In the intricate landscape of financial management, meticulous record-keeping stands as a cornerstone of accountability and transparency. For educational institutions, managing tuition payments effectively is not merely an administrative task; it is a critical function that impacts fiscal integrity, regulatory compliance, and stakeholder trust. A robust and clearly defined school tuition receipt template serves as an indispensable tool, providing a standardized mechanism to document every financial transaction with precision and professionalism.

This specialized document is designed to streamline the process of acknowledging payments received, offering a tangible proof of transaction for both the payer and the educational provider. Beneficiaries include parents and guardians who require accurate records for tax purposes or personal budgeting, students who may need proof of payment for enrollment status, and the institutions themselves, which rely on these documents for auditing, financial reporting, and dispute resolution. Implementing a consistent approach to generating these receipts fosters a professional image and significantly reduces potential errors or misunderstandings.

The Imperative of Clear Financial Documentation

Professional and unambiguous financial documentation is not merely a formality; it is a fundamental requirement for sound business operations across all sectors, including education. Every financial transaction, from a small purchase to a significant tuition payment, necessitates a clear audit trail. This ensures that all parties have a verifiable record, crucial for legal, tax, and internal accounting purposes.

Clear documentation fosters an environment of trust and accountability. It provides irrefutable evidence of a transaction’s occurrence, detailing the amount, date, purpose, and parties involved. Without such precision, organizations face risks ranging from financial discrepancies and reconciliation challenges to potential legal disputes and non-compliance with regulatory standards. Robust documentation underpins financial integrity and operational efficiency.

Key Benefits of a Structured School Tuition Receipt Template

Adopting a structured template for acknowledging tuition payments offers a multitude of advantages that extend beyond simple record-keeping. Foremost among these is the assurance of accuracy. By standardizing the information captured—such as the student’s name, payment date, amount received, and payment method—the potential for human error is significantly minimized, leading to more reliable data.

This standardization also enhances transparency, providing a consistent and understandable proof of transaction that all stakeholders can easily interpret. Consistency in format and content streamlines internal processes, making it easier for administrative staff to generate, file, and retrieve records efficiently. Furthermore, a well-organized system of receipts ensures audit preparedness, simplifying financial reviews and demonstrating adherence to best practices in financial management. Ultimately, the layout contributes to robust financial controls and operational efficiency.

Versatility: Customizing This Financial Template for Diverse Needs

While designed with educational institutions in mind, the underlying principles of a well-structured financial template are highly adaptable and can be customized to suit a wide array of transactional requirements. The core components—such as transaction date, amount, purpose, and parties involved—are universally applicable across different business contexts. This inherent flexibility transforms the document into a versatile tool for various financial acknowledgments.

For businesses offering services, this form can be adapted into a service receipt, confirming payment for work rendered. Retail operations might customize it as a sales record, detailing product purchases. Property managers can reconfigure the layout to serve as a rent payment receipt, while charitable organizations can utilize it as a donation acknowledgment, providing donors with essential documentation for tax deductions. Even for internal business reimbursements, a tailored version of the file can function as an expense record, ensuring meticulous tracking of employee spending. The utility of such a robust financial template extends far beyond its initial conception, serving as a universal proof of transaction for myriad scenarios.

When to Employ the School Tuition Receipt Template Effectively

The effective utilization of a tailored receipt is paramount for maintaining accurate financial records and fostering transparent communication between educational institutions and their constituents. This form is particularly valuable in specific scenarios where a formal acknowledgment of payment is crucial. Employing the school tuition receipt template consistently ensures that all financial interactions are properly documented, providing clarity and confidence to all parties.

Here are key instances when using the template is most effective:

- Initial Tuition Payments: To formally acknowledge the down payment or full payment for a student’s enrollment, providing immediate proof of transaction.

- Installment Payments: For each scheduled installment payment, ensuring a clear record of the ongoing financial commitment and progress.

- Enrollment and Application Fees: To document non-refundable fees paid during the application or registration process.

- Activity and Program Fees: When collecting payments for extracurricular activities, school trips, sports programs, or after-school care.

- Material and Resource Purchases: For acknowledging payments made for textbooks, uniforms, school supplies, or technology fees.

- Donations to School Funds: While a separate donation acknowledgment letter might be used, a receipt can serve as an initial record for smaller contributions.

- Miscellaneous Payments: For any ad hoc payments made to the school for various services or items not covered by standard tuition.

- Tax Documentation: Providing parents and guardians with the necessary proof of payment required for educational tax credits or deductions.

Design, Formatting, and Usability Best Practices

The efficacy of any financial document, including a receipt, hinges significantly on its design, formatting, and overall usability. A well-designed receipt is not only functional but also reflects professionalism and attention to detail. Whether intended for print or digital distribution, clarity and accessibility should be paramount considerations in the layout’s creation.

Key Design Elements:

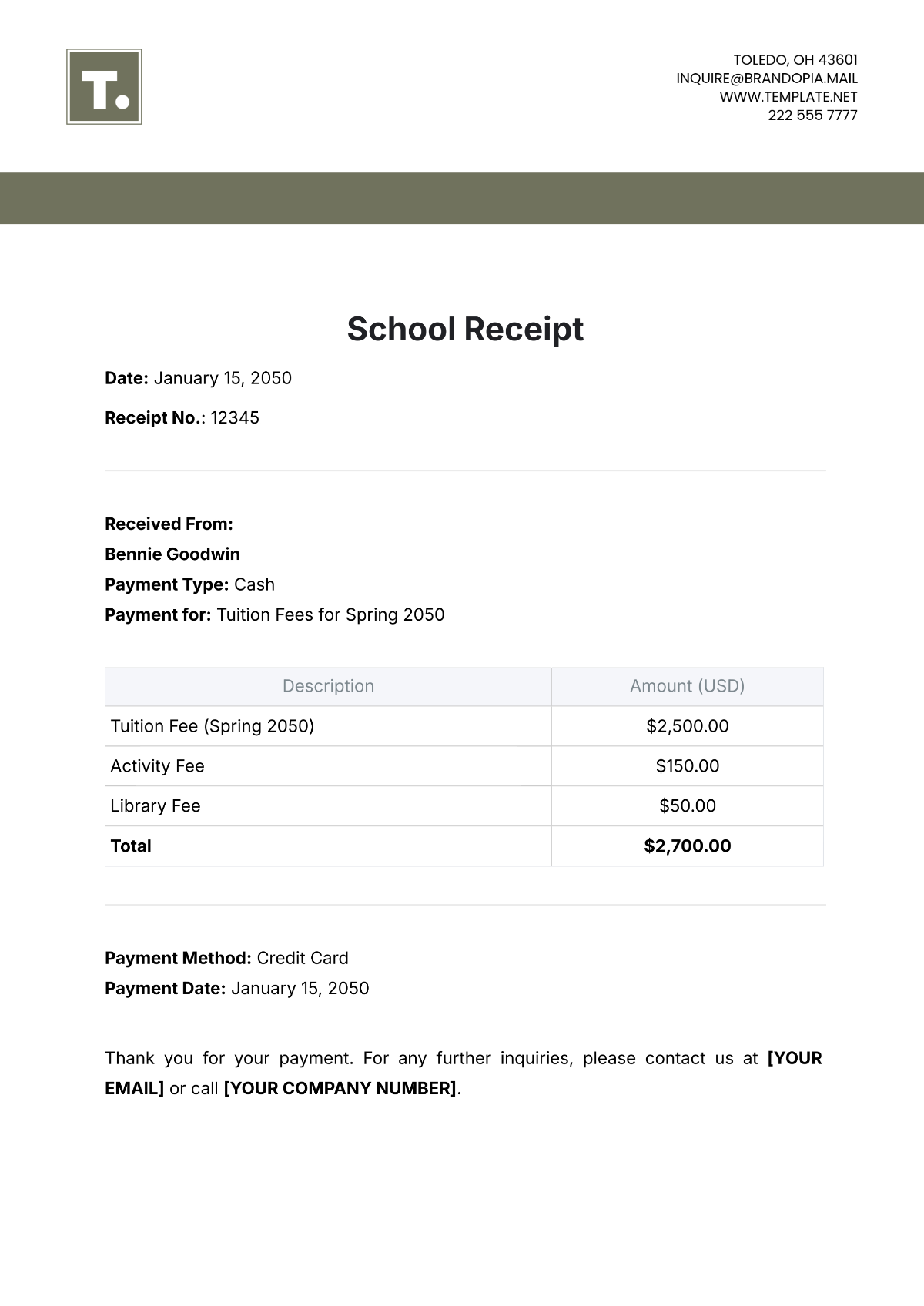

- Header Information: Prominently display the educational institution’s name, logo, address, and contact information. This instantly identifies the source of the document.

- Unique Receipt Number: Assign a distinct, sequential receipt number to each transaction. This is crucial for tracking, reconciliation, and audit purposes.

- Date of Payment: Clearly state the exact date the payment was received.

- Payer Information: Include the full name of the payer (e.g., parent/guardian) and the student’s name, ID number, or relevant identifier.

- Payment Details: Itemize the amount paid, specifying the purpose (e.g., "Fall Semester Tuition," "Enrollment Fee," "After-School Program"). If partial payments are made, the remaining balance due can also be noted.

- Payment Method: Indicate how the payment was made (e.g., cash, check, credit card, bank transfer). For card payments, include the last four digits of the card number for reference, if appropriate for your privacy policy.

- Total Amount Received: Clearly state the total monetary sum collected for that transaction.

- Authorization/Signature: A field for an authorized signature or digital stamp lends credibility and formality to the document.

- Disclaimers/Notes: Include any relevant disclaimers, refund policies, or notes regarding future payments or inquiries.

Formatting and Usability:

- Clean Layout: Utilize a clean, uncluttered layout with ample white space to enhance readability. Avoid overly ornate fonts or graphics that can distract from critical information.

- Legible Fonts: Choose professional, easy-to-read fonts in an appropriate size for both print and digital viewing.

- Logical Flow: Arrange information in a logical, intuitive order, typically from top to bottom, making it easy to scan and comprehend.

- Digital Versatility: For digital versions, ensure the file is easily shareable (e.g., PDF format) and, if possible, fillable. Consider mobile responsiveness if the template is accessed via an online portal.

- Print Compatibility: Design the template to print clearly on standard paper sizes without cutting off essential information.

By adhering to these best practices, the template becomes a highly effective tool for transparent and efficient financial communication, regardless of whether it’s issued in physical or electronic form.

A meticulously crafted financial template, such as a school tuition receipt template, is far more than a mere record of payment; it is a vital component of robust financial governance. Its structured design ensures that every transaction is captured with accuracy and consistency, providing a reliable proof of transaction for all stakeholders. By streamlining the acknowledgment process, it not only enhances operational efficiency for educational institutions but also builds confidence and trust with parents, guardians, and students.

The inherent versatility of this form further underscores its value, allowing it to be adapted for diverse financial acknowledgments beyond tuition, from service receipts to donation acknowledgments. In an environment where clarity and accountability are paramount, investing in a well-designed and consistently utilized financial template is an investment in an organization’s financial integrity and professional standing. This foundational document remains an indispensable tool for maintaining transparent, accurate, and readily accessible financial records.