In the intricate world of property management and financial stewardship, a reliable system for acknowledging payments is not merely a convenience—it is a foundational necessity. A well-structured rental income receipt template serves as an indispensable tool, formalizing the transaction between a payer (typically a tenant) and a payee (a landlord or property manager). This document precisely details the money received, establishing a clear record for both parties involved. Its purpose extends beyond simple acknowledgment, acting as a critical piece of business documentation that safeguards against misunderstandings and provides clarity in financial dealings.

This essential template benefits a wide array of stakeholders. Landlords and property managers leverage it to maintain accurate financial records, which are crucial for tax preparation, internal accounting, and demonstrating compliance with lease agreements. Tenants, on the other hand, gain irrefutable proof of payment, protecting them from claims of non-payment and aiding their personal financial record-keeping. Accountants and auditors also rely on these structured forms to verify income streams and expenditures, ensuring the integrity of financial statements. Ultimately, the adoption of a standardized approach to payment acknowledgment fosters transparency and professionalism, creating a more harmonious and accountable rental environment.

The Cornerstone of Financial Clarity: Professional Documentation

The importance of clear and professional documentation in all financial and business transactions cannot be overstated. In an era where regulatory scrutiny is common and disputes can arise quickly, meticulously maintained records are not just good practice; they are a legal and operational imperative. Every business interaction, particularly those involving monetary exchange, necessitates a robust audit trail. Without precise documentation, entities risk financial discrepancies, legal challenges, and a tarnished reputation.

Poor record-keeping can lead to significant operational inefficiencies, making it difficult to reconcile accounts, track cash flow, or prepare for tax season. Furthermore, it leaves businesses vulnerable during audits or in arbitration proceedings, where tangible evidence is paramount. Conversely, a commitment to structured business documentation, exemplified by the consistent use of a detailed payment receipt, instills confidence and demonstrates a high degree of organizational integrity. Such a document transforms an informal exchange into a formal, verifiable record, underscoring its pivotal role in maintaining financial stability and trust.

Unpacking the Advantages: Benefits of a Structured Rental Income Receipt Template

Adopting a structured rental income receipt template offers a multitude of key benefits that contribute significantly to accuracy, transparency, and consistency in financial record-keeping. This standardized approach ensures that every payment received is documented with uniform precision, preventing the omission of crucial details that could lead to future complications. Its inherent design promotes a methodical recording process, bolstering the reliability of financial data for all parties.

The advantages extend across several critical areas. Firstly, it ensures accuracy by guiding the user to input specific data points like payment amounts, dates, and names, drastically reducing the likelihood of manual errors. Secondly, it champions transparency, providing an unequivocal proof of transaction that both the payer and payee can reference, thus minimizing disputes and fostering mutual understanding. Thirdly, consistency is guaranteed; every receipt generated will contain the same categories of information in the same format, making it effortless to track, review, and organize records over time. This uniform approach is invaluable for audit preparedness, providing a clear, chronological, and comprehensive record of all financial movements. Such structured forms ultimately serve as a robust financial template, bolstering confidence in every documented exchange.

Versatility Beyond Rent: Customizing the Template for Diverse Transactions

While the primary design of a rental income receipt template is tailored for residential or commercial lease payments, its underlying structure and principles are remarkably adaptable. The fundamental components of any effective payment acknowledgment—details of the payer and payee, the amount received, the date, and a description of what was paid for—are universal across various financial transactions. This inherent flexibility means that with minor adjustments, the core layout can be repurposed to serve a wide range of business needs, evolving into a versatile financial template.

This adaptability transforms the receipt into a potent tool for various applications. For instance, modifying the "payment for" section allows it to function as a sales record for merchandise or an invoice form for services rendered. In non-profit contexts, it can be customized to serve as a donation acknowledgment, providing donors with the necessary documentation for tax purposes. Businesses can also utilize a variation of this form for documenting business reimbursements, ensuring clear tracking of expenses. Essentially, any scenario requiring concrete proof of transaction can benefit from the clear, organized framework offered by a well-designed payment receipt, making it an indispensable piece of business documentation across sectors.

Effective Application: When to Utilize a Rental Income Receipt Template

The utility of a well-designed rental income receipt template is most apparent during specific transactional moments, solidifying its role as an essential proof of transaction. Its consistent use provides immediate benefits, offering clarity and documentation precisely when it’s needed most. Whether dealing with routine payments or more nuanced financial exchanges, the application of this form streamlines the record-keeping process.

Here are specific scenarios where employing this form is most effective:

- Monthly Rent Payments: For all rent collections, particularly cash or check payments, providing a dated and signed receipt immediately confirms the transaction for both the tenant and landlord.

- Security Deposit Collections: Documenting the initial security deposit with a detailed receipt is crucial for legal compliance and clear expectations regarding the return or deduction of funds at lease termination.

- Pet Deposits and Other Fees: Any additional charges, such as pet deposits, application fees, or amenity fees, should be individually acknowledged to avoid future disputes.

- Late Fee Payments: When tenants pay late fees, a separate receipt confirms the specific nature of the payment and the date it was received.

- Utilities or Other Charges: If a landlord collects utility payments or other miscellaneous charges from tenants, a detailed payment receipt ensures transparency and proper allocation of funds.

- Commercial Lease Payments: Businesses leasing commercial spaces also benefit from formalized receipts for their own accounting and tax purposes, treating it as a key billing statement.

- Tenant Tax Deductions: For tenants who may be able to deduct rent payments (e.g., home office, business expenses), an official receipt is vital for tax filing.

- Landlord Income Tax Filings: Landlords require an accurate record of all rental income for their annual tax declarations, making each receipt a critical expense record.

In each of these instances, the document serves as an undeniable financial template, providing a clear audit trail and fostering trust between parties by concretely establishing when and how funds were exchanged.

Crafting for Impact: Design, Formatting, and Usability Best Practices

The efficacy of any financial template, including a rental income receipt, hinges significantly on its design, formatting, and overall usability. A well-crafted layout not only looks professional but also facilitates accurate data entry and easy comprehension, whether it’s a print or digital version. Attention to these details transforms a simple form into a powerful piece of business documentation.

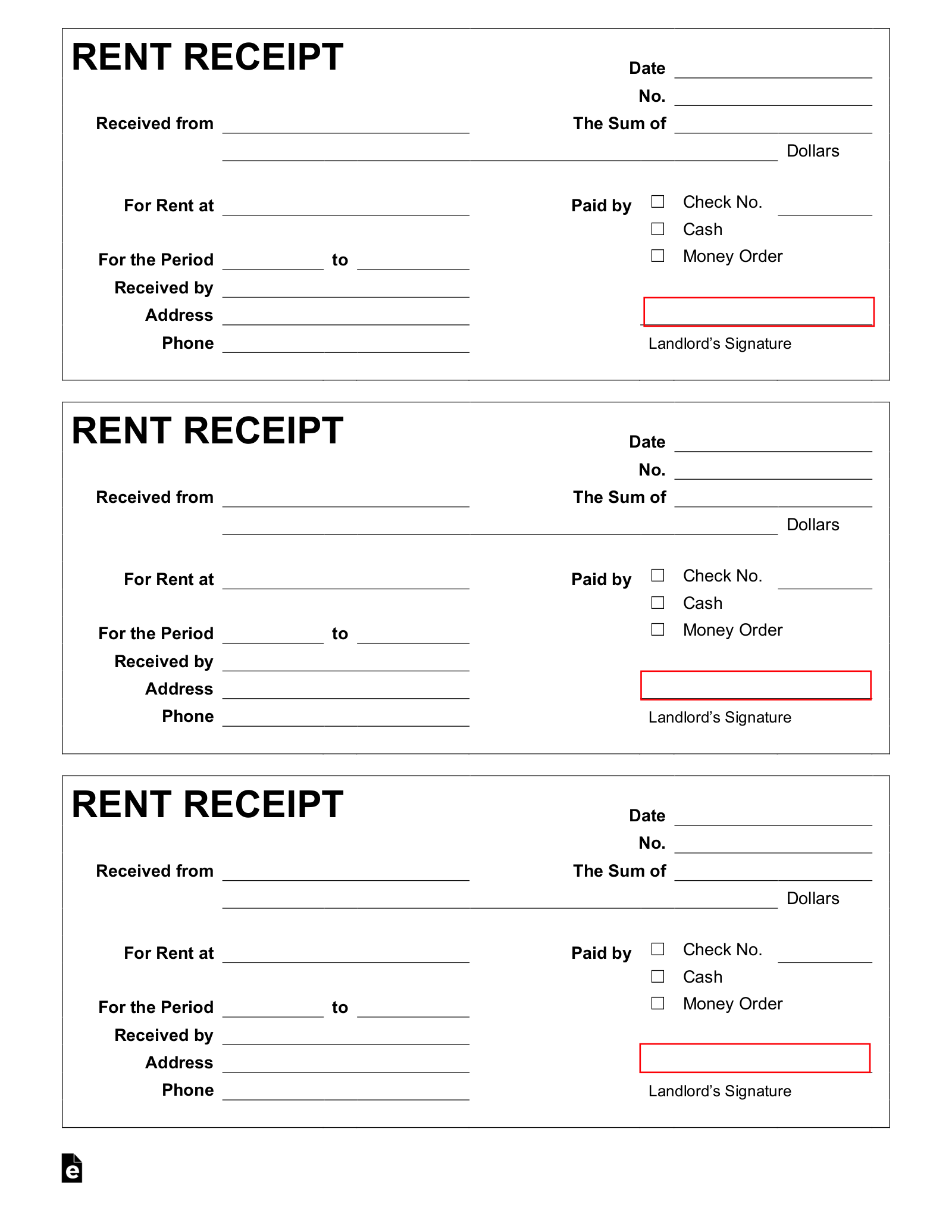

For optimal design, the receipt should prominently feature:

- A Clear Header: Including the company name (landlord/property management), logo, and the title "Payment Receipt" or "Rent Receipt" ensures immediate identification.

- Unique Receipt Number: Essential for tracking and referencing specific transactions, enhancing its function as an invoice form.

- Date of Payment and Date of Issuance: Differentiating these dates provides precision, especially if there’s a delay between payment and receipt generation.

- Payer’s and Payee’s Information: Full names, addresses, and contact details for both the tenant and the landlord/management.

- Property Address: Clearly state the address for which the rent or payment is being made.

- Payment Period: Specify the month(s) or period for which the payment applies (e.g., "Rent for January 2024").

- Amount Received: Present the amount numerically and in written form to prevent discrepancies.

- Method of Payment: Indicate how the payment was made (e.g., cash, check number, money order, bank transfer).

- Balance Due (if applicable): A section to note any outstanding balance after the current payment, offering clarity on the tenant’s account status.

- Signature Line: A space for the recipient (landlord/property manager) to sign, confirming receipt of funds. An optional line for the payer can further solidify agreement.

- Notes Section: A flexible area for any additional relevant information, special instructions, or details.

Regarding formatting, clarity is paramount. Use legible fonts, adequate spacing between sections, and logical grouping of information to ensure a professional appearance. Employing bolding or italics sparingly can highlight key data points without overwhelming the reader. For usability, especially with digital versions, consider features like fillable PDF fields, dropdown menus for common entries, and even automated calculations if integrated into property management software. The file should be easy to share digitally (e.g., as a PDF) and simple to print, ensuring accessibility for both parties. Cloud storage for digital copies also offers efficient archiving and retrieval, reinforcing its role as a vital financial record.

Solidifying Financial Practices: The Enduring Value of the Receipt Template

In conclusion, the strategic implementation of a specialized receipt template is far more than a bureaucratic formality; it is an indispensable element of sound financial management and robust business communication. This carefully constructed document acts as a tangible record, encapsulating the details of every monetary exchange with precision and clarity. It consistently upholds principles of accuracy and transparency, thereby reinforcing trust between all parties involved in financial transactions.

By providing undeniable proof of transaction, the document significantly mitigates potential disputes, simplifies financial reconciliations, and establishes a clear audit trail for tax compliance. Its adaptability, allowing it to function as a sales record, donation acknowledgment, or a general payment receipt, further underscores its versatility as a fundamental financial template. Embracing a standardized approach to these acknowledgments ensures operational efficiency and contributes profoundly to a professional and accountable financial ecosystem. Ultimately, this template stands as a reliable, accurate, and efficient tool, solidifying its place as a cornerstone of effective financial record-keeping and a testament to meticulous business documentation.