A precise and legally compliant vehicle donation receipt template serves as an indispensable tool for both charitable organizations and generous donors. This structured document provides official acknowledgment of a non-cash contribution, facilitating proper record-keeping and ensuring adherence to tax regulations set forth by the Internal Revenue Service (IRS). Its primary purpose is to clearly document the transaction, offering tangible proof of the donation for all parties involved.

For donors, this document is crucial for claiming potential tax deductions, as it substantiates the contribution amount and provides necessary details for tax filing. Charities, on the other hand, rely on such a template to maintain accurate financial records, demonstrate transparency to their stakeholders, and comply with their own reporting obligations. The clarity and professionalism embedded within a well-designed vehicle donation receipt template underscore the integrity of the transaction and the organization.

The Indispensable Role of Clear Financial Documentation

In any financial or business transaction, clear and comprehensive documentation is not merely a formality; it is a fundamental requirement for accountability and transparency. Whether dealing with a sales record, a payment receipt, or a significant charitable contribution, robust documentation provides an undeniable proof of transaction. It eliminates ambiguities, minimizes disputes, and establishes a reliable historical account of activities.

For non-profit organizations, maintaining meticulous business documentation is even more critical, particularly when dealing with donations that carry tax implications for the giver. An official donation acknowledgment is a cornerstone of this process, assuring donors that their contributions are recognized and handled with the utmost professionalism. It also acts as a vital component in internal audits and external compliance reviews, validating the organization’s financial practices.

Core Benefits of Utilizing a Structured Vehicle Donation Receipt Template

Adopting a standardized vehicle donation receipt template offers a multitude of advantages, significantly enhancing the efficiency and reliability of an organization’s administrative processes. A pre-defined layout ensures that all necessary information is captured consistently for every transaction, eliminating the risk of overlooked details that could cause complications later. This structured approach fosters a culture of accuracy in record-keeping.

Furthermore, the use of a unified template promotes transparency for both the donor and the receiving organization. It clearly outlines the details of the donated asset, the date of contribution, and relevant organizational information, leaving no room for misinterpretation. This level of clarity builds trust and confidence, essential elements in philanthropic relationships. Consistent application of the template also streamlines the process of generating financial reports and responding to inquiries from tax authorities or auditors, proving invaluable for maintaining operational integrity and audit readiness. A properly executed vehicle donation receipt template thus serves as a powerful instrument for operational excellence and regulatory compliance.

Adaptability: Customizing This Essential Form for Various Transactions

While specifically designed for vehicle donations, the fundamental structure of a well-developed receipt template is remarkably versatile and can be adapted for a wide array of financial acknowledgments. The underlying principles of documenting transaction details, parties involved, and the value exchanged remain constant across different scenarios. This inherent flexibility makes such a layout a foundational element for various business documentation needs.

For instance, the core components can be readily adjusted to create a payment receipt for goods or services rendered, effectively serving as an invoice form or a service receipt. It can be modified to function as a billing statement for ongoing services or even an expense record for internal company reimbursements. By simply altering the descriptive fields and headings, the same organizational clarity and professional appearance can be applied to diverse financial templates, ensuring a uniform approach to documentation across an entity’s operations. This adaptability underscores the strategic value of investing in a high-quality vehicle donation receipt template.

When and Where This Template Proves Most Effective

The application of a well-designed receipt goes beyond its primary role, extending to various scenarios where formal acknowledgment of a transaction is paramount. Its structured nature ensures that all critical details are consistently captured, providing an undisputed record. Here are several instances where utilizing this template, or an adapted version of it, is most effective:

- Vehicle Donations: This is the most direct application, where a donor contributes an automobile, boat, motorcycle, RV, or even an aircraft to a qualified charity. The template provides the necessary details for the donor’s tax deduction and the charity’s compliance.

- Other Non-Cash Charitable Contributions: While designed for vehicles, the template’s structure can be adapted to acknowledge other significant non-cash donations, such as real estate, valuable art, or publicly traded securities, with appropriate modifications to asset descriptions.

- General Payment Receipts: Businesses often require a clear payment receipt for services or products. The template can be modified to serve as a sales record, providing proof of purchase and payment for customers and internal accounting.

- Service Transaction Documentation: When a service is provided, and payment is received, a comprehensive service receipt can be generated from the template’s framework, detailing the service performed, date, cost, and payment method.

- Proof of Reimbursement: For internal business processes, such as employee expense records or reimbursements, a modified version of this form can act as an official acknowledgment that funds have been disbursed and received for legitimate business expenditures.

- Rent Payments and Lease Deposits: Landlords can adapt the template to issue rent payment receipts or acknowledge security deposits, providing tenants with formal proof of payment and maintaining clear financial records.

- High-Value Transactions: For any transaction involving a substantial amount of money or significant assets, employing a detailed proof of transaction ensures transparency and legal defensibility for both parties.

In each of these examples, the core benefit remains the same: the creation of a clear, verifiable, and professional record that supports financial integrity and simplifies administrative tasks.

Design, Formatting, and Usability Best Practices for Your Receipt

The effectiveness of any financial template hinges not just on its content but also on its design, formatting, and overall usability. A well-designed receipt should be intuitive, professional, and easy to complete, whether in print or digital format. Clarity is paramount; use clear headings and logical field arrangements to guide users through the document.

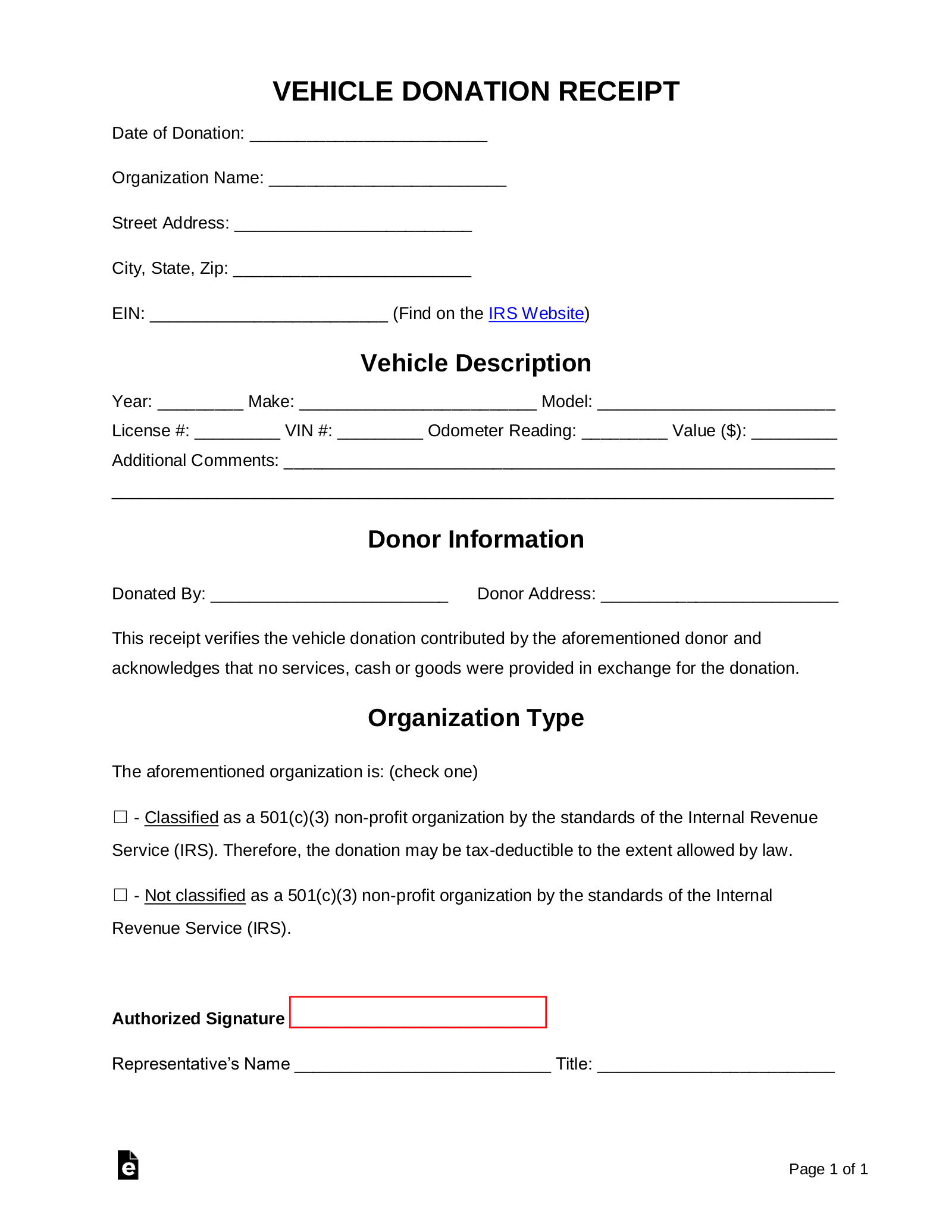

For print versions, ensure ample space for written entries and signatures, utilizing a legible font size and clean layout. Consider incorporating the organization’s logo and branding elements to reinforce professionalism and authenticity. For digital iterations, such as fillable PDFs or online forms, prioritize user-friendly input fields and automated calculations where appropriate. Digital versions should also be easily savable, shareable, and printable, allowing for convenient record-keeping and transmission. Essential fields to include are: the full legal name and contact information of the donor and the organization, the date of donation, a detailed description of the vehicle (make, model, VIN, year), an acknowledgment of the IRS substantiation requirements, and authorized signatures from the receiving charity. Robust design and thoughtful formatting significantly contribute to the template’s reliability as a critical piece of business documentation.

Conclusion

In the complex landscape of financial transactions and charitable giving, the value of a meticulously crafted receipt template cannot be overstated. It stands as a testament to an organization’s commitment to transparency, accuracy, and regulatory compliance. By standardizing the acknowledgment process, organizations not only streamline their operations but also foster greater trust and confidence with their donors and stakeholders.

This indispensable form transcends its immediate purpose, proving itself as a versatile financial template adaptable to numerous documentation needs. Its structured nature ensures that vital information is consistently captured, forming a reliable proof of transaction for everything from charitable contributions to business reimbursements. Ultimately, a well-implemented template serves as a cornerstone of sound financial management, reinforcing the integrity and professionalism of any entity that utilizes it.