In the realm of financial transactions, the significance of proper documentation cannot be overstated. Whether dealing with substantial investments or smaller, crucial agreements, a clear and unambiguous record serves as the bedrock of trust and accountability between parties. This principle holds particularly true for specialized transactions, such as the initial payment made for a future pet. Understanding this need, the purpose of a puppy deposit receipt template is to provide a standardized, professional framework for acknowledging the receipt of a deposit, ensuring clarity for both the recipient and the payer.

Utilizing a formal puppy deposit receipt template elevates a simple exchange into a professionally documented agreement. Such a document not only acts as concrete evidence of a financial transfer but also outlines the terms under which the deposit is made and held. For breeders, it streamlines administrative processes and enhances their professional image. For buyers, it offers peace of mind, confirming their commitment and the seller’s acknowledgment, thereby safeguarding both parties’ interests and fostering a transparent transaction.

The Imperative of Clear and Professional Financial Documentation

Effective financial and business communication hinges on the clarity and professionalism of its documentation. In any transaction, verbal agreements, while sometimes necessary, lack the legal enforceability and detailed record-keeping capabilities that written documents provide. A meticulously crafted payment receipt or proof of transaction eliminates ambiguity, minimizes potential disputes, and establishes a definitive record for all involved parties. This detailed documentation is crucial for both legal protection and accurate financial reporting.

Comprehensive documentation supports transparent business practices, which are essential for building and maintaining client trust. It provides a historical sales record or service receipt that can be referenced for future inquiries, tax purposes, or dispute resolution. Without such structured business documentation, businesses and individuals risk miscommunication, financial discrepancies, and legal challenges. Therefore, investing in precise and professional forms is not merely a formality but a strategic business necessity.

Key Benefits of Utilizing a Structured Template

Employing a structured template for any financial acknowledgment offers a multitude of advantages, directly contributing to accuracy, transparency, and consistency in record-keeping. A well-designed template, such as the one described, ensures that all critical information is consistently captured for every transaction, eliminating omissions that could lead to future complications. This standardization is invaluable for maintaining organized and reliable financial template records.

Firstly, such a template significantly enhances accuracy by prompting the user to include all necessary data points. This reduces the likelihood of manual errors or forgotten details that might occur with informal documentation. Secondly, transparency is inherently built into the structure; both parties receive an identical proof of transaction that clearly delineates the amount, date, purpose, and terms of the deposit. This openness fosters trust and clarifies expectations. Finally, consistency is a cornerstone benefit, as the layout ensures uniform data collection across all transactions, simplifying auditing, record retrieval, and overall financial management. The consistent presentation of the data helps both the giver and receiver to easily understand the details of the transaction.

Adaptability Across Various Transaction Types

While the specific context of a "puppy deposit" might suggest a niche application, the underlying principles of the template are universally applicable to a wide array of financial acknowledgments. The fundamental structure for documenting a partial payment or security holding can be readily adapted for diverse scenarios. This versatility makes the document a powerful tool beyond its initial naming, serving as a flexible financial template for various business and personal needs.

For instance, this form can be effortlessly customized for general sales, providing a clear sales record for any product. Businesses offering services can modify it into a service receipt, detailing the initial payment for consulting, design, or labor contracts. Property owners can adapt it for rent payments or security deposits, turning it into a concise billing statement or rent receipt. Furthermore, non-profit organizations can adjust the layout to serve as a donation acknowledgment, providing donors with an official record for tax purposes. Even in an internal business context, the template can be repurposed for expense record reimbursements, documenting initial outlays made by employees. The core design principles allow for broad application, making it an invaluable asset for anyone requiring formal deposit documentation.

Effective Applications of the Template

The utility of a robust deposit receipt template extends to numerous situations where a formal acknowledgment of funds received is necessary. Its structured nature ensures that every relevant detail is captured, providing a clear and indisputable record for both parties. Here are several scenarios where using this template is most effective:

- Receiving a down payment for a future purchase: This could range from custom-made goods to high-value items, where a partial payment secures the item and demonstrates buyer commitment. The template clearly outlines the amount received and the remaining balance.

- Collecting an initial fee for a service contract: For services requiring upfront commitment, such as extensive consulting projects, event planning, or creative commissions, the document serves as a

service receiptfor the initial payment, detailing the scope or terms associated with it. - Documenting security deposits for property rentals: Landlords can use the template to formally acknowledge the receipt of a security deposit, outlining the property address, tenant names, and conditions for the deposit’s return, functioning as a vital

financial template. - Acknowledging charitable contributions: Non-profit organizations can adapt the form to issue a

donation acknowledgment, providing donors with official proof of their contribution for tax deductions. It ensures all necessary organizational details are included. - Providing proof of reimbursement for employee expenses: Within a corporate setting, this form can be modified to document the reimbursement of an employee’s out-of-pocket expenses, acting as an

expense recordfor both the employee and the accounting department. - Any situation requiring an official billing statement or invoice form: Whenever a financial transaction involves an initial payment that needs formal documentation, the template provides the necessary framework to ensure all parties have a clear, written

proof of transaction. This covers a wide range of business operations where clear communication about payments is paramount.

Design, Formatting, and Usability Considerations

The effectiveness of any financial document lies not just in its content, but also in its design, formatting, and overall usability. A well-designed template facilitates easy completion, promotes readability, and upholds a professional image. Whether intended for print or digital use, careful attention to these aspects ensures the document serves its purpose efficiently.

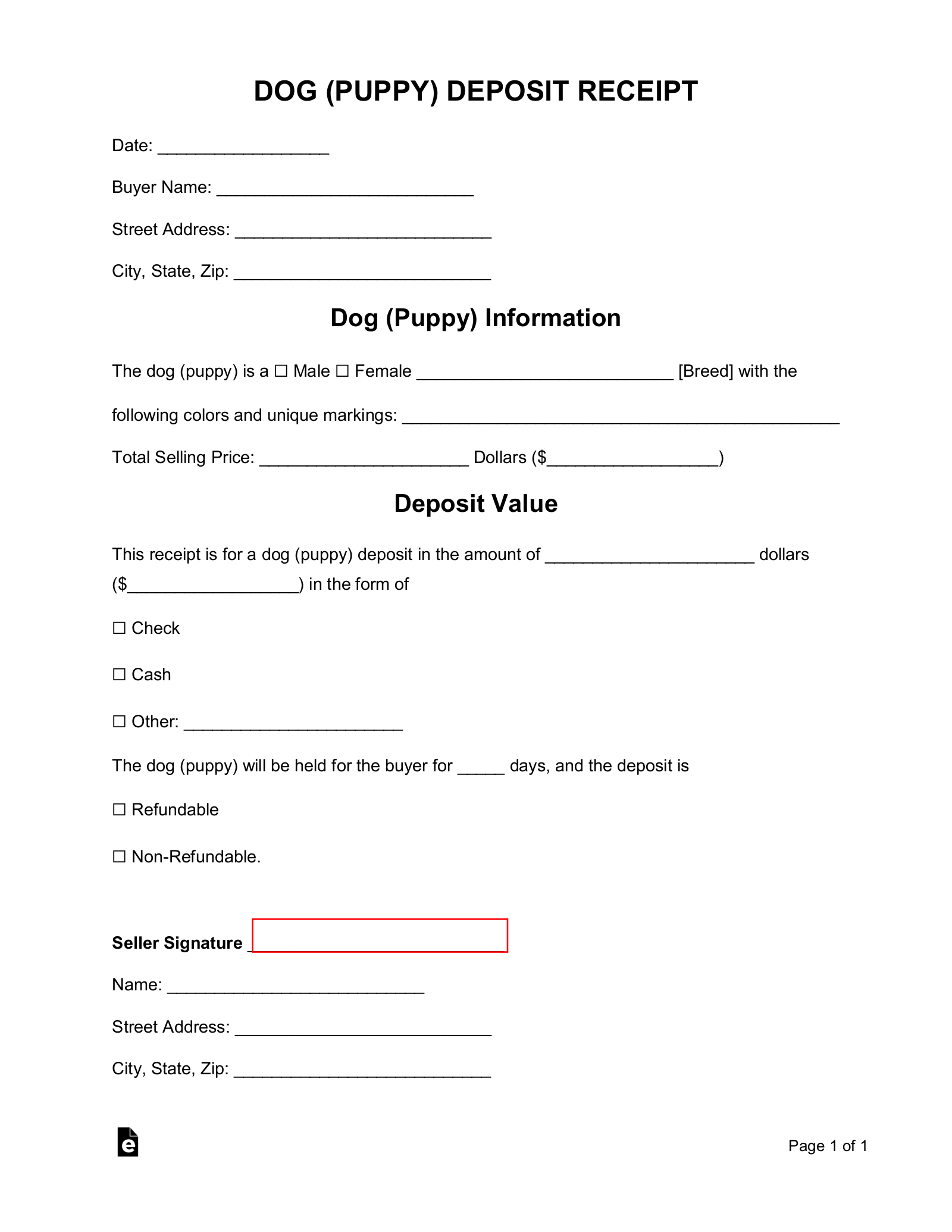

Structure and Content

The core of the template must include essential fields to be a valid payment receipt. These typically encompass: the date of transaction; the names and contact information of both the payer and recipient; the amount of the deposit, clearly stated in both numerical and written form; the purpose of the deposit (e.g., "deposit for X," "security deposit"); the method of payment; and designated spaces for the signatures of both parties, signifying their agreement. Optional fields can further enhance the document, such as: specific terms and conditions related to the deposit (e.g., non-refundable clauses, refund policies); an itemized breakdown if the deposit covers multiple aspects; and any relevant reference numbers or account details.

Clarity and Readability

To ensure optimal usability, the layout should prioritize clarity and readability. This involves selecting professional, legible fonts and maintaining adequate white space around text fields to prevent visual clutter. Information should be logically organized, with clear headings and a natural flow that guides the user through the document. The use of bolding for important details and consistent formatting throughout this form will further aid comprehension, making it easy for anyone to quickly grasp the crucial aspects of the financial record.

Print Versus Digital Versions

Consideration for both print and digital versions is crucial in today’s diverse business environments. For print versions, ensure that the document prints clearly on standard paper sizes, with sufficient space for manual signatures and any handwritten notes. The paper copy should be easily duplicable for multiple copies if required. For digital versions, the file should ideally be provided in a fillable PDF format, allowing users to enter information electronically. Digital versions can incorporate features like electronic signature fields, dropdown menus for standardized options, and automated calculations. This enhances efficiency, reduces paper waste, and facilitates easy digital storage and sharing of the proof of transaction.

Branding and Accessibility

Incorporating professional branding, such as a company logo and contact information, reinforces legitimacy and professionalism. This transforms a generic form into a branded business documentation asset. Additionally, consider accessibility; ensure that digital versions can be easily navigated and completed by individuals using assistive technologies. A thoughtful design considers all potential users, enhancing the overall utility of the receipt.

Conclusion

In the complex landscape of financial interactions, the value of structured and professional documentation cannot be overstated. The consistent application of a meticulously designed template transforms what might otherwise be an informal agreement into a secure, transparent, and legally sound proof of transaction. This commitment to detail not only minimizes the potential for misunderstandings and disputes but also reinforces the integrity and professionalism of all parties involved in a financial exchange.

The benefits of utilizing such a financial template extend far beyond mere record-keeping. It fosters an environment of trust by ensuring both the payer and the recipient have a clear, identical understanding of the transaction’s terms and conditions. By standardizing the information captured and presented, it streamlines administrative processes, simplifies auditing, and provides an invaluable reference for future inquiries or tax purposes. Ultimately, a well-crafted template serves as an indispensable tool for efficient and ethical financial management.

From initial deposits to final payments, maintaining comprehensive financial records is a cornerstone of responsible business and personal conduct. The adoption of such a reliable, accurate, and efficient financial record tool elevates transaction management, offering peace of mind and promoting a professional approach in all dealings. It empowers individuals and organizations to conduct their financial interactions with confidence and clarity, securing their interests and building lasting relationships founded on transparency and mutual understanding.