In the intricate world of fundraising and non-profit operations, meticulous documentation is not merely good practice; it is a cornerstone of financial integrity and donor trust. For organizations hosting silent auctions, managing numerous transactions, often involving significant sums, demands a system that is both efficient and impeccably accurate. This is precisely where a clear and professional silent auction receipt template becomes an indispensable asset, ensuring that every successful bid translates into a verifiable and acknowledged contribution.

The utility of a robust silent auction receipt template extends beyond simple acknowledgment. It serves as a vital record for both the organization and the donor, providing undeniable proof of payment, item acquisition, and, crucially, the details necessary for tax deductions where applicable. This structured approach, embodied by a well-crafted silent auction receipt template, elevates the operational standard, fostering an environment of transparency that benefits all stakeholders and strengthens an organization’s credibility.

The Imperative of Meticulous Documentation in Financial Transactions

Clear and professional documentation is not just a formality; it is a fundamental requirement in all financial and business transactions. In an era where accountability and transparency are paramount, every exchange of value, whether a sale, a service, or a donation, necessitates a reliable record. Such documentation serves multiple critical purposes, including legal compliance, audit preparedness, and internal financial management.

For organizations, a well-maintained system of payment receipts and proof of transaction forms is essential for accurate bookkeeping and financial reporting. It allows for precise tracking of income, expenditure, and assets, providing the data needed for strategic decision-making and ensuring regulatory adherence. Without such diligent record-keeping, businesses and non-profits alike risk inconsistencies, disputes, and potential legal or financial penalties, undermining their operational stability and public trust.

Core Benefits of a Structured Receipt Template

Adopting structured templates for financial documentation, especially for events like silent auctions, offers profound advantages in ensuring accuracy, transparency, and consistency in record-keeping. A standardized layout removes ambiguity, guiding users to capture all necessary information systematically. This reduces errors that often arise from hastily prepared or incomplete handwritten notes, thereby safeguarding the integrity of financial data.

The inherent structure of such a document promotes transparency by clearly detailing the transaction particulars, including item descriptions, payment amounts, and dates. This clarity fosters trust with donors and customers, as they receive a professional and understandable proof of their contribution or purchase. Furthermore, consistency in the format of every receipt generated streamlines administrative processes, making reconciliation and auditing significantly easier and more efficient. This uniform approach minimizes the time and effort required for financial oversight, allowing staff to focus on more strategic tasks rather than correcting discrepancies.

Versatility and Customization Across Diverse Transaction Types

While initially designed for specific applications, a well-conceived receipt template possesses remarkable versatility, allowing for extensive customization across a broad spectrum of transaction types. The fundamental elements of a payment receipt – sender, recipient, amount, date, and description – are universal, making the underlying structure adaptable to various financial exchanges. This means the layout can be readily modified to suit different organizational needs and purposes, serving as a robust financial template.

For instance, adapting this form for sales transactions might involve adding fields for product codes or quantity. When used as a service receipt, it could include details about hours worked or specific services rendered. Businesses collecting rent payments would customize it to feature property addresses and rental periods. Moreover, its utility extends to donation acknowledgment for general contributions or business reimbursements, where fields for expense categories and approval signatures become critical. The adaptability of the document ensures that organizations do not need to create entirely new forms for every specific financial scenario, promoting efficiency and uniformity in their documentation practices.

Optimizing Effectiveness: When to Employ This Receipt Form

The strategic deployment of a dedicated receipt template significantly enhances operational efficiency and financial clarity across numerous scenarios. Leveraging this tool ensures that every transaction is formally documented, providing a reliable proof of transaction and supporting robust financial management.

Here are examples of when using this standardized form is most effective:

- Silent Auctions and Fundraising Events: Immediately after a successful bid, to provide the winner with an itemized record of their purchase and payment, including tax-deductible portions. This serves as a vital donation acknowledgment.

- Charitable Donations: For all contributions received, whether cash, check, or in-kind, ensuring donors receive a formal receipt for tax purposes and to acknowledge their generosity. This strengthens donor relations.

- Product Sales: When selling merchandise or goods, such as at a gift shop, pop-up store, or market, providing customers with a detailed sales record.

- Service Provision: After completing a service, like consulting, training, or maintenance, issuing a service receipt to the client detailing the work performed and charges.

- Rental Collections: For landlords or property managers, providing tenants with a clear record of rent payments received, including dates and periods covered.

- Expense Reimbursements: Internally, when an employee is reimbursed for business-related expenses, providing a documented expense record for both the employee and company accounts.

- Membership Dues: Acknowledging the payment of annual or recurring membership fees for clubs, associations, or non-profit organizations.

- Subscription Renewals: Documenting payments for recurring subscriptions to services, software, or publications.

- Deposits and Advance Payments: When receiving partial payments or security deposits, ensuring both parties have a record of the amount paid and the outstanding balance.

- Billing Statements: While not a full invoice form, it can accompany one to confirm the payment received against a larger billing statement.

Design Principles and Usability for Optimal Record-Keeping

Effective design and thoughtful formatting are crucial for maximizing the usability and impact of any financial document, including a receipt template. The layout should prioritize clarity and ease of use, ensuring that both the issuer and the recipient can quickly understand the information presented. Whether intended for print or digital distribution, the form must be intuitive, professional, and visually accessible, adhering to principles that facilitate accurate record-keeping.

For optimal usability, consider the following design and formatting tips:

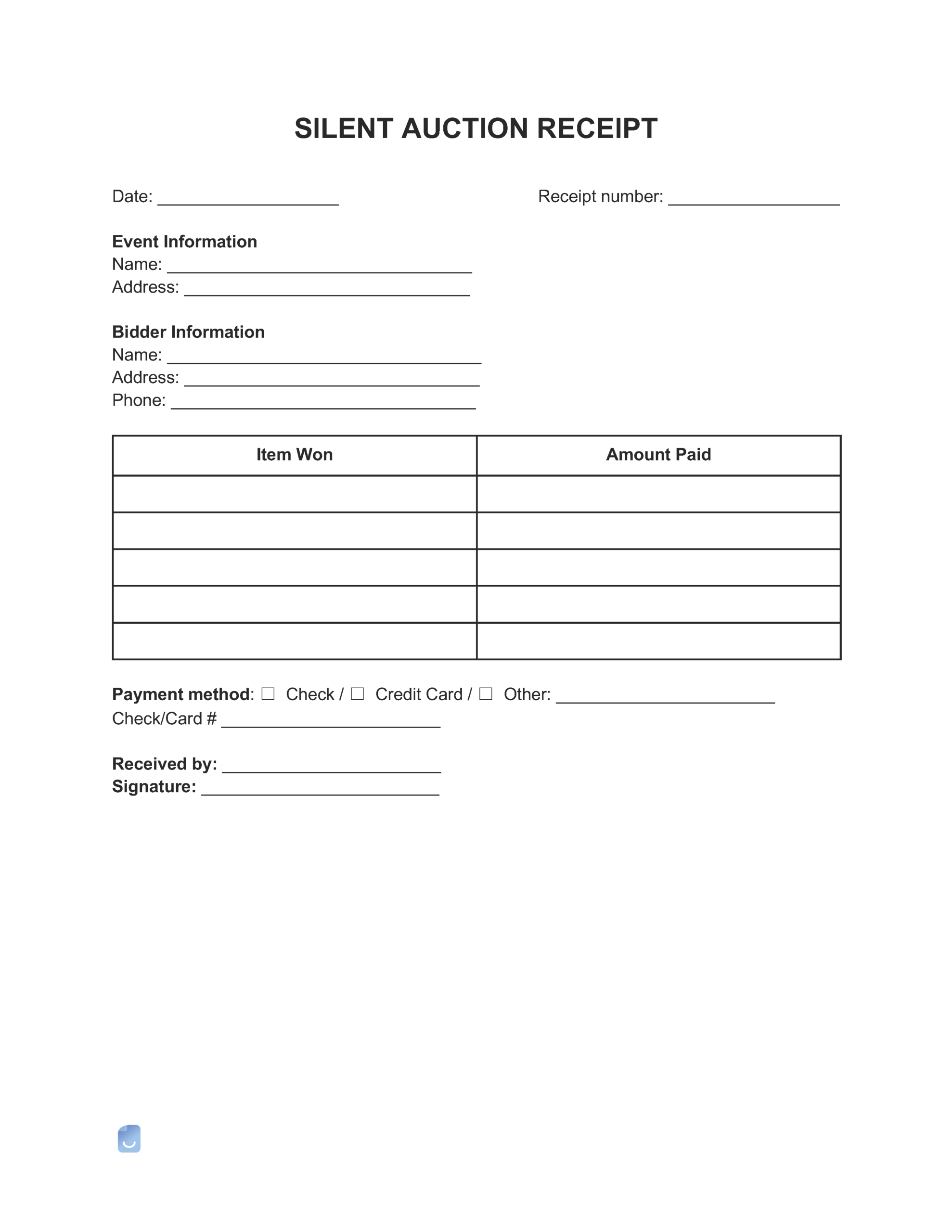

Clear Header and Branding

Begin with a prominent header that includes the organization’s logo, name, and contact information. This instantly brands the document and makes it easily identifiable. A clear title, such as “Official Receipt” or “Payment Acknowledgment,” sets the immediate context.

Essential Fields

Ensure the inclusion of all necessary data fields:

* **Receipt Number:** A unique identifier for tracking.

* **Date of Transaction:** When the payment was received.

* **Payer Information:** Name and contact details of the individual or entity making the payment.

* **Recipient Information:** The organization’s name and contact details.

* **Item/Service Description:** A clear, concise description of what was purchased or donated. For silent auctions, include the item number and a brief description.

* **Amount Received:** The total monetary value of the transaction.

* **Payment Method:** How the payment was made (e.g., cash, check, credit card).

* **Authorized Signature:** A space for the issuer’s signature or stamp for validation.

Legibility and Spacing

Utilize a clean, professional font that is easy to read. Adequate white space between fields and sections prevents the document from appearing cluttered and improves readability, particularly for printed versions.

Structured Layout

Organize information logically. Group related fields together, perhaps using distinct sections for payer details, transaction specifics, and payment summary. This enhances the overall flow and makes data retrieval more efficient.

Digital and Print Compatibility

Design the template to function seamlessly in both digital and print formats. For digital versions, ensure fields are fillable and the file is easily shareable (e.g., PDF format). For print, confirm that margins are appropriate and all content fits on standard paper sizes without cutting off information.

Instructions and Disclaimers

Include brief instructions if certain fields require specific input or provide clarity on the purpose of the receipt. Any relevant disclaimers, such as “This is not an invoice” or “Consult your tax advisor,” should be clearly stated, especially for donation-related documents.

Calculations and Totals

If the form involves multiple items, include clear subtotal, tax (if applicable), and total fields. For digital templates, consider incorporating automated calculations to minimize manual errors.

Color and Aesthetics

While maintaining professionalism, subtle use of organizational branding colors can enhance the visual appeal without being distracting. The overall aesthetic should reinforce the organization’s reputable image.

By adhering to these design principles, the resulting receipt becomes not just a record but a professional communication tool that reflects positively on the issuing organization and streamlines essential business documentation.

In conclusion, the strategic implementation of a well-designed receipt template is an act of proactive financial management, offering tangible benefits that extend across an organization’s operations. This singular document streamlines the often-complex process of transaction recording, transforming what could be a source of confusion into a clear, concise, and professional exchange. Its standardized format consistently delivers accuracy and promotes an unparalleled level of transparency in all financial dealings.

Ultimately, a robust financial template serves as a powerful testament to an organization’s commitment to accountability and integrity. By ensuring that every transaction, from a silent auction bid to a routine service payment, is meticulously documented, this tool not only protects against potential discrepancies but also builds a foundation of trust with donors, customers, and stakeholders. It is an indispensable asset, fostering efficiency, reinforcing reliability, and safeguarding the financial health and reputation of any entity that values precise and professional record-keeping.