In the intricate landscape of property management and tenancy, the meticulous documentation of financial transactions stands as a cornerstone of professional practice. A well-executed rent receipt is not merely a formality; it is a critical piece of evidence that provides irrefutable proof of payment, safeguarding the interests of both landlords and tenants. The implementation of a standardized landlord rent receipt template streamlines this essential process, ensuring clarity, accuracy, and legal compliance.

This comprehensive guide delves into the significance of such a template, outlining its benefits, customization potential, and best practices for its use. Designed for landlords, property managers, and even tenants who wish to understand best practices, this resource underscores how a structured approach to payment acknowledgment fosters transparency and builds trust within residential agreements. Ultimately, a robust landlord rent receipt template becomes an indispensable tool for effective financial management and dispute resolution.

The Imperative of Clear Financial Documentation

The foundation of sound financial management, whether in personal finances or complex business operations, rests upon clear and unambiguous documentation. Every transaction, particularly those involving monetary exchange, demands a reliable record to prevent misunderstandings, facilitate auditing, and ensure adherence to legal and tax requirements. Without such documentation, the potential for disputes escalates, and the ability to verify financial movements diminishes significantly.

In the context of landlord-tenant relationships, a clear payment receipt serves as a vital proof of transaction. It substantiates the tenant’s claim of fulfilling their financial obligations and provides the landlord with an accurate record of income received. This systematic approach to business documentation not only reflects professionalism but also offers a critical layer of protection for all parties involved, simplifying future references and legal inquiries.

Key Benefits of Utilizing a Structured Landlord Rent Receipt Template

Adopting a formalized landlord rent receipt template offers a multitude of advantages that extend beyond mere record-keeping. It transforms what could be an informal, error-prone process into a systematic and efficient operation. Such a structured approach inherently minimizes the potential for human error, which is a common source of conflict in financial dealings.

Firstly, consistency is a paramount benefit. A predefined layout ensures that all necessary information is captured for every payment, from the date and amount to the property address and payment method. This uniformity makes record-keeping more organized and simplifies future reconciliation and audits, providing a reliable expense record for tenants and an income record for landlords.

Secondly, accuracy is significantly enhanced. The template’s structured fields guide the user to input precise details, reducing the likelihood of misspellings or omitted information. This precision is invaluable for tax purposes and in the event of any financial discrepancies, serving as concrete proof of transaction.

Thirdly, transparency is inherently built into the use of a professional template. Both parties receive an identical, clear record of the payment, fostering an environment of trust and mutual understanding. This openness can significantly reduce potential disputes regarding payment status, contributing to smoother landlord-tenant relations.

Finally, efficiency is greatly improved. Instead of drafting a new receipt for each payment, the template can be quickly filled out, saving considerable time and effort. This allows landlords and property managers to dedicate more resources to other critical aspects of property management, while tenants benefit from prompt and professional acknowledgment of their payments.

Versatility and Customization of the Receipt Template

While the immediate focus is on rent payments, the fundamental structure of a well-designed receipt template possesses remarkable versatility. Its core elements—details of payer and payee, amount, date, purpose, and method of payment—are universally applicable across a broad spectrum of financial transactions. This adaptability means that the underlying framework can be readily customized to serve various business and personal needs, extending its utility far beyond basic rent acknowledgment.

For instance, this form can be easily adapted to function as a sales record for retail businesses, detailing goods sold, quantities, and prices. Similarly, service providers can customize the layout to create a service receipt, itemizing specific services rendered and their corresponding charges. Charitable organizations frequently employ modified versions of such templates to generate donation acknowledgments, essential for tax purposes for their benefactors.

Businesses also find the template invaluable for managing internal finances, using it as an invoice form or a business reimbursement document for employee expenses. The key lies in identifying the core data points required for a specific transaction and then adjusting the fields and branding of the template accordingly. This flexibility underscores the power of a standardized financial template in creating a consistent and professional approach to documenting diverse monetary exchanges, ensuring that each payment receipt is clear, comprehensive, and fit for its intended purpose.

Practical Applications: When to Employ a Rent Receipt Template

The utility of a well-structured receipt template extends across numerous scenarios, providing critical documentation for a variety of financial interactions. Its primary purpose, of course, is to provide undeniable proof of payment, but its value is realized in many other contexts. Below are some of the most effective applications for such a robust financial template:

- Cash Rent Payments: When tenants pay rent in cash, a receipt is absolutely essential. Using a landlord rent receipt template ensures that all relevant details—date, amount, tenant name, property address, and landlord signature—are captured, providing both parties with an official record that cannot be disputed.

- Partial Rent Payments: In instances where a tenant pays a portion of the rent due, a detailed receipt clarifies the amount received and the remaining balance, preventing confusion and ensuring accurate accounting.

- Security Deposit Acknowledgments: Beyond monthly rent, the payment of a security deposit should always be acknowledged with a formal receipt, detailing the amount, the date received, and the conditions under which it is held.

- Miscellaneous Property-Related Payments: Any other payments related to the tenancy, such as late fees, pet fees, or charges for property damage, should also be documented using this template to maintain a comprehensive expense record.

- Sales of Goods: Small businesses selling products can adapt the document to serve as a sales record, itemizing items purchased and total cost, offering a clear payment receipt to customers.

- Provision of Services: Freelancers and service providers can utilize the template to acknowledge payment for services rendered, detailing the nature of the service, hours worked, and associated fees. This helps in maintaining a transparent service receipt trail.

- Charitable Donations: Non-profit organizations often modify this template to provide official donation acknowledgments to donors, which are crucial for tax deduction purposes.

- Business Reimbursements: Companies can use a customized version of this financial template to document employee reimbursements for business expenses, ensuring proper accounting and audit trails.

In each of these scenarios, the template transforms a simple act of payment into a formally recorded transaction, safeguarding interests, fostering transparency, and aiding in accurate financial management.

Design, Formatting, and Usability Best Practices for Your Template

The effectiveness of any financial template heavily relies on its design, formatting, and overall usability. A well-designed receipt is not only professional in appearance but also intuitive to fill out and easy to understand. Thoughtful consideration of these elements ensures the document serves its purpose flawlessly, whether printed or distributed digitally.

Clarity and Readability:

The layout should prioritize clarity. Use legible fonts (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12pt for body text). Headings and critical information should stand out, perhaps through bolding or slightly larger font sizes. Avoid overly decorative fonts or complex backgrounds that could hinder readability. The structure of the receipt should guide the eye logically from one piece of information to the next.

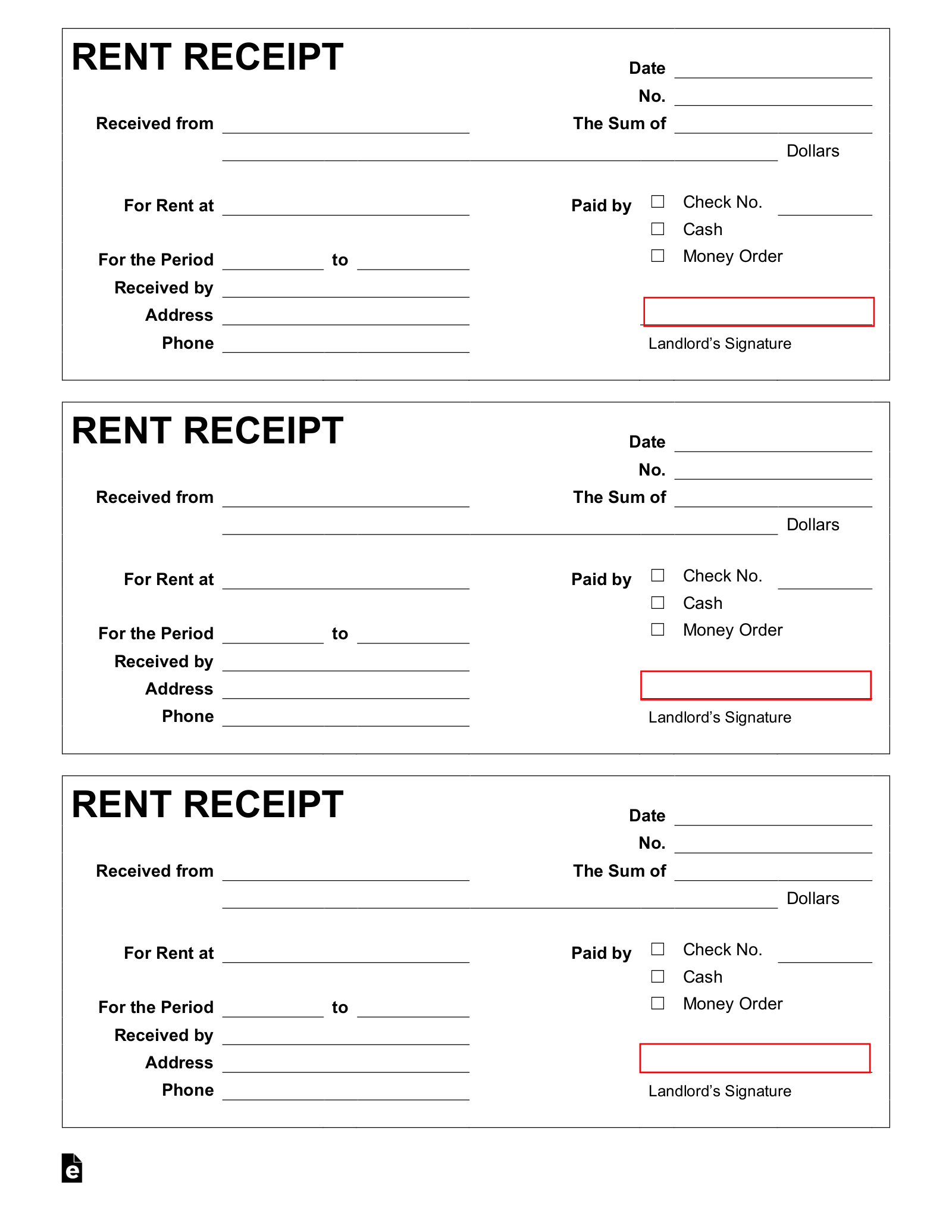

Essential Fields:

Every receipt, regardless of its specific application, must include core fields to be legally sound and functionally effective. These typically include:

- Date of Payment

- Amount Received (both numerically and in words, to prevent alteration)

- Payer’s Name and Contact Information

- Payee’s Name (e.g., Landlord/Company Name) and Contact Information

- Purpose of Payment (e.g., "Rent for October 2024," "Security Deposit")

- Property Address (for rent receipts) or Item/Service Description (for sales/service receipts)

- Method of Payment (e.g., Cash, Check, Money Order, Bank Transfer, Credit Card)

- Check Number or Transaction ID (if applicable)

- Balance Due (if partial payment)

- Signature Line for the recipient (landlord/company representative)

- Optional: Receipt Number for internal tracking.

Branding and Professionalism:

Incorporate your business or property management logo and branding elements if applicable. A consistent, professional appearance reinforces your authority and attention to detail. Ensure the logo is subtle and doesn’t overpower the essential information. The overall aesthetic should be clean and uncluttered.

Digital vs. Print Versions:

Consider both digital and print usability. For digital versions, a fillable PDF format is highly recommended. This allows users to type in information directly, ensuring legibility and making it easy to save and send via email. Ensure the file is accessible and can be opened on common devices. For print versions, design the layout to fit standard paper sizes (e.g., Letter, A4) with adequate margins. If using carbon copy books, ensure the fields align properly. Provide clear instructions on how to obtain copies if not using duplicate forms.

Accessibility and User Experience:

The template should be straightforward for anyone to complete and understand, regardless of their technological proficiency. Avoid jargon. Use clear labels for each field. Test the template by having different individuals fill it out to identify any areas of confusion or difficulty. This iterative approach ensures that the document is truly user-friendly and effective as a business documentation tool.

The judicious application of these design and formatting principles ensures that the receipt is not just a record, but a clear, efficient, and professional communication tool that enhances trust and operational efficiency for all parties involved.

In an era where clarity and accountability are paramount in financial dealings, the utility of a well-crafted receipt template cannot be overstated. From documenting critical rent payments to acknowledging diverse financial transactions, this invaluable tool serves as a reliable cornerstone of effective financial management. Its structured format guarantees precision, promotes transparency, and provides irrefutable proof of transaction, safeguarding the interests of both payers and recipients.

By adopting and customizing such a template, individuals and businesses alike can significantly enhance their record-keeping practices, minimize potential disputes, and ensure compliance with financial regulations. This commitment to detailed and professional documentation not only streamlines administrative tasks but also fosters an environment of trust and clarity in every financial interaction. Ultimately, leveraging a robust financial template is an investment in accuracy, efficiency, and the enduring integrity of your financial records.