In the intricate landscape of modern commerce, the meticulous documentation of financial transactions stands as a cornerstone of operational integrity and legal compliance. Whether operating a burgeoning small business, managing personal finances, or overseeing non-profit activities, the need for clear, accurate, and professional records is paramount. A well-designed small sales receipt template fulfills this critical requirement, providing a structured framework for acknowledging payments and detailing the exchange of goods or services.

This essential document serves a dual purpose, benefiting both the payer and the recipient by establishing a transparent and verifiable record of each transaction. For businesses, it reinforces professionalism, aids in financial reconciliation, and supports tax obligations. For customers, it offers peace of mind, serves as proof of purchase for returns or warranties, and contributes to personal expense tracking. The strategic implementation of such a template can significantly streamline administrative processes, minimize disputes, and foster an environment of trust and accountability.

The Imperative of Clear and Professional Business Documentation

Accurate financial documentation is not merely a bureaucratic formality; it is an indispensable element of sound business practice. Every transaction, regardless of its monetary value, represents a critical data point that contributes to a comprehensive financial narrative. Professional documentation, such as a precise payment receipt or a detailed sales record, provides an indisputable account of economic activity, fostering transparency and reducing ambiguity.

Without clear documentation, businesses risk discrepancies in accounting, potential legal complications, and an inability to accurately assess their financial health. Such forms serve as a critical component of business documentation, enabling comprehensive auditing, supporting tax filings, and ensuring adherence to regulatory standards. Moreover, a professional presentation of these records enhances a company’s credibility and demonstrates a commitment to operational excellence.

Key Benefits of Structured Templates for Financial Records

The adoption of a standardized small sales receipt template offers numerous advantages, fundamentally enhancing the accuracy, transparency, and consistency of record-keeping. Utilizing a predefined layout ensures that all pertinent information is captured uniformly across every transaction. This structured approach significantly reduces the likelihood of errors or omissions that can occur with ad-hoc documentation methods.

Consistency in record generation is vital for internal financial management and external auditing purposes. A template ensures that every sales record or service receipt contains the same categories of information, making reconciliation and analysis far more efficient. This standardized approach acts as a reliable proof of transaction, providing a clear audit trail for every payment receipt and contributing to robust financial integrity. The operational efficiencies gained by using a consistent financial template free up valuable time and resources, allowing businesses to focus on core activities rather than manual record creation.

Customizing the Template for Diverse Applications

The versatility of a small sales receipt template extends beyond simple merchandise sales, making it an adaptable financial template for a wide array of transactional contexts. Its fundamental structure, which details payer, recipient, date, amount, and purpose, can be readily modified to suit various specific needs. This adaptability makes the document an invaluable tool across different sectors and scenarios.

For service-based businesses, the layout can be customized to include detailed descriptions of services rendered, hourly rates, and project milestones. Landlords can adapt the form into a rent payment receipt, specifying the rental period and property address. Non-profit organizations can utilize it as a donation acknowledgment, providing donors with verifiable proof for tax purposes. Even individuals or small entities can use it for business reimbursements, documenting personal expenditures made on behalf of an organization. The core framework of the template is designed for flexibility, allowing businesses to tailor the content while maintaining a professional appearance.

When Using This Template is Most Effective

Utilizing a small sales receipt template is particularly effective in scenarios where a clear, concise, and professional proof of transaction is required without the complexity of a full invoice form or billing statement. Its focused design makes it ideal for immediate acknowledgment of payment and simple record-keeping.

The template proves most valuable in the following situations:

- Retail Transactions: For small businesses, pop-up shops, or market vendors, providing customers with an immediate, tangible sales record for their purchase.

- Service Deliveries: When a service, such as a consultation, repair, or personal training session, is paid for immediately upon completion.

- Rent Payments: Landlords issuing a payment receipt to tenants to confirm the receipt of rent for a specific period.

- Donations and Contributions: Non-profit organizations providing a donation acknowledgment to benefactors for their contributions, ensuring compliance for tax deductions.

- Independent Contractors: Freelancers or contractors receiving partial or full payment for their work, requiring a simple service receipt.

- Internal Expense Records: Documenting cash payments for business reimbursements or petty cash expenditures, contributing to accurate expense records.

- Peer-to-Peer Sales: Individuals selling items through online marketplaces or local classifieds, needing to provide the buyer with a basic payment confirmation.

- Temporary or Event-Based Sales: At events, fairs, or temporary kiosks where quick, on-the-spot documentation of sales is essential.

In each of these instances, the simplicity and clarity of the template ensure that all parties have an accurate and easy-to-understand record of the exchange.

Design, Formatting, and Usability Considerations

Effective design and thoughtful formatting are crucial for maximizing the usability and professionalism of any financial template, whether in print or digital format. A well-designed layout enhances readability, minimizes confusion, and projects a competent image. Key elements should be logically organized, ensuring that essential information is easily identifiable.

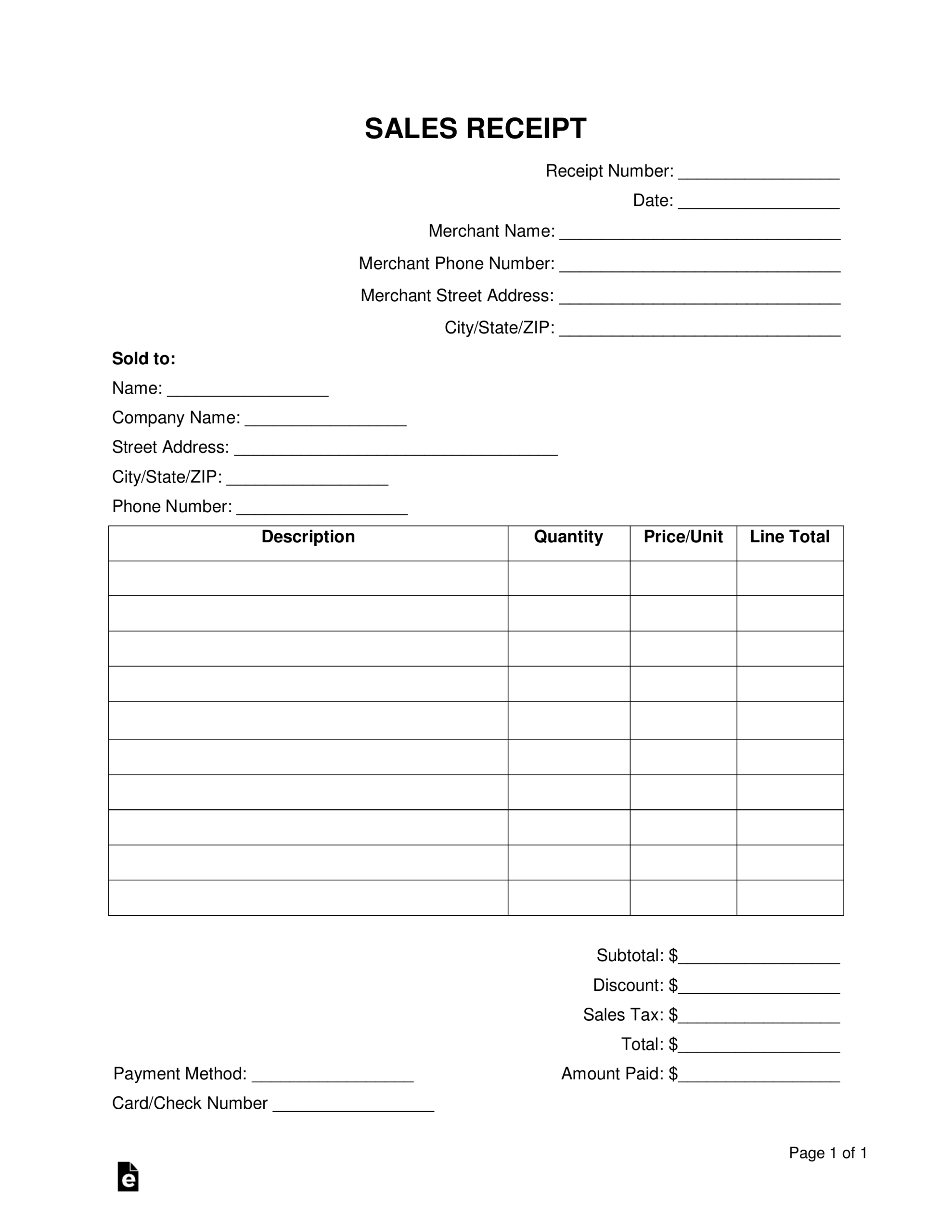

For print versions, consider a clean, uncluttered design with ample white space. Use legible fonts and appropriate font sizes to prevent eye strain. Incorporate fields for the business name, contact information, date of transaction, itemized list of goods or services, quantities, unit prices, total amount, payment method, and a unique receipt number. A dedicated space for signatures, if required, should also be included. High-quality paper stock for printed copies can further elevate the professional perception of the document.

For digital versions, accessibility and ease of use are paramount. The file should be easily shareable and compatible with common software (e.g., PDF, Word, Excel). Ensure that the document is fillable if intended for digital completion, with clear prompts for data entry. Consider responsive design elements if the template is to be accessed on various devices, ensuring it remains readable and functional across desktops, tablets, and smartphones. Implementing automated calculations for totals and taxes within the digital layout can significantly improve efficiency and reduce mathematical errors, making the template a truly powerful tool for accurate business documentation.

Optimizing the Template for Enhanced Efficiency

Beyond basic design, optimizing the template for efficiency involves considering how it integrates into broader business operations. For instance, pre-populating recurring information, such as business details and tax rates, saves time and ensures consistency. Implementing a sequential numbering system for each receipt helps in tracking and reconciliation, preventing duplicate entries and aiding in audit trails. This systematic approach transforms the document from a simple form into an integral component of an organized financial system.

Furthermore, integrating the template with digital tools, such as accounting software or customer relationship management (CRM) systems, can automate data entry and reporting. This seamless flow of information reduces manual workload, minimizes human error, and provides real-time insights into financial performance. Whether printed or digitally managed, the layout should prioritize quick data capture and easy retrieval, making it a reliable and efficient financial template for managing daily transactions.

The Enduring Value of a Reliable Financial Record

In summary, the strategic implementation of a small sales receipt template is an investment in the reliability, accuracy, and efficiency of a business’s financial operations. This fundamental financial template transcends its simple appearance, serving as a critical proof of transaction that safeguards both the business and its clientele. By standardizing the documentation process, it instills confidence, reduces administrative burdens, and provides an unassailable record for all financial engagements.

Its capacity for customization across a myriad of applications—from basic sales records and service receipts to rent payments and donation acknowledgments—underscores its universal utility. Embracing a well-designed and consistently applied template streamlines record-keeping, supports compliance, and fosters an environment of transparency essential for sustainable growth. Ultimately, this foundational document stands as a testament to professional integrity and meticulous financial stewardship in any operational context.