In the realm of financial transactions, precision and clarity are not merely preferred; they are imperative. A meticulously crafted receipt for cash payment template stands as a fundamental instrument in ensuring that every monetary exchange is thoroughly documented, providing a verifiable record for both the payer and the payee. This essential document serves as tangible proof of a transaction, cementing trust and providing a clear audit trail for financial accountability.

This article delves into the critical importance of such a template, exploring its multifaceted benefits for individuals, small businesses, non-profit organizations, and anyone involved in cash-based transactions. We will examine how this structured form enhances transparency, facilitates accurate record-keeping, and contributes significantly to sound financial management and compliance.

The Indispensable Role of Clear Financial Documentation

Effective financial documentation is the bedrock of transparent and accountable operations, regardless of scale. In a world increasingly driven by digital transactions, cash payments retain their prevalence, particularly in small businesses, local markets, and personal exchanges. Without a robust system for acknowledging these cash flows, businesses risk operational inconsistencies, potential disputes, and challenges in maintaining accurate financial records.

A clear payment receipt provides immediate confirmation of an exchange, preventing misunderstandings and offering tangible evidence should any discrepancies arise. Beyond mere confirmation, comprehensive business documentation supports compliance with tax regulations, facilitates internal audits, and strengthens the overall financial integrity of an entity. It transforms an ephemeral cash handover into a permanent, undeniable record.

Key Benefits of a Structured Template

The strategic adoption of a standardized receipt for cash payment template offers myriad advantages, extending far beyond simple acknowledgment. Such a structured form is instrumental in fostering accuracy, ensuring transparency, and maintaining consistency across all cash-based interactions. It streamlines administrative processes, allowing for greater efficiency and reducing the potential for human error.

By providing a pre-defined format, the template guides the user to capture all necessary details, thereby guaranteeing that no crucial information is overlooked. This systematic approach minimizes ambiguity, enhances professional credibility, and serves as a reliable reference point for future inquiries. The consistent application of this document bolsters a business’s reputation for professionalism and meticulousness.

- Accuracy: A well-designed template prompts the inclusion of all essential data, such as transaction date, amount, purpose, and parties involved, significantly reducing errors in recording cash movements. This precision is vital for financial reporting and reconciliation.

- Transparency: Providing a clear, itemized payment receipt to the payer fosters trust and transparency. Both parties have an identical record of the transaction, eliminating guesswork and potential disputes. This level of clarity builds stronger business relationships.

- Consistency: Utilizing the same layout for every cash payment ensures uniformity in record-keeping. This consistency simplifies auditing, streamlines internal processes, and makes it easier to track financial patterns over time. It establishes a recognizable standard for all cash dealings.

Customization for Diverse Transactional Needs

One of the most valuable attributes of a well-designed cash receipt template is its inherent adaptability. While the core elements of a payment acknowledgment remain universal, the specific details required can vary significantly depending on the nature of the transaction. This flexibility allows businesses and individuals to tailor the document to their unique operational contexts without compromising its fundamental purpose.

For a sales record, the layout might include fields for product codes, quantities, and unit prices. A service receipt could incorporate space for hours worked or a detailed description of the service rendered. When acknowledging donations, specific wording related to tax-deductibility might be necessary, alongside donor recognition fields. The ability to customize this form ensures that it remains relevant and effective across a broad spectrum of uses.

- Sales: Templates can be customized to include itemized lists of products sold, quantities, SKU numbers, and applicable sales tax, functioning as a comprehensive sales record for tangible goods.

- Services: For professional services, the document can detail the type of service provided, hours spent, hourly rates, and any associated project fees, serving as a robust service receipt.

- Rent Payments: Landlords can adapt the template to specify the rental period covered, property address, and any late fees or deposits, providing a clear proof of transaction for tenants.

- Donations: Non-profit organizations can customize the file to include their tax-exempt status, specific fund designations, and language required for donation acknowledgment, which is crucial for donor tax purposes.

- Business Reimbursements: Employees seeking reimbursement can use a tailored version to list expenses, dates incurred, and the business purpose, acting as an essential expense record for internal accounting.

When is this Document Most Effective?

The utility of a clear cash payment receipt extends across numerous scenarios, providing critical documentation where cash changes hands. Its application ensures that even the simplest transactions are formally acknowledged, protecting both parties and simplifying financial management. Here are several instances where employing such a document is particularly effective:

- Small Business Cash Sales: When a local shop, market vendor, or service provider receives cash directly from customers, issuing a receipt provides immediate proof of purchase and a vital sales record.

- Freelance Services: Freelancers often receive cash for their services. Providing a detailed service receipt validates the payment and outlines the work completed, fostering professional trust.

- Landlord-Tenant Transactions: For rent or security deposit payments made in cash, this document offers indisputable proof for both landlord and tenant, preventing future disputes regarding payment status.

- Non-Profit Fundraising Events: During charity galas or donation drives where cash contributions are common, a donation acknowledgment can be immediately issued, which is important for donor records and tax purposes.

- Personal Loans or Repayments: In informal financial agreements between individuals, a simple receipt can formalize the payment of a loan installment, offering a clear record for both parties.

- Employee Expense Reimbursements: When employees pay for business expenses in cash and need reimbursement, this form can serve as the primary expense record, detailing the expenditure for company accounting.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template is heavily influenced by its design, formatting, and overall usability. A well-designed receipt should be clear, concise, and easy to complete, ensuring that essential information is captured without ambiguity. For both print and digital versions, aesthetic appeal combines with functional layout to create a professional and reliable record. Attention to detail in these areas enhances the document’s utility and reinforces the issuer’s professionalism.

Consideration should be given to font choices, logical flow of information, and sufficient space for writing. Branding elements, such as a company logo, can further professionalize the document. The goal is to create a billing statement or payment receipt that is not only accurate but also visually accessible and easy to understand for all parties involved.

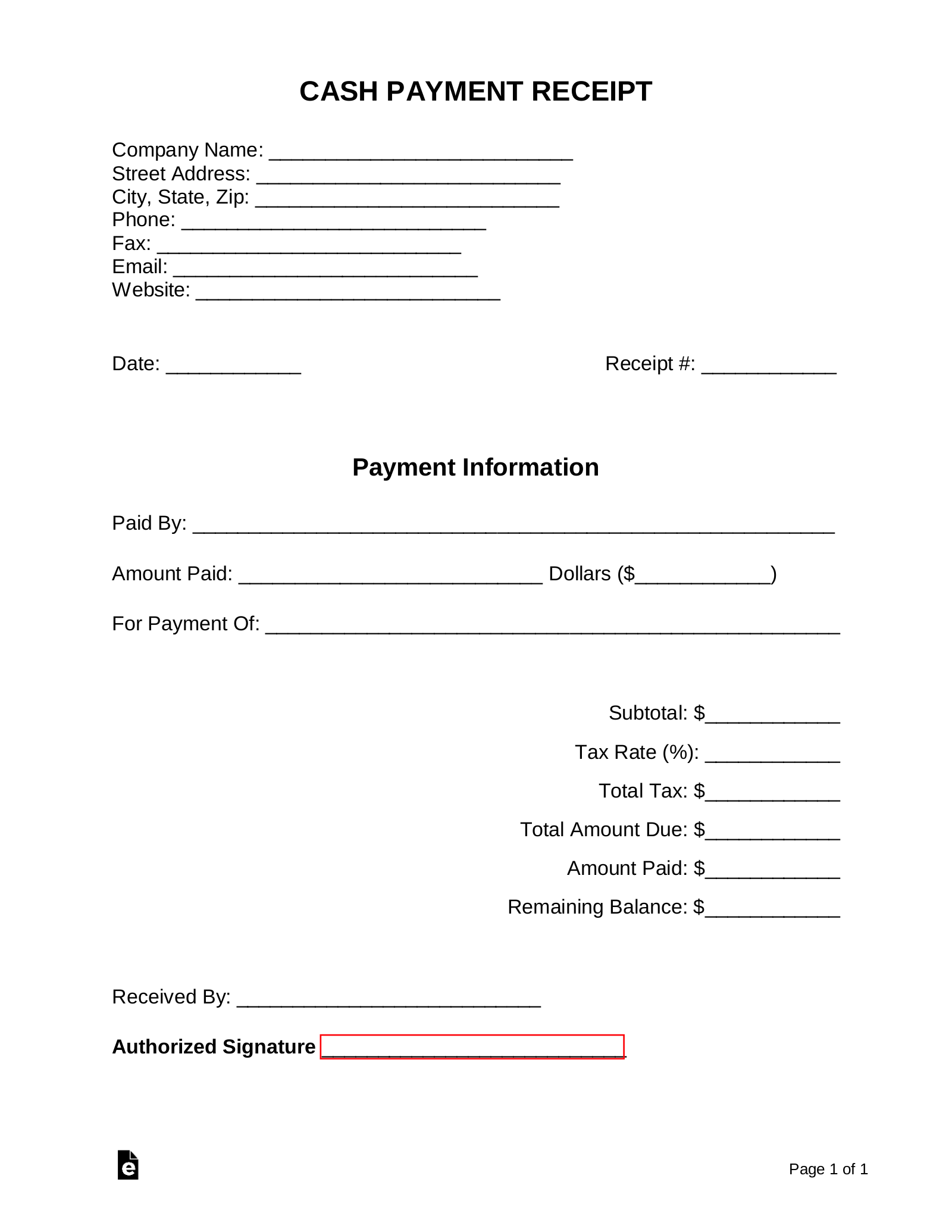

Essential Elements for an Effective Receipt

To ensure a cash payment receipt is comprehensive and legally sound, it must include several key pieces of information. These elements collectively provide a full account of the transaction, leaving no room for doubt.

- Company/Issuer Information: Full legal name, address, phone number, and logo of the entity or individual issuing the receipt.

- Recipient Information: Name of the person or entity making the cash payment.

- Date of Transaction: The exact date the payment was received.

- Description of Goods/Services: A clear, itemized list of what was purchased or for what service the payment was made.

- Amount Paid (numeric and written): The total amount of cash received, expressed both in numbers and written out to prevent alteration.

- Payment Method (Cash): Explicitly stating "Cash" as the method of payment.

- Transaction or Receipt Number: A unique identifier for the specific transaction, crucial for tracking and auditing.

- Signature Lines: Space for the signature of the person receiving the cash and, optionally, the person making the payment, affirming receipt.

- Disclaimers/Notes: Any relevant terms, conditions, return policies, or specific instructions related to the transaction.

Print vs. Digital Considerations

When designing this form, it’s important to consider both its physical and digital manifestations. A print version requires clear, legible fonts, adequate spacing for handwritten details, and potentially carbon copies for record-keeping. The paper quality can also reflect the professionalism of the issuer.

For digital iterations, the layout should be optimized for on-screen viewing and easy electronic sharing (e.g., PDF format). Digital versions can incorporate fillable fields, automated date stamps, and instant email delivery capabilities. Ensuring that the digital file is secure and easily archivable is paramount, allowing for efficient digital record-keeping and retrieval. Both formats should prioritize clarity and ease of use to maintain the document’s integrity and functionality.

Ultimately, utilizing a robust receipt for cash payment template is an investment in sound financial practices and transparent communication. This essential tool transcends its basic function as a simple acknowledgment; it serves as a critical component of professional business documentation, contributing to greater accuracy, trust, and operational efficiency. Its structured nature ensures that every cash transaction is meticulously recorded, providing a clear and undeniable proof of transaction for all parties involved.

By embracing the principles of clear design, comprehensive information capture, and systematic application, businesses and individuals can significantly enhance their financial record-keeping capabilities. The consistent use of this financial template not only minimizes errors and disputes but also reinforces a commitment to integrity and professionalism. It stands as a testament to diligent management, offering peace of mind and a solid foundation for all cash-based dealings.

In an environment where financial accountability is paramount, the value of a well-implemented template cannot be overstated. It is a fundamental instrument that underpins responsible financial stewardship, offering a reliable, accurate, and efficient means of tracking monetary exchanges. Investing time in selecting or creating an effective layout for cash receipts pays dividends in improved clarity, reduced administrative burdens, and enhanced credibility.