In the intricate landscape of modern business operations and personal financial management, the meticulous recording of transactions is not merely a bureaucratic formality but a cornerstone of accountability and transparency. Every exchange of value, from major corporate acquisitions to minor everyday expenses, necessitates a clear, verifiable record. Among these, the seemingly simple taxi cab ride often represents a critical link in an individual’s or business’s financial chain, requiring proper documentation for expense tracking, reimbursement, and tax purposes.

A well-designed and consistently utilized taxi cab receipt template serves as an indispensable tool in this regard. It provides a standardized framework for capturing essential details of a transaction, ensuring that all necessary information is readily available for record-keeping, auditing, or dispute resolution. This systematic approach benefits not only the passenger, who needs proof of payment for expense reports or personal budgeting, but also the driver, who can maintain accurate records of services rendered, and the accounting departments of businesses, which rely on precise data for financial reporting and compliance. The adoption of such a template elevates a casual exchange into a professionally documented business interaction.

The Importance of Clear and Professional Documentation

The foundation of robust financial health, whether for an individual or an enterprise, lies in the clarity and professionalism of its documentation. In an era where regulatory compliance and financial scrutiny are paramount, vague or incomplete records can lead to significant complications, ranging from delayed reimbursements to audit discrepancies and potential legal challenges. A payment receipt is more than just a piece of paper; it is a definitive proof of transaction, a legally recognized record that verifies the exchange of goods or services for monetary value.

Professional documentation fosters an environment of trust and transparency. It ensures that all parties involved in a transaction have a shared understanding of its terms and execution. For businesses, this translates into streamlined accounting processes, easier reconciliation of accounts, and enhanced ability to generate accurate financial statements. An invoice form or a sales record, meticulously completed, mitigates errors, prevents fraud, and provides an undeniable audit trail, safeguarding assets and ensuring operational integrity. This commitment to precise record-keeping is a hallmark of sound business practice and financial prudence.

Key Benefits of Using Structured Templates

The strategic adoption of structured templates for financial records, such as a taxi cab receipt template, yields substantial benefits that extend far beyond mere administrative convenience. These documents are engineered to ensure accuracy, transparency, and consistency in record-keeping, which are vital attributes for any organization or individual managing expenses. By providing predefined fields for all critical information, a template significantly reduces the likelihood of human error, ensuring that crucial details are never overlooked or misrecorded.

Furthermore, a standardized layout promotes transparency. All necessary information—such as the date, time, fare breakdown, driver identification, and passenger details—is presented clearly and uniformly, making it easy for anyone reviewing the receipt to understand the transaction at a glance. This consistency streamlines the processing of expense reports, simplifies audits, and facilitates quick data entry into financial systems. Whether used as an expense record for an employee reimbursement or as a service receipt for internal tracking, the uniform nature of the template ensures that every record adheres to the same high standards, contributing to more reliable and efficient financial management.

Customization for Diverse Applications

While the primary utility of a taxi cab receipt template is evident for transportation services, the underlying principles of its structured design allow for remarkable adaptability across a spectrum of financial transactions. The fundamental architecture of capturing transaction specifics—who, what, when, where, and how much—can be easily customized to serve various other purposes, transforming it into a versatile financial template for different business needs.

For instance, adapting the fields can convert this basic framework into a robust invoice form for sales of goods, a service receipt for professional consultations, or even a detailed billing statement for recurring services. In non-commercial contexts, similar templates can be tailored as donation acknowledgments for charitable contributions, providing necessary documentation for tax deductions and donor relations. For rent payments, the layout could include property details, landlord information, and period covered. This inherent flexibility underscores the value of structured templates; they provide a foundation that can be specialized to meet the unique demands of virtually any financial documentation requirement, extending far beyond its initial application as a taxi cab receipt template.

When Using a Taxi Cab Receipt Template Is Most Effective

The precise and comprehensive documentation offered by a well-designed taxi cab receipt template proves invaluable in numerous scenarios, particularly when financial accountability and verifiable proof of transaction are paramount. Its utility shines brightest in situations demanding meticulous record-keeping for various stakeholders.

- Business Travel Reimbursement: Employees frequently utilize taxi services for business travel. A standardized taxi cab receipt template ensures that all necessary information—date, fare, origin, destination, and driver details—is captured for seamless submission and approval of expense reports, preventing delays or disputes.

- Tax Deductions and Filings: For individuals or businesses claiming transportation expenses as tax deductions, official receipts are mandatory. The template provides a clear, organized document that substantiates these claims, crucial during audits or tax assessments.

- Personal Budgeting and Expense Tracking: Individuals aiming for better financial control can use these receipts to track their transportation spending accurately, aiding in personal budgeting and identifying areas for potential savings.

- Dispute Resolution: In instances of billing discrepancies or service issues, a detailed receipt serves as concrete proof of the transaction, detailing the amount paid and services rendered, which can be critical for resolving disputes effectively.

- Internal Accounting and Auditing: Businesses require consistent financial documentation for internal accounting purposes, reconciling accounts, and preparing for external audits. The uniform nature of the document simplifies these processes considerably.

- Driver Record Keeping: For independent taxi operators or ride-share drivers, the template facilitates personal record-keeping of fares earned, helping them manage their income, track working hours, and fulfill tax obligations.

- Customer Service and Feedback: Offering a clear, detailed receipt enhances customer service by providing passengers with a tangible record of their journey, fostering trust and demonstrating professionalism.

Design, Formatting, and Usability Tips

The effectiveness of any financial template hinges significantly on its design, formatting, and overall usability. A well-crafted layout not only ensures that all critical information is captured but also makes the document easy to read, understand, and process for both print and digital versions. The aesthetic and functional attributes contribute directly to its reliability as a business documentation tool.

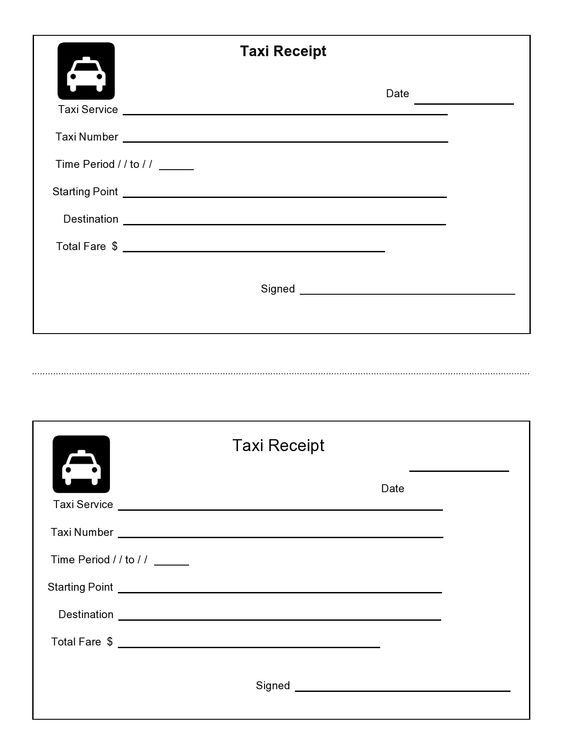

For optimal design, consider incorporating a professional header that includes the company logo, name, address, and contact information. This instantly brands the receipt and lends credibility. Essential fields must be clearly labeled and positioned logically: date and time of service, pick-up and drop-off locations, total fare with a breakdown of components (base fare, surcharges, tips), payment method, and a unique receipt number or transaction ID for easy tracking. Driver identification, such as a name or license number, is also crucial for accountability.

Formatting should prioritize legibility. Use clear, sans-serif fonts that are easy to read at a glance. Adequate white space between sections prevents the receipt from appearing cluttered. Bold text can be used sparingly to highlight key figures like the total amount. For digital versions, ensure the file is easily shareable (e.g., PDF format), responsive for viewing on various devices, and potentially includes interactive fields if it’s meant for digital input. Consider accessibility standards to ensure the document is usable by individuals with disabilities. A well-thought-out design transforms the receipt from a mere record into an efficient and professional component of your financial workflow, whether it’s a simple payment receipt or a comprehensive billing statement.

Concluding Thoughts on Robust Financial Templates

The strategic implementation of a specialized financial template, initially conceived as a taxi cab receipt, stands as a testament to the power of structured documentation in fostering clarity, accuracy, and efficiency across all financial interactions. Beyond its direct application, the principles it embodies—standardization, comprehensive data capture, and verifiable proof of transaction—are universally applicable and profoundly beneficial. This commitment to precise record-keeping is not merely an administrative convenience; it is a fundamental pillar of sound financial management, empowering individuals and organizations to navigate their monetary affairs with confidence and control.

Ultimately, the deployment of such a reliable and efficient financial record tool contributes significantly to operational excellence and robust accountability. By ensuring that every transaction, no matter how minor, is meticulously documented, businesses and individuals can streamline their expense management, simplify auditing processes, and uphold the highest standards of financial transparency. The enduring value of a well-designed financial template lies in its capacity to transform potentially chaotic data into an organized, actionable record, serving as an indispensable asset in the pursuit of financial integrity and effective business communication.