In the intricate world of property management and tenancy, robust financial documentation serves as the bedrock of transparent and professional relationships. A well-designed rental property receipt template is not merely a formality; it is an indispensable tool that validates financial transactions, protects the interests of both property owners and tenants, and streamlines record-keeping processes. This foundational document ensures that every payment, whether for rent, security deposits, or fees, is meticulously acknowledged and recorded, fostering trust and clarity.

The primary purpose of an effective rental property receipt template is to provide incontrovertible proof of payment, establishing a clear financial trail. Property owners and managers benefit from organized records for accounting, tax preparation, and potential dispute resolution, while tenants gain assurance and a verifiable record of their financial obligations being met. This article will delve into the critical aspects of creating, utilizing, and customizing such a template, emphasizing its profound impact on effective business communication and financial accountability for US readers.

The Paramount Importance of Clear and Professional Documentation

Clear and professional documentation is fundamental to the integrity of all financial and business transactions. In real estate, where significant monetary exchanges are routine, precise records mitigate risks, prevent misunderstandings, and uphold legal compliance. A meticulously prepared payment receipt, acting as a proof of transaction, reflects an organization’s commitment to transparency and professionalism.

Such documentation is crucial for several reasons. It provides an audit trail, essential for financial reviews and tax preparations, preventing discrepancies that could lead to costly errors or legal challenges. Furthermore, well-maintained business documentation strengthens a company’s credibility, ensuring all parties are operating from a shared understanding of financial commitments. Without standardized records, the potential for disputes over payments, balances, and obligations escalates significantly, leading to protracted and expensive resolutions.

Key Benefits of Using Structured Templates for a Rental Property Receipt Template

Adopting structured templates for a rental property receipt template offers a multitude of advantages that extend beyond simple record-keeping. These benefits contribute directly to enhanced operational efficiency, financial accuracy, and improved stakeholder relations. Utilizing a standardized format ensures that all essential information is consistently captured for every transaction, eliminating omissions and promoting uniformity.

Foremost among these is enhanced accuracy. A pre-formatted layout guides users to input all necessary data, significantly reducing the likelihood of errors or incomplete records. This precision is vital for financial reconciliation and avoids discrepancies that can complicate accounting processes. Secondly, such templates promote unparalleled transparency. Each receipt clearly itemizes the payment amount, purpose, date, and payer/recipient details, leaving no room for ambiguity regarding the transaction’s specifics. This clarity builds trust and prevents misunderstandings between landlords and tenants. Lastly, consistency in record-keeping is a major advantage. Employing a uniform template across all rental properties or transactions ensures that the data collected is standardized, simplifying data analysis, reporting, and archiving. This systematic approach transforms an otherwise ad-hoc process into a streamlined financial template that serves as a reliable expense record.

Customizing This Template for Diverse Transaction Types

While the core functionality of a receipt template is to acknowledge payment, its inherent structure is remarkably adaptable to various financial transactions beyond rent collection. The underlying principles of clear identification, detailed itemization, and confirmation of payment can be tailored to suit a wide array of business needs. This flexibility makes the document an invaluable asset across different operational contexts.

For sales records, the template can be modified to include product codes, quantities, unit prices, and sales tax, effectively serving as an itemized invoice form. Businesses providing services can adapt it into a service receipt, detailing labor hours, materials used, and specific services rendered. Charitable organizations frequently customize such forms into donation acknowledgments, incorporating information pertinent to tax-deductible contributions, such as the organization’s EIN and specific IRS-mandated language. Similarly, for business reimbursements, the layout can accommodate details about employee expenses, project codes, and approval signatures, ensuring proper accountability. The versatility of the basic receipt format allows it to seamlessly transform into a specialized billing statement or financial record, demonstrating its utility across varied financial documentation requirements.

Examples of When Using a Rental Property Receipt Template Is Most Effective

The structured nature of a rental property receipt template makes it exceptionally effective in numerous scenarios, particularly where consistent and verifiable financial documentation is paramount. Its application extends across the entire lifecycle of a tenancy and beyond, ensuring clarity and compliance at every step. Here are several key instances where its use is most beneficial:

- Monthly Rent Payments: Providing a receipt for each monthly rent payment offers undeniable proof that the tenant has fulfilled their primary obligation, preventing disputes over non-payment.

- Security Deposit Collections: When collecting a security deposit, a detailed receipt outlining the amount, the date, and the specific property provides both parties with a clear record, crucial for future reconciliation or potential deductions.

- Application Fees: For non-refundable application fees, a receipt confirms the receipt of funds and acknowledges the terms associated with the fee.

- Late Fees or Miscellaneous Charges: Any additional charges, such as late fees, pet fees, or utility reimbursements, require separate documentation to maintain transparency and provide a clear breakdown of costs.

- Move-Out Reconciliations: During the move-out process, receipts for final payments or deductions from security deposits are vital for a transparent and amicable close-out.

- Proof for Tax Purposes: Both landlords and tenants can utilize these receipts as valid documentation for tax deductions or income reporting, simplifying year-end financial processes.

- Documentation for Dispute Resolution: In the unfortunate event of a legal dispute, a comprehensive set of receipts serves as critical evidence, substantiating claims and demonstrating compliance with lease agreements.

Design, Formatting, and Usability: Optimizing Your Financial Records

Optimizing the design, formatting, and usability of your receipt template is crucial for its effectiveness as a financial record. A well-designed receipt is not only professional in appearance but also intuitive to use and easy to interpret, whether in print or digital form. The layout should prioritize clarity and readability, ensuring that critical information is immediately accessible.

Clarity and Readability: Choose professional, legible fonts and utilize sufficient white space to prevent visual clutter. The information should flow logically, typically from transaction date and payer details to payment specifics and any outstanding balances. Bold headings and clear labels for each field enhance comprehension.

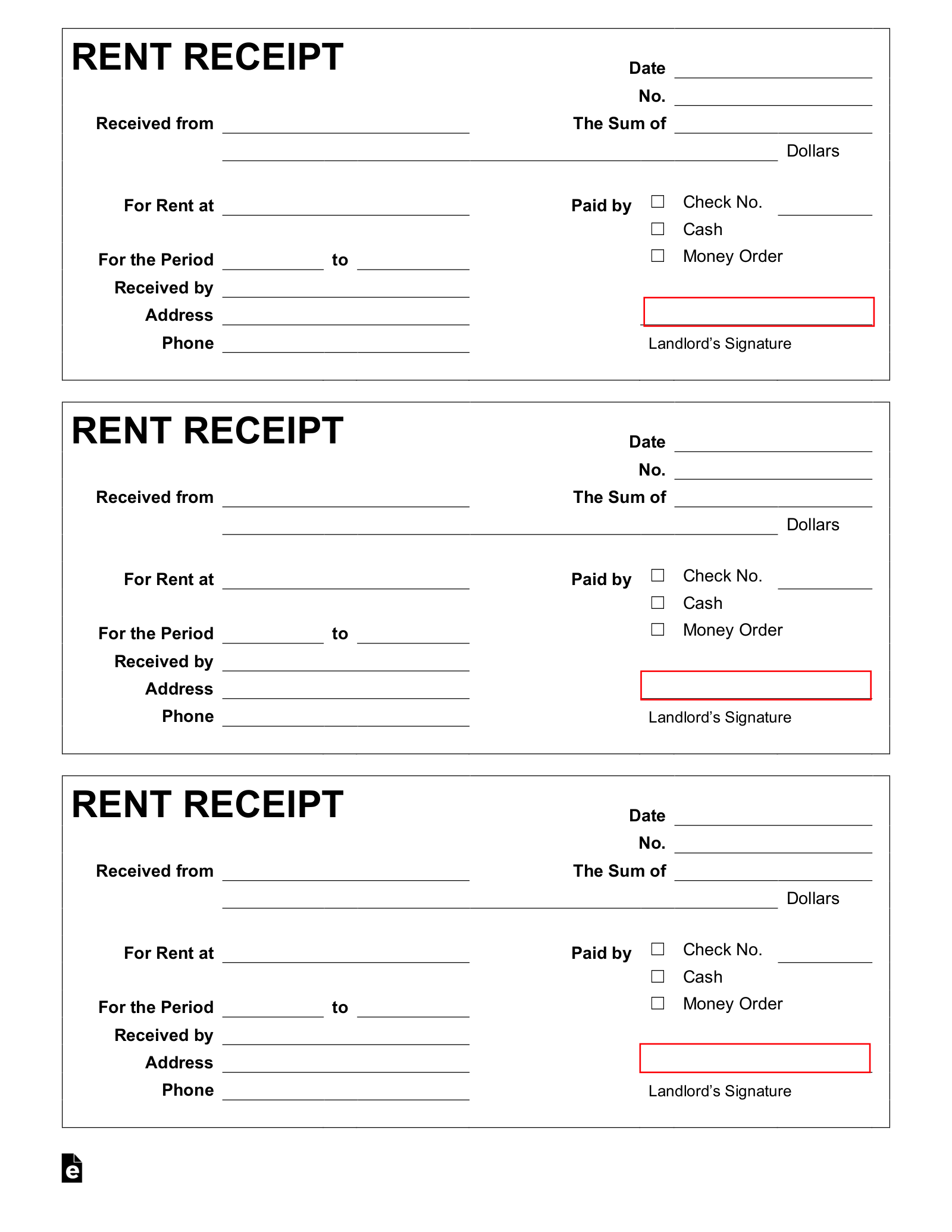

Essential Fields: Every effective receipt must include core components. These typically encompass the date of payment, the names of the payer and recipient, the property address, the specific purpose of the payment (e.g., "August Rent"), the total amount received, the method of payment (cash, check, bank transfer), and the period covered. Optionally, it can include the remaining balance or any amount due. A unique receipt number is also advisable for tracking.

Branding and Professionalism: Incorporating a company logo, contact information, and consistent branding elements adds a layer of professionalism and reinforces your business identity. This attention to detail elevates the perception of your documentation.

Digital vs. Print Versions:

- Digital Templates: For digital versions (e.g., PDF forms), ensure fields are fillable and calculations are automated where possible. Digital files should be easily shareable via email, secured against unauthorized modification, and stored in an organized, searchable system. They offer convenience, environmental benefits, and robust backup capabilities.

- Print Templates: For print, consider a layout that is easy to write on clearly, perhaps with designated lines for manual entries. Carbon copy versions or duplicate forms are excellent for providing immediate copies to both parties, ensuring both landlord and tenant have an identical record. Ensure the dimensions are practical for filing.

Accessibility: The language used should be clear and straightforward, avoiding jargon. Instructions for filling out the form, if any, should be concise and easy to follow. A well-designed template is universally usable, minimizing potential errors from misinterpretation.

Conclusion

In conclusion, the strategic implementation of a robust receipt template transcends mere administrative task completion; it is a critical component of sound financial management and ethical business practice. This comprehensive form serves as an undeniable proof of transaction, safeguarding the financial interests of all involved parties and establishing a clear, auditable trail for every payment received. From the initial collection of rent to the final reconciliation of deposits, its consistent application ensures accuracy, fosters transparency, and promotes a professional operational environment.

Embracing this meticulously designed template empowers property owners, managers, and tenants alike with a reliable, accurate, and efficient financial record tool. It not only simplifies accounting processes and aids in tax preparation but also significantly reduces the potential for disputes, thereby building stronger, more trusting relationships. In the complex landscape of property management, the value of such a standardized receipt cannot be overstated—it is an indispensable asset for ensuring clarity, compliance, and peace of mind.