In the intricate landscape of financial management and business operations, the importance of meticulously documented transactions cannot be overstated. For child care providers, parents, and associated entities, a clear and comprehensive record of payments and services rendered is not merely a formality but a fundamental necessity. This article delves into the utility and significant benefits of a specialized form designed to streamline this crucial aspect of financial record-keeping: the receipt for child care services template.

This structured document serves as a vital tool for ensuring accuracy, transparency, and accountability in financial exchanges within the child care sector. It provides irrefutable proof of transaction for both parties, facilitating smoother tax preparations, accurate budgeting, and effective dispute resolution. Understanding its components, applications, and best practices can significantly enhance the operational efficiency and professional standing of any child care service.

The Imperative of Professional Financial Documentation

Robust and professional financial documentation forms the bedrock of sound business practices across all industries. For services involving direct payments, such as child care, a clear paper trail or digital record is indispensable. It establishes a verifiable history of all financial interactions, protecting both the service provider and the client.

Beyond simple proof of payment, well-maintained financial records are critical for regulatory compliance, internal auditing, and fostering trust. They provide the necessary data for financial reporting, income tax declarations, and demonstrate adherence to financial obligations. Without standardized documentation, businesses risk inconsistencies, misunderstandings, and potential legal or financial complications.

Every payment receipt or service receipt issued contributes to a larger picture of financial integrity. These documents serve as definitive proof of transaction, essential for managing finances effectively. They uphold the principles of transparency and accountability, crucial for maintaining a reputable and trustworthy operation.

Core Advantages of a Structured Receipt For Child Care Services Template

Implementing a structured receipt for child care services template offers a multitude of advantages that extend beyond basic record-keeping. This standardized approach significantly enhances accuracy, ensures transparency, and promotes consistency in all financial transactions. It transforms what could be an ad-hoc process into a professional and reliable system.

Ensuring Accuracy

A pre-designed template minimizes the risk of human error by providing dedicated fields for all essential information. Details such as the date of payment, amount received, service period, payee, and payer information are consistently captured. This precision is invaluable for financial reconciliation, preventing discrepancies that can arise from incomplete or hastily written records.

Promoting Transparency

Transparency is paramount in financial dealings, especially in sensitive areas like child care. The clarity offered by such a document ensures both parties have an identical, unambiguous record of the transaction. This eliminates guesswork and fosters an environment of trust, clearly detailing what was paid for and by whom.

Maintaining Consistency

Consistency in documentation is key to professional operations and efficient record management. A standardized layout means every payment receipt looks identical, making it easier to file, retrieve, and review records. This consistency aids in creating uniform business documentation, simplifying auditing processes and financial analysis over time.

Streamlining Operations

By automating the structure of the receipt process, child care providers can save significant time and effort. Instead of drafting a new record for each payment, staff can quickly populate the template with transaction-specific details. This efficiency allows more time to be dedicated to core services and less to administrative tasks.

Facilitating Tax Reporting

For parents, these receipts are often crucial for claiming child care tax credits or deductions. For providers, they form the basis of income reporting. A well-organized collection of these forms makes tax season considerably less daunting, providing readily available proof of payment and service provision.

Adaptability Across Various Transactional Contexts

While specifically tailored for child care services, the fundamental principles and structural elements of a robust receipt for child care services template are highly adaptable. The core function of providing proof of transaction and detailed financial acknowledgment transcends specific industries. This inherent flexibility makes the underlying concept invaluable for various financial interactions.

The customizable nature of such a template allows its basic structure to be repurposed efficiently. For instance, an organization needing a donation acknowledgment can adapt the layout to reflect charitable contributions. Similarly, businesses can modify it to serve as a sales record or a service receipt for other sectors, ensuring clarity and compliance across diverse operations.

Sales and Services

Businesses providing goods or other services can easily modify the template to create a standardized invoice form or sales record. Fields for itemized services or products, unit prices, quantities, and totals can replace child care-specific details, maintaining the essential elements of a comprehensive financial record.

Rent Payments

Landlords can utilize a modified version of this financial template to issue rent payment receipts. This ensures a clear record of monthly payments, security deposits, and any associated fees, benefiting both property owners and tenants in maintaining accurate financial histories.

Donation Acknowledgments

Non-profit organizations require formal documentation for donations, particularly for tax purposes. Adapting the layout to include donor information, donation amount, and acknowledgment of charitable contribution streamlines compliance and donor relations. This transformation underscores the versatility of a well-designed financial template.

Business Reimbursements and Expense Records

For employees seeking reimbursement for business expenses, or for businesses tracking internal expenditures, a simplified version of this form can serve as an expense record or proof of expenditure. This ensures all out-of-pocket costs are properly documented and accounted for, aiding in budgeting and financial oversight.

Practical Applications of a Standardized Receipt

The implementation of a well-designed receipt for child care services template proves most effective in numerous scenarios, providing clarity and efficiency where it is most needed. This document serves as a cornerstone for transparent financial dealings between providers and clients.

- Regular Tuition Payments: For recurring weekly or monthly child care fees, providing a standardized receipt ensures that every payment is formally acknowledged, helping parents track their expenses and providers manage their income.

- Enrollment Fees and Deposits: When new children are enrolled, this form can confirm the receipt of initial fees, such as registration costs or security deposits, setting clear financial expectations from the outset.

- Extra Services or Activities: For additional charges like field trips, extended hours, or special classes, a specific receipt clarifies the extra costs incurred and ensures these are properly itemized.

- Government Subsidies or Aid: When payments are partially or fully covered by government programs, this form can document the portion paid by the parent and, if adaptable, the portion covered by the subsidy, ensuring comprehensive financial tracking.

- Tax Season Documentation: Both child care providers and parents rely heavily on these documents for accurate tax filings. The consistent format of the template simplifies the aggregation of information needed for deductions or income reporting.

- Resolving Billing Disputes: In the event of a disagreement regarding payments, the detailed information contained within the receipt serves as an objective proof of transaction, facilitating quick and fair resolution.

- Internal Auditing and Financial Reviews: For the child care business itself, a uniform collection of these forms greatly assists in internal audits, financial planning, and demonstrating fiscal responsibility.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial template, including one for child care services, is significantly influenced by its design, formatting, and overall usability. A well-designed layout enhances clarity, professionalism, and ease of use for both print and digital applications. Focusing on these aspects ensures the document serves its purpose optimally.

Key Design Elements

A professional layout should prioritize readability and logical flow. Essential fields must be clearly labeled and grouped, allowing for quick data entry and verification. Incorporating the organization’s logo and contact information reinforces branding and professionalism, making the document instantly recognizable as official business documentation.

Formatting for Clarity

Use clear, legible fonts and appropriate spacing to prevent information from appearing cluttered. Bold text can highlight critical information such as the total amount paid or the service period. Ensuring ample space for signatures, if required, and any additional notes can also improve the functionality of the document. The objective is to make the payment receipt easily digestible and unambiguous.

Usability for Print and Digital Versions

For print versions, ensure the file is easily printable on standard paper sizes without cutting off information. Margins should be generous, and the design should avoid heavy backgrounds that consume excessive ink. For digital versions, the template should be editable using common software (e.g., PDF editors, word processors) and ideally exportable in various formats. Providing fillable fields in a digital template greatly enhances efficiency and reduces manual errors.

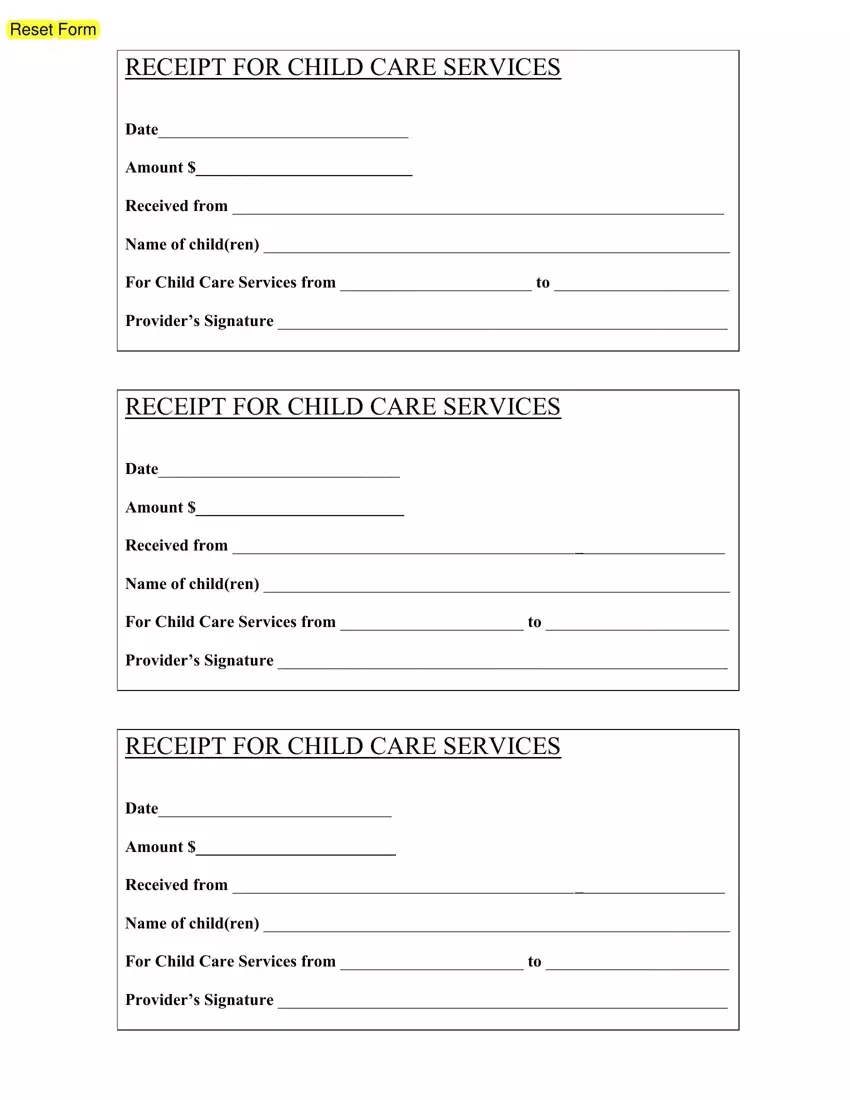

Essential Fields to Include in the Template

- Provider Information: Full legal name of the child care facility/provider, address, phone number, and perhaps a license number.

- Recipient Information: Full name of the parent(s) or guardian(s), address, and contact details.

- Child(ren)’s Name(s): Clearly list the child or children for whom services were rendered.

- Date of Payment: The exact date the payment was received.

- Payment Amount: The total monetary value of the payment, clearly specified in both numbers and words to prevent ambiguity.

- Payment Method: Indicate how the payment was made (e.g., cash, check, credit card, bank transfer).

- Service Period: The specific dates or period for which the payment covers child care services (e.g., “Week of Oct 2-6,” “Month of October”).

- Itemized Services (Optional but Recommended): A breakdown of costs, such as tuition, extracurricular activities, late fees, or supply fees.

- Balance Due (if any): If the payment does not cover the full outstanding amount, clearly state the remaining balance.

- Authorized Signature: A space for the provider’s signature to authenticate the receipt.

- Receipt Number: A unique identifier for tracking purposes, crucial for an organized expense record system.

By carefully considering these design and formatting aspects, the utility of the template is maximized, ensuring it functions as a highly effective financial record tool.

The value of a well-implemented financial template for child care services extends far beyond a simple record of payment. It represents a commitment to professionalism, accuracy, and transparency in financial dealings. By standardizing the receipt process, providers can enhance their operational efficiency, minimize administrative burdens, and build stronger trust with the families they serve.

This essential document ensures that every transaction is meticulously recorded, serving as an unimpeachable proof of transaction for all parties involved. Whether for tax purposes, budgeting, or resolving potential discrepancies, having a clear and consistent billing statement is invaluable. It positions the child care service as a reliable and organized entity, upholding the highest standards of business documentation.

Ultimately, investing in a robust and user-friendly template for financial acknowledgments like this is an investment in the long-term integrity and success of the child care operation. It simplifies complex financial tasks, safeguards against errors, and provides peace of mind, allowing both providers and parents to focus on what truly matters: the well-being and development of the children.