In the intricate landscape of financial management, particularly within educational institutions, the issuance of a clear and verifiable payment receipt is not merely a formality; it is a fundamental requirement for transparency, accountability, and legal compliance. A well-designed school fee receipt template serves as the cornerstone of this process, providing both the institution and the payer with an irrefutable record of a financial transaction. This foundational document ensures clarity regarding tuition payments, enrollment fees, and other scholastic expenditures, fostering trust and simplifying financial reconciliation.

The primary purpose of such a template is to standardize the documentation of all incoming payments, ensuring that every transaction is recorded accurately and consistently. It benefits a wide array of stakeholders: parents and guardians gain a clear proof of transaction for their records, essential for budgeting or tax purposes; educational institutions maintain meticulous financial documentation crucial for internal accounting, audits, and dispute resolution; and financial administrators can streamline their record-keeping processes. Ultimately, a robust school fee receipt template underpins the financial integrity of an educational establishment, offering a professional and organized approach to money management.

The Indispensable Role of Professional Documentation in Financial Transactions

In any financial or business transaction, professional documentation stands as a non-negotiable element, reflecting an organization’s commitment to integrity and meticulous record-keeping. Clear and unambiguous financial records, such as a meticulously prepared payment receipt, are vital for numerous reasons. They provide an undeniable audit trail, safeguarding against discrepancies and offering protection in potential legal or financial disputes. For educational institutions, this rigor demonstrates accountability to students, parents, and regulatory bodies.

Beyond legal and regulatory compliance, professional documentation fosters an environment of trust. When institutions consistently issue detailed and standardized receipts, it signals transparency and professionalism. This practice not only aids in internal financial management and reporting but also simplifies external audits, tax preparations, and the overall assessment of financial health. Such documents are crucial pieces of business documentation, ensuring that every financial interaction is recorded with precision and clarity.

Core Benefits of a Structured School Fee Receipt Template

Adopting a structured school fee receipt template offers significant advantages, primarily enhancing accuracy, transparency, and consistency in financial record-keeping. These templates are meticulously designed to capture all essential information, thereby drastically reducing the potential for human error that often accompanies manual entry or unstructured documentation. Every field, from the date of payment to the specific fee category, prompts the user for precise data, ensuring comprehensive record generation.

Furthermore, the use of a standardized template champions transparency. Both the payer and the recipient receive an identical, clear record of the transaction, eliminating ambiguity and fostering trust. This shared understanding is vital for open communication regarding financial obligations and payments. Lastly, consistency is paramount; a uniform layout for every payment receipt ensures that financial data is collected and presented in a predictable format, which is invaluable for efficient data entry, streamlined reconciliation, and simplified auditing processes. It forms a crucial part of an institution’s robust internal controls, reinforcing financial integrity and operational efficiency, whether it pertains to a simple payment receipt or a more complex invoice form.

Adaptability: Customizing the Receipt Template for Diverse Applications

While the core principles of a reliable payment receipt remain constant, the underlying template structure is remarkably adaptable, allowing it to serve a multitude of financial documentation needs beyond just school fees. The fundamental layout, designed to record transaction details, payment methods, and participating parties, can be easily modified to suit various sectors and purposes. For instance, a basic school fee receipt template can be transformed into a detailed sales record by adjusting line item descriptions and adding product codes.

This inherent flexibility allows for customization across a spectrum of financial interactions. Businesses can modify the document to create service receipts for delivered professional services, detailing hours worked or specific tasks completed. Landlords might adapt the form into a rent payment acknowledgment, specifying the rental period and property address. Non-profit organizations frequently adjust the layout to serve as a donation acknowledgment, providing tax-deductible proof of contribution. Even for internal use, such a financial template can be tailored for business reimbursements, documenting employee expenses. The key is to retain the essential elements of proof of transaction while adjusting the specific fields to align with the unique requirements of each financial scenario, ensuring the template remains a powerful tool for comprehensive financial tracking.

Practical Applications: When to Leverage a Receipt Template

The utility of a well-designed receipt template extends across numerous scenarios within an educational institution, ensuring every financial interaction is formally documented. Employing such a structured form simplifies record-keeping, enhances transparency, and provides critical proof of transaction for both the payer and the institution. Utilizing a robust financial template is most effective in the following instances:

- Enrollment and Registration Fees: Documenting initial payments required for student admission or course registration, providing clear evidence of a student’s official status.

- Tuition Payments: Recording regular tuition installments, whether paid monthly, quarterly, or annually, ensuring a precise history of educational funding.

- Extracurricular Activities: Acknowledging payments for sports teams, clubs, arts programs, or other optional school activities, detailing the specific program covered.

- Textbook and Material Purchases: Providing a receipt for the acquisition of textbooks, lab materials, art supplies, or specialized equipment through the school.

- Field Trip Expenses: Documenting contributions or payments for educational excursions, which often cover transportation, entry fees, and related costs.

- After-School Program Fees: Recording payments for extended care, tutoring, or supplementary educational programs offered outside regular school hours.

- Donations to School Funds: Issuing donation acknowledgments for contributions made by parents, alumni, or community members to school improvement funds, scholarships, or specific projects, which can also function as a tax-deductible proof of transaction.

- Uniform and Apparel Sales: Documenting purchases of school uniforms, branded apparel, or other mandatory clothing items.

- Cafeteria and Meal Plan Payments: Recording payments for school lunch programs or pre-paid meal plans, ensuring proper allocation of funds.

- Late Fees and Penalties: Providing formal documentation for any charges incurred due to late payments or other administrative penalties, clearly stating the reason and amount.

In each of these examples, the consistent application of the receipt template guarantees that both parties possess an accurate and verifiable expense record, reinforcing financial integrity and simplifying future audits or inquiries. This approach transforms every payment into a clear billing statement, bolstering trust and accountability.

Best Practices for Design, Formatting, and Usability

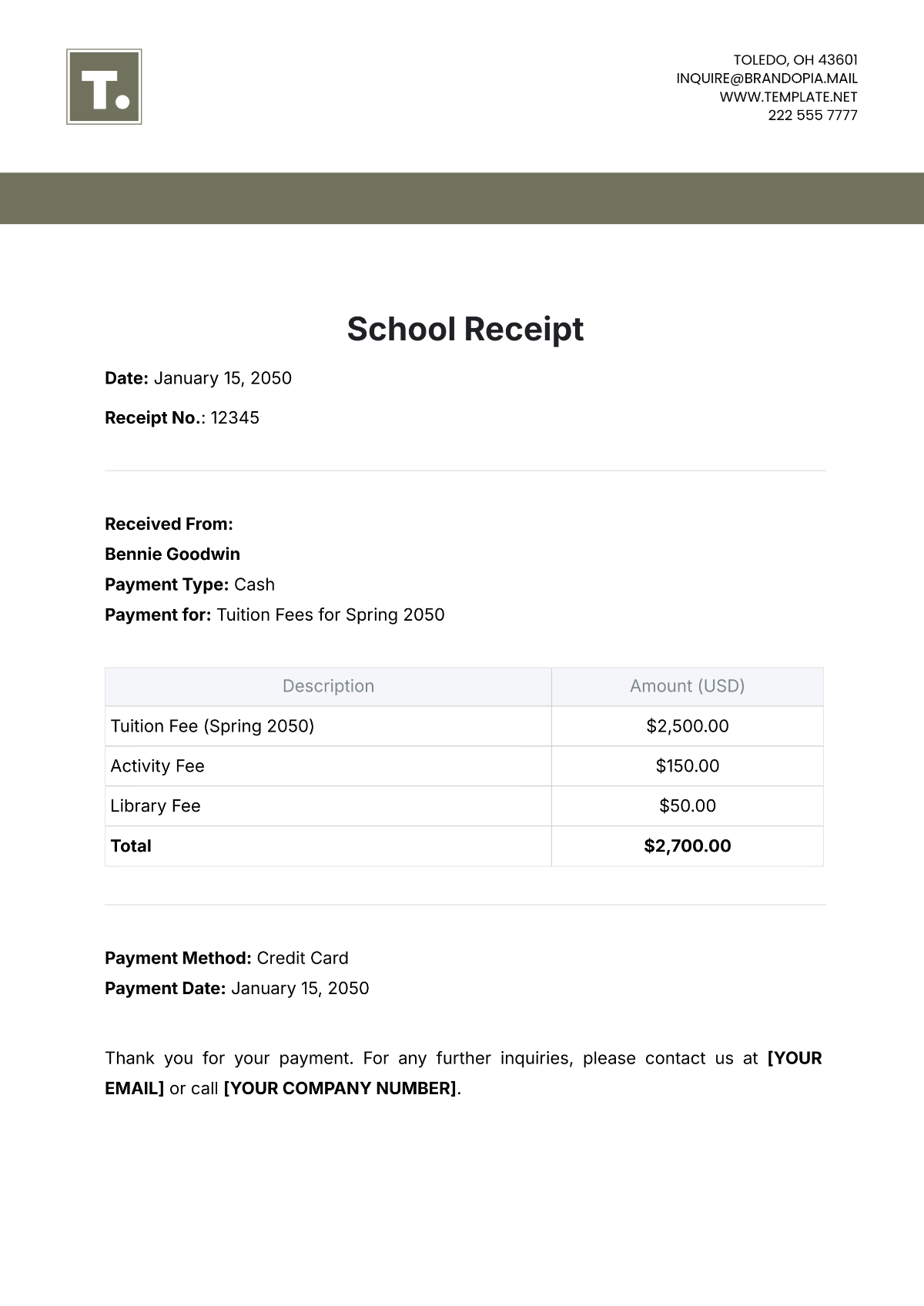

Creating an effective receipt template involves careful consideration of design, formatting, and usability to ensure it serves its purpose efficiently in both print and digital formats. The primary goal is clarity and completeness, making the payment receipt easy to understand for all stakeholders. A well-designed template should feature a clear header that includes the institution’s name, logo, contact information, and the title "Payment Receipt" or "Official Receipt."

The body of the receipt needs to be logically structured, typically divided into sections such as Transaction Details, Payer Information, and Payment Information. Transaction details should encompass a unique receipt number, date of issue, a clear description of the services or items paid for (e.g., "Annual Tuition Fee – Grade 5"), the amount, and any applicable taxes or discounts. Payer information should include the student’s name, parent/guardian’s name, and contact details. Payment information should specify the method of payment (cash, check, credit card, bank transfer) and any relevant transaction IDs.

For optimal usability, use clear, legible fonts and ensure sufficient white space to prevent visual clutter. Bullet points or clearly defined line items are beneficial for listing multiple items. In terms of formatting, consistency is key; maintain uniform font sizes, colors (if applicable), and alignment throughout the document. A dedicated section for "Amount Paid" and "Balance Due" (if applicable) is essential for financial clarity.

When considering digital versions, ensure the template is easily convertible to PDF format for secure distribution and archiving. Digital templates can often be integrated with accounting software, allowing for automated data entry and reducing manual effort. Features like electronic signature fields can enhance convenience and authenticity. For print versions, consider the layout on standard paper sizes, ensuring all information fits without truncation and providing adequate space for physical signatures or stamps. Both versions should include a clear footer with a thank you message or important disclaimers. Ultimately, a thoughtfully designed and formatted receipt is a powerful piece of business documentation that streamlines operations and enhances transparency, functioning as a reliable financial template.

The Enduring Value of a Reliable Financial Record

In conclusion, the strategic implementation of a robust receipt template transcends mere administrative convenience; it is a critical component of sound financial governance within any organization, particularly educational institutions. This structured financial template acts as a reliable, accurate, and efficient tool for documenting every monetary exchange, transforming complex transactions into clear, verifiable records. Its consistent use bolsters trust between institutions and their constituents, providing both parties with an undeniable proof of transaction that safeguards against disputes and clarifies financial obligations.

Moreover, the enduring value of a standardized payment receipt lies in its ability to streamline auditing processes, facilitate tax preparations, and support transparent financial reporting. By meticulously capturing essential details in a consistent format, the receipt not only fulfills regulatory requirements but also simplifies internal controls and enhances operational efficiency. Adopting and consistently utilizing such a sophisticated financial template demonstrates a profound commitment to accuracy and accountability, ensuring that every payment, from a simple fee to a significant donation acknowledgment, is managed with the utmost professionalism and integrity.