Effective financial record-keeping is a cornerstone of responsible financial management, whether for individuals, small businesses, or large corporations. A precisely executed payment receipt serves as undeniable proof of transaction, crucial for both payers and recipients. This article delves into the critical role of a formal document in streamlining these processes, offering a robust framework for documenting various financial exchanges. It outlines the structure, benefits, and applications of a well-designed rent invoice receipt template, a foundational tool for maintaining clear and verifiable financial records.

This structured approach to financial documentation benefits a wide array of stakeholders. Landlords and property managers rely on clear receipts to track rental income and provide tenants with proof of payment, essential for legal and tax purposes. Similarly, tenants gain peace of mind and protection against disputes by possessing an official record of their financial obligations being met. Beyond rent, the principles and formats discussed herein extend to any scenario requiring a formal acknowledgment of funds received, establishing transparency and accountability for all parties involved.

The Importance of Clear and Professional Financial Documentation

Maintaining clear and professional financial documentation is not merely a formality; it is a fundamental requirement for legal compliance, financial transparency, and operational efficiency. Every transaction, from a simple payment receipt to a complex billing statement, contributes to an organization’s financial narrative. Inaccurate or incomplete records can lead to significant discrepancies, auditing challenges, and potential legal disputes that can be both costly and time-consuming.

Well-structured business documentation fosters trust between parties, clearly outlining the terms and conditions of a transaction. For tax purposes, robust financial templates are indispensable, providing verifiable evidence of income and expenses that can withstand scrutiny. They serve as an immutable record, critical for dispute resolution and ensuring that all financial interactions are accurately reflected and understood by relevant stakeholders. This meticulous approach to record-keeping is a hallmark of sound financial practice.

Key Benefits of Structured Templates for Financial Records

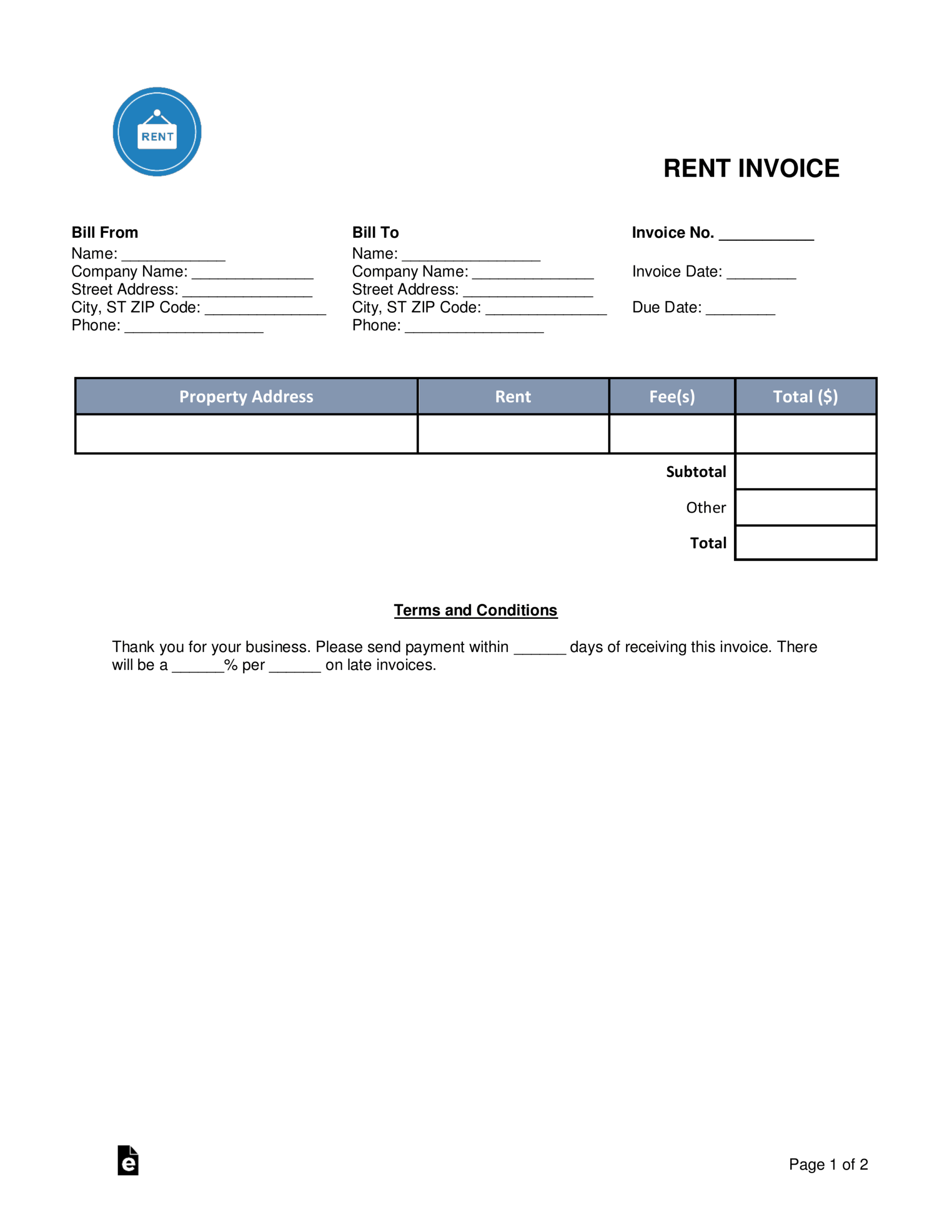

Utilizing a structured template, such as a rent invoice receipt template, offers profound advantages in ensuring accuracy, transparency, and consistency in record-keeping. These standardized forms eliminate guesswork, guiding users to input all necessary data fields for a complete and comprehensive record. This systematic approach significantly reduces the likelihood of human error, ensuring that critical details like dates, amounts, and payee information are correctly captured every time.

Transparency is inherently built into a well-designed template. It provides a clear, itemized breakdown of charges and payments, allowing both parties to easily understand the specifics of the financial exchange. This level of detail is vital for fostering trust and preventing misunderstandings. Furthermore, the consistent layout across all transactions creates a uniform system of record-keeping, simplifying auditing processes, financial analysis, and overall data management for individuals and organizations alike. The efficiency gained from not having to create a new form for each transaction is also invaluable, saving considerable time and resources.

Customizing the Document for Diverse Financial Transactions

While initially conceived for rental payments, the inherent design principles of a rent invoice receipt template make it remarkably versatile for various financial transactions. Its adaptable structure allows for easy customization to suit a multitude of purposes beyond rent collection. The core elements—payer details, recipient details, date, amount, and a description of the transaction—are universally applicable, providing a robust foundation for any financial acknowledgment.

Businesses can modify this document to function as a sales record for products, a service receipt for work rendered, or even a donation acknowledgment for charitable contributions. By adjusting specific fields and incorporating company branding, the layout transforms into an effective tool for diverse financial needs. This flexibility underscores the value of having a foundational financial template that can be tailored to meet specific operational requirements, maintaining professional communication across all types of financial exchanges.

Examples of When Using This Form is Most Effective

The strategic deployment of a formalized financial form proves most effective in situations demanding clear, verifiable proof of transaction and detailed record-keeping. These scenarios span both personal and professional domains, ensuring accountability and clarity.

- Rental Payments: Landlords issue these forms to tenants as definitive proof that rent and associated fees (e.g., late fees, security deposits) have been paid, preventing disputes and aiding in lease compliance.

- Service Renderings: Businesses providing services, such as consulting, plumbing, or design work, can issue this receipt upon completion and payment, detailing the services provided and the amount received.

- Product Sales: Retailers, both brick-and-mortar and online, use similar documents as a sales record for customer purchases, itemizing products, quantities, and prices for inventory and customer service.

- Charitable Contributions: Non-profit organizations provide donation acknowledgments using a modified version of this template, essential for donors claiming tax deductions and for the organization’s financial transparency.

- Business Reimbursements: Employees seeking reimbursement for work-related expenses can provide these forms as an expense record, detailing the expenditure and the purpose, facilitating internal financial processes.

- Freelancer Payments: Freelancers or independent contractors can provide such a payment receipt to clients, confirming payment for projects or hours worked, which is crucial for their personal accounting and client records.

- Large Personal Transactions: For significant personal financial exchanges, like purchasing a used vehicle or a substantial asset from an individual, a formal receipt provides legal protection and proof of ownership transfer.

Design, Formatting, and Usability Tips for Optimal Effectiveness

An effective financial form is not only comprehensive in its content but also excels in its design, formatting, and usability. The layout should prioritize clarity and ease of understanding, ensuring that all critical information is immediately discernible. Logical grouping of data fields, such as recipient information, payment details, and itemized charges, enhances readability and reduces processing time. Using clear, legible fonts and appropriate spacing prevents visual clutter, making the document appear professional and approachable.

Consistency in branding, including logos and color schemes, reinforces the professional image of the issuing entity. For usability, consider both print and digital versions; the file should be easily convertible to PDF for secure digital sharing and printing. Editable digital formats, like Microsoft Word or Google Docs, allow for quick customization and data entry while maintaining structural integrity. Incorporating unique receipt numbers or transaction IDs is crucial for internal tracking and easy retrieval. Finally, ensuring the document includes space for signatures (physical or digital) adds an extra layer of authentication, formalizing the transaction and enhancing its legal validity.

The Enduring Value of a Structured Financial Template

In an increasingly complex financial landscape, the value of a structured financial template cannot be overstated. It stands as a testament to diligent record-keeping, offering a reliable, accurate, and efficient mechanism for documenting every monetary exchange. From ensuring regulatory compliance to fostering clear communication, this foundational document empowers both individuals and businesses to manage their finances with greater precision and confidence. Its consistent application mitigates risks, streamlines operations, and provides an undeniable audit trail for all transactions.

Ultimately, embracing a standardized approach to financial documentation, exemplified by the thoughtful design of such a template, cultivates an environment of financial integrity and accountability. It transforms a potentially convoluted process into a clear, methodical routine, proving instrumental in maintaining transparent relationships and solid financial standing. The lasting impact of such an organized system extends far beyond the immediate transaction, serving as a powerful tool for long-term financial health and effective business communication.