Accurate and professional record-keeping is a cornerstone of responsible financial management for any organization, especially those reliant on public generosity. For schools, parent-teacher associations (PTAs), and other educational entities, meticulously documenting contributions is not merely a best practice; it is a fundamental requirement for transparency, accountability, and legal compliance. A well-crafted school donation receipt template serves as the primary tool to acknowledge these vital contributions, providing donors with the necessary documentation for tax purposes while ensuring the school maintains an impeccable record of its funding sources.

The primary purpose of such a template extends beyond a simple acknowledgment. It acts as a formal proof of transaction, establishing a clear record of the donor’s generous act and the school’s acceptance. This clarity benefits both parties: donors gain the assurance that their contributions are officially recognized and eligible for potential tax deductions, while schools uphold their reputation for integrity and facilitate streamlined auditing processes. This document is indispensable for fostering trust within the community and ensuring all financial interactions are handled with the utmost professionalism.

The Importance of Clear and Professional Documentation

In the realm of finance and business, the reliability of documentation cannot be overstated. Every transaction, whether a large corporate investment or a small individual donation, contributes to an organization’s financial narrative. Clear and professional documentation, such as a robust payment receipt, ensures that this narrative is accurate, transparent, and defensible under scrutiny. It forms the bedrock of financial auditing, regulatory compliance, and internal accountability.

Without standardized business documentation, organizations risk miscommunications, disputes, and potential legal complications. A poorly managed record-keeping system can lead to significant operational inefficiencies, making it difficult to track funds, reconcile accounts, or report financial health accurately. Conversely, a systematic approach reinforces an organization’s credibility, demonstrating a commitment to responsible governance and ethical financial practices, which is crucial for public and private institutions alike.

Key Benefits of Using Structured Templates for Donations

Implementing a structured approach to generating donation acknowledgments, particularly through the use of a pre-designed financial template, offers a multitude of benefits. One of the most significant advantages is the assurance of accuracy and consistency in record-keeping. A standardized layout minimizes the chances of errors that can arise from manual, ad-hoc documentation, ensuring all essential information is captured uniformly across every receipt issued.

Beyond accuracy, the structured school donation receipt template enhances transparency for both the donor and the receiving institution. Donors receive a clear, official record detailing their contribution, fostering trust and encouraging future giving. For the school, these consistent records simplify internal tracking, streamline accounting procedures, and provide ready data for financial reports and audits. This proactive approach significantly reduces administrative burden and reinforces the professional image of the organization.

Customization for Various Financial Purposes

While the core functionality of a receipt template is to acknowledge a transaction, its inherent design allows for remarkable versatility, extending its utility far beyond simple donations. A well-designed receipt template can be easily adapted to serve a multitude of financial documentation needs. For instance, the general structure of a payment receipt is applicable across various sectors, making it a highly adaptable expense record tool.

Fields for donor information can be re-purposed for customer details in a sales record or client particulars for a service receipt. The section detailing the donation amount and description can be modified to list items purchased, services rendered, or rent payments received. Furthermore, the format can be tailored to function as an invoice form for billing, a billing statement for subscription services, or a reimbursement form for business expenses. The power lies in its modularity, enabling organizations to create specific, yet consistent, documentation for nearly any financial exchange by simply adjusting labels and data fields within the existing layout.

Examples of When Using a Donation Acknowledgment Is Most Effective

The application of a dedicated receipt template for donations is critical in various scenarios, ensuring that all contributions are formally recognized and properly recorded. Its consistent use facilitates efficient financial management and supports donor relations.

- Annual Fundraising Campaigns: For large-scale events like galas, silent auctions, or pledge drives, utilizing a standardized template ensures that every single contribution, whether monetary or in-kind, receives proper acknowledgment and accurate financial entry. This helps manage high volumes of donations efficiently.

- Specific Project Funding: When donors contribute to targeted initiatives, such as a new library fund, athletic equipment purchase, or technology upgrade, the receipt clearly specifies the designated purpose, linking the donation directly to its intended use and aiding in restricted fund accounting.

- Major Donor Contributions: High-value donations require meticulous documentation. A professional receipt template provides the formal

donation acknowledgmentnecessary for significant contributors, often including specific legal language about tax deductibility and the school’s tax-exempt status. - In-Kind Donations: Beyond monetary gifts, schools often receive valuable non-cash contributions like books, equipment, or volunteer services. The template can be adapted to describe these items or services, estimate their fair market value (as reported by the donor), and provide the necessary documentation for the donor’s tax records.

- Online and Digital Donations: As digital giving becomes more prevalent, the template can be integrated into online donation platforms, automatically generating and emailing a customized receipt to the donor immediately after a transaction is completed, ensuring timely and convenient documentation.

- Grants and Institutional Funding: While often accompanied by formal agreements, a simple receipt can supplement these, providing a clear

proof of transactionfor initial or subsequent grant disbursements, simplifying internal record-keeping and external reporting.

Tips for Design, Formatting, and Usability

Creating a highly effective donation receipt template involves careful consideration of its design, formatting, and overall usability for both print and digital versions. The goal is to produce a document that is clear, professional, easy to understand, and visually appealing.

Clarity and Readability:

- Font Choice: Select professional, legible fonts (e.g., Arial, Calibri, Times New Roman) in appropriate sizes (10-12pt for body, larger for headings).

- White Space: Utilize adequate white space around text blocks and between sections to prevent visual clutter and improve readability.

- Logical Flow: Organize information logically, moving from general details (donor, recipient) to specific transaction data (date, amount, description).

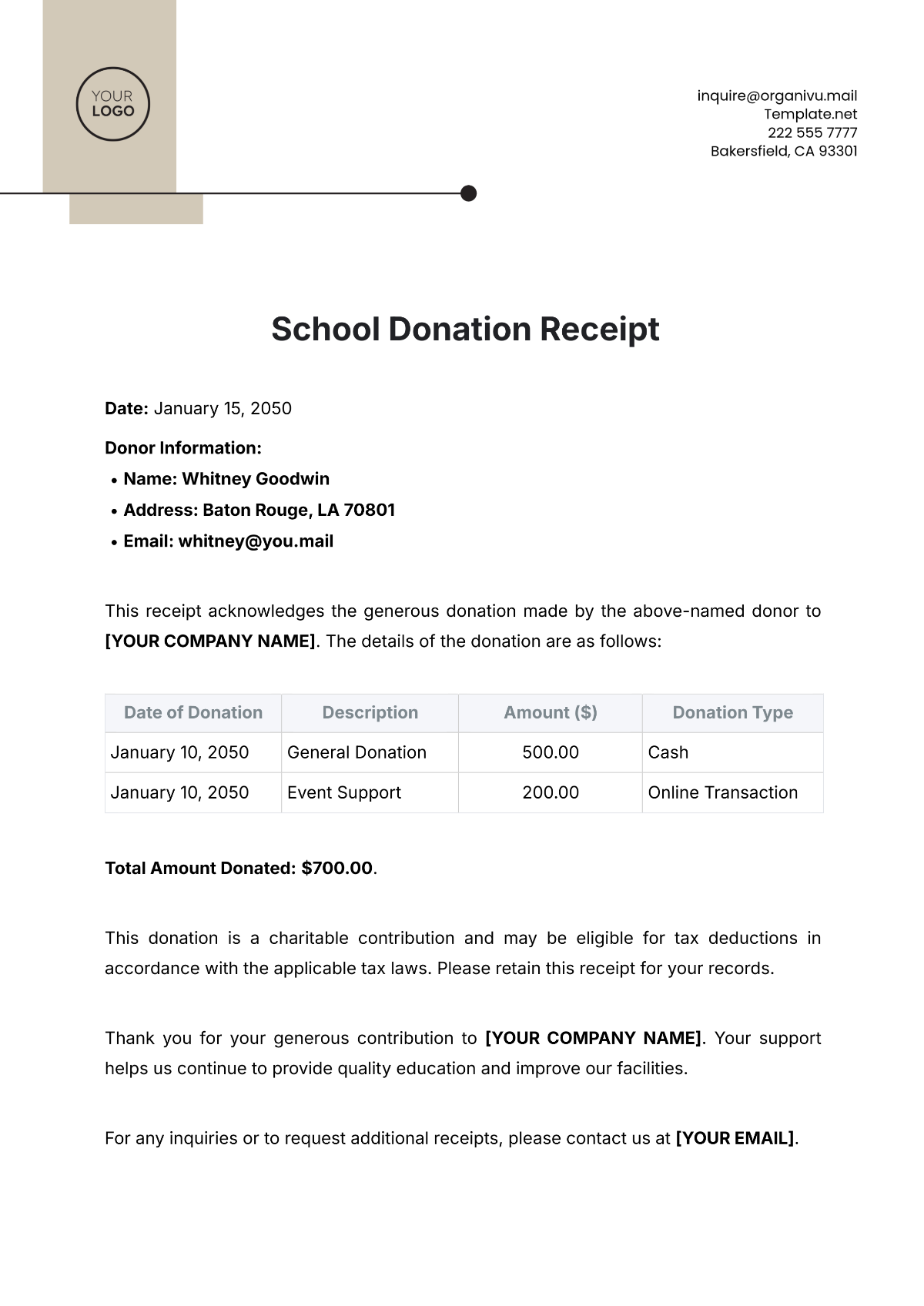

Essential Content Elements:

- Recipient Information: Full legal name of the school or organization, address, phone number, and Employer Identification Number (EIN) or tax ID.

- Donor Information: Full name, address, and contact details of the donor.

- Date of Donation: The exact date the contribution was received.

- Donation Details:

- Monetary donations: clearly state the exact amount in both numerical and written form (e.g., "$100.00 – One Hundred Dollars and Zero Cents").

- In-kind donations: provide a detailed description of the item(s) or service(s) donated. The IRS requires the donor, not the charity, to determine the fair market value of non-cash contributions, but the receipt should document the item received.

- Statement of No Goods/Services: Include a clear statement affirming whether any goods or services were provided to the donor in exchange for the contribution. If goods or services were provided, the fair market value of those benefits must be stated and subtracted from the donation amount to determine the deductible portion.

- Signature Line: A designated space for an authorized representative’s signature and printed name, indicating official acknowledgment.

- Optional – Thank You Message: A brief, heartfelt thank-you message can personalize the receipt and strengthen donor relationships.

Branding and Professionalism:

- Logo Integration: Incorporate the school’s or organization’s official logo at the top of the receipt to reinforce brand identity and professionalism.

- Consistent Styling: Use consistent colors, fonts, and styling that align with the school’s brand guidelines.

- Paper Quality (Print): If printing, use quality paper stock that conveys a sense of importance and permanence.

Usability for Digital and Print:

- Digital Accessibility: Design the form to be easily fillable electronically (e.g., a PDF with editable fields) and distributable via email.

- Printer-Friendly: Ensure the layout is optimized for printing, avoiding excessive use of background colors or images that might consume too much ink.

- File Formats: Offer the template in common, accessible formats like PDF or Microsoft Word for ease of use and compatibility. Consider cloud-based solutions for automated generation and storage.

In conclusion, a thoughtfully designed and consistently utilized template is more than just a piece of paper; it is a critical instrument in the school’s financial toolkit. It simplifies administrative tasks, safeguards against errors, and ensures legal and tax compliance for all parties involved. This reliable document serves as a powerful testament to the school’s commitment to transparent financial practices and its appreciation for the generosity that fuels its mission.

Ultimately, the value of a high-quality receipt lies in its ability to instill confidence. For donors, it provides irrefutable proof of transaction and the assurance that their contributions are officially recognized and recorded for tax purposes. For the school, it establishes an unimpeachable financial template for managing resources, navigating audits, and building a foundation of trust with its community. Embracing such a standardized approach elevates the entire donation process, making it efficient, accurate, and profoundly professional.