In the realm of financial record-keeping, the importance of accurate and professional documentation cannot be overstated. For individuals and organizations alike, maintaining precise records of monetary transactions is not merely a best practice; it is often a legal and ethical imperative. This principle holds particularly true for charitable contributions, where both the donor seeking tax deductions and the recipient organization upholding transparency rely on clear, verifiable proof of transaction.

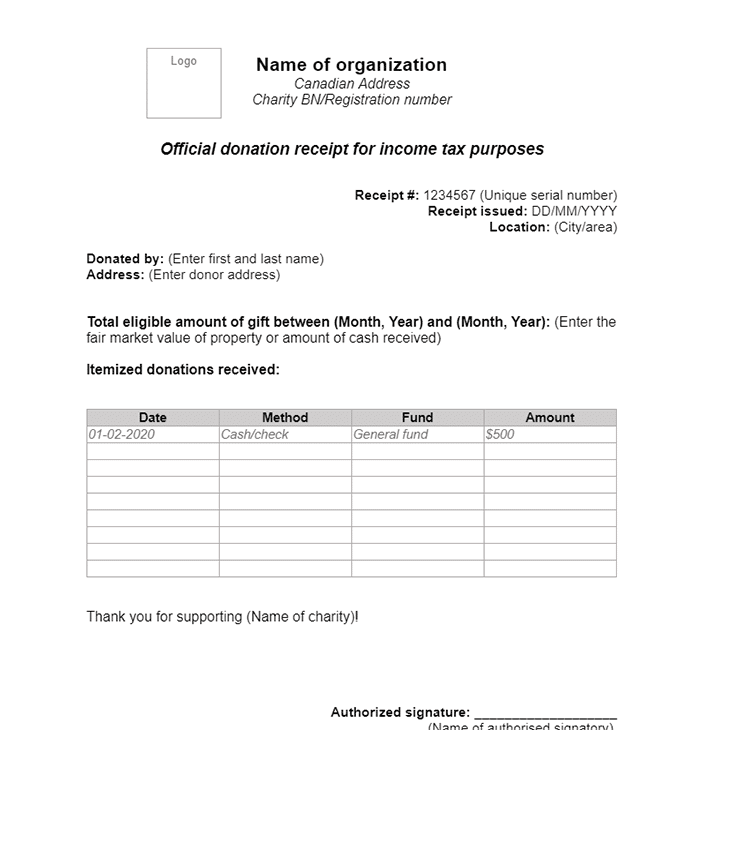

This article delves into the critical role and practical application of a robust year end donation receipt template. Designed to streamline the process of acknowledging contributions, this essential business documentation serves as a definitive record for donors, enabling them to substantiate their charitable giving for tax purposes. For non-profit entities, it provides a consistent, professional method for issuing donation acknowledgments, thereby fostering trust, ensuring compliance, and enhancing overall operational efficiency. Its utility extends across various financial interactions, establishing a standardized approach to confirming payments and transfers.

The Indispensable Value of Clear and Professional Documentation

The bedrock of any sound financial operation, whether personal or corporate, rests on meticulously maintained documentation. Clear and professional records are not just an administrative convenience; they are fundamental to financial integrity, accountability, and legal compliance. Every payment receipt, invoice form, and sales record contributes to a comprehensive financial narrative, offering an undeniable proof of transaction.

In a world increasingly scrutinized by regulatory bodies and auditors, ambiguity in financial records can lead to significant complications. Professional business documentation mitigates risks associated with misinterpretations, disputes, and potential legal challenges. It serves as an authoritative reference point, validating the flow of funds and the nature of each transaction. For charitable organizations, particularly, transparent record-keeping through documents like a year end donation receipt template reinforces their commitment to ethical governance and public trust, demonstrating their accountability to donors and stakeholders alike. This meticulous approach ensures that all parties involved possess accurate information for their respective record-keeping and reporting obligations.

Key Benefits of Structured Templates for Financial Records

Utilizing structured templates for financial records, such as a dedicated year end donation receipt template, offers a multitude of benefits that extend far beyond mere convenience. These templates are meticulously designed to ensure accuracy, foster transparency, and maintain unwavering consistency in record-keeping practices. By standardizing the information captured for each transaction, they eliminate common errors associated with manual data entry and inconsistent formats.

One of the primary advantages is the enhancement of accuracy. A predefined layout prompts users to include all necessary details, from donor information and donation amount to the date of contribution and the organization’s tax identification number. This structured approach significantly reduces the likelihood of omissions or inaccuracies that could lead to discrepancies in financial statements or issues during audits. Furthermore, the inherent design of a well-crafted template promotes transparency. By presenting information in a clear, organized manner, it makes the transaction details easily understandable and verifiable for both internal stakeholders and external parties, such as donors and regulatory bodies. This clarity builds confidence and trust, essential elements in any financial relationship.

Consistency is another critical benefit. When every donation acknowledgment or service receipt adheres to the same format, it creates a uniform repository of financial information. This uniformity simplifies data retrieval, analysis, and reporting, saving valuable time and resources. It also ensures that all records meet specific organizational and regulatory standards, thereby minimizing compliance risks. The efficiency gained from using a pre-designed financial template frees up staff time, allowing them to focus on core activities rather than on designing individual receipts or correcting inconsistencies. Such a structured approach ultimately underpins robust financial management and reporting.

Customizing Templates for Diverse Financial Transactions

While the core principles of a well-structured financial template remain constant, its adaptability is one of its most valuable attributes. A foundational receipt template can be readily customized to serve a multitude of purposes beyond charitable giving, becoming a versatile tool for documenting various financial interactions. Whether it’s acknowledging a payment, issuing an invoice form, or recording an expense, the underlying framework ensures consistency while allowing for specific details to be tailored.

For sales transactions, the template can be adapted into a detailed sales record, incorporating product descriptions, quantities, unit prices, and total amounts. Service providers can transform it into a comprehensive service receipt, detailing the services rendered, hours worked, and associated fees. Landlords can utilize it as a rent payment receipt, specifying the rental period, property address, and any outstanding balances. Businesses seeking to track internal spending can create an expense record template, perfect for documenting reimbursements or operational expenditures.

The key to effective customization lies in identifying the unique data points required for each type of transaction and integrating them seamlessly into the existing layout. This might involve adding specific fields, adjusting labels, or incorporating logos and branding elements pertinent to the specific use case. For a donation acknowledgment, particular emphasis is placed on the non-profit status and tax-deductible nature of the gift. The flexibility of such a financial template ensures that it remains relevant and efficient across the diverse landscape of business documentation, providing a reliable proof of transaction regardless of its specific application.

When Using a Year End Donation Receipt Template Is Most Effective

The strategic deployment of a comprehensive template for financial acknowledgments significantly enhances efficiency and compliance. While its primary function centers on charitable contributions, its underlying structure provides a robust framework for various situations requiring definitive proof of payment or transaction. Here are examples of when using such a template is most effective:

- Year-End Tax Reporting for Donors: Essential for individuals and corporations claiming charitable deductions on their annual tax returns. A clear, itemized receipt is mandatory for substantiating contributions to the IRS.

- Compliance for Non-Profit Organizations: Crucial for non-profits to meet IRS requirements for acknowledging donations, especially for gifts over specific thresholds, and to maintain transparency with their donor base.

- Documentation of Large or Complex Donations: For significant cash gifts, in-kind donations, or pledges, a detailed document ensures all aspects of the contribution are accurately recorded and acknowledged.

- Tracking Recurring Contributions: Provides a consistent record for donors making regular payments, allowing them to easily aggregate their contributions over a fiscal year.

- Internal Audit and Reconciliation: Facilitates accurate financial reconciliation and internal audits for non-profits, ensuring that all received funds are properly accounted for against their accounting systems.

- Building Donor Trust and Professionalism: A well-designed and promptly issued donation acknowledgment enhances a non-profit’s professional image and reinforces donor confidence in the organization’s integrity.

- Dispute Resolution: Serves as irrefutable evidence in the event of any discrepancy or query regarding a donation, providing a clear proof of transaction.

- Record-Keeping for Grants and Restricted Funds: While not a grant agreement itself, the receipt often forms part of the supporting documentation for restricted donations, ensuring funds are tracked according to donor intent.

Tips for Design, Formatting, and Usability

Creating a highly effective financial template involves more than just listing required fields; it demands thoughtful consideration of design, formatting, and overall usability. Whether intended for print or digital distribution, the layout should be intuitive, professional, and easily navigable for both the issuer and the recipient.

For design, focus on clarity and brand consistency. Incorporate the organization’s logo and branding elements, such as colors and fonts, to reinforce professionalism and credibility. The hierarchy of information should be clear, with essential details like the donation amount and date prominently displayed. Avoid clutter; white space is your ally in making the document easy to read. Use legible fonts and appropriate font sizes to ensure accessibility for all users. A clean, uncluttered aesthetic is paramount.

Formatting plays a crucial role in readability and data organization. Use bolding and headings to differentiate sections and highlight key information. Employ tables or clear columns for itemized lists, such as a breakdown of services or multiple donation items. Ensure consistent date formats (e.g., MM/DD/YYYY) and currency formatting. For digital versions, consider using fillable PDF forms or web-based templates that allow for easy data input and automatic calculation, minimizing manual errors. Ensure that the template is responsive if it’s designed for online use, adapting seamlessly to various screen sizes.

Usability is about making the document as user-friendly as possible. For digital files, provide clear instructions for completion if it’s an internal form, or for accessing and downloading if it’s for external recipients. Include fields for all necessary information, such as the donor’s full name, address, email, donation amount, date of contribution, and a clear statement about the tax-deductibility of the gift, as required by law. For a donation acknowledgment, clearly state the organization’s legal name and Employer Identification Number (EIN). Ensure the template is easily shareable and savable in common formats like PDF. Including a unique receipt number for each transaction greatly aids in tracking and reconciliation. The ultimate goal is to create a financial template that simplifies the administrative process, reduces potential errors, and provides clear, unambiguous documentation for all parties involved.

Concluding Thoughts on Essential Financial Documentation

The strategic implementation of a well-designed financial template, such as a comprehensive year end donation receipt template, represents a cornerstone of effective financial management and robust business documentation. It transcends the basic function of merely acknowledging a payment; it embodies a commitment to accuracy, transparency, and regulatory compliance. For non-profit organizations, it solidifies trust with donors, simplifies their year-end tax preparations, and reinforces the organization’s professional integrity. For any business transaction, a standardized payment receipt provides invaluable proof of transaction, streamlining audits and mitigating potential disputes.

In an environment where financial accountability is paramount, investing in the creation and consistent use of such a reliable financial template is not an overhead, but a strategic asset. It ensures that every monetary interaction, from a charitable contribution to a service rendered, is meticulously recorded and easily accessible. By adopting a standardized approach to documentation, organizations can foster greater operational efficiency, enhance their reputation, and confidently navigate the complexities of financial reporting. This disciplined approach ultimately underpins long-term stability and success for all entities involved.