In the intricate landscape of modern financial documentation, the seemingly simple taxi receipt template holds significant importance. It serves as a foundational instrument for accurately recording transactions related to transportation services, bridging the gap between service provided and payment received. This document is not merely a slip of paper; it is a critical piece of business documentation that supports financial transparency, facilitates expense tracking, and provides verifiable proof of transaction for both individuals and organizations.

The primary purpose of a well-designed taxi receipt template is to standardize the recording of essential trip details, ensuring clarity and completeness for every fare. Passengers rely on these receipts for various reasons, including business expense reimbursements, personal budget management, or tax reporting. Simultaneously, taxi drivers and fleet operators benefit from structured receipts as they provide an organized record for accounting, service verification, and compliance with local regulations, thereby streamlining their operational and financial processes.

The Importance of Clear and Professional Documentation

The bedrock of sound financial management and ethical business practices is clear, professional documentation. In any sector, from retail to complex corporate finance, meticulous record-keeping instills confidence and establishes credibility. A well-executed receipt, invoice, or financial statement acts as an official record, an immutable witness to a financial exchange, minimizing ambiguities and potential disputes.

Such documentation is indispensable for establishing an auditable trail, which is crucial for internal controls, external audits, and regulatory compliance. It provides concrete proof of transaction, detailing the nature of the exchange, the parties involved, the amount, and the date. This level of detail is vital for maintaining transparency, fostering trust, and ensuring that all financial activities are accurately represented and easily verifiable, thereby safeguarding financial integrity and supporting effective business communication.

Key Benefits of Using Structured Templates for Taxi Receipt Template

Adopting a structured approach through a dedicated taxi receipt template offers an array of compelling advantages that transcend mere record-keeping. Such a template is meticulously designed to capture all relevant information consistently, ensuring that no critical detail is overlooked during a transaction. This systematic methodology significantly contributes to ensuring accuracy, transparency, and consistency in financial records.

Firstly, accuracy is enhanced through predefined fields that prompt the inclusion of essential data points such as the date, time, fare amount, driver identification, and passenger details. This minimizes errors that can arise from manual, ad-hoc documentation. Secondly, transparency is achieved by providing a clear, itemized breakdown of costs, eliminating any confusion regarding the fare calculation or additional charges. Every party involved gains a clear understanding of the financial terms. Lastly, consistency is maintained across all transactions, regardless of the driver or time of service, which simplifies record-keeping, streamlines the expense reporting process for passengers, and aids in the efficient retrieval of specific transaction details for auditing or dispute resolution. This structured financial template thus becomes an invaluable tool for robust expense records.

Customizing the Template for Diverse Applications

While the core utility of a receipt template is firmly rooted in documenting financial transactions, its underlying principles of structured data capture and clear presentation are remarkably adaptable across various business functions. The fundamental layout, designed to confirm payment and service delivery, can be readily customized to suit a multitude of purposes beyond just transportation. This versatility makes the template a powerful tool for diverse financial record-keeping needs.

For instance, the document can be easily modified to serve as a sales record for small businesses, itemizing products sold and prices. Similarly, for service providers, it can function as a service receipt, detailing the specific services rendered and their associated costs. Non-profit organizations often adapt such forms into donation acknowledgments, providing donors with official proof of their contributions for tax purposes. Even for property management, the form can be modified for rent payments, clearly stating the period covered and the amount received. The adaptability of the template ensures that the critical elements of date, amount, and purpose are consistently captured, regardless of the specific financial exchange, thereby providing a flexible and reliable financial template for various business documentation needs.

Practical Applications: When a Taxi Receipt Template Excels

The effective deployment of a well-structured taxi receipt template proves invaluable in numerous scenarios, cementing its role as a fundamental tool for financial accountability. Its utility extends across personal finance, business operations, and compliance requirements. Below are specific instances where utilizing this template is most beneficial:

- Business Expense Reimbursements: Employees on business trips rely heavily on these receipts to document transportation costs accurately for their company’s expense reports. A clear receipt ensures timely and hassle-free reimbursement processing.

- Personal Budget Tracking: Individuals can use the document to monitor their transportation spending, helping them adhere to personal budgets and understand their expenditure patterns.

- Tax Deductions for Business-Related Transport: For self-employed individuals or businesses, properly documented taxi fares can be crucial for claiming legitimate tax deductions, requiring specific details for compliance.

- Proof of Service or Payment for Disputes: In instances where there might be a discrepancy over a fare or service provided, the receipt serves as an irrefutable proof of transaction, detailing the agreement and payment made.

- Fleet Management and Driver Accountability: Taxi companies use these forms to track individual driver performance, reconcile daily earnings, and ensure proper financial oversight of their fleet operations.

- Audit Trails and Compliance: For businesses subject to audits, these receipts form part of a comprehensive audit trail, demonstrating adherence to financial regulations and internal policies.

- Client Billing: When taxi services are billed directly to a client as part of a larger project, the receipt provides the necessary substantiation for the service component of the invoice.

Design, Formatting, and Usability Best Practices

The effectiveness of any financial document, including a taxi receipt, is significantly influenced by its design, formatting, and overall usability. A well-designed receipt is not only professional but also intuitive, ensuring that information is clear, concise, and easily digestible for all parties involved. Whether intended for print or digital distribution, adhering to specific best practices can greatly enhance its functionality.

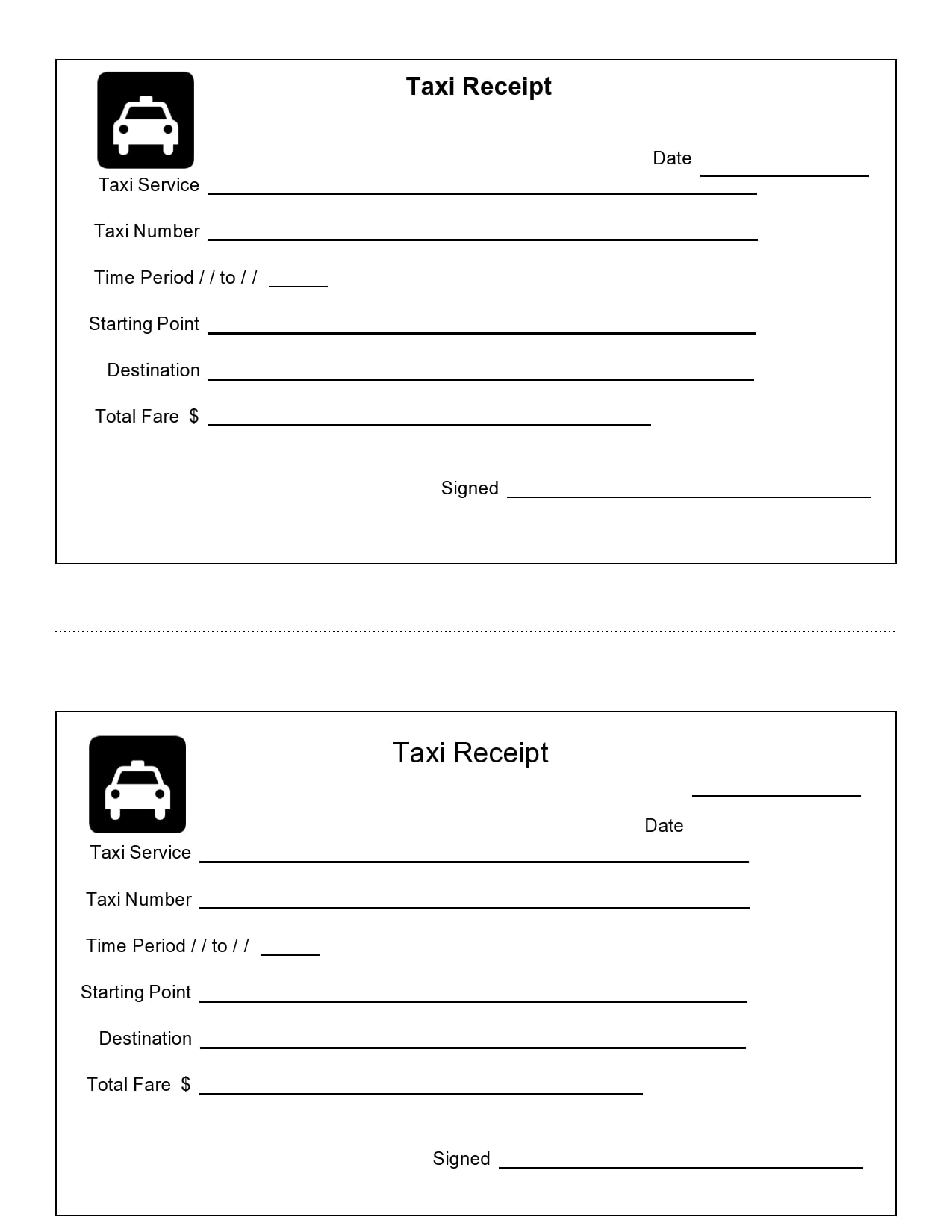

For both versions, legibility is paramount. This involves selecting a clean, professional typeface and maintaining an appropriate font size, generally no smaller than 10-12 points for body text. Headings and key figures should be bolded or slightly larger to draw attention. The layout should be logical and uncluttered, with ample white space separating distinct sections to prevent visual fatigue. Essential fields must be clearly labeled, such as "Date," "Time," "Fare," "Driver ID," "Vehicle Number," "Payment Method," and "Total Amount Paid." Incorporating a unique transaction ID or receipt number is crucial for easy referencing and tracking. For print versions, consider paper size and quality; a standard, durable paper stock ensures the receipt withstands handling. For digital versions, optimize the file format for accessibility and universal compatibility, with PDF being a common choice. Branding elements, such as a company logo and contact information, should be prominently yet tastefully displayed to reinforce professionalism and brand identity. Finally, the receipt should include a space for a signature, if required, and a clear breakdown of the fare, including base fare, mileage, waiting time, and any surcharges, ensuring maximum transparency and an accurate billing statement.

A meticulously crafted taxi receipt template is far more than a simple record; it is a testament to professionalism and a cornerstone of effective financial management. By providing a clear, accurate, and consistent account of transportation transactions, it empowers individuals to manage expenses efficiently and enables businesses to maintain robust, auditable records. Its structured format ensures that every necessary detail is captured, mitigating potential disputes and streamlining accounting processes.

In an environment where financial transparency and accountability are paramount, the strategic implementation of a reliable payment receipt tool becomes indispensable. This financial template not only facilitates accurate expense reporting and tax compliance but also reinforces trust between service providers and their clients. Embracing a standardized, well-designed template elevates the quality of business documentation, ensuring that every taxi fare contributes to a comprehensive and organized financial narrative.