The integrity of a retail business’s financial operations hinges significantly on a meticulously organized chart of accounts. This fundamental organizational tool categorizes every financial transaction, providing the framework for accurate reporting and strategic analysis. To streamline this critical process, professionals often leverage retail chart of accounts templates, which offer a standardized yet adaptable structure for diverse operational scales.

The primary purpose of such a template is to provide a consistent, logical classification system for all financial entries, from sales revenue to operational expenses. This foundational structure benefits a broad spectrum of stakeholders, including internal accounting departments, external auditors, and business leaders requiring clear financial insights. By standardizing account nomenclature and numbering, this document significantly enhances the efficiency of data entry and the reliability of financial statements.

The Imperative of Visual Organization and Professional Data Presentation

In the contemporary business environment, raw financial data, however accurate, holds limited value without clear, professional presentation. Visual organization transforms complex numerical information into comprehensible insights, enabling swift understanding and informed decision-making. This approach is crucial for identifying patterns, highlighting anomalies, and tracking performance over time.

Professional data presentation extends beyond mere aesthetics; it underpins effective communication and fosters trust among stakeholders. Well-structured financial reports and visualizations, such as those derived from a systematic chart of accounts, facilitate clearer internal discussions, simplify external audits, and enhance credibility with investors and financial institutions. Leveraging principles of data visualization, businesses can convert intricate accounting details into accessible infographic layouts, making financial narratives compelling and easy to digest.

Key Benefits of Utilizing Structured Templates

Implementing structured templates for financial categorization offers numerous advantages, fundamentally improving operational efficiency and accuracy. These predefined frameworks ensure consistency across all financial entries, minimizing errors and the need for retrospective corrections. This standardization is particularly vital for retail organizations managing high volumes of diverse transactions.

Furthermore, structured templates facilitate more robust financial analysis, which is critical for strategic planning. With a consistent chart, businesses can easily generate detailed reports, conduct trend analysis, and construct performance dashboards that provide real-time views of financial health. This capability allows management to quickly ascertain profitability by product line, identify cost centers, and assess the efficiency of various retail operations.

Implementing well-designed retail chart of accounts templates can significantly reduce the time spent on initial setup and ongoing maintenance of accounting records. They provide a ready-to-use blueprint that can be adapted rather than built from scratch, accelerating the onboarding of new accounting personnel and ensuring compliance with industry standards. This efficiency translates directly into cost savings and allows finance teams to dedicate more resources to strategic initiatives.

The use of a consistent accounting layout also ensures uniformity across multiple retail locations or departments. This organizational consistency is paramount for consolidated financial reporting, allowing headquarters to accurately compare performance metrics across different branches and make data-driven decisions regarding resource allocation and growth strategies. It builds a unified financial language throughout the entire enterprise.

Adaptability Across Diverse Business Applications

The inherent flexibility of retail chart of accounts templates allows for their adaptation beyond fundamental ledger management, serving a multitude of strategic and operational purposes. While foundational for daily bookkeeping, these structured frameworks can be customized to support advanced analytical requirements, offering granular insights tailored to specific business needs. This adaptability makes them an invaluable asset across various functional areas.

These templates can be expertly adapted for several key applications:

- Business Reports: Creating customized views for management summaries, investor presentations, or operational reviews. They allow for the aggregation or disaggregation of data to focus on specific financial aspects relevant to different audiences.

- Academic Projects: Providing a practical, real-world example of financial structuring for students in accounting, finance, or business administration programs. They serve as an educational tool for understanding financial hierarchy and reporting.

- Performance Tracking: Developing detailed expense or revenue breakdowns vital for operational managers to monitor key performance indicators (KPIs). This supports micro-level analysis, identifying areas for improvement or success.

- Financial Analysis: Facilitating deep dives into profitability by product category, geographic region, or sales channel, and enabling comprehensive cost structure evaluations. This aids in strategic decision-making and resource optimization.

The robust architecture provided by retail chart of accounts templates enables businesses to evolve their financial reporting without fundamental overhauls. Whether scaling operations, diversifying product lines, or integrating new technologies, the underlying structure can be modified to accommodate new accounts and categories, maintaining integrity and continuity in financial data. This forward-thinking design ensures that the accounting system remains agile and responsive to market changes.

Scenarios Where Retail Chart Of Accounts Templates Prove Most Effective

The strategic deployment of a pre-designed chart of accounts template offers tangible benefits across a spectrum of operational circumstances within the retail sector. Their structured nature makes them particularly impactful in situations demanding clarity, efficiency, and compliance.

Using these structured accounting records is most effective in scenarios such as:

- New Business Launch: Establishing a robust and comprehensive financial system from inception, ensuring all transactions are categorized correctly from day one and laying a solid foundation for future growth.

- System Migration: Ensuring data integrity and consistency during transitions to new enterprise resource planning (ERP) or specialized accounting software, minimizing disruption and data loss.

- Multi-Location Expansion: Maintaining uniform financial reporting standards and account categorization across all new and existing branches, facilitating consolidated financial analysis and management.

- Specialized Retail Segments: Tailoring account structures for unique inventory types, revenue streams, or operational nuances specific to fashion, electronics, grocery, or other distinct retail environments.

- Budgeting and Forecasting: Providing the granular data necessary for accurate financial projections, scenario planning, and effective allocation of resources based on historical performance and anticipated trends.

- Audit Preparation: Demonstrating meticulously organized and compliant financial records to auditors, streamlining the audit process and enhancing the company’s credibility and transparency.

- Investor Relations: Presenting clear, understandable financial statements and performance metrics to potential investors and existing stakeholders, fostering confidence and supporting fundraising efforts.

Best Practices for Template Design, Formatting, and Usability

Optimizing a retail chart of accounts template for maximum utility involves a keen focus on design, formatting, and overall usability. A well-designed chart enhances not only readability but also the efficiency of data entry and analysis, becoming a true asset for the finance department. Adhering to established principles of chart design ensures that the layout is intuitive and logically structured.

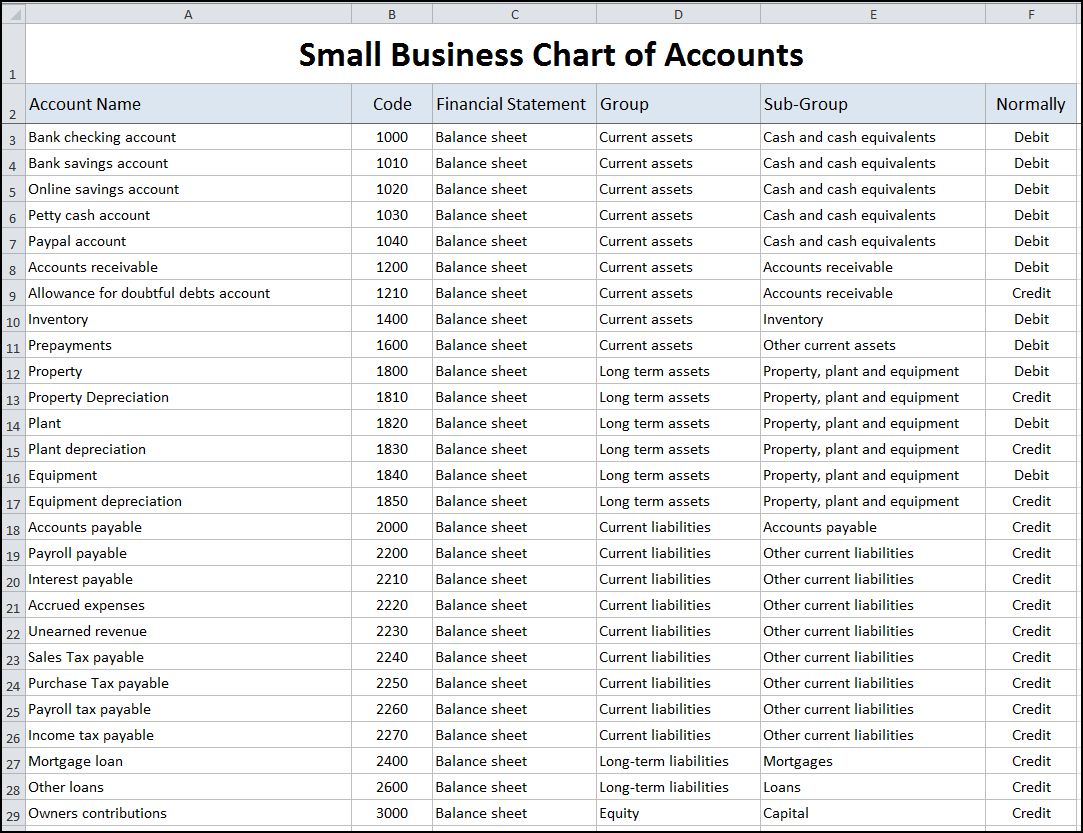

Effective design starts with a clear, hierarchical numbering system that logically groups accounts. For instance, assets might begin with 1000, liabilities with 2000, equity with 3000, revenues with 4000, and expenses with 5000. Within these major categories, sub-accounts should follow a consistent numbering pattern (e.g., 1010 for Cash, 1020 for Accounts Receivable). This systematic approach greatly improves navigation and understanding of the financial data flow.

Regarding formatting, the template should be easily readable in both print and digital versions. This implies appropriate font sizes, clear labels, and sufficient white space to prevent visual clutter. For digital use, the template should ideally be compatible with standard accounting software and spreadsheets, allowing for easy exportability and integration with other business intelligence tools. Consistent report formatting across all generated outputs reinforces professionalism.

Usability considerations are paramount for day-to-day operations. The template should be straightforward to update and modify as the business evolves, without requiring extensive technical expertise. Features like drop-down menus for common entries, built-in validation rules, and clear instructions can significantly enhance user experience and data accuracy. Effective data tracking and aggregation capabilities within the template can transform it into a powerful performance monitoring tool.

The inclusion of specific notes or definitions for ambiguous accounts can also prevent misclassification errors. By ensuring the template is both aesthetically pleasing and functionally robust, businesses can leverage it not just as a record-keeping tool but as an active component in their strategic decision-making process. Such a well-crafted presentation template reinforces financial discipline and analytical capacity.

The strategic implementation of such a sophisticated template extends far beyond mere accounting compliance. It empowers retail organizations with time-saving efficiencies, transforming raw transactional data into actionable insights. By providing a standardized framework, the template streamlines financial processes, allowing teams to focus on analysis rather than data categorization.

Furthermore, the inherent structure of the chart facilitates superior data visualization, enabling clearer communication of financial performance to both internal teams and external stakeholders. This visual clarity is indispensable for identifying trends, assessing profitability, and making informed strategic decisions that propel business growth and foster a data-driven culture.

Ultimately, leveraging a well-conceived accounting record is not merely an operational convenience; it is a foundational element for robust financial governance and a critical asset in navigating the complexities of the modern retail landscape. Its role as a consistent, adaptable, and visually effective communication tool underscores its value as an indispensable component of sound business management.