Effective financial record-keeping is a cornerstone of responsible business operation and personal fiscal management. Among the myriad documents essential for this purpose, the humble receipt stands as a fundamental proof of transaction. For businesses, professionals, and individuals alike, a well-structured receipt ensures clarity, accuracy, and accountability. This article delves into the critical role of a standardized vet receipt template, exploring its purpose, inherent benefits, and how it serves as an indispensable tool for maintaining transparent and professional financial documentation in various contexts.

A robust vet receipt template streamlines the process of issuing and receiving financial acknowledgments, providing a uniform framework for recording essential transactional details. This systematic approach benefits not only the issuer by simplifying administration and compliance but also the recipient by offering a clear, verifiable record of their expenditure or payment. Such a template becomes particularly invaluable in scenarios demanding meticulous expense tracking, tax preparation, or dispute resolution, fostering trust and efficiency across all interactions.

The Imperative of Meticulous Financial Documentation

In the modern financial landscape, the clarity and integrity of business documentation are non-negotiable. Every financial transaction, irrespective of its scale, necessitates a precise and professional record. This is not merely a matter of good practice; it is fundamental to legal compliance, financial auditing, and the overall credibility of an entity. A properly issued payment receipt serves as incontrovertible proof of transaction, safeguarding both parties involved against potential misunderstandings or discrepancies.

Beyond legal and compliance requirements, transparent documentation builds confidence and trust. For businesses, clear billing statements and service receipts reflect professionalism and attention to detail, enhancing client relationships. For individuals, robust expense records are crucial for budgeting, tax deductions, and personal financial management. The absence of such detailed records can lead to significant operational inefficiencies, financial inaccuracies, and even legal complications, underscoring the critical need for structured financial templates.

Core Benefits of a Structured Receipt Template

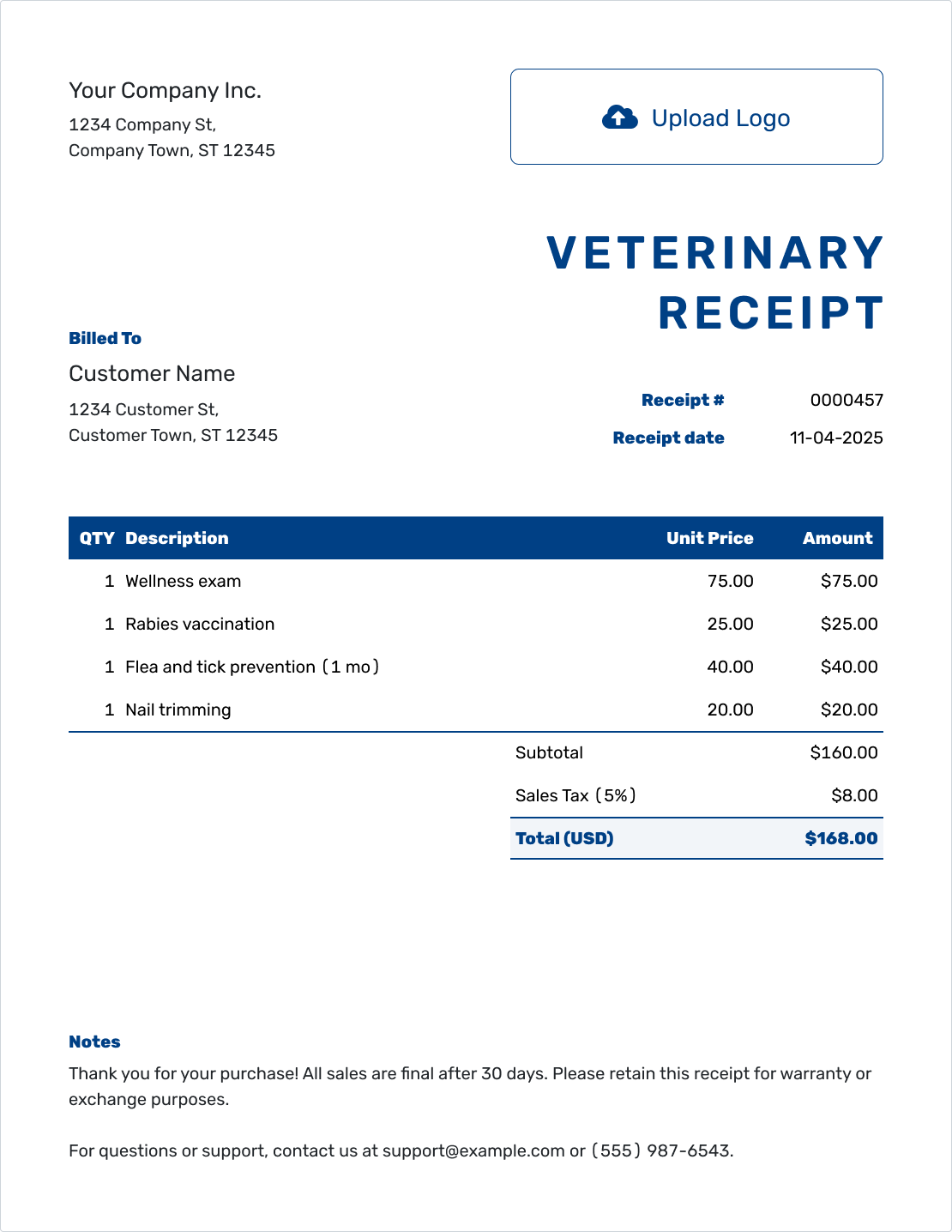

Utilizing a standardized vet receipt template offers a multitude of advantages that extend beyond mere record-keeping. Primarily, it ensures unparalleled accuracy and consistency in financial reporting. By providing predefined fields for all necessary information, it minimizes the risk of omissions or errors, which are common with ad-hoc documentation. This systematic approach guarantees that every transaction is captured with precision, from the date and amount to the specific goods or services rendered.

Furthermore, a structured receipt template promotes transparency, fostering an environment of openness and clarity in all financial dealings. Both the issuer and the recipient possess an identical, unambiguous record, which is invaluable for dispute resolution and internal auditing. This consistency also significantly streamlines accounting processes, enabling quicker data entry, reconciliation, and financial analysis. Ultimately, adopting such a robust financial template contributes to more efficient operations and more reliable financial oversight.

Customization for Diverse Transactional Needs

The versatility of a well-designed vet receipt template extends its utility far beyond its initial conception. While originally tailored for specific veterinary contexts, this foundational structure can be readily customized to accommodate a broad spectrum of transactional needs. Its adaptable framework makes it an invaluable asset for various financial interactions, demonstrating its applicability across different sectors and purposes.

For instance, this robust template can be transformed into a detailed invoice form for sales of goods, incorporating itemized lists, unit prices, and total amounts. Similarly, it functions effectively as a service receipt for professional fees, clearly delineating services performed and associated costs. Its adaptability also makes it suitable for rent payments, providing tenants with clear proof of their monthly contributions, or as a donation acknowledgment for non-profit organizations, ensuring transparency for charitable contributions. The inherent flexibility of this document design allows businesses to maintain a uniform yet adaptable system for all their financial documentation, enhancing efficiency and professional presentation.

Optimal Scenarios for Utilizing a Receipt Template

The application of a standardized receipt template is most effective in scenarios where clear, verifiable financial records are paramount. Its structured nature ensures that all necessary details are captured consistently, providing irrefutable proof of transaction. Here are several instances where utilizing the template proves highly beneficial:

- Veterinary Practices: When pet owners make payments for consultations, treatments, medications, or surgical procedures, a detailed vet receipt template provides a clear breakdown of costs, serving as an essential expense record for personal budgeting or insurance claims.

- Retail Sales: For any business selling products, this form can function as a sales record, itemizing purchases and total costs, which is crucial for inventory management and customer service.

- Service-Based Businesses: Professionals offering services, such as consultants, therapists, or independent contractors, can use the document to issue service receipts, detailing the work performed and the fees charged, ensuring transparency for clients.

- Rental Payments: Landlords can provide tenants with this receipt to acknowledge rent payments received, establishing a clear financial trail for both parties and preventing disputes.

- Charitable Donations: Non-profit organizations can adapt the layout to create donation acknowledgments, essential for donors seeking tax deductions and for the organization’s financial transparency.

- Business Reimbursements: Employees submitting expense reports for business travel, meals, or supplies require clear proof of transaction; this file offers a standardized format for submitting these expense records to their employers.

- Online Transactions: Even for digital payments, a virtual version of the receipt can be generated and sent via email, providing immediate proof and an electronic financial template for reference.

In each of these examples, the consistency and clarity offered by a structured receipt prevent misunderstandings, streamline record-keeping, and uphold professional standards.

Design and Usability Considerations for Effective Documentation

The effectiveness of any financial document, including a receipt, hinges significantly on its design and usability. A well-designed layout is not only aesthetically pleasing but also enhances readability and ensures that critical information is easily identifiable. When developing or customizing this form, several key considerations should guide the process, catering to both print and digital applications.

Firstly, clarity and conciseness are paramount. The document should feature a clean, uncluttered design, utilizing ample white space to prevent information overload. Essential fields such as transaction date, amount, issuer details, recipient details, and a clear description of goods or services should be prominently displayed. Utilizing a logical flow for information, perhaps from top-left to bottom-right, can guide the eye and improve comprehension.

Branding elements, such as a company logo and contact information, should be strategically placed to reinforce professionalism and brand identity without distracting from the core financial details. Employing legible fonts and appropriate font sizes is crucial for accessibility, ensuring that the receipt can be easily read by all users, regardless of whether it’s a printed copy or a digital file viewed on various devices.

For digital versions, consider aspects like file format (e.g., PDF for universal compatibility and preservation of layout), responsiveness for viewing on mobile devices, and ease of digital distribution. Including unique transaction identifiers or reference numbers is also vital for both print and digital formats, facilitating quick retrieval and cross-referencing within accounting systems. Finally, ensuring that the template is easy to fill out, whether manually or digitally, contributes significantly to its overall usability and adoption. A user-friendly financial template minimizes errors and saves time for both the issuer and the recipient.

Conclusion

The strategic implementation of a well-crafted receipt template transcends mere administrative convenience; it embodies a commitment to financial accuracy, transparency, and professional integrity. From managing the nuanced specifics of a veterinary practice to simplifying diverse financial transactions across various industries, the template provides a robust framework for documenting every exchange. Its consistent application mitigates risks associated with financial disputes, streamlines accounting operations, and enhances the overall credibility of financial interactions.

Ultimately, this document serves as an indispensable tool for anyone seeking to maintain meticulous financial records. Its adaptability across different payment receipts—whether for sales, services, donations, or reimbursements—underscores its universal value as a reliable, accurate, and efficient financial record tool. Embracing a standardized approach to receipt generation is a testament to sound business practice and a fundamental step toward achieving comprehensive financial oversight and trust in all dealings.