifies the process of reviewing and understanding historical transactions. This uniformity is particularly beneficial for large portfolios or businesses with multiple staff members, as it standardizes procedures and ensures a cohesive approach to financial administration. Ultimately, a well-implemented template contributes to greater operational efficiency, reducing the time spent on administrative tasks and allowing property managers to focus on core activities.

Customization and Versatility Across Transaction Types for a Property Management Receipt Template

While specifically designed for property management, the underlying framework of a well-constructed property management receipt template boasts remarkable versatility, allowing for effective customization across a spectrum of financial transactions. This adaptability makes it an invaluable asset not just for acknowledging rent but for various other financial interactions that demand proof of transaction. The ability to modify fields and sections means that the core structure can serve diverse business needs, extending its utility beyond its initial scope.

For instance, adapting this form for rent payments is straightforward, requiring fields for the rental period, the specific property address, and a breakdown of rent, utilities, and any associated fees. When used as a service receipt, it can be customized to detail the nature of services rendered, hourly rates, material costs, and labor hours, ensuring a clear invoice form for work completed. Businesses requiring a sales record can adjust the layout to include product codes, quantities, unit prices, and total sales tax. Even for acknowledging donations, the template can be repurposed to function as a donation acknowledgment, providing fields for donor information, donation amount, date, and tax-deductible status. Furthermore, for internal business reimbursements, the document can clearly itemize expenses incurred, attach supporting documentation references, and confirm the reimbursement amount. This flexibility underscores the power of a structured financial template: it provides a robust foundation that can be fine-tuned to precisely match the specific requirements of nearly any financial acknowledgment, proving its worth as a truly comprehensive financial template.

Practical Applications: When to Leverage This Template

The effective deployment of this financial template significantly enhances the professionalism and efficiency of any property management operation. Its utility spans numerous critical touchpoints in the tenant-landlord relationship and beyond, solidifying its role as an indispensable piece of business documentation. Leveraging the template ensures that every financial exchange is properly recorded and acknowledged, providing peace of mind for all parties involved.

Here are specific instances when utilizing this form is most effective:

- Receiving Monthly Rent Payments: Providing a detailed receipt immediately upon receiving rent confirms the payment, specifying the rental period covered, the amount received, and any outstanding balance. This is perhaps the most frequent and critical application.

- Acknowledging Security Deposit Payments: Issuing a separate receipt for a security deposit clearly documents the amount, the date received, and often includes information about the terms under which the deposit is held and returned.

- Confirming Receipt of Maintenance Fees: When tenants or owners pay for specific maintenance or repair services, this document can itemize the service, labor, and parts, acting as a service receipt and proof of transaction.

- Documenting Utility Bill Reimbursements: For properties where utilities are billed through the landlord and then reimbursed by the tenant, the receipt serves as an expense record, detailing the utility type, period, and amount paid by the tenant.

- Providing Proof of Payment for Miscellaneous Property-Related Services: This includes payments for pet fees, application fees, late fees, parking permits, or amenity usage, ensuring every charge has a corresponding payment acknowledgment.

- Issuing Refunds or Credits: Even when money is being returned, the template can be adapted to act as a credit memo or refund receipt, detailing the reason for the refund and the amount disbursed.

- General Vendor Payments or Expense Records: Property managers often manage a range of expenses. When paying vendors or reimbursing staff for property-related expenses, this layout can be used internally as an expense record to confirm the outflow of funds.

- Tracking Partial Payments: For larger sums or rent arrears, issuing a receipt for a partial payment helps track outstanding balances and confirms the amount received towards the total.

In all these scenarios, the consistent use of the template prevents misunderstandings, ensures legal compliance, and provides a clear audit trail for financial reporting, making it a foundational element of effective property administration.

Design Principles and Usability for Optimal Effectiveness

The utility of a payment receipt is significantly amplified by thoughtful design and a focus on usability, whether it’s intended for print or digital distribution. A well-designed receipt not only conveys information clearly but also reinforces a professional brand image. Attention to aesthetic and functional details ensures that the document is easy to read, understand, and integrate into existing financial workflows.

For both print and digital versions, clarity and conciseness are paramount. The layout should be intuitive, guiding the eye through essential information without clutter. Using clean, legible fonts and adequate white space enhances readability. Branding elements, such as a company logo and contact information, should be prominently featured to establish authenticity and professionalism. These details turn a simple payment receipt into a powerful piece of business documentation.

When considering print versions, durability and legibility in physical form are key. This means selecting appropriate paper stock and ensuring that text and figures are dark enough to resist fading over time. The physical dimensions should be practical for filing and storage. Including a signature line for both the payer and payee can add an extra layer of verification, especially for cash transactions, acting as a direct proof of transaction.

For digital versions, functionality and accessibility become central. The template should ideally be available in a universally accessible format, such as PDF, to ensure it can be opened and viewed across various devices without special software. Fillable fields can significantly enhance efficiency, allowing information to be entered quickly and accurately before generation. Features like automated numbering for invoice forms or unique receipt identifiers are crucial for tracking. Furthermore, the integration with digital signature capabilities adds security and legal validity. Considerations for digital archiving and searchability are also vital; a well-structured digital receipt can easily be stored in cloud-based systems, enhancing its value as an expense record and simplifying retrieval for audits or inquiries. The aim is to create a seamless experience that mirrors the efficiency and clarity of its physical counterpart, providing an accessible and robust financial template.

The Enduring Value of a Structured Financial Record

The diligent use of a structured payment receipt stands as a cornerstone of transparent and efficient property management. It transcends the basic act of acknowledging a transaction, evolving into a critical component of risk mitigation, compliance adherence, and the cultivation of strong, trustworthy relationships between property managers, landlords, and tenants. By providing a clear, verifiable record of every financial exchange, this document serves as an indispensable tool that simplifies accounting processes and fortifies financial integrity.

Ultimately, the inherent value of this financial template lies in its capacity to transform potentially complex or ambiguous financial interactions into straightforward, documented facts. It fosters an environment where financial clarity is paramount, reducing the likelihood of disputes and enhancing the overall professionalism of property operations. For any entity engaged in managing properties, embracing such a reliable, accurate, and efficient financial record is not merely an option but a strategic imperative for long-term success and sustained credibility.