In the intricate world of financial transactions and business operations, the creation and maintenance of precise documentation stand as a cornerstone of professionalism and legal compliance. Whether dealing with complex corporate agreements or routine individual payments, a well-structured record provides clarity, reduces ambiguity, and protects all parties involved. A particularly critical area where meticulous documentation is indispensable is the collection of security deposits in rental agreements, necessitating a robust rental security deposit receipt template.

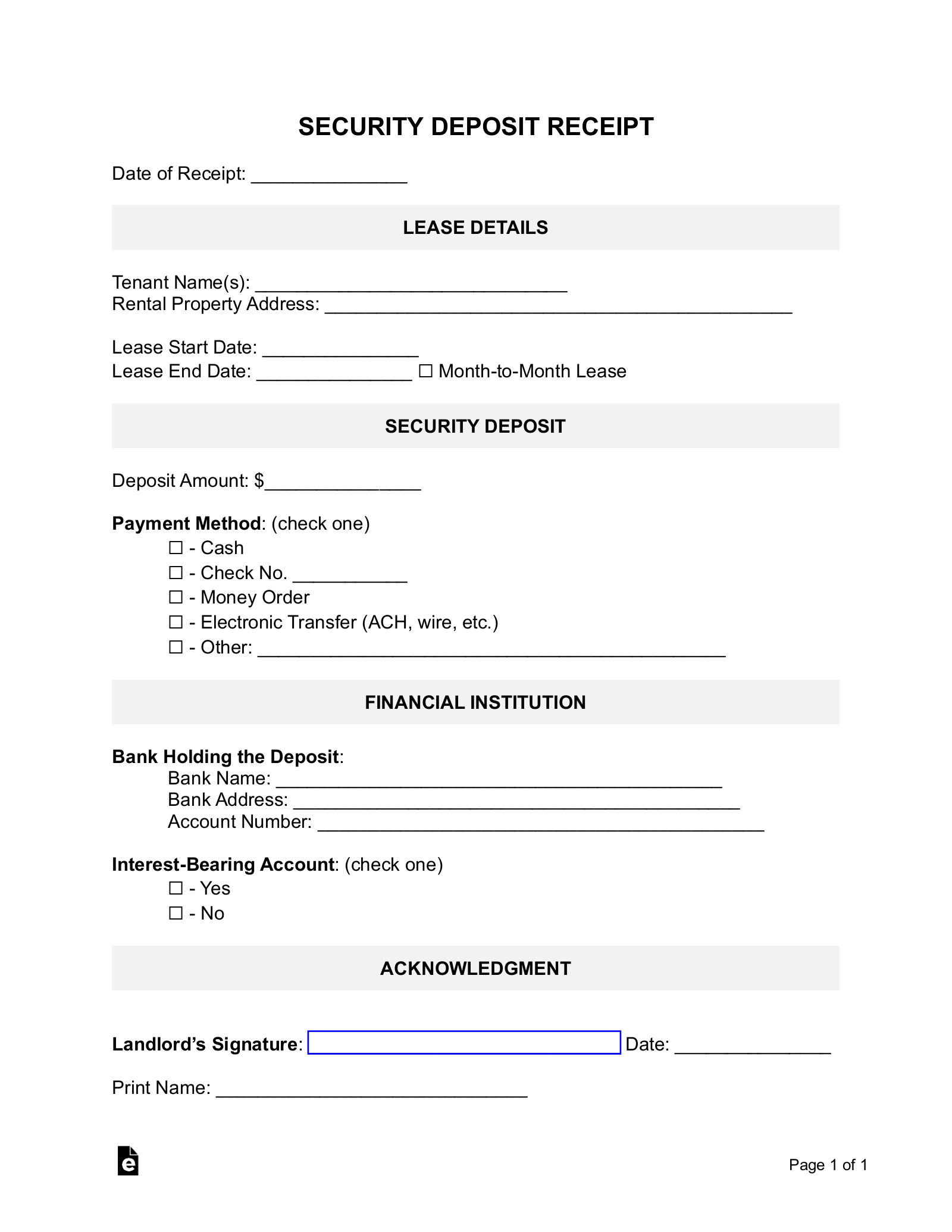

This essential tool serves as a formal acknowledgment of funds received, offering undeniable proof of a financial exchange between a tenant and a landlord or property manager. Its primary purpose extends beyond a simple confirmation; it acts as a safeguard, delineating the terms, amounts, and specific purpose of the deposit. For both the party submitting funds and the recipient, having a clear, standardized receipt is paramount for accurate record-keeping, dispute resolution, and ensuring transparency in all financial dealings related to a tenancy.

The Imperative of Professional Financial Documentation

The bedrock of any successful business or personal financial management strategy is the commitment to clear, professional documentation. Every financial transaction, irrespective of its scale, leaves a trace, and the proper recording of these traces is vital for accountability, auditing, and legal protection. Without structured documentation, businesses risk operational inefficiencies, potential disputes, and non-compliance with regulatory requirements.

Accurate records underpin trust and credibility, fostering transparent relationships between entities and individuals. They serve as objective evidence, eliminating reliance on memory or informal agreements, which are often prone to misinterpretation. In an era where financial scrutiny is constant, possessing a comprehensive suite of professional documents, such as a robust payment receipt or an detailed invoice form, is not merely a best practice; it is an absolute necessity for demonstrating diligence and integrity.

Key Benefits of a Structured Receipt Template

Adopting a standardized rental security deposit receipt template offers a multitude of advantages that transcend mere convenience, significantly enhancing the operational integrity of financial transactions. One of its foremost benefits is the assurance of accuracy. By providing pre-defined fields for all essential information—such as dates, amounts, payer and payee details, and the explicit purpose of the payment—the template minimizes the risk of omissions or errors that often occur with ad-hoc documentation.

This structured approach also dramatically boosts transparency. Every transaction recorded using this form becomes immediately clear and understandable to all stakeholders. Details like the exact sum received, the method of payment, and the specific property address are laid out unambiguously, reducing potential misunderstandings or disputes regarding the deposit’s nature or return conditions. Furthermore, the consistent use of such a document ensures uniformity in record-keeping across all tenants or financial interactions. This consistency is invaluable for internal accounting, external audits, and for maintaining an organized and easily retrievable archive of all proof of transaction records. The document acts as a legal safeguard, providing tangible evidence of payment that can be crucial in resolving any future disagreements.

Versatility: Customizing the Template for Diverse Transactions

While initially designed for rental security deposits, the fundamental structure of a well-conceived rental security deposit receipt template is remarkably adaptable, making it a versatile asset for a wide array of financial acknowledgments. The underlying principles of documenting a payment—identifying parties, amounts, dates, and purposes—remain consistent across various transactional contexts. This inherent flexibility allows businesses and individuals to customize the template for numerous other applications, extending its utility far beyond its initial scope.

For instance, the basic layout can be easily modified to serve as a sales record, providing customers with a proof of purchase for goods received. Similarly, service providers can adapt the form into a service receipt, detailing the services rendered and the payment collected, which is invaluable for both client billing and internal financial tracking. Non-profit organizations frequently customize such forms to create donation acknowledgments, essential for both their records and for donors seeking tax deductions. Businesses often use modified versions as an expense record, facilitating clear documentation for employee reimbursements or tracking operational costs. Essentially, any scenario requiring a clear, official record of money changing hands can benefit from the foundational design principles embedded within this type of financial template.

Optimal Scenarios for Utilizing a Receipt Template

A robust receipt template proves invaluable across a diverse spectrum of financial interactions, ensuring clarity and accountability. The following scenarios highlight instances where deploying such a structured document is most effective:

- Collecting Security Deposits: The primary and most common use, providing landlords and tenants with a formal acknowledgment of the deposit amount, date received, and the property it relates to. This document is critical for clarifying the terms of the deposit and its eventual return.

- Receiving Rent Payments: Issuing a receipt for monthly rent payments offers tenants a clear record of their payment history, which can be essential for their financial planning and as proof of fulfilling their lease obligations.

- Acknowledging Service Fees: Businesses providing services, from consultations to repairs, can use the template to confirm payment for work completed, detailing the service provided and the amount paid. This service receipt enhances professionalism and aids in client billing inquiries.

- Recording Product Sales: For retail businesses or individual sellers, a customized version serves as a sales record, providing customers with proof of purchase and detailing items bought, quantities, and prices.

- Confirming Charitable Contributions: Non-profit organizations can adapt this layout to create donation acknowledgments, which are crucial for both internal record-keeping and for providing donors with documentation for tax purposes.

- Documenting Employee Expense Reimbursements: Companies can utilize this form to officially record reimbursements made to employees for business-related expenses, ensuring an accurate expense record for accounting and audit purposes.

- Any Situation Requiring a Clear Proof of Transaction: Fundamentally, whenever money changes hands and a formal, verifiable record is needed for either party, this template provides the structured framework to ensure all pertinent details are captured.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial document, including this essential template, hinges significantly on its design, formatting, and overall usability. A well-designed receipt should prioritize clarity and readability above all else. This involves selecting clean, professional fonts and ensuring adequate spacing between lines and sections to prevent visual clutter. Logical flow is also paramount; information should be presented in an intuitive sequence, starting with key identifiers like the date and receipt number, followed by payee and payer details, and then a clear breakdown of the transaction itself.

Essential fields that must be present include the date of transaction, the exact amount received, the full names and contact information of both the payer and payee, a precise description of the payment’s purpose (e.g., "security deposit for 123 Main St."), and the method of payment. A unique receipt number is also crucial for easy tracking and reference. Branding elements, such as a company logo and contact information, should be incorporated subtly to reinforce professionalism and provide immediate identification.

For print versions, considerations include paper size, sufficient margins for filing, and designated spaces for signatures from both parties to signify agreement and acknowledgment. Digital versions require additional thought regarding file formats (e.g., PDF for unalterable records), ease of electronic distribution, and compatibility with various devices. Regardless of the format, the template should be easily accessible, simple to complete, and straightforward to file and retrieve. Focusing on these design and usability principles ensures that the financial template serves its purpose effectively as a reliable piece of business documentation, whether as a simple payment receipt or a complex billing statement.

Ensuring Security and Integrity of Financial Records

Beyond design and usability, the security and integrity of financial records are paramount. Whether dealing with digital copies or physical documents, robust practices must be in place to protect sensitive information and prevent unauthorized access or alteration. For digital versions of the receipt, this includes implementing strong encryption for files, using secure cloud storage solutions, and regularly backing up data to multiple locations. Access controls should be strict, ensuring that only authorized personnel can view, edit, or generate these critical documents.

Physical copies of the receipt also demand careful handling. Secure filing systems, such as locked cabinets or fireproof safes, should be utilized to protect against theft, damage, or loss. Establishing a clear retention policy for financial records, in compliance with legal and accounting standards, is also essential. This ensures that records are kept for the required duration and then securely disposed of when no longer needed. Maintaining the confidentiality of personal and financial information contained within these documents is a core ethical and legal responsibility, reinforcing the trust placed in the entities managing such sensitive data.

Conclusion

In the dynamic landscape of financial transactions, the consistent application of a meticulously crafted receipt template, such as the rental security deposit receipt template, stands as an indispensable tool for fostering clarity, accountability, and legal protection. Its structured format ensures that every critical detail of a payment is accurately captured, mitigating potential disputes and reinforcing transparency between all parties. From landlords securing tenancy agreements to businesses processing sales or donations, the underlying framework of this financial template offers a versatile solution for robust record-keeping.

Ultimately, embracing such a reliable and efficient financial template is not merely a matter of administrative convenience; it is a fundamental pillar of sound financial management and ethical business practice. By providing indisputable proof of transaction, these forms contribute significantly to operational efficiency, regulatory compliance, and the cultivation of trust. Investing in a well-designed and consistently utilized receipt template ensures that all financial dealings are recorded with the precision and professionalism they demand, serving as a testament to an organization’s commitment to accuracy and integrity.