In the intricate landscape of financial transactions, the meticulous documentation of payments stands as a cornerstone of accountability and transparency. This principle is particularly pertinent in rental agreements, where the regular exchange of funds necessitates a clear, undeniable record. The utility of well-designed rent receipt templates extends beyond mere record-keeping; they serve as a critical tool for both landlords and tenants, streamlining the process of acknowledging rent payments and ensuring all parties possess an unequivocal proof of transaction.

These structured documents are invaluable for anyone involved in property management, from individual landlords overseeing a single unit to large-scale property management firms handling extensive portfolios. Tenants also benefit significantly, as a consistent and professional payment receipt provides them with the necessary documentation for financial planning, tax purposes, and dispute resolution. By standardizing the information captured, rent receipt templates foster an environment of clarity and mutual understanding, minimizing potential ambiguities or disagreements regarding payment status.

The Imperative of Professional Documentation

Clear and professional documentation is not merely a courtesy; it is an absolute necessity in all financial and business transactions. In the absence of proper records, disputes can arise, legal challenges may escalate, and financial inconsistencies can lead to significant liabilities for all parties involved. A well-prepared document serves as irrefutable evidence, detailing the specifics of a transaction with precision and impartiality.

This level of meticulousness ensures compliance with relevant financial regulations and best practices, safeguarding against potential audits or legal scrutiny. Professional documentation reflects an organization’s commitment to integrity and transparency, building trust and fostering stronger relationships with clients, tenants, and business partners. It transforms complex financial interactions into straightforward, verifiable events.

Core Advantages of Structured Payment Receipts

Utilizing structured templates for any payment receipt offers a multitude of core advantages that significantly enhance financial operations. These forms are engineered to capture all essential information, thereby eliminating omissions and ensuring a comprehensive record of every transaction. This systematic approach guarantees accuracy, leaving no room for misinterpretation of amounts, dates, or parties involved.

Moreover, a consistent layout ensures transparency. All relevant details are presented in an easily digestible format, allowing for quick verification and review. This consistency in design and content cultivates trust, as both payers and recipients can rely on the predictability and completeness of each document.

Enhancing Financial Record-Keeping with Rent Receipt Templates

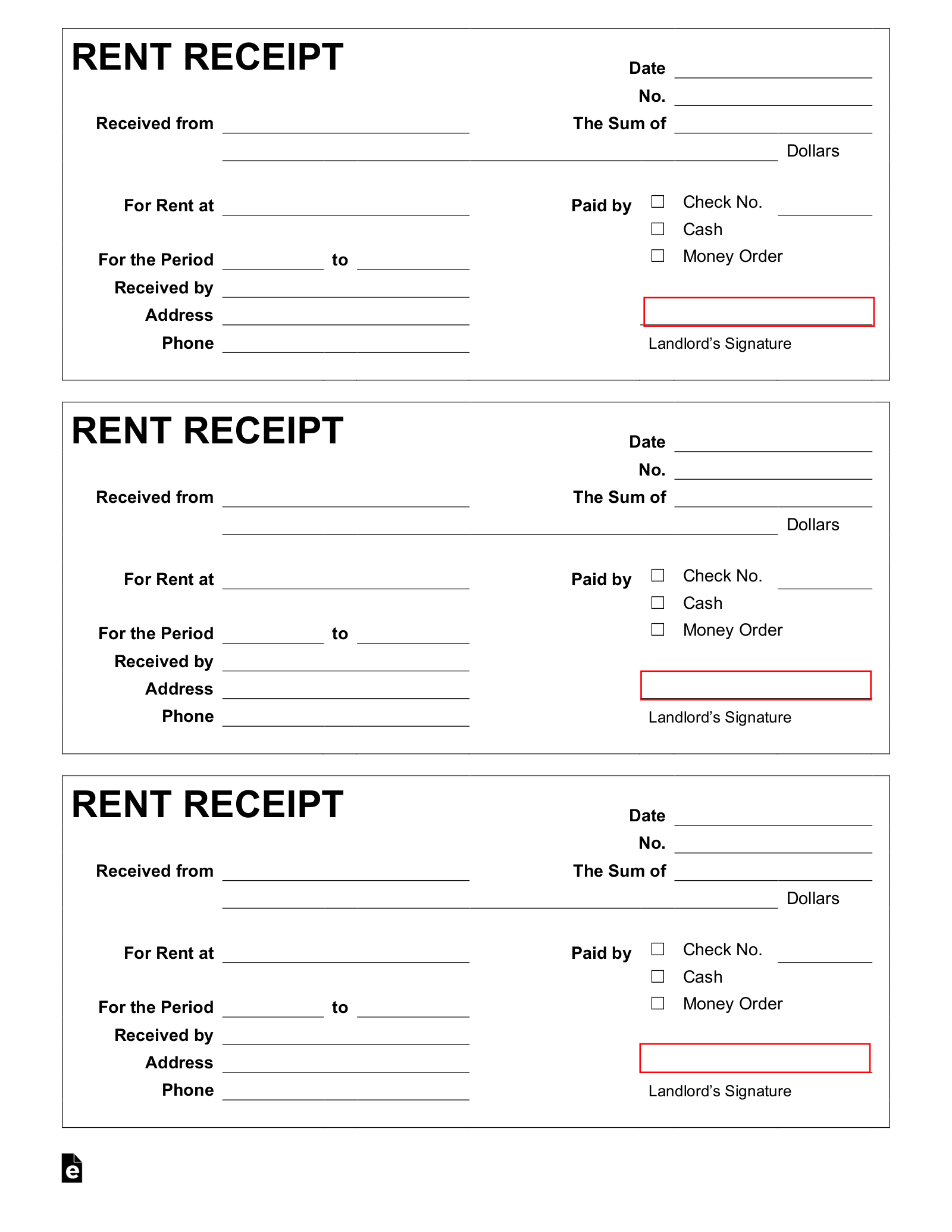

Structured forms are indispensable for enhancing financial record-keeping, transforming a potentially disorganized process into an efficient and reliable system. When applied to rental agreements, employing a consistent approach with rent receipt templates helps maintain an organized ledger of payments, making it simpler to track arrears, identify timely payments, and provide tenants with an accurate history of their financial contributions. This systematic capture of data reduces administrative burden and frees up valuable time for more strategic tasks.

Furthermore, leveraging rent receipt templates strengthens internal controls and external accountability. For landlords, a standardized payment receipt streamlines bookkeeping and simplifies tax preparation by consolidating all necessary financial information. For tenants, it provides an essential proof of transaction, crucial for their own financial records or in situations requiring verification of payment history. This consistency ensures all financial documentation is uniformly robust and reliable.

Customization and Versatility Across Financial Transactions

One of the most significant benefits of a well-designed financial template is its inherent adaptability. While specific fields may be tailored for rent payments, the underlying structure of this form can be easily customized to serve a broad spectrum of other financial purposes. Its versatility allows it to function effectively as a payment receipt across diverse industries and transaction types.

For instance, the layout can be modified to serve as an invoice form for sales of goods, detailing product descriptions, quantities, and unit prices. It can also be adapted into a service receipt for professional services rendered, outlining the scope of work and associated fees. Furthermore, the template is highly effective as a donation acknowledgment for non-profit organizations, providing donors with verifiable proof for tax deductions. Businesses can also utilize it as an expense record for reimbursements, ensuring employees are accurately compensated for out-of-pocket costs. This adaptability makes the template a powerful, multipurpose business documentation tool.

Optimal Scenarios for Utilizing a Comprehensive Payment Record

The application of a robust payment record extends across numerous scenarios where proof of transaction is paramount. Implementing such a comprehensive form ensures clarity and accountability in diverse financial interactions. Its structured nature makes it ideal for regular, recurring payments as well as one-off transactions requiring formal acknowledgment.

Here are several examples of when utilizing this template is most effective:

- Residential Rent Payments: Providing tenants with a clear, itemized record of their monthly rent, security deposits, and any additional charges.

- Commercial Lease Payments: Documenting lease payments for business properties, including base rent, common area maintenance (CAM) fees, and utilities.

- Service Payments: Acknowledging receipt of payment for professional services such as consulting, repairs, or freelance work.

- Goods Purchases: Serving as a sales record for transactions involving physical goods, detailing items, quantities, and prices.

- Donation Acknowledgments: Providing non-profit organizations with a standardized way to confirm charitable contributions for tax purposes.

- Business Reimbursements: Documenting expenses incurred by employees that require reimbursement, ensuring proper accountability.

- Subscription or Membership Fees: Recording payments for recurring services or memberships, offering members a consistent record.

- Contractual Payments: Formalizing the receipt of funds for specific milestones or deliverables outlined in a contract.

Design Principles for Effective Financial Documentation

Effective financial documentation hinges on clarity, legibility, and completeness. When designing a payment receipt, the primary goal should be to convey essential information unmistakably. This means utilizing a clean, uncluttered layout with logical grouping of related fields. Important details such as the payment amount, date, and recipient’s name should be immediately discernible.

The inclusion of clearly defined sections for itemized charges, payment methods, and any outstanding balances further enhances comprehension. Consistent branding, including a company logo and contact information, not only lends professionalism but also reinforces legitimacy. Ultimately, a well-designed form acts as a professional representation of the transaction and the parties involved.

Formatting for Print and Digital Usability

To maximize usability, a financial record should be optimized for both print and digital formats. For print versions, ensure sufficient white space and appropriate font sizes to prevent overcrowding and maintain readability. High-quality paper stock can further enhance the professional appearance of the physical document.

For digital versions, consider creating the template in a universally accessible format such as PDF, which preserves formatting across different devices and operating systems. Incorporate fillable fields for easy digital input and allow for digital signatures where legally permissible, streamlining the electronic workflow. Ensuring the template is responsive for viewing on various screen sizes also improves its digital utility, making it convenient for recipients to access and store their records electronically. These considerations ensure the document remains functional and professional in any medium.

Conclusion: The Enduring Value of Meticulous Financial Records

In summary, the strategic implementation of a well-designed financial template is not merely an administrative formality but a critical component of sound financial management. These robust documents serve as a reliable, accurate, and efficient tool for documenting a wide array of transactions, fostering transparency and accountability for all stakeholders. They provide an indisputable proof of transaction, safeguarding against disputes and offering a clear historical ledger of financial interactions.

The inherent versatility of such a template further underscores its value, allowing for seamless adaptation across various applications, from rent and service payments to sales records and donation acknowledgments. By standardizing the documentation process, organizations and individuals alike can significantly enhance their record-keeping practices, ensuring accuracy and consistency while reducing administrative overhead. This commitment to meticulous financial records ultimately strengthens trust and facilitates smoother, more professional business operations.

Embracing the structured approach offered by a comprehensive payment record template is a definitive step towards achieving greater financial clarity and operational efficiency. It empowers both payers and recipients with the essential documentation needed for financial planning, compliance, and dispute resolution, solidifying its role as an indispensable asset in any financial ecosystem.