In the realm of property management and personal finance, meticulous record-keeping is not merely a best practice; it is a fundamental requirement for clarity, accountability, and legal protection. A well-structured payment receipt serves as incontrovertible proof of transaction, safeguarding the interests of both the payer and the recipient. This article delves into the critical role of a specialized receipt template for rent payment, outlining its purpose, benefits, and how its effective implementation can streamline financial operations for landlords, tenants, and businesses alike.

The primary objective of such a document is to formally acknowledge the transfer of funds for rental obligations. Beyond its basic function, a comprehensive receipt template for rent payment fosters transparency and mitigates potential disputes by providing a clear, itemized account of financial exchanges. For tenants, it offers essential documentation for tax purposes, expense tracking, and verifying their payment history. For landlords and property managers, it provides a structured system for tracking income, managing ledger entries, and demonstrating compliance with rental agreements.

The Importance of Clear and Professional Financial Documentation

Effective business communication hinges on clarity and precision, particularly concerning financial transactions. Professional documentation, such as a robust payment receipt, ensures that all parties possess an identical understanding of the agreement and its execution. This level of detail is paramount in preventing misunderstandings that can escalate into costly disputes or legal challenges.

Financial records serve as the backbone of accountability. They provide an auditable trail of all monetary exchanges, which is crucial for internal financial management, external audits, and tax compliance. Without clear, standardized documentation, verifying past transactions becomes an arduous task, potentially leading to discrepancies and a lack of trust between parties. A consistent approach to documenting payments underscores professionalism and builds confidence in financial interactions.

Key Benefits of Structured Templates for Rent Payments

Utilizing structured templates for financial acknowledgments, particularly those tailored as a receipt template for rent payment, offers a multitude of advantages that extend beyond simple record-keeping. These templates are designed to ensure accuracy, promote transparency, and establish consistency in all financial record-keeping practices.

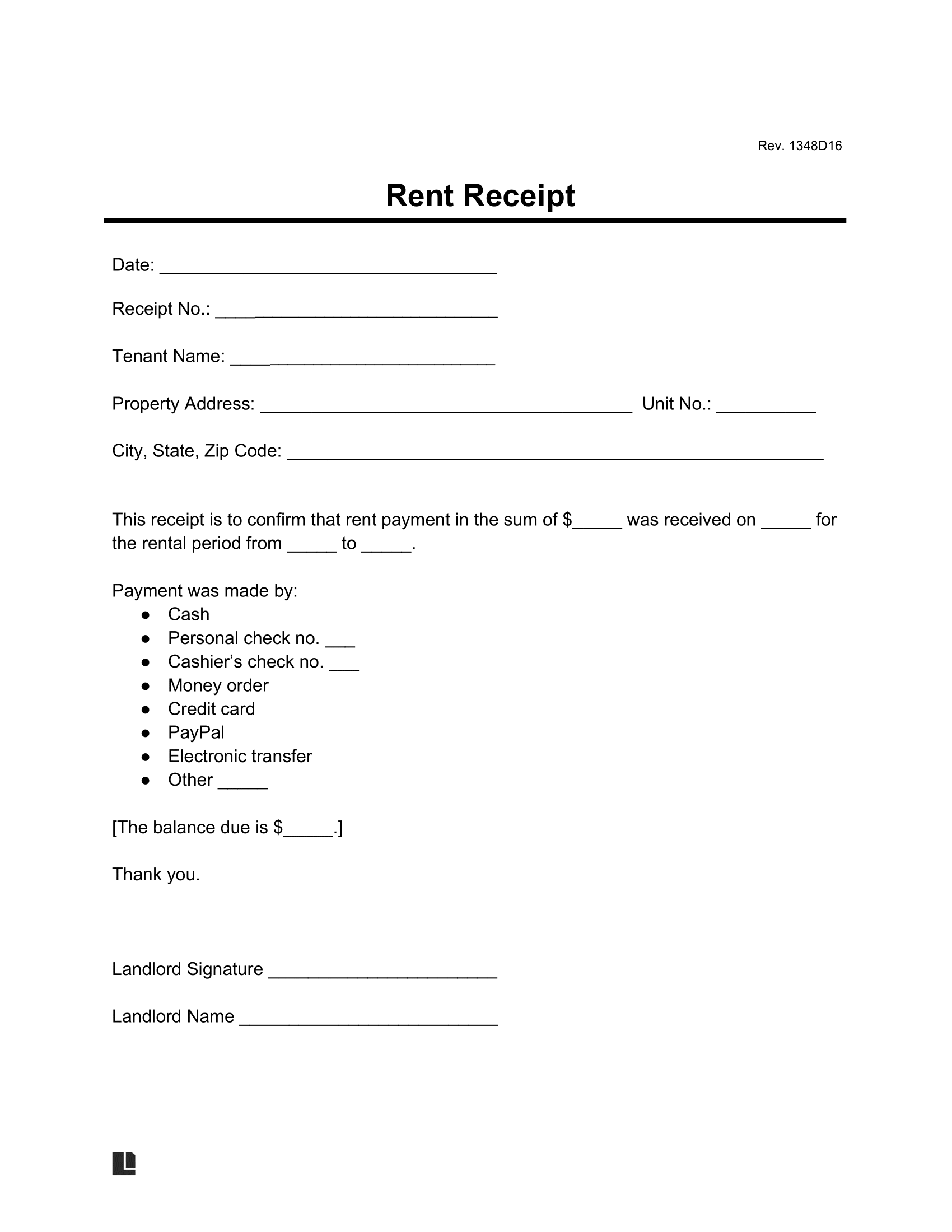

Firstly, accuracy is significantly enhanced. By providing predefined fields for essential information—such as the date, amount, payer’s name, recipient’s name, property address, and payment method—the potential for errors or omissions is drastically reduced. This systematic approach ensures that every pertinent detail is captured consistently, thereby creating reliable proof of transaction.

Secondly, transparency is inherently built into the design of these forms. When all required information is clearly presented and easily accessible, both parties can readily verify the specifics of the payment. This openness fosters trust and eliminates ambiguity, which is particularly vital in ongoing financial relationships like tenancy. A clear payment receipt clarifies precisely what was paid, for what period, and by whom.

Lastly, consistency is a critical outcome. A standardized layout means that every payment receipt issued follows the same format, making it effortless to organize, review, and reconcile financial records over time. This uniform approach simplifies bookkeeping for landlords and offers tenants a consistent record for their own financial tracking, contributing to better overall financial management and organization.

Customizing Templates for Diverse Financial Transactions

While the focus here is on a receipt template for rent payment, the underlying principles of a well-designed financial template are universally applicable. The flexibility of these forms allows for broad customization, making them suitable for various types of monetary acknowledgments beyond just rental income. This adaptability transforms a basic form into a versatile business documentation tool.

A robust template can be easily adapted to function as a sales record for retail transactions, a service receipt for professional fees, or even a donation acknowledgment for non-profit organizations. By simply modifying specific fields—such as changing "Property Address" to "Items Purchased" or "Service Rendered"—the core structure remains effective. This adaptability underscores the value of investing in a high-quality, modifiable financial template. Whether for tracking business reimbursements or issuing billing statements, the fundamental layout ensures all critical data points are consistently captured, providing a clear proof of transaction regardless of the context.

Examples of When Using a Payment Receipt Template Is Most Effective

The strategic deployment of a dedicated payment receipt template can significantly enhance efficiency and accountability across various scenarios. Its utility is most pronounced in situations demanding verifiable proof of transaction and meticulous expense record management.

- Residential Rent Payments: Crucial for landlords to track income and for tenants to prove payments, especially for cash or check transactions where immediate bank statements may not suffice.

- Commercial Lease Payments: Essential for businesses to maintain accurate expense records for tax purposes and for property managers to reconcile larger, often more complex, rental agreements.

- Security Deposit Acknowledgments: Provides clear documentation for the initial deposit, detailing the amount, date, and conditions under which it was received, safeguarding both parties at the start of a tenancy.

- Partial Payments or Installments: Ensures that every incremental payment is formally acknowledged, detailing the remaining balance, thereby preventing disputes over outstanding amounts.

- Utility Bill Reimbursements (Landlord-Tenant): When tenants reimburse landlords for utilities, a detailed service receipt clarifies what was paid and for which period, providing transparency.

- Business Expense Reimbursements: Employees submitting expense reports benefit from a standardized form that details the amount, purpose, and date of a payment, streamlining internal accounting processes.

- Donations to Non-Profit Organizations: A formal donation acknowledgment is vital for donors for tax deductions and for organizations to maintain accurate donor records.

- Payment for Services Rendered: Freelancers or service providers can issue these receipts to clients, confirming payment for work completed and serving as a professional billing statement.

Tips for Design, Formatting, and Usability

The effectiveness of a financial template extends beyond its content; its design, formatting, and overall usability play a significant role in its adoption and accuracy. Whether intended for print or digital use, thoughtful consideration of these elements ensures the document is practical and professional.

For design, prioritize a clean, uncluttered layout. Use clear headings and sufficient white space to enhance readability. The chosen font should be professional and easy to read, such as Arial, Calibri, or Times New Roman. Incorporate your organization’s logo and contact information at the top to reinforce branding and provide immediate identification. This transforms a simple payment receipt into an extension of your professional identity.

Formatting should emphasize consistency. Ensure all date fields follow a uniform format (e.g., MM/DD/YYYY). Clearly label all fields and consider using bold text for key information like the total amount paid. For digital versions, utilize fillable fields to facilitate quick and accurate data entry. This ensures that the generated document is neat and professional, whether it’s an invoice form or a simple expense record.

Usability is paramount for both print and digital versions. For printed documents, ensure there’s adequate space for signatures from both the payer and the recipient, confirming mutual agreement to the transaction details. For digital forms, provide clear instructions for completion and submission. Consider creating versions that are easily shareable via email as a PDF, maintaining its integrity and professional appearance. The goal is to make the process of completing and issuing the receipt as intuitive and efficient as possible, minimizing user error and expediting the creation of a reliable financial template.

The Enduring Value of Structured Financial Records

In conclusion, the careful implementation of a well-designed financial template, particularly a specialized receipt template for rent payment, stands as a cornerstone of sound financial management. It transcends its basic function to become an indispensable tool for ensuring accuracy, fostering transparency, and maintaining consistency across all financial interactions. For landlords, it solidifies income tracking and compliance. For tenants, it provides crucial proof of payment and expenditure verification.

Ultimately, investing in and consistently utilizing such a structured document system safeguards against disputes, streamlines bookkeeping, and enhances the professional reputation of all parties involved. This reliable and efficient financial record tool is not merely a formality; it is an essential component of effective business communication and robust financial governance, empowering individuals and organizations with the clarity and control needed to manage their fiscal responsibilities with confidence and precision.