In the intricate landscape of modern financial management, the precise documentation of transactions stands as a cornerstone of integrity, compliance, and operational efficiency. For both individuals and organizations, the ability to accurately record monetary exchanges, particularly charitable contributions, is not merely a best practice; it is often a legal imperative. This article delves into the utility and importance of a well-structured tax donation receipt template, an indispensable tool designed to streamline the process of acknowledging financial or in-kind contributions while ensuring adherence to relevant tax regulations.

The primary purpose of such a template is to provide irrefutable proof of a transaction, a critical component for tax deductions, internal auditing, and maintaining transparent financial records. Whether you are a non-profit organization acknowledging gifts from generous donors or an individual seeking to itemize deductions, utilizing a robust tax donation receipt template empowers all parties with clarity and confidence. It facilitates clear communication regarding the nature and value of a contribution, mitigating potential disputes and simplifying end-of-year tax preparations for everyone involved.

The Indispensable Role of Clear and Professional Documentation

The bedrock of any sound financial operation, whether personal or corporate, rests upon meticulous and professional documentation. In an era where scrutiny from regulatory bodies and stakeholders is ever-present, the absence of clear records can lead to significant complications. Inadequate documentation can result in audit failures, legal disputes, financial penalties, and a severe erosion of trust. Conversely, well-maintained records provide an unassailable audit trail, offering transparency and accountability.

Every payment receipt, invoice form, or service record contributes to a comprehensive narrative of financial activities. These documents serve as tangible proof of transactions, establishing when, by whom, to whom, and for what purpose funds or assets were exchanged. Beyond mere compliance, professional documentation fosters an environment of trust, demonstrating a commitment to ethical practices and operational excellence. It allows for accurate financial reporting, facilitates budgeting, and supports strategic decision-making by providing reliable historical data.

Key Benefits of a Structured Tax Donation Receipt Template

Adopting a standardized layout for documenting contributions offers a multitude of advantages that extend beyond simple record-keeping. A well-designed template serves as a powerful instrument for enhancing accuracy, ensuring transparency, and promoting consistency across all financial transactions. It transforms what could be an administrative burden into a streamlined, efficient process, benefiting both the issuing entity and the recipient.

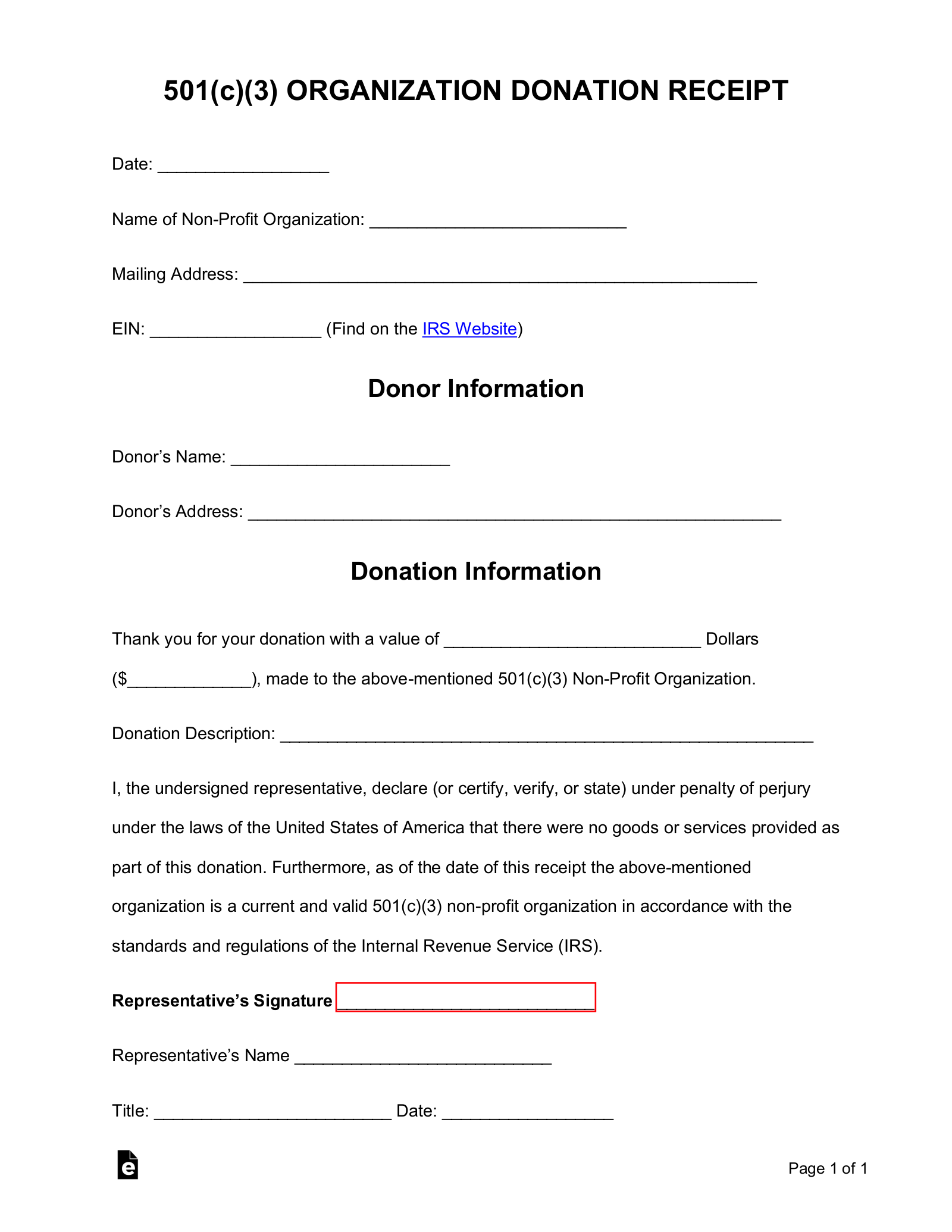

One of the foremost benefits is the assurance of accuracy. By clearly delineating fields for essential information—such as the donor’s name, organization details, date of donation, and value of the contribution—the template minimizes errors and omissions that can plague manual or ad-hoc record-keeping. This precision is vital for compliance with tax authorities like the IRS, which requires specific information for charitable contribution deductions. Furthermore, the inherent structure of the document promotes transparency, clearly detailing the nature of the transaction and leaving no room for ambiguity. This clarity protects both the donor and the organization, fostering a relationship built on trust and mutual understanding.

Consistency is another significant advantage. Using a unified layout ensures that every receipt issued follows the same format and includes the same essential data points. This uniformity simplifies internal auditing, makes it easier for donors to track their contributions, and presents a professional image of the organization. The template also significantly boosts efficiency, allowing for quicker generation of receipts, especially when integrated with digital systems. This automation frees up valuable staff time, enabling them to focus on core organizational missions rather than repetitive administrative tasks. Ultimately, the systematic use of this kind of financial template reinforces robust internal controls and strengthens overall financial governance.

Customization for Diverse Financial Needs

While the core functionality of a receipt template centers on acknowledging a transaction, its design is remarkably versatile and can be adapted to suit a wide array of financial documentation needs. The underlying principles of clearly identifying parties, specifying dates, detailing items or services, and stating monetary values remain consistent, allowing for broad applicability. This adaptability makes the template an invaluable asset for various businesses and entities, far beyond just charitable organizations.

For instance, a business might adapt the layout into a basic invoice form or a sales record for goods sold. Service providers can customize it to serve as a service receipt, detailing the work performed and the associated costs. Landlords can modify the form for rent payments, providing tenants with official proof of transaction. Even internal business documentation, such as expense record forms for employee reimbursements, can benefit from a structured and consistent format derived from the fundamental principles of a donation acknowledgment. The flexibility to incorporate specific legal disclaimers, organizational branding, or unique transactional details ensures that the document remains highly relevant and effective across a spectrum of financial interactions, all while maintaining its authoritative and professional tone.

Examples of When Using This Template Is Most Effective

The application of a well-designed financial template extends across numerous scenarios, providing critical documentation and streamlining operations. Its effectiveness is particularly pronounced in situations requiring clear proof of payment or acknowledgment of value transferred.

- Charitable Contributions (Monetary and In-Kind): Essential for non-profit organizations to issue to donors for tax deduction purposes, detailing cash gifts, stock donations, or the fair market value of donated goods.

- Sales of Goods or Services: Businesses can use it as a simplified payment receipt, confirming that a customer has paid for products purchased or services rendered, serving as an official sales record.

- Rental Payments: Landlords can provide tenants with official documentation of rent received, which is crucial for tenants’ personal financial records and for resolving any payment disputes.

- Business Expense Reimbursements: Companies can issue the form to employees as an expense record, acknowledging the reimbursement of business-related out-of-pocket costs, ensuring proper accounting.

- Service Provision Acknowledgments: Professionals (e.g., consultants, repair technicians) can use it to confirm the completion of services and receipt of payment, offering a clear service receipt to clients.

- Proof of Payment for Loans or Installments: For individuals or entities making regular payments, this document serves as an ongoing record, verifying that scheduled payments have been made on time.

- Membership Dues or Subscription Payments: Organizations that rely on recurring payments can issue the receipt to members or subscribers, confirming their payment and continued membership.

Design, Formatting, and Usability Best Practices

The efficacy of any financial document is heavily influenced by its design, formatting, and overall usability. A well-designed receipt template not only conveys information clearly but also projects professionalism and attention to detail. Key elements to consider for optimal performance include content structure, visual clarity, and adaptability for both digital and print environments.

Crucially, the layout must be logical and intuitive. Essential fields, such as the full legal name and contact information of both the payer and payee, the exact date of the transaction, a clear description of the item or service, and the precise monetary amount, should be prominently displayed. Including a unique receipt number or transaction ID is also vital for easy tracking and cross-referencing. For donation acknowledgments, specifying whether any goods or services were provided in exchange for the contribution, and their estimated value, is a critical IRS requirement that should be clearly addressed within the document.

Visual clarity is paramount. Employing professional, legible fonts, maintaining appropriate line spacing, and using a clean, uncluttered layout enhance readability and reduce the likelihood of misinterpretation. Branding elements, such as a company logo, can be subtly incorporated to reinforce identity, but they should not detract from the primary information. For digital versions, ensuring the file is easily shareable (e.g., PDF format) and, if editable, protected to prevent unauthorized alterations, is essential. For print, consider a layout that prints cleanly on standard paper sizes without excessive ink usage or truncation. Ultimately, the template should be straightforward to complete and easy for all parties to understand, serving its function as a reliable and accessible proof of transaction.

The Enduring Value of a Reliable Financial Template

In conclusion, the strategic implementation of a specialized financial template, whether utilized as a tax donation receipt template, a detailed invoice form, or a simple payment record, transcends mere administrative convenience. It represents a fundamental commitment to financial integrity, operational excellence, and robust compliance. Such a document serves as an authoritative proof of transaction, fortifying record-keeping practices for individuals and organizations alike, minimizing potential disputes, and ensuring accuracy in financial reporting.

By standardizing the acknowledgment process, the template not only saves valuable time and resources but also cultivates an environment of transparency and trust between all parties involved. Its adaptability across various financial contexts — from charitable giving to commercial transactions and expense reimbursements — underscores its universal utility as an indispensable tool for sound financial management. Embracing a professional and well-structured financial template is not merely about fulfilling obligations; it is about building a foundation of reliability and efficiency that underpins all successful financial endeavors.