In the intricate landscape of modern business, the clear and consistent documentation of financial transactions stands as a cornerstone of operational integrity and fiscal responsibility. A uniform receipt template is not merely a formality; it is a critical instrument designed to standardize the acknowledgment of payments, services rendered, or goods exchanged. By providing a consistent format for capturing essential transaction details, it serves as a reliable record for both the issuer and the recipient.

The primary purpose of such a template is to foster clarity, ensure accuracy, and streamline record-keeping processes across various business operations. It benefits a broad spectrum of stakeholders, from small business owners meticulously tracking daily sales to large corporations managing complex financial audits. Customers gain clear proof of purchase, while accounting departments find their reconciliation tasks significantly simplified, ultimately contributing to a more transparent and efficient business ecosystem.

The Imperative of Clear and Professional Documentation

Professional documentation is more than just a paper trail; it is the backbone of financial integrity and legal compliance for any entity. Every transaction, regardless of its size or nature, contributes to the overall financial health and operational narrative of a business. Clear records provide an irrefutable account of events, mitigating potential disputes and safeguarding against misunderstandings between parties.

Well-structured documentation, such as a standardized payment receipt, forms the basis for accurate financial reporting, tax declarations, and internal audits. It instills confidence in clients and partners by demonstrating a commitment to transparency and professionalism. Furthermore, in the event of legal challenges or discrepancies, detailed business documentation becomes an invaluable resource, providing objective evidence of agreements and exchanges.

Core Benefits of a Structured Template

Employing a uniform receipt template offers a multitude of strategic advantages that extend far beyond mere administrative convenience. Its structured nature is fundamental to enhancing accuracy, promoting transparency, and ensuring consistency across all financial interactions. This standardization simplifies complex processes, making them more reliable and less prone to human error.

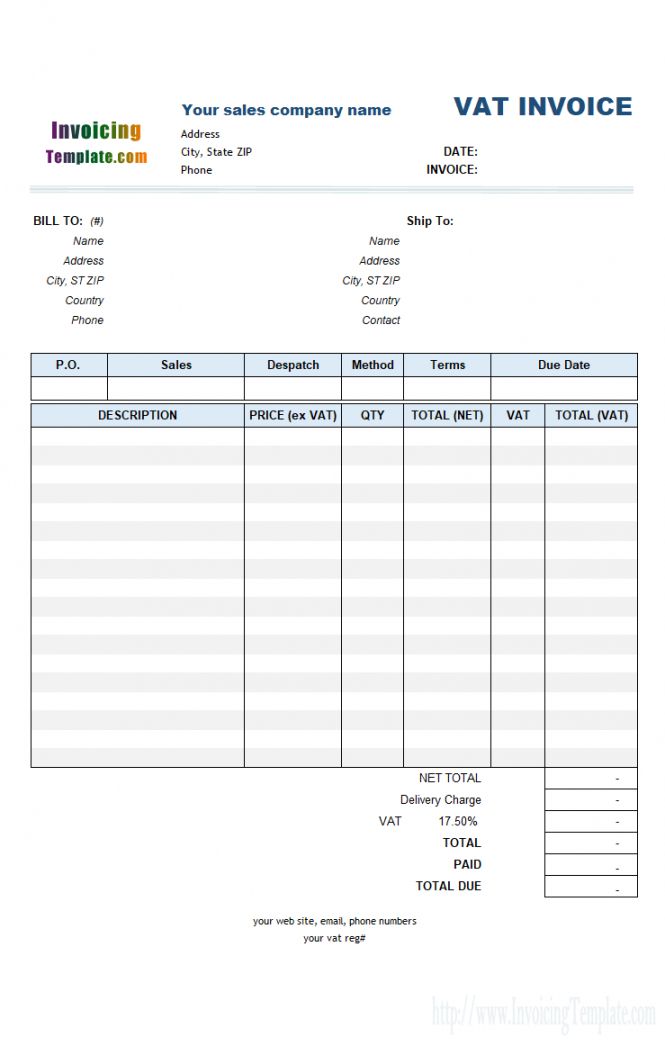

Accuracy and Reliability: A predefined structure minimizes the risk of omitting crucial information, ensuring that every necessary field, from transaction ID to tax breakdowns, is consistently captured. This precision is vital for correct accounting and financial reconciliation.

Transparency and Trust: Clear and detailed receipts provide an unequivocal record for both parties, fostering trust and transparency in all business dealings. Customers appreciate a legible and comprehensive proof of transaction, which helps them track their own expenditures.

Consistency and Branding: A standardized layout ensures a professional and consistent brand image across all customer touchpoints. This uniformity reinforces the company’s identity and commitment to quality, irrespective of the transaction type or location.

Operational Efficiency: Templates significantly expedite the process of generating receipts, saving valuable time for employees and customers alike. This efficiency translates into smoother operations and improved customer service, especially during peak transaction periods.

Compliance and Audit Readiness: Adhering to a consistent format simplifies the aggregation of financial data, making it easier to comply with regulatory requirements and prepare for internal or external audits. It ensures that all necessary data points are readily available for scrutiny.

Versatility and Customization Across Applications

The inherent adaptability of this form allows it to transcend its basic function as a simple proof of purchase, making it an invaluable tool across a diverse range of business activities. While the fundamental structure of the document remains consistent, key elements can be tailored to suit specific operational requirements, ensuring its relevance and efficacy in various contexts. This flexibility ensures that the template can be utilized without extensive redesigns for each new application.

For instance, a sales record for retail goods will emphasize product codes, quantities, and unit prices, whereas a service receipt might detail labor hours, specific tasks performed, and material costs. Non-profit organizations can adapt it into a donation acknowledgment, including donor information and tax-deductible amounts. Similarly, property management firms can customize it for rent payments, clearly indicating the period covered and any outstanding balances. The core layout provides a robust framework upon which specific industry or organizational needs can be layered, incorporating unique fields or sections as required. This customization often includes integrating company logos, specific terms and conditions, or even specialized data fields essential for regulatory compliance within a particular sector.

Effective Applications of This Form

The utility of a robust receipt template extends across numerous scenarios, serving as an indispensable tool for accurate record-keeping and customer satisfaction. Its structured nature makes it ideal for environments where consistent documentation is paramount. Below are several key instances where employing this template proves most effective:

- Retail Sales Transactions: Providing customers with a detailed

payment receiptat the point of sale, outlining items purchased, prices, taxes, and the total amount paid. This is crucial for returns, exchanges, and personal budgeting. - Service-Based Businesses: Issuing a

service receiptafter completing a job, such as IT support, plumbing, or consulting, detailing the services provided, labor charges, and any parts used. This clarifies the scope of work and associated costs. - Rental Property Management: Documenting

rent paymentsfor tenants, which serves as a vitalproof of transactionfor both the landlord and the renter, aiding in dispute resolution and tax preparation. - Charitable Organizations: Generating a

donation acknowledgmentfor contributions received, providing donors with essential documentation for tax deductions and confirming their support. - Business Expense Reimbursements: Employees submitting

expense recordsfor business-related outlays require clear receipts to justify their reimbursements, ensuring transparency and accountability within organizational budgets. - Freelance and Consulting Work: Presenting clients with a comprehensive

billing statementorinvoice formthat itemizes services rendered, project milestones, and total fees due upon completion of a project or service period. - Online and E-commerce Transactions: Automatically generating and emailing

digital receiptsthat confirm purchases, shipping details, and order numbers, which is critical for customer service and tracking.

Design, Formatting, and Usability Best Practices

The efficacy of any financial template hinges not only on its content but also on its design and usability. A well-designed receipt is easy to read, comprehend, and process, whether in print or digital format. Strategic considerations in layout and formatting can significantly enhance the user experience and the overall utility of the document.

Clarity and Readability: Prioritize legible fonts, appropriate font sizes, and ample white space to prevent visual clutter. Information should be logically grouped, with headings and subheadings used to guide the eye through the document. This ensures that key details can be quickly identified.

Essential Fields Inclusion: Ensure the layout prominently features all critical information: the transaction date and time, unique receipt or transaction ID, names of the payer and payee, a clear itemized list of goods or services, quantities, unit prices, any applicable taxes, discounts, the total amount due, and the payment method used. Incorporating contact information for customer support is also highly beneficial.

Branding Consistency: Integrate company logos, colors, and branding elements subtly and professionally. This reinforces brand identity and ensures the receipt looks official and trustworthy. Consistent branding aids in immediate recognition and builds corporate credibility.

Digital Considerations: For electronic versions, ensure the file is in a universally accessible format like PDF. Optimize the layout for various screen sizes, including mobile devices, ensuring it remains readable and easy to navigate. Consider features like clickable links to websites or customer support.

Print Considerations: If the template will be printed, design it to fit standard paper sizes (e.g., Letter, A4) efficiently, minimizing paper waste. Use colors that translate well from digital to print, and ensure bar codes or QR codes, if included, are clear and scannable. The layout should also be ink-friendly, avoiding heavy graphics that consume excessive toner.

Accessibility: Design with accessibility in mind, using high contrast text and offering alternative formats if necessary. Clear, concise language should be used throughout, avoiding jargon where possible to ensure all users can understand the information presented in the file.

Conclusion

In conclusion, the strategic implementation of a uniform receipt template is an indispensable practice for any organization committed to precision, transparency, and operational excellence. It transcends the basic function of a simple acknowledgment, evolving into a sophisticated tool that underpins robust financial management and fosters trust with all stakeholders. This commitment to standardized documentation ultimately translates into enhanced efficiency, mitigated risks, and a stronger foundation for sustained business growth.

By providing a clear, consistent, and comprehensive record of every transaction, this form solidifies financial integrity and simplifies complex administrative tasks. It empowers businesses to maintain impeccable records, comply with regulatory mandates, and build enduring relationships with their clientele based on clarity and accountability. The continuous use of such a reliable and accurate financial template is not merely a best practice; it is a fundamental requirement for navigating the complexities of the modern commercial landscape with confidence and authority.